Retail investors are pouring a record $1.5 billion per day into the stock market

source link: https://finance.yahoo.com/news/retail-investors-record-inflows-us-stock-market-193801422.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Retail investors are pouring a record $1.5 billion per day into the stock market

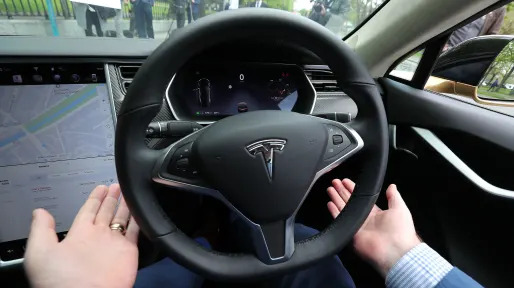

Tesla remained the favorite among this group, with retail inflows to the stock totaling $9.7 billion year-to-date in 2023 so far.

Individual investors have been snapping up stocks at the fastest pace on record as U.S. equity markets have charged higher to start the year.

Over the past month, retail investors funneled an average of $1.51 billion each day into U.S. stocks, the highest amount ever recorded, according to data from research firm VandaTrack published Thursday.

"With recent surveys showing the institutional investor community remaining broadly bearish on stocks, it would be unwise to underestimate the importance of the retail cohort," strategists at VandaTrack said in a note. "That's in keeping with retail sales and jobs data for January, suggesting that consumers retain impressive levels of buying power."

Tesla (TSLA) remained the favorite among this group, with retail inflows to the stock totaling $9.7 billion year to date.

Those allocations come during a comeback rally for the electric vehicle giant after closing out its worst year on record in 2022. Tesla shares have gained 74% in 2023 through Wednesday's close.

The SPDR S&P 500 ETF Trust (SPY), an ETF which tracks the benchmark S&P 500, has been the second-most popular purchase by retail investors this year, with retail flows totaling $3.6 billion in 2023. The index is up 8.2% year to date through Wednesday.

Amazon (AMZN), Apple (AAPL), and Nvidia (NVDA) rounded out the top five, receiving $1.8 billion, $1.7 billion, and $1.4 billion in inflows this year, respectively. These names were up 20%, 19.5%, and 55.8% this year in that order.

More speculative, beaten-down names have also been popular buys, with investors again circling baskets of stocks favored by ARK Invest's Cathie Wood.

Wood's flagship ARK Innovation (ARKK) ETF, a bellwether for high-flying technology stocks, has seen a modest uptick in inflows this year, but stood 27th on a list of the biggest purchases from retail investors ponying up $169 million for the fund.

Retail investors did, however, snag key underlying names from ARK's family of exchange-traded funds — Coinbase (COIN), Block (SQ), Roku (ROKU), for example — faster than the firm itself, a phenomenon seen early into the COVID pandemic.

Yahoo Finance

Yahoo FinanceTesla recalls 362,758 vehicles over self-driving safety concerns, stock falls

Tesla shares are dropping after the National Highway Traffic Safety Administration (NHTSA) announced the automaker would recall 362,758 Tesla vehicles due to safety issues with its Full Self-Driving (FSD) beta software.

9h ago MarketWatch

MarketWatchRussia’s year-old war on Ukraine has informed U.S. planning for prospective conflict with China

‘[T]here are clear parallels between the Russian invasion of Ukraine and a possible Chinese attack on Taiwan,’ concluded a report early this year by the Center for Strategic and International Studies.

9h ago Benzinga

BenzingaIllegal for 79 Years, This Loophole Lets Regular Americans Invest Alongside Silicon Valley Insiders

For 79 years, if you wanted the right to invest in early-stage companies like Apple in the 1970s, Facebook in 2004, or Airbnb in 2009, you had to be an “accredited investor.” The concept came from a 1933 law that created the U.S. Securities & Exchange Commission (SEC) to guard against some of the excesses on Wall Street that had led to the 1929 crash and the ensuing Great Depression. The Securities Act also held a provision barring any non-founders or other company insiders from investing in a p

16h ago MoneyWise

MoneyWiseThe US is about to sell another 26M barrels of oil reserves — depleting the 'oil piggy bank' even further. But here's President Biden's 3-part plan to replenish it

The SPR is already at its lowest level in 40 years.

13h ago TheStreet.com

TheStreet.comElon Musk, Others Call For Microsoft to Shut Down ChatGPT in Bing: 'Clearly Not Safe Yet'

After the new AI-powered Microsoft search engine rolled out last week, users testing it are finding some unexpected results.

6h ago MarketWatch

MarketWatchAnother ‘Volmageddon’? JPMorgan becomes the latest to warn about an increasingly popular short-term options strategy.

"While history doesn’t repeat, it often rhymes, and current selling of 0DTE (zero day to expiry), daily and weekly options is having a similar impact on markets," says JPM's Marko Kolanovic.

18h ago Yahoo Finance

Yahoo FinanceStocks moving after hours: DraftKings, Applied Materials, Redfin

DraftKings, Applied Materials, and Redfin were among the stock making movers in after hours trading on Thursday, Feb. 16, 2023.

8h ago Fortune

FortuneJPMorgan’s top strategist warns markets could be heading for another ‘Volmageddon’

“While history doesn’t repeat, it often rhymes,” Marko Kolanovic warned.

13h ago TheStreet.com

TheStreet.com'One Of The Biggest Mistakes I Ever Made': Charlie Munger Regrets Major Investment

The Berkshire Hathaway vice chairman opens up about an investment misstep in remarks at the Daily Journal annual meeting.

1d ago CoinDesk

CoinDeskBitcoin Primed to Rally to $56K as Nasdaq Breaks Out of Bull Flag, Chart Analyst Says

Analyst, who correctly predicted the late 2020 bull run, said 2023 could be a surprisingly good year for both crypto and equities.

23h ago Benzinga

BenzingaPennsylvania Farmer Behind $5 Trillion Trend Speaks Out: I Created A Monster

Add up the market valuation of Apple Inc. (NASDAQ: AAPL), all the cryptos in the world and entrepreneur Jeff Bezos’s fortune, and you get to over $3 trillion. But one 80-year-old man has created something bigger than all three of these combined. These days, he shuns the spotlight and lives on a modest farm in rural Pennsylvania. You would never guess the farm’s owner set in motion a $5 trillion force that grows each fortnight. It’s a comfortable enough retirement, but Ted Benna has some regrets.

16h ago Benzinga

BenzingaMPW Soars 8% In One Day: What In The World Happened?

Stocks can fly up or down very quickly for many reasons, including rumors, analyst upgrades or downgrades, dividend increases or solid earnings reports that beat the Street. But when a stock that has been sinking — both short and long term — suddenly soars 8% in one day on heavier than usual volume, it bears a closer look. Here is one real estate investment trust (REIT) that soared 8% on Feb. 16. What in the world happened? Medical Properties Trust Inc. (NYSE: MPW) is a Birmingham, Alabama-based

10h ago TheStreet.com

TheStreet.comBillionaire George Soros Bets on Carvana

Betting that the stock price will rise, the legendary investor acquired call options on the online seller of second-hand vehicles.

8h ago Zacks

ZacksStar Bulk Carriers (SBLK) Beats Q4 Earnings and Revenue Estimates

Star Bulk Carriers (SBLK) delivered earnings and revenue surprises of 9.76% and 7.58%, respectively, for the quarter ended December 2022. Do the numbers hold clues to what lies ahead for the stock?

7h ago Bloomberg

BloombergStocks Sink as Fed Officials Embrace Bigger Hikes: Markets Wrap

(Bloomberg) -- US equity indexes closed firmly in the red Thursday after two Federal Reserve officials said they were considering 50 basis-point interest rate hikes to battle persistently high inflation. Most Read from BloombergChina Hits Back at US with Sanctions on Lockheed, RaytheonStocks Sink as Fed Officials Embrace Bigger Hikes: Markets WrapChina Warns of Retaliation Against US Over Balloon SagaTesla Recalls More Than 362,000 Cars Due to Self-Driving Crash RiskTesla Fires Dozens After Work

9h ago Barrons.com

Barrons.comThe Stock Market Is Playing a ‘Game of Chicken’ With Bonds. It Won’t End Well.

Wall Street is making some assumptions that will derail the S&P 500's rally if they turn out to be wrong.

11h ago Bloomberg

BloombergChina’s Top Tech Banker Goes Missing, Unnerving Finance Industry

(Bloomberg) -- The disappearance of high-profile banker Bao Fan is fueling speculation of a renewed clampdown on China’s finance industry. Most Read from BloombergChina Hits Back at US with Sanctions on Lockheed, RaytheonStocks Sink as Fed Officials Embrace Bigger Hikes: Markets WrapChina Warns of Retaliation Against US Over Balloon SagaTesla Recalls More Than 362,000 Cars Due to Self-Driving Crash RiskAdderall’s Disappearing Act Has Left Millions Without TreatmentBao’s company China Renaissance

4h ago Quartz

QuartzApple wants to move its manufacturing out of China

Apple supplier Foxconn announced the creation of a major new factory in Vietnam and a $300 million investment to expand its current operations in the country. The decision comes as Apple attempts to move parts of its manufacturing process out of China.

1d ago TheStreet.com

TheStreet.comWalmart, Kroger, Amazon and Grocery Stores Have a Problem Bigger Than Inflation

Higher prices are an issue, but they're not the biggest problem facing America's largest supermarkets.

15h ago Zacks

ZacksHow Much Upside is Left in Energy Transfer LP (ET)? Wall Street Analysts Think 25.57%

The consensus price target hints at a 25.6% upside potential for Energy Transfer LP (ET). While empirical research shows that this sought-after metric is hardly effective, an upward trend in earnings estimate revisions could mean that the stock will witness an upside in the near term.

16h ago SmartAsset

SmartAssetGood News: There's an Easy Way to Boost Your 401(k) By 8%

If you've looked at the investment options in your workplace 401(k) retirement plan, chances are you'll see mutual funds that put your money into stocks, bonds or cash and cash equivalents. Those have been the options available ever since 401(k) … Continue reading → The post Here's One Easy Way to Boost Your 401(k) By 8% appeared first on SmartAsset Blog.

16h ago American City Business Journals

American City Business JournalsMarathon Oil makes $3.6B profit in 2022, plans Eagle Ford activity this year

After raking in big profits in 2022, Marathon Oil Corp. (NYSE: MRO) is bullish on growth in 2023 and 2024. Houston-based Marathon Oil made $3.61 billion in net income in 2022, up from $946 million a year prior, the company reported in fourth-quarter earnings after markets closed Feb.

11h ago Yahoo Finance

Yahoo FinanceTravelCenters stock pops 70% after BP announces $1.3 billion deal to buy company

TravelCenters of America (TA) shares are surging today as BP’s (BP) North America subsidiary announced it is buying the fuel and service centers in a $1.3 billion all-cash deal.

15h ago MarketWatch

MarketWatchHere’s where the 60/40 could really fail you. But a better option may be under your nose.

Only in 1974 — the year of Watergate, OPEC embargoes, gas lines and recession — did the standard, benchmark, middle-of-the-road investment portfolio lose more value than it did in 2022. The so-called “balanced” or “60/40” portfolio, consisting of 60% U.S. large-company stocks and 40% U.S. bonds, lost a staggering 23% of its value last year in real money (meaning when adjusted for inflation). The point about 60/40—the point at least sold to savers by Wall Street — is that the 40% invested in “safe” bonds is supposed to balance out the risks of the 60% invested in stocks.

15h ago SmartAsset

SmartAssetGood News: Biden's News Retirement Saver's Match Could Help You Save More For Retirement

The SECURE 2.0 Act was recently signed into law by President Biden. Coming just a few years after the first SECURE Act, this legislation makes a bevy of changes designed to make it easier for Americans to save for retirement … Continue reading → The post Retirement Saver's Credit Goes Further in Conversion to Saver's Match appeared first on SmartAsset Blog.

2d ago MarketWatch

MarketWatchBed Bath & Beyond falls toward 8th-straight loss, the longest such streak in 3 months

Shares of Bed Bath & Beyond Inc. (BBBY) sank 6.5% in afternoon trading Thursday, to put them on track for an eighth straight decline. The losing streak comes after the stock rocketed 92.1% on Feb. 6, even amid growing concerns the home goods retailer was nearing bankruptcy. The stock then sold off after the Feb. 6 close, after the company announced plans to sell convertible preferred shares and warrants to buy common stock in an effort to stave off bankruptcy.

11h ago Reuters

ReutersU.S. household debt jumps to $16.90 trillion

Household debt, which rose by $394 billion last quarter, is now $2.75 trillion higher than just before the COVID-19 pandemic began while the increase in credit card balances last December from one year prior was the largest since records began in 1999, the New York Fed's quarterly household debt report also said. Mortgage debt increased by $254 billion to $11.92 trillion at the end of December, according to the report, while mortgage originations fell to $498 billion, representing a return to levels last seen in 2019.

14h ago The Wall Street Journal

The Wall Street JournalHow Bed Bath & Beyond Avoided Bankruptcy

As banks pushed for repayment, a hedge fund saw a troubled company that had one thing going for it: the passionate interest of individual investors.

12h ago Barrons.com

Barrons.comDeere Earnings Are Coming. The Stock Needs a Beat.

Wall Street is looking for earnings of $5.57 a share from $11.3 billion in equipment sales for the latest quarter.

9h ago Zacks

Zacks2 Semiconductor Stocks to Buy if the Supply Glut is Over

The semiconductor industry powers the electronics industry, and in 2021 sales reached $556 billion, with a record 1.15 trillion semiconductor units sold

10h ago Investor's Business Daily

Investor's Business DailyDow Jones Falls 400 Points On Hot Inflation Data; Shopify Plunges On Earnings

The Dow Jones sold off 400 points Thursday on hot inflation data and weekly initial jobless claims. Shopify plunged on earnings.

15h ago Zacks

ZacksNewmont Corporation (NEM) Expected to Beat Earnings Estimates: Should You Buy?

Newmont (NEM) possesses the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

15h ago Bloomberg

BloombergZero-Day Options Are Like Betting on ‘Horse Race,’ Tchir Says

(Bloomberg) -- A surge in short-dated options trading, driven by risk-taking behavior from investors, is amplifying daily moves in the stock market, according to Peter Tchir at Academy Securities.Most Read from BloombergChina Hits Back at US with Sanctions on Lockheed, RaytheonChina Warns of Retaliation Against US Over Balloon SagaStocks Sink as Fed Officials Embrace Bigger Hikes: Markets WrapTesla Recalls More Than 362,000 Cars Due to Self-Driving Crash RiskAdderall’s Disappearing Act Has Left

15h ago Zacks

ZacksForget Bargain Hunting: Buy These 5 Stocks With Rising P/E

Tap five stocks with increasing P/E ratios to try out a different approach.

17h ago Zacks

ZacksWhy Earnings Season Could Be Great for BioCryst (BCRX)

BioCryst (BCRX) is seeing favorable earnings estimate revision activity and has a positive Zacks Earnings ESP heading into earnings season.

15h ago Investor's Business Daily

Investor's Business DailyPalo Alto Networks Stock Earns Another Composite Rating Upgrade

On Thursday, Palo Alto Networks got an upgrade for its IBD SmartSelect Composite Rating from 91 to 96.

14h ago Zacks

ZacksCommunity Health (CYH) Q4 Earnings Beat on Strong Admissions

Community Health's (CYH) fourth-quarter results indicate growing patient volumes. However, management estimates net loss per share to lie between 65 cents and 5 cents in 2023.

14h ago Barrons.com

Barrons.comParamount Posts Big Earnings Miss, CEO Says Price Increases Are Coming

The entertainment company reported earnings per share of 8 cents, analysts were expecting 24 cents. The company said falling advertising revenue was partly to blame.

14h ago Zacks

ZacksAnalysts Estimate MP Materials Corp. (MP) to Report a Decline in Earnings: What to Look Out for

MP Materials Corp. (MP) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

15h ago Reuters

ReutersChina's Lenovo Q3 revenue tumbles 24% as PC demand slumps

China's Lenovo Group Ltd reported a 24% revenue decline for the third quarter, its second consecutive decline as global demand for computers and smartphones continued to slump. The world's largest maker of personal computers (PCs) said on Friday that total revenue during the October-December quarter was $15.3 billion, down 24% from the same quarter a year earlier. The outbreak of the COVID-19 pandemic in 2020 provided a huge boost in electronic sales for Lenovo and its peers worldwide as many people opted to work remotely and replaced or upgraded their gadgets.

2h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK