Lyft is making 'progress towards profitability, but it’s slow progress’: Analyst

source link: https://finance.yahoo.com/video/lyft-making-progress-towards-profitability-222247543.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Lyft is making 'progress towards profitability, but it’s slow progress’: Analyst

Lyft is making 'progress towards profitability, but it’s slow progress’: Analyst

ROTH MKM Managing Director Rohit Kulkarni sits down with Yahoo Finance Live to talk about ride-share leader Lyft's latest earnings report, its revenue growth amid heightened competition with Uber, and acquisition potentials.

-

Lyft is making 'progress towards profitability, but it’s slow progress’: Analyst

-

NFL star J.J. Watt talks Super Bowl picks, family, retirement opportunities

-

Newell Brands set to report Q4 earnings ahead of Friday’s closing bell

-

Stocks moving in after hours: Lyft, Expedia PayPal

-

President Biden ‘ought to be proud’ of manufacturing job growth: NAM CEO

-

PayPal has developed into ‘an ecosystem of digital banking’ for consumers, merchants: Analyst

-

Lyft stock continues to slide following earnings miss, weakened revenue guidance

-

Are A.I. trends more than just a fad amid the rise of ChatGPT, Google Bard?

-

Lucid set to pay $7,500 credit to customers for high-end EV models

-

Stocks move lower, Nasdaq leaders mixed ahead of the closing bell

-

Amazon releases trailer for Nike’s Air Jordan biopic

-

Traditional news cycles were focused on ‘red and blue, and nobody was focused on Black’: REVOLT CEO

-

Canopy Growth stock dives on earnings miss, restructuring plan

ROTH MKM Managing Director Rohit Kulkarni sits down with Yahoo Finance Live to talk about ride-share leader Lyft's latest earnings report, its revenue growth amid heightened competition with Uber, and acquisition potentials.

Video Transcript

- Joining us now to break down lip's earnings, Roth MKM's Managing Director Rohit Kulkarni. Nice to see you, sir. So what do you see in this earnings report? Are you surprised, at all, by that type of investor reaction?

ROHIT KULKARNI: Hey, thanks for having me. I think the reaction is based on what happened prior to the earnings result. People tend to forget that the stock was up 60%, maybe 65% since December lows. Again, now, was there a specific reason why the stock was up? The market is up. NASDAQ is outperforming. And then all the tech companies are going up 30%, 40%, 50%.

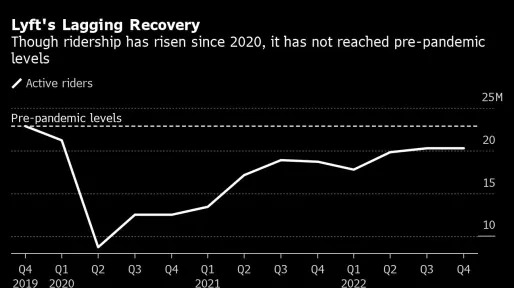

So Lyft was up as part of that wave. So what they needed to do was expectations had been grinding higher. And they needed to just jump over those higher expectations. In isolation, 4Q numbers are not that bad. They are actually better than what we had expected. 1Q guidance is much more worse than what we had expected.

But again, whether this reaction is in line with this weakening of fundamentals, I don't think so. It is just mostly based on what happened prior to this. The stock was up 65%. I am not surprised that it is going to give up some of those gains.

The company's making progress towards profitability. But again, it is just slow progress. And it is much, much slower than what Uber is showing us.

- So Rohit, in regards to the reaction here, because revenue guidance, it was late. It might have been better than what you were expecting. But in terms of Street consensus, we're expecting to see Q1 revenue of $975 million. The estimate out there was for about $1.1 billion. So $975 million, that, of course, would be a step down from what we saw last quarter. How does that set us up, then, into this new year? Clearly, investors are a bit skeptical about Lyft, its ability to compete with Uber. What's going to change investor sentiment on Lyft?

MarketWatch

MarketWatchAppLovin stock set to recover more than $1 billion of its vanished valuation after strong forecast

AppLovin shares soared after hours Wednesday after the app-monetization company provided a strong forecast in a weak mobile-ad market.

1d ago Bloomberg

BloombergLyft Tumbles as Profit Outlook Misses Wall Street Estimates

(Bloomberg) -- Lyft Inc. shares plunged more than 30% in extended trading after the ride-hailing company said it would prioritize lower prices to attract more customers, a move it expects to shrink future profits.Most Read from BloombergRussia Blames US for Nord Stream Blasts, Threatens ConsequencesCommodity Trader Trafigura Faces $577 Million Loss After Uncovering Nickel FraudUS Makes Case That Chinese Balloon Was Part of Spying ProgramUS Takes Custody of Venezuela Embassy in Wake of Guaidó Vot

4h ago Yahoo Finance

Yahoo FinanceStocks moving in after-hours: Lyft, Expedia, PayPal

These are the stocks making moves in after-hours trade on Feb. 9, 2023.

5h ago Investor's Business Daily

Investor's Business DailyLyft Stock Plunges As Earnings Miss Big, Revenue Outlook Falls Short

Lyft stock plunged as earnings fell below expectations, with a current-quarter outlook that was also below views for the ride-hailing firm.

5h ago CoinDesk

CoinDeskKraken to Shut US Crypto-Staking Service, Pay $30M Fine in SEC Settlement

The U.S. Securities and Exchange Commission sued Kraken in federal court Thursday, alleging its crypto staking as a service program violated federal securities laws.

8h ago MarketWatch

MarketWatchLyft stock sinks 30% after sales outlook falls short of $1 billion

Lyft posted record revenue for a second consecutive quarter Thursday, but the company's worse-than-expected forecast tanked its stock in extended trading.

4h ago Fortune

Fortune‘We’re not seeing any signs of consumer weakness’: Uber’s CEO says the company’s strong quarter shows how people are spending their money very differently from a year ago

Uber's strong earnings could be flashing a signal that the economy is returning to normal.

4h ago TechCrunch

TechCrunchLyft shares get crushed on weak guidance for first quarter

Lyft beat the Street on revenue in the fourth quarter, but it wasn't enough to assuage investors who reacted to the ride-hailing company's weak guidance for the first three months of 2023. Lyft lowered expectations for revenue in the first quarter to $975 million, a decline of about $200 million. Logan Green, Lyft’s CEO and co-founder, said the colder weather would lead to a drop in ride-hail and bike and scooter usage, putting pressure on the company's Q1 guidance.

6h ago Zacks

ZacksPreviewing Lyft's Q4 Following Strong Results From Uber

The market took Uber's strong results in stride, sending shares soaring in pre-market trading. Can Lyft deliver the same?

1d ago Yahoo Finance

Yahoo FinanceLyft Q4 earnings: Stock tanks 30% after Q1 2023 guidance miss

Lyft reported its Q4 2022 earnings on Feb. 9 after market close.

6h ago Yahoo Finance

Yahoo FinanceTesla stock rally a 'short covering for the ages,' analyst says

Here's what's behind the move in Tesla stock.

8h ago MoneyWise

MoneyWiseBill Gates is using these dividend stocks right now to produce a fat inflation-fighting income stream — you might want to do the same in 2023

Bill Gates looks for income, too. This is how he gets it.

16h ago Bloomberg

BloombergTreasury Yield-Curve Inversion Reaches Deepest Level Since 1980s

(Bloomberg) -- US government bond investors pushed two-year yields above 10-year yields by the widest margin since the early 1980s Thursday, a sign of flagging confidence in the economy’s ability to withstand additional Federal Reserve interest-rate hikes.Most Read from BloombergRussia Blames US for Nord Stream Blasts, Threatens ConsequencesCommodity Trader Trafigura Faces $577 Million Loss After Uncovering Nickel FraudUS Makes Case That Chinese Balloon Was Part of Spying ProgramUS Takes Custody

8h ago TheStreet.com

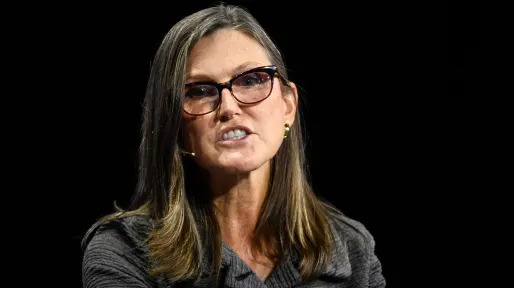

TheStreet.comCathie Wood Doubles Down on Stance That Forthcoming Tesla Product Will 8X Its Stock Price

Famed money manager Cathie Wood, chief executive of Ark Investment Management, has been a Tesla proselytizer for quite some time. "Tesla is one of the most profound AI [artificial intelligence] companies out there," she told Maria Bartiromo on Fox Business. "Autonomous taxi platforms, and Tesla is in the pole position, will have [profit] margins in the 80% range."

8h ago MarketWatch

MarketWatch15 dividend stocks whose 5% to 10% yields appear safe in 2023 and 2024 by this analysis

V.F., an S&P 500 Dividend Aristocrat, raised its payout for at least 25 straight years before cutting. Here's how to select dividend stocks for safety.

1d ago MarketWatch

MarketWatchThese 20 AI stocks are expected by analysts to rise up to 85% over the next year

Artificial intelligence is the hottest area of the stock market right now. A screen of five ETFs points to a list of highly favored companies.

9h ago Investor's Business Daily

Investor's Business DailyWe Asked ChatGPT For Stock Picks — Here's What It Said

Artificial intelligence marvel ChatGPT can write poetry, answer trivia questions and take tests. But it falls flat with S&P 500 stock picks — meaning you'll need to look elsewhere.

15h ago Barrons.com

Barrons.comCoinbase CEO Warns of ‘Staking’ Crackdown. The Stock Is Tumbling.

Brian Armstrong said on Wednesday that he was aware of rumors that the SEC wanted to stop crypto staking in the U.S. for retail customers.

8h ago TheStreet.com

TheStreet.comWhen Will Tesla Stock Give Us a Dip to Buy? The Chart Holds Clues.

Tesla stock has been roaring, doubling off the January low. Here are the support levels to watch now.

7h ago Investor's Business Daily

Investor's Business DailyCheap Stocks To Buy: Should You Watch These 5 Growth Stocks?

Regardless of what stage of the market cycle we're in, some folks never tire of searching for cheap stocks to buy. If it has thin trading volume, the fund manager will have an awfully tough time accumulating shares — without making a big impact on the stock price.

2h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK