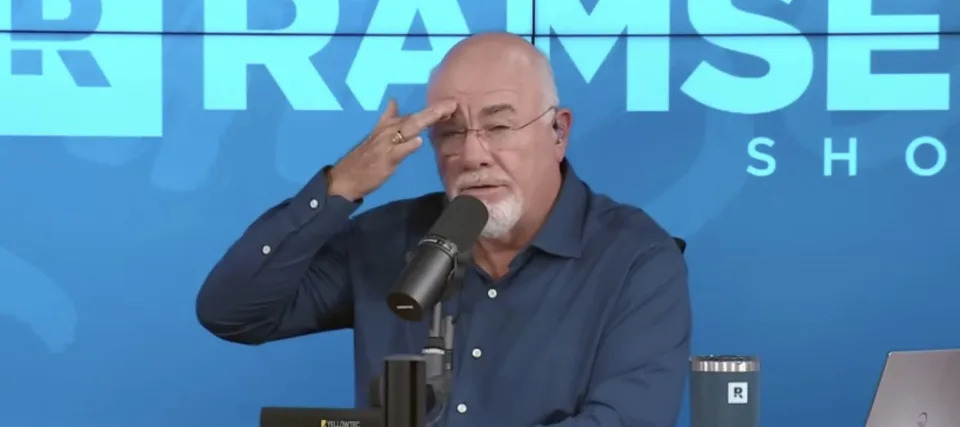

'Absolutely horrible': Here are the 3 big reasons Dave Ramsey hates whole life i...

source link: https://finance.yahoo.com/news/absolutely-horrible-3-big-reasons-140000554.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

'Absolutely horrible': Here are the 3 big reasons Dave Ramsey hates whole life insurance — do this with your hard-earned retirement savings instead

When it comes to whole life insurance, “It’s not a mild dislike,” said Dave Ramsey in a recent episode of “The Ramsey Show,” where he’s offered financial advice since 1992. “I hate it.”

Why the disdain for whole life when so many Americans invest in it? Half have some form of life insurance, according to Annuity.org.

Don't miss

'Hold onto your money': Jeff Bezos issued a financial warning, says you might want to rethink buying a 'new automobile, refrigerator, or whatever' — here are 3 better recession-proof buys

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Here's the average salary each generation says they need to feel 'financially healthy.' Gen Z requires a whopping $171K/year — but how do your own expectations compare?

The idea is two-fold: First, having life insurance allows people to live with a sense of financial security. And second, when a policyholder passes away, the beneficiary (or beneficiaries) receive the funds from whole life insurance investments.

Yet when counting the reasons for his hate, Ramsey has three. And just like an overzealous insurance salesman, they’re pretty hard to ignore.

1. Fees, fees, fees

For every $100 you invest in whole life insurance, the first $5 goes to purchase the insurance itself; the other $95 goes to the cash value buildup from your investment. Yes, but … for about the first three years, your money goes to fees alone.

Someone is making out, and it’s not your beneficiary.

“It’s front-loaded as an investment,” Ramsey said. “That isn’t necessarily evil in and of itself but is frowned upon in the financial investment world by and large.”

2. Lousy returns

Ok, but you have it your whole life, right? Well, it doesn’t get much better after the first three years. The average rate of return after those “three years of zeroes” will be about 1.2% on that $95.

“Let’s be generous and say it’s double that,” Ramsey said. “It’s still not a good long-term investment. If I could get 2.4% on my money market I’d be dancing a jig, but not on my long-term investments.” Those, he noted, need to be north of 10% to beat inflation and taxes.

MarketWatch

MarketWatchAt 55 years old, I will have worked for 30 years — what are the pros and cons of retiring at that age?

It is completely understandable that you would want to retire after working for 30 years, especially when you have rental income, but I would caution you to take this decision very seriously and find a few backup plans. Usually, savers have to wait until they’re 59 ½ years old in order to take distributions from their retirement accounts, such as 401(k) plans and IRAs. Rental property is great, and having no mortgage over your head is a huge plus, but will it be enough to cover your everyday expenses and the unexpected for decades to come?

7h ago MoneyWise

MoneyWise'10 years left': This famed geopolitical analyst says China is going to collapse in the next decade — here are 3 key numbers that could support his contrarian forecast

But is China really that fragile?

3h ago 4h ago

4h ago Yahoo Finance

Yahoo FinanceMillions of debt collections dropped off Americans' credit reports

The total number of debt collections on credit reports dropped by 33% from 261 million in 2018 to 175 million in 2022.

1d ago TechCrunch

TechCrunchMeta to sell blue badge on Instagram and Facebook as Zuckerberg borrows Musk's playbook

Facebook-parent Meta has launched a subscription service, called Meta Verified, that will allow users to get the coveted blue check mark on their Instagram and Facebook accounts for up to $15 a month by verifying their identity, its chief executive Mark Zuckerberg said on Sunday, tapping a new revenue channel that has had mixed success for its smaller rival Twitter. The subscription service, first rolling out in New Zealand and Australia starting this week, is priced at $11.99 per month on the web or $14.99 on Apple’s iOS. Zuckerberg said in a Facebook post that Meta Verified "is about increasing authenticity and security across our services."

3h ago Yahoo Finance

Yahoo Finance'Stop being so greedy': Netflix users lash out as password crackdown grows

More and more Netflix users are expressing their concerns (and confusion) over the streamer's crackdown on password sharing.

6h ago MoneyWise

MoneyWise'Signs of resilience': Mortgage demand plummets to lowest 2023 level as rates rise for second week — but experts predict cooling rental prices will eventually bring rates below 6%

Rental prices make up around 40% of the consumer price index calculations.

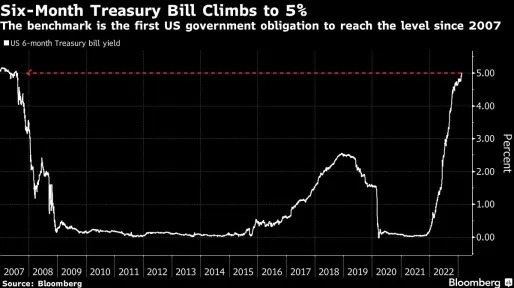

1d ago Bloomberg

BloombergTreasury Bills Offer Stock-Like 5% to Take Fed, Debt-Limit Risk

(Bloomberg) -- For the first time in nearly two decades, investors can earn more than 5% on some of the safest debt securities in the world. That’s competitive with riskier assets like the S&P 500 Index.Most Read from BloombergNorth Korea Fires ICBM, Issues New Warnings to USBlinken Rebukes China’s Top Diplomat on Balloon, UkraineAdani Credit Facilities Expose Collateral Web Full of Red FlagsWall Street Is Baffled by the Stock MarketThe Collapse of the UK Housing Market May Be ComingThere’s just

22h ago TheStreet.com

TheStreet.com3 High-Growth Stocks That Also Pay Dividends

Here are three dividend payers likely to grow earnings at double-digit rates over the next five years.

1d ago TipRanks

TipRanksBuy These 2 EV Charging Stocks, Analysts Say, Forecasting Over 50% Upside

Say ‘electric vehicle’ these days, and Elon Musk is probably the first association that will come to mind. After all, he’s a headline machine – but his Tesla company has proven that the EV market can be profitable for automakers and investors alike. But cars aren’t the only game in town for investors who want to buy into the EV sector, and worthwhile stocks don’t need to have Tesla-level prices. EVs are bringing a range of supporting technologies and infrastructure with them, from battery manufa

2d ago Investor's Business Daily

Investor's Business DailyDeere Leads 5 Stocks With Hot Products Near Buy Points

Deere, fresh off Friday's strong earnings move, leads this weekend's watch list of 5 stocks near buy points.

1d ago The Wall Street Journal

The Wall Street JournalWalgreens CEO Bets on Doctors Over Drugstores in Search for Growth

Deerfield, Ill.—A year into her job as Walgreens Boots Alliance chief executive, Rosalind Brewer realized the company’s board wasn’t entirely sold on her plan to save its ailing drugstore business. Together they visited a Phoenix-area medical practice belonging to VillageMD, a chain of primary-care clinics. Walgreens months into Ms. Brewer’s tenure, doubled its stake in the chain as part of a plan to attach VillageMD clinics to hundreds of its drugstores.

9h ago SmartAsset

SmartAssetWatch Out: Enabling Family Members Could Cost You Way More Than You Think

The recession, inflation and COVID-19 have made a bad situation worse. Financial dependency now has aging parents living with their adult children and their adult children footing the bill for their parent's ill-planned retirement. All while also trying to raise … Continue reading → The post Enablement Could Leave you Permanently Footing the Bill for Your Entire Family appeared first on SmartAsset Blog.

1d ago MarketWatch

MarketWatchBuy the stock-market dip? Why ‘cash’ yielding more than it has since 2007 could be king.

Cash equivalents like Treasury bills are yielding 5% for the first time since 2007, tempting investors worried about the Federal Reserve's inflation fight.

26m ago SmartAsset

SmartAssetCan I Contribute to an IRA After Retirement?

An IRA (and its corollary, the Roth IRA) is a form of tax-advantaged retirement account that lets you save money during your working years so you can withdraw it during retirement. There is no age limit to contributing to an … Continue reading → The post Can You Contribute to an IRA After Retirement? appeared first on SmartAsset Blog.

5h ago Bloomberg

BloombergAdani Credit Facilities Expose Collateral Web Full of Red Flags

(Bloomberg) -- Financing arrangements across the Adani Group conglomerate have sent a fresh chill through ESG markets as investors wake up to a new risk.Most Read from BloombergNorth Korea Fires ICBM, Issues New Warnings to USBlinken Rebukes China’s Top Diplomat on Balloon, UkraineAdani Credit Facilities Expose Collateral Web Full of Red FlagsWall Street Is Baffled by the Stock MarketThe Collapse of the UK Housing Market May Be ComingNorway’s largest pension fund, KLP, recently dumped its entire

11h ago Investor's Business Daily

Investor's Business DailyStock Market Holidays 2023: Is Wall Street Closed For Presidents' Day?

Take a look at this list of stock market holidays in 2023 to find out whether the market will be open on days like Labor Day, Black Friday, Christmas Eve and more.

6h ago TheStreet.com

TheStreet.comThis Pharma Is Starting to Recover Nicely

The stock trades just under eight bucks a share and sports an approximate market capitalization of $1.1 billion. Let's review some positives for Aurinia and explore a covered call idea that will have solid potential returns -- even if the shares give back a good bit of their recent gains over the option duration.

7h ago The Wall Street Journal

The Wall Street JournalIt’s Hard to Play the Market With Bed Bath & Beyond. These Meme Stock Investors Are Trying.

Enthusiastic buyers sent the stock higher in January and early February, with the price at times more than doubling for the year even as the company seemed to careen toward bankruptcy. The gains then rapidly unwound after Bed Bath & Beyond landed a new financing deal, which should keep the company afloat, at least for now, but will also dilute existing shareholders. The stock has fallen for all but one of the nine trading sessions since the retailer’s deal with hedge fund Hudson Bay Capital Management was reported.

9h ago Bloomberg

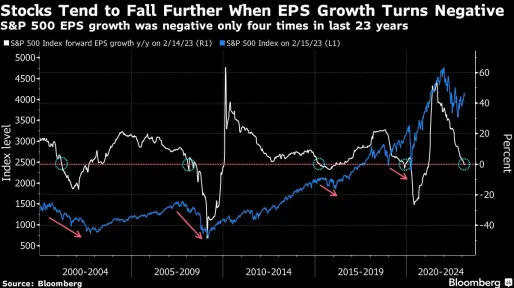

BloombergInvestors in a Bind as Risk Appetite Slams Into a Resolute Fed

(Bloomberg) -- Stock-market investors clamoring for a sense of direction after a month of yo-yo action are bracing for a week chock-full of economic data and Federal Reserve speakers that should help clarify the next step for US equities.Most Read from BloombergNorth Korea Fires ICBM, Issues New Warnings to USBlinken Rebukes China’s Top Diplomat on Balloon, UkraineAdani Credit Facilities Expose Collateral Web Full of Red FlagsWall Street Is Baffled by the Stock MarketThe Collapse of the UK Housi

5h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK