A 50-year-old Mom on Reddit emptied her daughter's college fund to keep her Mali...

source link: https://finance.yahoo.com/news/50-old-mom-reddit-emptied-112000458.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

A 50-year-old Mom on Reddit emptied her daughter's college fund to keep her Malibu dream house — the teen is 'furious.' 5 tips to retire comfortably without raiding your kid's account

A 50-year-old woman claims she inherited seven figures when her husband passed away, but ended up squandering the funds on ill-fated investments with her money manager — including a beautiful Malibu home by the beach.

With just around $35,000 of the inheritance left and multiple debts to take care of, she decided to liquidate her 16-year-old daughter’s college fund to cover some of the mortgage bills, posting her story on Reddit’s Am I The A-hole (AITA) forum.

“[My daughter] was furious and said she cannot believe all her dad's work is gone. [She also] said she won't be supporting me for retirement,” writes the mother, who goes by Throwawayveal-9 on Reddit.

Don't miss

Here's how much money the average middle-class American household makes — how do you stack up?

UBS says 61% of millionaire collectors allocate up to 30% of their overall portfolio to this exclusive asset class

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Plenty of the subreddit commenters held the mother responsible for making poor financial choices and hurting her child’s future in the process.

Here are five tips to avoid putting yourself in the same boat to secure a comfortable retirement.

1. Talk to a certified financial professional

You can skip this step if you feel confident enough to tackle your finances on your own — but if you’ve got limited knowledge and experience with handling money (like the aforementioned Reddit mom), it doesn’t hurt to speak to an expert.

Just make sure you do your research first. Don’t be fooled by the first so-called “financial advisor” or “money manager” you meet and check their credentials and reviews to make sure they’re legit. You can even ask for references from previous clients.

It’s important to understand how they get paid as well. A fee-only adviser will earn a flat rate or percentage of the assets they manage, whereas a commission-based adviser is more incentivized to get you to spend money and may recommend certain products or services that are more beneficial for them than they are for you.

Quartz

QuartzTaylor Swift didn’t fall for FTX because she asked a simple question

Taylor Swift’s inquisitiveness saved her from jumping on the doomed FTX bandwagon.

5h ago SmartAsset

SmartAssetThis Is Who Should Consider Getting a Transfer on Death (TOD) Deed By the End of the Year

Part of planning for the future involves getting your estate in order, and determining who you want your assets to pass to when you die. If you have real estate property, and want it to transfer to loved ones without passing … Continue reading → The post How a Transfer on Death Deed Works appeared first on SmartAsset Blog.

5h ago Fortune

FortuneChatGPT asked the founder of the world’s largest hedge fund for his best investing tip. This was his response

Ray Dalio has taken on a new role as an educator after releasing control of Bridgewater Associates. And he dished out some classic investing advice to ChatGPT over the weekend.

21h ago SmartAsset

SmartAssetAsk an Advisor: I Am 60 Years Old, Have $1.1M Cash, $880K in a 401(k), Several Pensions and Social Security. Should I Retire Now?

I am 60 years old, married, with no mortgage. We also have $1.1 million in liquid cash and $880,000 in a 401(k). I will have two pensions, which have not started yet, and my wife will have one pension, all … Continue reading → The post Ask an Advisor: I Am 60 Years Old, Have $1.1M Cash, $880K in a 401(k), Several Pensions and Social Security. Should I Retire Now? appeared first on SmartAsset Blog.

1d ago Fortune

FortuneAfter he sold his company for over $1 billion, Ryan Reynolds’ investing spree continues with a fintech company that has ties to Binance and DraftKings

The actor has invested in a gin company, mobile network and more. Reynolds says he likes less-glamorous, yet important projects with his marketing firm.

2d ago SmartAsset

SmartAsset$400k Will Last You This Long in Retirement

Data from the Federal Reserve shows that the average savings in the United States at retirement age is just $255,200. So if you find yourself with $400,000 in assets at retirement age, congratulations! You're doing much better than average. But how … Continue reading → The post How Long Will $400k Last in Retirement? appeared first on SmartAsset Blog.

1d ago SmartAsset

SmartAssetDo You Really Know The Difference Between Being Rich & Wealthy?

Being rich and being wealthy are often seen as being the same thing. After all, people who are rich or wealthy tend to have more assets and greater financial freedom than the typical person. In reality, there are some major … Continue reading → The post Key Differences Between Rich and Wealthy People appeared first on SmartAsset Blog.

1d ago SmartAsset

SmartAssetIs Fidelity's 45% Rule Outdated?

Financial services giant Fidelity has a rule for retirement savings you may have heard of: Have 10 times your annual salary saved for retirement by age 67. This oft-cited guideline can help you identify a retirement savings goal, but it … Continue reading → The post Should the 45% Rule Guide Your Retirement Strategy? appeared first on SmartAsset Blog.

1d ago SmartAsset

SmartAssetHow Much Income Do I Need to be Considered Rich?

Earning more money can make it easier to pay the bills, fund your financial goals and spend on hobbies or "fun," but what income is considered to make you rich? The answer can depend on several factors, including where you … Continue reading → The post What Income Level Is Considered Rich? appeared first on SmartAsset Blog.

1d ago Bloomberg

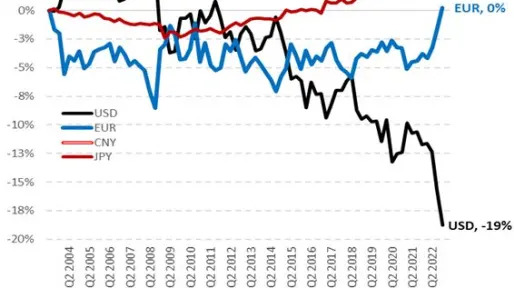

BloombergDe-Dollarization Is Happening at a ‘Stunning’ Pace, Jen Says

(Bloomberg) -- The dollar is losing its reserve status at a faster pace than generally accepted as many analysts have failed to account for last year’s wild exchange rate moves, according to Stephen Jen. Most Read from BloombergWorthless Degrees Are Creating an Unemployable Generation in IndiaOne Tesla Deal Propels Little-Known Family to $800 Million FortuneApple, Goldman Sachs Debut Savings Account With 4.15% Annual YieldFirst Republic Worked Hard to Woo Rich Clients. It Was the Bank’s UndoingC

1d ago Bloomberg

BloombergBrookfield Defaults on $161 Million Office-Property Debt

(Bloomberg) -- Brookfield Corp. funds have defaulted on a $161.4 million mortgage for a dozen office buildings, mostly around Washington, DC, as rising vacancies hit property values.Most Read from BloombergWorthless Degrees Are Creating an Unemployable Generation in IndiaOne Tesla Deal Propels Little-Known Family to $800 Million FortuneApple, Goldman Sachs Debut Savings Account With 4.15% Annual YieldFox to Pay $787 Million to Settle Election Suit, Dominion SaysChatGPT Can Decode Fed Speak, Pred

1d ago Bloomberg

BloombergTesla Slashes Prices of Key Models Again Ahead of Earnings

(Bloomberg) -- Tesla Inc. is cutting prices in the US for the second time this month and just ahead of its latest earnings report, further demonstrating Elon Musk’s willingness to sacrifice profitability for demand.Most Read from BloombergAirline Blunder Sells $10,000 Asia-US Business Class Tickets for $300Tesla Slashes Prices of Key Models Again Ahead of EarningsWorthless Degrees Are Creating an Unemployable Generation in IndiaIndia Passes China as World’s Most Populous Nation, UN SaysDisney Is

4h ago Zacks

ZacksIs Most-Watched Stock Medical Properties Trust, Inc. (MPW) Worth Betting on Now?

Zacks.com users have recently been watching Medical Properties (MPW) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

5h ago CBS MoneyWatch

CBS MoneyWatchMillions of boomers have nothing saved for retirement

1 in 4 older Americans may have to work longer or scrimp and save to make ends meet in their golden years, a new study suggests.

21h ago TipRanks

TipRanksThese 2 ‘Strong Buy’ Penny Stocks Could Rally to $40 (or More), Says Piper Sandler

Bull or bear market, no investment is a sure thing. Especially in the current financial environment, which remains riddled with uncertainty, finding compelling plays can be challenging for even the most seasoned market watchers. However, this is not to say that investment opportunities with stand-out growth prospects can’t be found. For the more risk-tolerant investor, penny stocks, or tickers trading for less than $5 per share, can be an enticing option. The appeal is clear; the bargain price t

2h ago Business Insider

Business InsiderBillionaire investor Howard Marks sounds the alarm on commercial real estate – warning of a wave of mortgage defaults

The Oaktree Capital Management CEO warned of mortgage defaults in the face of higher interest rates, tighter lending, and remote work trends.

22h ago Benzinga

BenzingaHow Billionaires Like Jeff Bezos, Elon Musk and George Soros Pay Less Income Tax Than You – And How You Can Replicate The Strategy. It's Legal

Most billionaires don’t get to where they are by earning a salary. And that also means they might pay less income tax than Americans who make a living through wages. According to a report from ProPublica, some billionaires in the U.S. paid little or no income tax relative to the vast amount of wealth they have accumulated over the years. The report noted that Amazon.com Inc. Founder Jeff Bezos “did not pay a penny in federal income taxes” in 2007 and 2011. It also pointed out that Tesla Inc. CEO

1h ago Yahoo Finance

Yahoo FinanceDeposits dropped at regional banks USB and CFG during 1Q tumult

Some of the nation's largest regional banks offer new signs of how they fared during a tumultuous period for the industry

6h ago Yahoo Finance

Yahoo FinanceHere’s how much President Biden paid in taxes in 2022

President Joe Biden and Vice President Kamala Harris released their complete 2022 tax returns as tax day wound down.

17h ago Zacks

ZacksFreeport (FCX) to Report Q1 Earnings: What's in the Cards?

Freeport (FCX) is expected to have gained from higher operating rates across Indonesia and South America operations amid headwinds from lower year over year copper prices.

6h ago Investor's Business Daily

Investor's Business DailyAbbott Labs Hits Two-Month High With The Help Of One First-Quarter Rock Star

Abbott Laboratories reported better-than-expected first-quarter sales despite a slowdown from its Covid test segment. ABT stock jumped.

2h ago Zacks

ZacksStar Bulk Carriers (SBLK) Outpaces Stock Market Gains: What You Should Know

In the latest trading session, Star Bulk Carriers (SBLK) closed at $22.25, marking a +0.18% move from the previous day.

20h ago SmartAsset

SmartAssetThis Is What Happens to Your Pension When You Die

If you worked in a job with a pension, this means you will receive ongoing benefits once you retire. A critical part of estate planning, then, will be figuring out what happens to that money when you die. The answer … Continue reading → The post What Happens to Your Pension When You Die? appeared first on SmartAsset Blog.

5h ago Investor's Business Daily

Investor's Business DailyIBD 50 Stocks To Watch: Sports-Betting Giant DraftKings Approaches New Buy Point

Sports-betting giant DraftKings stock is approaching a new buy point and is one of the best stocks to buy and watch in today's stock market.

32m ago Zacks

ZacksAnalysts Estimate Pioneer Natural Resources (PXD) to Report a Decline in Earnings: What to Look Out for

Pioneer Natural Resources (PXD) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

4h ago Zacks

ZacksInvestors Heavily Search UnitedHealth Group Incorporated (UNH): Here is What You Need to Know

UnitedHealth (UNH) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

1d ago Zacks

ZacksAnalysts Estimate PacWest Bancorp (PACW) to Report a Decline in Earnings: What to Look Out for

PacWest (PACW) doesn't possess the right combination of the two key ingredients for a likely earnings beat in its upcoming report. Get prepared with the key expectations.

1d ago Zacks

ZacksInvestors Heavily Search Innovative Industrial Properties, Inc. (IIPR): Here is What You Need to Know

Recently, Zacks.com users have been paying close attention to Innovative Industrial Properties (IIPR). This makes it worthwhile to examine what the stock has in store.

5h ago Bankrate

BankrateSavings APYs are hitting 5%: Time to switch banks?

Is your bank offering you the best APY you can get right now for your savings?

22h ago Bloomberg

BloombergAlly’s Profit Tumbles, Highlighting US Auto-Loan Risks

(Bloomberg) -- Ally Financial Inc.’s profit fell more than analysts expected as it made fewer auto loans and put aside additional provisions to cover mounting consumer defaults.Most Read from BloombergAirline Blunder Sells $10,000 Asia-US Business Class Tickets for $300Tesla Slashes Prices of Key Models Again Ahead of EarningsWorthless Degrees Are Creating an Unemployable Generation in IndiaIndia Passes China as World’s Most Populous Nation, UN SaysDisney Is Set to Eliminate Thousands of Jobs St

4h ago Investor's Business Daily

Investor's Business DailyDow Jones Falls: Netflix Slides On Q1 Results, Tesla Skids On Pre-Earnings Price Cuts

The Dow Jones fell Wednesday morning, as Netflix dropped on weak subscriber growth. Tesla skidded on more price cuts ahead of earnings.

4h ago Zacks

ZacksPfizer (PFE) Stock Sinks As Market Gains: What You Should Know

Pfizer (PFE) closed the most recent trading day at $40.55, moving -1.53% from the previous trading session.

20h ago Zacks

ZacksWall Street Analysts Think Schlumberger (SLB) Could Surge 25.44%: Read This Before Placing a Bet

The average of price targets set by Wall Street analysts indicates a potential upside of 25.4% in Schlumberger (SLB). While the effectiveness of this highly sought-after metric is questionable, the positive trend in earnings estimate revisions might translate into an upside in the stock.

4h ago Benzinga

BenzingaU.S. Bancorp Q1 Earnings Top Street View, Net Interest Income Jumps 46%

U.S. Bancorp (NYSE: USB) clocked a first-quarter total net revenue increase of 28.2% year-over-year to $7.18 billion, beating the consensus of $7.12 billion. Net interest income jumped 46% to $4.63 billion, while noninterest income rose 4.6% to $2.51 billion. Provision for credit losses in the quarter under review jumped to $427 million, compared with $112 million in the year-ago period. This was driven by the acquisition of MUB and continued economic uncertainty. While credit quality factors ha

4h ago Zacks

ZacksDiebold Nixdorf (DBD) Stock Sinks As Market Gains: What You Should Know

In the latest trading session, Diebold Nixdorf (DBD) closed at $0.84, marking a -1.52% move from the previous day.

20h ago Investor's Business Daily

Investor's Business DailyDow Jones Flat With Netflix Wild After Earnings; These 3 Bill Ackman Stocks Are Near Buy Points

The Dow Jones held steady despite Goldman Sachs results. A trio of Bill Ackman stocks are near entries. Netflix stock whipsawed on earnings.

21h ago Yahoo Finance

Yahoo FinanceStocks waver as earnings flurry continues: Stock market news today

Morgan Stanley added to the bank earnings mix as stocks slumped midday Wednesday.

1h ago Investor's Business Daily

Investor's Business DailyIs Verizon A Buy As Analysts Eye Consumer Unit Rebound?

VZ stock provides a dividend but a buyback has been shelved amid 5G wireless investments. When will revenue growth reaccelerate?

4h ago Business Insider

Business InsiderHere's why Morgan Stanley's top equity strategist is staying bearish on stocks despite the latest rally

"We think the recent collapse in breadth is the market's way of warning us we are far from out of the woods with this bear market," Mike Wilson said.

18h ago Business Insider

Business InsiderStocks are unlikely to retest bear market lows and there's too much pessimism about the US economy, market veteran Ed Yardeni says

Investors could miss out on gains if they are too gloomy about the economy, the strategist said in calling out Jamie Dimon's pessimism.

18h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK