Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

source link: https://finance.yahoo.com/news/grab-70-tumble-shows-limits-234624871.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

- 10/10

Uber of Asia's 70% Tumble Shows the Limits of Singapore's Tech Dream

(Bloomberg Markets) -- In the ballroom of the five-star Shangri-La Singapore hotel, Anthony Tan celebrated a triumph for the country’s up-and-coming tech scene. “Today we shine a spotlight on Southeast Asia!” he told the adoring crowd. His company, Grab, the region’s answer to Uber, was about to make its stock market debut.

Most Read from Bloomberg

Tan had launched Grab Holdings Ltd. in 2012, just as ride-hailing companies were taking off. Masayoshi Son, the billionaire founder of Japan’s SoftBank Group Corp., one of Uber’s venture capital backers, was also behind Grab. Other investors included BlackRock, Fidelity, Morgan Stanley and Temasek, the Singapore state investment firm.

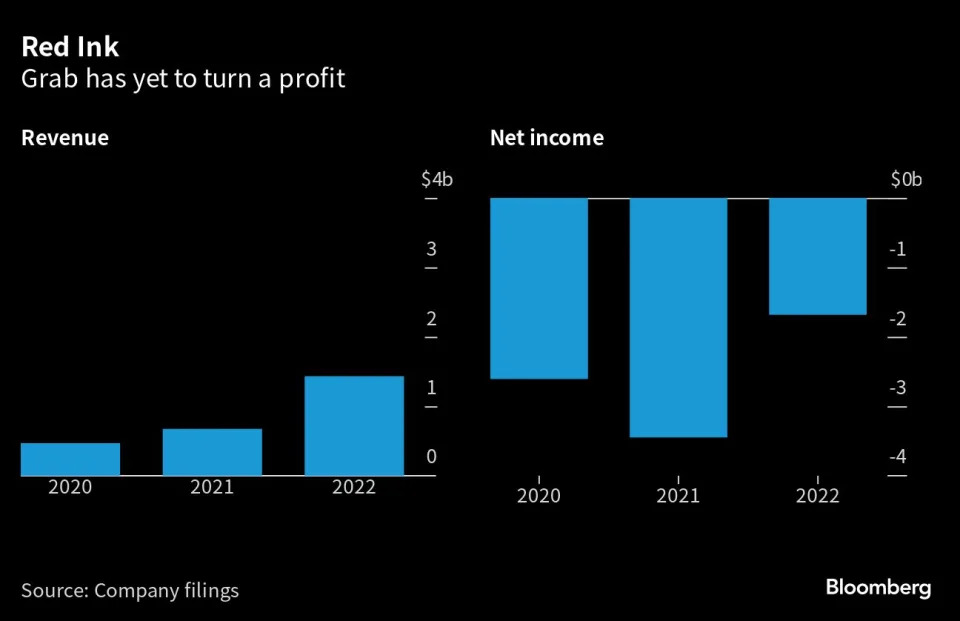

Not since the first internet boom of the 1990s had there been such hunger for unprofitable startups. Before it started publicly trading, Grab was valued at $40 billion, almost as much as American Airlines, Delta Air Lines and United Airlines combined. Tan, only 39 at the time, was on track to become a billionaire.

Even the date of Grab’s listing seemed auspicious. It read the same backward and forward: 12 02 2021. An eight-digit palindrome date will happen only 12 times this century. At 9:30 a.m. New York time, Tan and his co-founder, Tan Hooi Ling, rang the Nasdaq opening bell remotely from the Shangri-La. A blizzard of confetti showered the room. The Queen song We Are the Champions blasted out. But almost before the confetti hit the floor, Tan’s luck turned. The stock plunged 21% by the close of the trading day. Then it fell more. Even after a recent bounce, Grab is still down almost 70%.

The market’s cold appraisal raised questions about Grab’s future and Son’s investing acumen. It also hastened the demise of Wall Street’s latest mania. Grab had raised money in a complicated maneuver involving a corporate structure called a special purpose acquisition company, or SPAC. It was, and remains, the biggest SPAC deal in history.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK