Arm Needed 3,500 Words to Explain Its China Risks Before IPO

source link: https://finance.yahoo.com/news/arm-needed-3-500-words-053312309.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Arm Needed 3,500 Words to Explain Its China Risks Before IPO

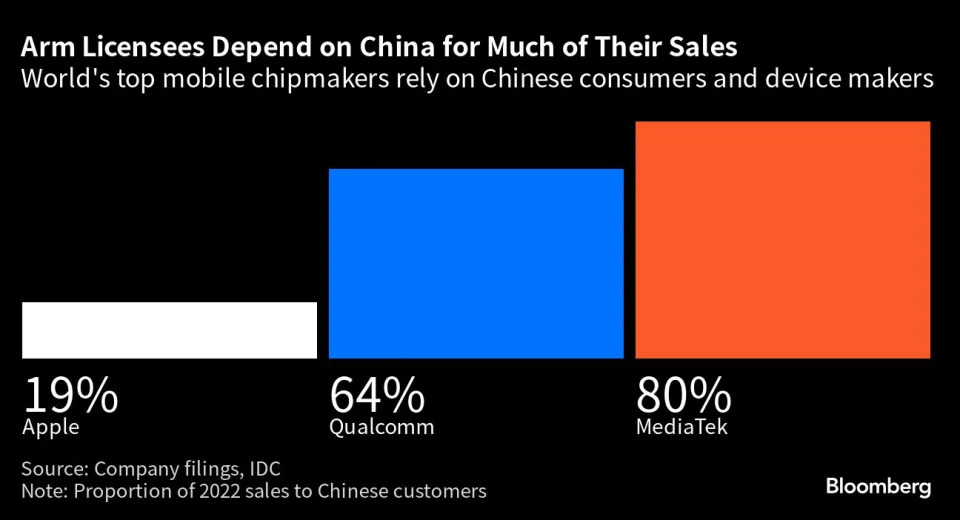

(Bloomberg) -- As it seeks to pull off what could be the largest initial public offering of the year, Arm Holdings Ltd. spent more than 3,500 words explaining the risks it faces in China, a critical market that accounts for about a quarter of its revenue.

Most Read from Bloomberg

In a chunky section of the IPO filing’s 330-page prospectus, the British designer of chips detailed a litany of challenges in the country: a concentration of business in the People’s Republic of China that “makes us particularly susceptible to economic and political risks affecting the PRC”; a downward spiral in Asia’s biggest economy; rising political tensions with the US and the United Kingdom; and the potential complete loss of control over its pivotal Chinese subsidiary.

Arm runs most of its China business through an independent unit, called Arm Technology Co., which is its single largest customer and accounted for about 24% of its sales in the year ended March. But Arm and its parent, Japan’s SoftBank Group Corp., don’t control that business.

Instead, SoftBank owns approximately 48% of Arm China, with the majority held by local investors, including entities affiliated with Allen Wu, Arm China’s former chief executive officer who was fired over allegations of conflicts of interest in 2020. The prolonged power struggle still leaves open the risk of leadership changes and affect regional operations.

“We depend on our commercial relationship with Arm China to access the PRC market,” the filing said. “If that commercial relationship no longer existed or deteriorates, our ability to compete in the PRC market could be materially and adversely affected.”

The Telegraph

The TelegraphChina facing ‘downward spiral’ as property crisis deepens

China is facing a “downward economic spiral” amid a mounting crisis in its debt-laden property sector, analysts have warned.

1d ago Bloomberg

BloombergCoinbase Takes Stake in Stablecoin Issuer Circle

(Bloomberg) -- Coinbase Global Inc., the biggest US crypto exchange, has taken a stake in stablecoin issuer Circle citing “growing regulatory clarity for stablecoins in the US” and elsewhere.Most Read from BloombergMusk Told Pentagon He Spoke to Putin Directly, New Yorker SaysBorrowers With $39 Billion in Student Loans Finally See ReliefQuant Trader Doubles Fortune to $11 Billion as XTX Profit SurgesS&P Joins Moody’s in Cutting US Banks Amid ‘Tough’ ClimateThe companies were co-founders of the C

1d ago Bloomberg

BloombergSoftBank’s Arm Files for IPO That Is Set to Be 2023’s Biggest

(Bloomberg) -- SoftBank Group Corp.’s Arm Holdings Ltd. took a step toward what’s set to become the biggest initial public offering of the year, a bet that the once-obscure designer of phone chips can flourish in the era of artificial intelligence computing.Most Read from BloombergMusk Told Pentagon He Spoke to Putin Directly, New Yorker SaysBorrowers With $39 Billion in Student Loans Finally See ReliefQuant Trader Doubles Fortune to $11 Billion as XTX Profit SurgesS&P Joins Moody’s in Cutting U

1d ago Bloomberg

BloombergWhy Threads, Meta's Twitter Killer, Needs a Desktop Version

(Bloomberg) -- On Threads, Meta Platforms Inc.’s Twitter copycat, users have been asking for weeks for a version that works on their computers. Soon, the company is expected to fulfill the wish.Most Read from BloombergMusk Told Pentagon He Spoke to Putin Directly, New Yorker SaysGoldman Is Cracking Down on Employees That Aren't in Office Five Days a WeekBorrowers With $39 Billion in Student Loans Finally See ReliefStocks Fail to Catch a Bid Before Nvidia’s Results: Markets WrapHalf a Million US

14h ago Bloomberg

BloombergMore Autonomous Robots to Hit Farms With Manufacturer’s US Expansion

(Bloomberg) -- Startup Solinftec, a maker of autonomous farming robots, has doubled its global capacity as a shortage of agricultural workers boosts the appeal of robots and drones.Most Read from BloombergMusk Told Pentagon He Spoke to Putin Directly, New Yorker SaysBorrowers With $39 Billion in Student Loans Finally See ReliefQuant Trader Doubles Fortune to $11 Billion as XTX Profit SurgesS&P Joins Moody’s in Cutting US Banks Amid ‘Tough’ ClimateFollowing a factory expansion in Indiana, the com

1d ago The Wall Street Journal

The Wall Street JournalTech, Media & Telecom Roundup: Market Talk

Find insights on Totvs, Palo Alto Networks, Nano Dimension and more in the latest Market Talks covering Technology, Media and Telecom.

1d ago Bloomberg

BloombergArm Listing Set to Be Turning Point for IPO Market, SoftBank

(Bloomberg) -- Arm Ltd. is expected to unveil its filing for an initial public offering as soon as Monday, giving the market a peek at the chip designer’s financial health seven years after it was acquired by SoftBank Group Corp.Most Read from BloombergMusk Told Pentagon He Spoke to Putin Directly, New Yorker SaysGoldman Is Cracking Down on Employees That Aren't in Office Five Days a WeekBorrowers With $39 Billion in Student Loans Finally See ReliefStocks Fail to Catch a Bid Before Nvidia’s Resu

2d ago Bloomberg

BloombergGetir’s Late Bills, Staff Cuts Show Delivery’s European Decline

(Bloomberg) -- Turkish startup Getir said it struggled to pay some bills in Germany and will cut more than 10% of its global workforce, as the rapid delivery service seeks to raise new funds and attempt to turn around its cash-hungry business. Most Read from BloombergMusk Told Pentagon He Spoke to Putin Directly, New Yorker SaysGoldman Is Cracking Down on Employees That Aren't in Office Five Days a WeekBorrowers With $39 Billion in Student Loans Finally See ReliefStocks Fail to Catch a Bid Befor

11h ago Investopedia

InvestopediaPalo Alto Networks Shares Surge After Earnings Beat on Cybersecurity Demand

Shares of Palo Alto Networks rallied after the company beat expectations for earnings on strong demand for the firm's cybersecurity services.

1d ago Reuters

ReutersRobust equities erode gold's safe-haven allure as ETF holdings fall

(Reuters) -Receding fears of a U.S. slowdown, surging bond yields and the robust performance of equities have gradually eroded the appeal of exchange-traded funds (ETF) backed by traditional safe-haven gold this year, despite sticky inflation. Overall holdings in over 100 gold ETFs tracked by the World Gold Council (WGC) fell to 3,348 metric tons as of Aug. 18, at their lowest level since 3,330 tons in April 2020. The biggest ETF, SPDR Gold Trust, saw holdings dwindle to pre-pandemic levels.

2d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK