Alphabet downgrades 'legit,' tech valuations becoming worrisome: Portfolio manag...

source link: https://finance.yahoo.com/video/alphabet-downgrades-legit-tech-valuations-214512075.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Alphabet downgrades 'legit,' tech valuations becoming worrisome: Portfolio manager

Alphabet downgrades 'legit,' tech valuations becoming worrisome: Portfolio manager

Tech stocks have been high-fliers this year, with the Nasdaq (^IXIC) up about 30 percent year to date. But there are growing concerns about whether those stocks have come too far, too fast. Paul Meeks, Independent Solutions Wealth Management Portfolio Manager, tells Yahoo Finance Live's Seana Smith and Akiko Fujita that he is worried about the valuations of tech stocks. Meeks cites two reasons. First is the AI hype. Meeks notes that a lot of companies spoke about AI on their earnings calls, but analysts didn't adjust their outlooks based on those comments, with the exception of Nvidia (NVDA). The second is interest rates. "Tech and aggressive growth stocks need low interest rates," Meeks said, so the Federal Reserve's "hawkish pause" is a "real incremental negative" to tech stocks. When it comes to specific stocks, Meeks says the two recent Alphabet (GOOGL) downgrades are "legit," even though he likes the stock long term. Meeks says he is looking for defensive stocks within the tech sector. When it comes to defensive AI plays, Meeks specifically mentions Extreme Networks (EXTR) and AMD (AMD). Meeks also likes Uber Technologies (UBER) which he says is on a "very visible path to profitability," while rival Lyft (LYFT) is "a company that's badly damaged." As far as Tesla (TSLA) is concerned, Meeks says the stock's performance is "a bit worrisome," adding that it can sometimes be hard to value because "it's more a cult." Meeks is less of a fan of Chinese tech stocks such as JD.com (JD) and Alibaba (BABA) because of the China's weak economic recovery from the Covid pandemic. Key video moments 00:00:55 Meeks on Alphabet downgrades 00:01:30 Meeks explains why he is concerned about tech valuations 00:03:14 How Meeks is playing AI 00:03:40 Best ways to play AI 00:04:45 What Meeks likes about Uber Technologies 00:05:19 Why Meeks is not a fan of some Chinese stocks 00:06:08 Meeks on Tesla

-

Alphabet downgrades 'legit,' tech valuations becoming worrisome: Portfolio manager

-

Walgreens cuts guidance, Lordstown Motors' bankruptcy, Unity Software shares soared: Top stories

-

Pickleball could cost Americans up to $500 million in medical costs: UBS

-

Ryan Seacrest to replace Pat Sajak as 'Wheel of Fortune' host

-

Airbnb listens to customer feedback on booking transparency, cleaning fees

-

2 in 5 Americans find credit card debt embarrassing: Report

-

Big banks face Fed stress test after this year's bank failiures

-

Costco cracking down on shoppers sharing membership cards

-

Why consumers are less pessimistic on stocks according to economic data

-

Lordstown Motors files for bankruptcy: Why there could be more consolidation in the EV space

-

Walgreens slashes guidance, Delta stock, Meta price target: Trending stocks

-

Lordstown Motors stock sinks on bankruptcy filing

-

Housing outlook: Why one economist says its going to be an 'interesting year' for the market

Tech stocks have been high-fliers this year, with the Nasdaq (^IXIC) up about 30 percent year to date. But there are growing concerns about whether those stocks have come too far, too fast.

Paul Meeks, Independent Solutions Wealth Management Portfolio Manager, tells Yahoo Finance Live's Seana Smith and Akiko Fujita that he is worried about the valuations of tech stocks. Meeks cites two reasons. First is the AI hype. Meeks notes that a lot of companies spoke about AI on their earnings calls, but analysts didn't adjust their outlooks based on those comments, with the exception of Nvidia (NVDA). The second is interest rates. "Tech and aggressive growth stocks need low interest rates," Meeks said, so the Federal Reserve's "hawkish pause" is a "real incremental negative" to tech stocks.

When it comes to specific stocks, Meeks says the two recent Alphabet (GOOGL) downgrades are "legit," even though he likes the stock long term. Meeks says he is looking for defensive stocks within the tech sector. When it comes to defensive AI plays, Meeks specifically mentions Extreme Networks (EXTR) and AMD (AMD). Meeks also likes Uber Technologies (UBER) which he says is on a "very visible path to profitability," while rival Lyft (LYFT) is "a company that's badly damaged." As far as Tesla (TSLA) is concerned, Meeks says the stock's performance is "a bit worrisome," adding that it can sometimes be hard to value because "it's more a cult."

Meeks is less of a fan of Chinese tech stocks such as JD.com (JD) and Alibaba (BABA) because of the China's weak economic recovery from the Covid pandemic.

Key video moments

00:00:55 Meeks on Alphabet downgrades

00:01:30 Meeks explains why he is concerned about tech valuations

00:03:14 How Meeks is playing AI

00:03:40 Best ways to play AI

00:04:45 What Meeks likes about Uber Technologies

00:05:19 Why Meeks is not a fan of some Chinese stocks

00:06:08 Meeks on Tesla

Video Transcript

SEANA SMITH: Google trading lower today over the past two days. We're looking at losses of just about 3%. Now, this comes on the heels of two downgrades. Bernstein cutting its rating on the tech giant to market perform. But it kept its price target at $125 a share. This is the first time that Berenstein analyst Mark Shmulik downgraded Alphabet since he started covering the stock in 2020.

Yahoo Finance

Yahoo FinanceGoogle parent Alphabet’s stock hit with two downgrades this week

Google parent Alphabet's stock was hit by downgrades at two investment firms.

9h ago Zacks

ZacksDexcom (DXCM) to Launch New Product in 2024, Ups Long-Term View

Dexcom (DXCM) announces encouraging developments in 2024, including faster coverage for its products by private payers and new product launch for diabetic patients not on insulin.

16h ago Investor's Business Daily

Investor's Business DailyTop 5 China Stocks: EV Giant BYD, Mobile Gaming Play NetEase In Buy Zones

Several China stocks are doing well, setting up near buy points, with renewed stimulus hopes buoying shares again.

5h ago Zacks

ZacksIs It Worth Investing in Coke (KO) Based on Wall Street's Bullish Views?

According to the average brokerage recommendation (ABR), one should invest in Coke (KO). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' recommendations tend to be overly optimistic. Would it be worth investing in the stock?

2d ago Zacks

ZacksAlphabet Inc. (GOOG) Stock Sinks As Market Gains: What You Should Know

Alphabet Inc. (GOOG) closed at $119.01 in the latest trading session, marking a -0.07% move from the prior day.

6h ago Investor's Business Daily

Investor's Business DailyDow Jones Futures: Market Rallies Bullishly, But Nvidia Falls Late On AI Chip Export Ban Report

The market rallied bullishly, with many stocks flashing buy signals. But Nvidia fell late on an AI chip export ban report.

7m ago Business Insider

Business InsiderRussia's near-mutiny just cratered its currency against the dollar

Insider's Phil Rosen breaks down how political turmoil in Russia has swayed foreign currency markets.

10h ago The Wall Street Journal

The Wall Street JournalHow to Make Uber and Other Ratings Work for You

The proliferation of ratings for many services and experiences has left customers mystified and at times annoyed. While ratings are intended to help consumers make better choices and provide feedback to workers, a recent Wall Street Journal article detailed how they have become almost meaningless in many areas. “I think for this ‘5 star’ rating system to work properly, we need to first define to BOTH parties—driver and passengers, host and guest—what we are looking for to constitute a ‘5 star’ review,” said William Ho of Los Angeles.

1d ago Yahoo Finance

Yahoo FinanceCompetition heats up in weight loss drug pills, injectables space

The weight loss drug space will be dominated by three big pharma players, two of which are way ahead of the game.

8h ago Bloomberg

BloombergNvidia Leads Selloff After Report of More US AI Chip Curbs

(Bloomberg) -- Nvidia Corp. led declines in tech stocks after a report Washington could close loopholes in the sale to China of powerful chips used to train artificial intelligence, potentially denting sales in the world’s top semiconductor market.Most Read from BloombergStudent Loan-Relief Backers Warn Biden ‘Failure Isn’t an Option’UBS Preparing to Cut Over Half of Credit Suisse WorkforceWagner Chief Lands in Belarus as Putin Says ‘Civil War’ AvertedPickleball Injuries May Cost Americans Nearl

1h ago Yahoo Finance

Yahoo FinanceTesla: Why Wall Street is getting cautious after a monster rally to start 2023

Tesla's soaring stock price to start 2023 has analysts worried shares of the electric vehicle maker might be looking frothy.

19h ago Barrons.com

Barrons.comChargePoint Stock Rises After It Adopts Tesla’s EV Plug. The Standards War Is Won.

EV charging stocks rallied Tuesday in response to the latest news about companies switching over to use Tesla -style EV charging plugs. Investors are still having some trouble making sense of EV charging in the wake of Tesla’s (ticker: TSLA) decision to open up its supercharging network to other EV drivers. Coming into Tuesday trading, stock in Wallbox, an EV charging company, was down about 13% since the late May Tesla-Ford announcement that opened up the Tesla (TSLA) charging network to Ford Motor (F) drivers.

8h ago Barrons.com

Barrons.comAlphabet Stock’s Pressures Are Building. Why It’s ‘Time to Move to the Sidelines.’

While it’s a tough call to bet against the tech giant, which historically is a winner, Alphabet may be fairly valued right now, according to Bernstein analysts.

10h ago The Wall Street Journal

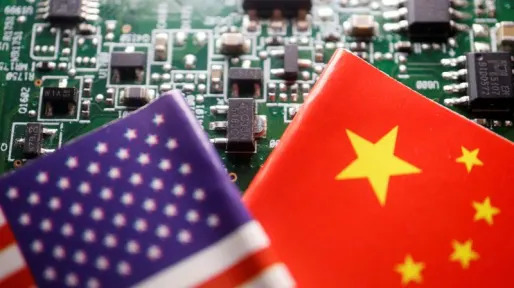

The Wall Street JournalU.S. Considers New Curbs on AI Chip Exports to China

Restrictions come amid concerns that China could use AI chips from Nvidia and others for weapon development and hacking.

6h ago Reuters

ReutersUS considering new restrictions on AI chip exports to China - WSJ

Shares of Nvidia fell more than 2%, while Advanced Micro Devices (AMD) fell about 1.5% on the news in extended trading. The Commerce Department will stop the shipments of chips made by Nvidia and other chip companies to customers in China as early as July, the report said.

6h ago Investor's Business Daily

Investor's Business DailyThis Cathie Wood Stock Is Outperforming Even Tesla

Cathie Wood has bet big on 10 stocks. Tesla stock has more than doubled in 2023, but it's not the strongest performer among Ark Invest's major holdings.

17h ago Benzinga

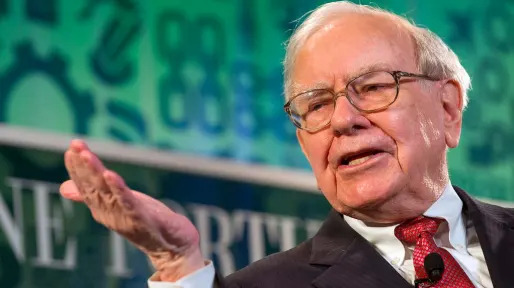

BenzingaFrugal Billionaire Warren Buffett Drives A 2014 Car And Looks For Hail-Damaged Deals

Warren Buffett's choice of vehicle has become a topic of interest among many people. Renowned for his frugal and simple lifestyle, the billionaire investor drives a 2014 Cadillac XTS. While some billionaires indulge in extravagant cars as a visible symbol of wealth and success, Buffett's preference for older models reflects his unique approach to life and finances. Buffett's frugality and minimalist mindset have been key factors in his tremendous success as an investor. His ability to seek value

1d ago Business Insider

Business InsiderUS home prices are still dropping - and the S&P 500 will erase this year's gains, top economist David Rosenberg says

Prices of both new and existing US homes dropped in April, and stocks are likely to slump as the Fed's rate hikes take effect, David Rosenberg said.

4h ago Business Insider

Business InsiderPile into mega-cap tech stocks for the next 6 months as a recession is likely, top Citi strategist says

The US economy will slip into a recession in the fourth quarter, boosting mega-cap stock prices even higher, Stuart Kaiser said.

6h ago Fortune

FortuneA recession indicator that predicted every downturn since 1969 started flashing months ago—and a Wall Street veteran warns it always works on a delay

Megan Horneman, who worked at Deutsche Bank before moving to Verdence Capital, says many signals are pointing to an “unavoidable” recession later this year.

11h ago Investor's Business Daily

Investor's Business DailyMarket Shrugs Off Wagner Insurrection - These Stocks Could Surge If Putin Is Overthrown

The stock market shrugged off the failed Wagner insurrection attempt, but if President Vladimir Putin is overthrown some stocks could rally.

1d ago Zacks

ZacksBoeing (BA) Outpaces Stock Market Gains: What You Should Know

Boeing (BA) closed the most recent trading day at $209.43, moving +1.87% from the previous trading session.

6h ago TipRanks

TipRanksThese 2 ‘Strong Buy’ Penny Stocks Could Soar to $25 (Or Higher), Says Piper Sandler

Whether you love them or hate them, penny stocks are contentious. These tickers, which trade for less than $5 per share, have earned a reputation on Wall Street for their divisive nature, leaving investors struggling to find common ground on the matter. The appeal is clear. For the same price as one share of a more well-known company, investors can snap up hundreds of shares of a penny stock. What’s more, the fact that even minor share price appreciation can translate to irresistible percentage

14h ago Yahoo Finance

Yahoo FinanceLordstown Motors files for bankruptcy, sues Foxconn

Lordstown Motors, which once had a valuation of more than $5 billion, filed for bankruptcy on Tuesday.

15h ago Business Insider

Business InsiderThese are the bearish signals investors should monitor to stay ahead of a potential sell-off in stocks, according to Bank of America

"Dow Theory has yet to confirm a primary bull market from late 2022," Bank of America technical strategist Stephen Suttmeier said.

4h ago Zacks

ZacksEV Roundup: NIO Raises More Than $700M, RIVN to Ride TSLA's NACS Wave & More

While NIO secures a $738.5 million investment from Abu Dhabi's CYVN Holdings, Rivian (RIVN) becomes the latest automaker to embrace Tesla's (TSLA) EV charging standard.

14h ago SmartAsset

SmartAssetTreasury Bonds vs. TIPS Ladders vs. Annuities: Which Strategy Is Best For Retirement Income?

Generating enough income in retirement to meet your spending needs is crucial. While Social Security provides inflation-protected retirement income, it's simply not enough for many retirees. If you need help planning for retirement, consider working with a financial advisor. John Rekenthaler, … Continue reading → The post Treasury Bonds vs. TIPS Ladders vs. Annuities: Which Strategy Is Best For Retirement Income? appeared first on SmartAsset Blog.

15h ago Investor's Business Daily

Investor's Business DailyAnalysts Are Almost 100% Certain You Should Buy These 10 Stocks

Analysts rarely agree on much. So when they do — especially on the best S&P 500 stocks to buy — it's worth hearing them out.

2d ago Barrons.com

Barrons.comApple Hit a New High Today. Why It’s Still Risky.

Apple stock hit a new high on Tuesday, but the stock isn’t immune to problems that could cause a selloff. Apple (ticker: AAPL) shares on Tuesday afternoon closed up 1.5%, ending at $188.06 each. Apple stock has been on a tear, jumping 45% so far this year.

8h ago The Wall Street Journal

The Wall Street JournalLucid Stock Jumps on Aston Martin Electric-Vehicle Partnership

Shares of Lucid Group jumped after Aston Martin Lagonda said it intended to enter a supply deal with the startup to create [luxury electric vehicles](https://www.wsj.com/articles/lucid-revs-up-aston-martins-ev-plans-1dec4b45). London-listed Aston Martin also rose nearly 11%. The agreement will give Aston Martin access to Lucid's technology such as powertrains and battery systems.

1d ago Benzinga

BenzingaWarren Buffett's Sweetest Investment: His Dream Prototype Business Is A Candy Company

Warren Buffett, the billionaire CEO of Berkshire Hathaway Inc., has made countless successful investments in his lifetime. But when it comes to his favorite investment, you might be surprised to learn that it’s not a tech giant or a blue-chip company but a small candy business called See’s Candies. See Next: This Startup Invented Programmable, Drinkable Plastic That Dissolves In Water In 60 Hours Despite representing less than 0.1% of Berkshire Hathaway’s holdings, Buffett has repeatedly called

1d ago Bloomberg

BloombergFund Founder Beschloss Warns Interest Rate ‘Regime Change’ Will Ruin Investing

(Bloomberg) -- When the Federal Reserve ended a years-long policy of ultra-low interest rates, it upended expectations for investments, according to Afsaneh Beschloss, founder and chief executive officer of RockCreek Group.Most Read from BloombergStudent Loan-Relief Backers Warn Biden ‘Failure Isn’t an Option’Wagner Chief Lands in Belarus as Putin Says ‘Civil War’ AvertedPutin Blasts Wagner ‘Traitors’ as Prigozhin Defends RevoltPickleball Injuries May Cost Americans Nearly $400 Million This Year

16h ago Zacks

ZacksAbbVie (ABBV) Dips More Than Broader Markets: What You Should Know

AbbVie (ABBV) closed the most recent trading day at $134.95, moving -0.71% from the previous trading session.

1d ago Barrons.com

Barrons.comNvidia-Snowflake AI Pact Creates Two Winners, Says Analyst

A deal with Nvidia will offer generative artificial-intelligence technology to Snowflake's customers. Mizuho analyst Jordan Klein says Snowflake is entering the generative AI arena.

12h ago Zacks

ZacksAmazon (AMZN) Outpaces Stock Market Gains: What You Should Know

Amazon (AMZN) closed at $129.18 in the latest trading session, marking a +1.45% move from the prior day.

6h ago Zacks

ZacksHere is What to Know Beyond Why CVR Energy Inc. (CVI) is a Trending Stock

CVR (CVI) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

2d ago Investor's Business Daily

Investor's Business DailyThese Are The 5 Best Stocks To Buy And Watch Now

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist?

8h ago Business Insider

Business Insider'Dean of Valuation' Aswath Damodaran says Nvidia's stock is overvalued even considering its bright prospects

Nvidia's stellar rally so far has dominated the US stock market, but the company's stock price is overvalued even considering its bright future.

8h ago Zacks

ZacksThe Zacks Analyst Blog Highlights ServiceNow, Palo Alto Networks and Vinci

ServiceNow, Palo Alto Networks and Vinci are included in this Analyst Blog.

19h ago Zacks

ZacksHere's Why You Should Retain CVS Health (CVS) Stock for Now

Investors are optimistic about CVS Health (CVS) backed by the acquisition of Oak Street Health, which broadens its value-based primary care platform.

12h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK