The market's biggest winners are getting downgraded by Wall Street

source link: https://finance.yahoo.com/news/the-stock-markets-biggest-winners-are-getting-downgraded-by-wall-street-160502699.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The stock market's biggest winners are getting downgraded by Wall Street

giant from buy to neutral,

Tech stocks have rebounded so well from their down year in 2022 that there might not be a buying opportunity there anymore.

At least that's what some Wall Street analysts are saying as they slap downgrades on some of 2023's best performers like Tesla (TSLA), Apple (AAPL)and Alphabet (GOOGL).

"It's difficult to model upside to our current high-single-digit [websites] growth estimates," UBS analyst Lloyd Walmsley said in a note on Monday that downgraded Alphabet shares from Buy to Neutral.

Walmsley joins a growing list of big tech analysts to caution about future upside in the 2023 rally. Two weeks ago, his colleague at UBS David Vogt downgraded Apple from Buy to Neutral, noting that "growth is likely to remain under pressure." Three analysts have now downgraded Tesla in less than a week.

Importantly, the downgrades aren't saying that things look overly gloomy for some of the tech stalwarts. In fact, in some cases, analysts are still expecting the stocks to go up.

The downgrades indicatethe market is finally correctly pricing in the potential for future earnings, and therefore, the stocks might be priced just fine where they stand today.

"We believe the stock now better reflects our positive long-term view of the company’s growth potential and competitive positioning post the substantial move higher YTD," Goldman Sachs analyst Mark Delaney wrote in a note in Monday.

Delaney downgraded Tesla from Buy to Neutral while boosting his price target from $185 to $248. Last week, Morgan Stanley analyst Adam Jonas made a similar move downgrading Tesla from Overweight to Equal Weight, while lifting his price target from $200 to $250.

"I have to be up-front with you all," Jonas wrote. "While the team has defended the Tesla OW rating all year, I did not see this 111% YTD rally coming (the S&P 500 is up 14% YTD, for context). We think it's understandable and are sympathetic to the changes in the market narrative around the name. We're not trying to call 'the end' to the Tesla rally and from our discussions continue to find a significant degree of investor skepticism/lack of exposure around the name."

Yahoo Finance

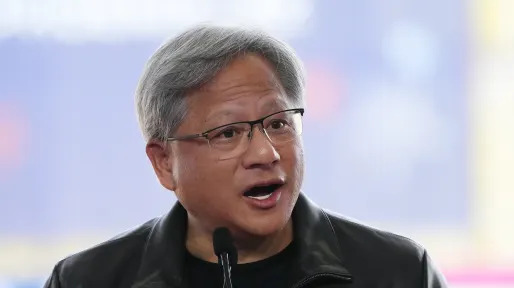

Yahoo FinanceNvidia, Snowflake announce partnership for custom generative AI models

Nvidia and Snowflake are entering a partnership that will let Snowflake customers build custom generative AI models.

4h ago Yahoo Finance

Yahoo FinanceTesla stock drops after Goldman Sachs downgrade

Goldman Sachs became the latest Wall Street firm to downgrade Tesla stock as analysts react to a more than 100% rally in the stock so far this year.

11h ago Benzinga

BenzingaFrugal Billionaire Warren Buffett Drives A 2014 Car And Looks For Hail-Damaged Deals

Warren Buffett's choice of vehicle has become a topic of interest among many people. Renowned for his frugal and simple lifestyle, the billionaire investor drives a 2014 Cadillac XTS. While some billionaires indulge in extravagant cars as a visible symbol of wealth and success, Buffett's preference for older models reflects his unique approach to life and finances. Buffett's frugality and minimalist mindset have been key factors in his tremendous success as an investor. His ability to seek value

7h ago TipRanks

TipRanksWells Fargo Predicts up to 125% Rally for These 2 Stocks — Here’s Why They Have Solid Upside

Even accounting for recent losses, the tech-heavy NASDAQ index is up 28% so far this year, leading the way in an overall bullish market. The surge in the NASDAQ has been fueled by investors gravitating towards tech giants. According to Chris Harvey, head of equity strategy for Wells Fargo, the rally is solid, and it will remain so until the Federal Reserve cranks up interest rates enough to kill it. Harvey notes that inflation, while falling, remains persistently above the central bank’s 2% targ

8h ago Yahoo Finance

Yahoo FinancePfizer stock drops after company picks twice-daily weight loss pill candidate

Pfizer stock fell Monday after the company announced it would pursue a twice-daily weight loss treatment pill in favor of its once-daily alternative amid a booming market for GLP-1 drugs.

10h ago Yahoo Finance

Yahoo FinanceStocks slip, tech drags to start last week of June trading: Stock market news today

Stocks slipped to start the new week Monday as tech stocks fell and investors considered what the weekend's short-lived challenge to Vladimir Putin by armed mercenaries in Russia means for markets.

8h ago Investor's Business Daily

Investor's Business DailyMarket Shrugs Off Wagner Insurrection - These Stocks Could Surge If Putin Is Overthrown

The stock market shrugged off the failed Wagner insurrection attempt, but if President Vladimir Putin is overthrown some stocks could rally.

8h ago Business Insider

Business InsiderNancy Pelosi's husband just snapped up $2.6 million of Apple and Microsoft stock, closing out an options bet that the shares would soar

Paul Pelosi bought 5,000 shares of both Apple and Microsoft stocks on June 15, exercising 50 call options purchased on May 24, 2022.

4h ago Investor's Business Daily

Investor's Business DailyAnalysts Are Almost 100% Certain You Should Buy These 10 Stocks

Analysts rarely agree on much. So when they do — especially on the best S&P 500 stocks to buy — it's worth hearing them out.

16h ago Zacks

ZacksHere is What to Know Beyond Why AT&T Inc. (T) is a Trending Stock

AT&T (T) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

15h ago Benzinga

BenzingaIt'll 'Upset A Lot Of Donors': Elon Musk Mocks Joe Biden's Tweet Calling On The Super Rich To Pay 'Their Fair Share.' Here's How Some Billionaires Pay Less Income Tax Than You

The fairness of the U.S. tax system has long been debated. Earlier this month, President Joe Biden tweeted, “It’s about time the super-wealthy start paying their fair share.” The message caught the attention of Tesla Inc. CEO and Twitter Inc. owner Elon Musk. “Please give him the password, so he can do his own tweets,” Musk replied, implying that the tweet wasn’t written by the commander in chief himself. But the billionaire business tycoon actually agrees with Biden’s view. “In all seriousness,

11h ago Bloomberg

BloombergPalantir’s AI Surge Hardens Resolve of Stock’s Bears

(Bloomberg) -- Few stocks have better embodied Wall Street’s frenzy around artificial intelligence lately than Palantir Technologies Inc.Most Read from BloombergPutin Blasts Wagner ‘Traitors’ After Prigozhin Denies Coup PlotRussia Latest: Zelenskiy Adviser Says Wagner Remains in UkrainePutin Faces Historic Threat to Absolute Grip on Power in RussiaRussia Latest: Putin Says Mutiny’s Organizers Sought to DivideSilence Cloaks Kremlin After Russian Mutiny Against PutinAfter a rough couple of years,

14h ago Oilprice.com

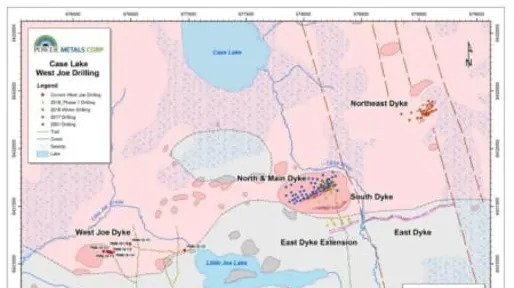

Oilprice.comThe Rare Metal Keeping Xi and Biden Up At Night

Canada’s Case Lake is the center of one of the most exciting rare metal discoveries of the last decade, with a small explorer unearthing what could be the only new cesium play in existence

4h ago TipRanks

TipRanks‘When Overbought Is Bullish’: Oppenheimer Sees S&P Uptrend Reaching 4,600 — Here Are 2 ‘Strong Buy’ Stocks to Bet on It

Investors will never stop looking for the best time to enter or exit the markets, but it is a very difficult move to get right. As fabled investor Peter Lynch has put it, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” With this in mind, Ari Wald, the Head of Technical Analysis at Oppenheimer says a better way to assess where the market is at is to follow the trend. More specifically, from a

1d ago Business Insider

Business InsiderWarren Buffett's global market gauge soars to nearly 110%, signaling stocks are overvalued and might crash

Warren Buffett has cautioned that a spike in the so-called Buffett indicator is a "very strong warning signal" for the stock market.

5h ago Zacks

ZacksMicrosoft (MSFT) Dips More Than Broader Markets: What You Should Know

Microsoft (MSFT) closed the most recent trading day at $328.60, moving -1.92% from the previous trading session.

6h ago Investopedia

InvestopediaTop CD Rates Today, June 26, 2023

See what today's top nationwide rate is for every CD term, and how it compares to the previous business day's top rate. We collect data from more than 200 financial institutions.

6h ago Investor's Business Daily

Investor's Business DailyUnited Airlines Nears Buy Point With 281% Earnings Growth Estimates

Growth stock UAL is near a buy point in a cup with handle. Wall Street estimates a 281% earnings growth for 2023.

10h ago SmartAsset

SmartAssetHow Much Will a $1.5 Million Annuity Earn Me Annually?

Annuities are a form of hybrid financial product. Part investment and part contract, they're primarily sold by insurance companies as a way to save for retirement. While in recent years they have come under criticism for below-market returns, many retirees … Continue reading → The post How Much Would a $1.5 Million Annuity Pay? appeared first on SmartAsset Blog.

2d ago Investor's Business Daily

Investor's Business DailyTesla Stock Downgraded Yet Again; Cathie Wood Sells $7 Million In TSLA Shares

Tesla got a fourth downgrade in five days on Sunday. Goldman Sachs expects vehicle price cuts and discounts to continue whittling away Tesla's gross margins.

8h ago SmartAsset

SmartAssetThis Loophole Could Help You Want Buy More than $10,000 in I Bonds

In a world where the stock market is unpredictable and interest rates are rising, many investors are looking for someplace to put their money that is as close to risk-free as possible - even if it means forgoing the chance … Continue reading → The post How to Buy More than $10,000 in I Bonds Through This Loophole appeared first on SmartAsset Blog.

2d ago Zacks

ZacksVerizon Communications (VZ) Gains As Market Dips: What You Should Know

Verizon Communications (VZ) closed at $36.11 in the latest trading session, marking a +1.69% move from the prior day.

6h ago TipRanks

TipRanksTipranks’ ‘Perfect 10’ List: These Top-Rated Dividend Stocks Yield Up to 10%

We’re in the midst of a general bullish trend, with strong year-to-date gains, but last week saw a brake on that rally, with a losing week across the main indexes. Call it a warning sign. While sentiment remains solid, the headwinds are gathering. The Federal Reserve held interest rates steady in its June meeting, after more than a year of hikes to combat inflation, but inflation, while down to 4% annualized, is still double the target rate. Conventional wisdom says that the Fed isn’t done hikin

1d ago Zacks

ZacksRivian Automotive (RIVN) Dips More Than Broader Markets: What You Should Know

Rivian Automotive (RIVN) closed at $13.45 in the latest trading session, marking a -0.59% move from the prior day.

6h ago Zacks

ZacksCoinbase Global, Inc. (COIN) Gains As Market Dips: What You Should Know

Coinbase Global, Inc. (COIN) closed the most recent trading day at $61.94, moving +0.76% from the previous trading session.

6h ago SmartAsset

SmartAssetWhat Happens to My 401(k) If I Die Without a Beneficiary?

If you die without naming a beneficiary for your 401(k) account, the rules for your retirement plan will likely require that funds in the account be considered part of your estate and have to go through probate. The probate process … Continue reading → The post What Happens to Your 401(k) If You Die Without a Beneficiary? appeared first on SmartAsset Blog.

15h ago Zacks

ZacksIBM (IBM) Gains As Market Dips: What You Should Know

In the latest trading session, IBM (IBM) closed at $131.34, marking a +1.48% move from the previous day.

6h ago Business Insider

Business InsiderThe AI gold rush could spark a 15% rally in tech stocks through the rest of the year as firms shell out $800 billion in the arms race, Wedbush says

An $800 billion AI spending wave is about the hit the market, and it could trigger another "1995 moment" for tech stocks, Wedbush said.

4h ago Zacks

ZacksFord Motor Company (F) Gains As Market Dips: What You Should Know

In the latest trading session, Ford Motor Company (F) closed at $14.11, marking a +0.64% move from the previous day.

6h ago Barrons.com

Barrons.comMagellan’s Deal With Oneok Could Derail. Should Berkshire Step In?

Getting individual investors to vote will be a problem. There also has been criticism because of a big tax bill for longtime holders.

10h ago Zacks

ZacksTake the Zacks Approach to Beat the Market: Shopify, Oracle, Uber in Focus

Last week, our time-tested methodologies served investors well in navigating the market. Check out some of our achievements from the past three months.

16h ago Bloomberg

BloombergChina Gains Prop Up Asia Stocks; Dollar Edges Down: Markets Wrap

(Bloomberg) -- Strength in Hong Kong-listed technology stocks helped prop up Asian shares on Tuesday, buoying sentiment after US stocks slid amid concern that the Federal Reserve will push the US into recession.Most Read from BloombergPutin Blasts Wagner ‘Traitors’ After Prigozhin Denies Coup PlotThe 10 Worst US Airports for Flight Disruptions This SummerStudent Loan-Relief Backers Warn Biden ‘Failure Isn’t an Option’Putin Faces Historic Threat to Absolute Grip on Power in RussiaRussia Latest: Z

1h ago Bloomberg

BloombergCarnival Shares Tumble as ‘Solid’ Results Fail to Impress Investors

(Bloomberg) -- Carnival Corp. shares tumbled by the most in more than seven months after the cruise-ship operator reported quarterly results and an annual forecast that failed to keep pace with the high expectations that had fueled a sharp rally in the stock. Most Read from BloombergPutin Blasts Wagner ‘Traitors’ After Prigozhin Denies Coup PlotThe 10 Worst US Airports for Flight Disruptions This SummerStudent Loan-Relief Backers Warn Biden ‘Failure Isn’t an Option’Putin Faces Historic Threat to

7h ago Zacks

ZacksBank of America (BAC) Gains As Market Dips: What You Should Know

Bank of America (BAC) closed the most recent trading day at $28.09, moving +1.23% from the previous trading session.

6h ago Reuters

ReutersInvestors watch for quarter-end rebalancing in US stocks, bonds and options

Investors are watching a large hedged-equity fund's quarterly refresh of its options positions and quarter-end rebalancing by portfolio managers to potentially influence U.S. stock moves as the first half of the year winds down this week. The nearly $16 billion JPMorgan Hedged Equity Fund, which holds a basket of S&P 500 stocks along with options on the benchmark index, is expected to roll its options positions on Friday. While the trade is anticipated by many market participants, it can exacerbate or suppress daily stock market moves, especially during times of poor market liquidity, analysts said.

5h ago Zacks

ZacksHere's Why Investors Should Retain Abbott (ABT) Stock Now

Investors are optimistic about Abbott (ABT) on continued growth in Diabetes business and upbeat guidance.

11h ago Bankrate

BankrateWarren Buffett’s top stock picks of all time and longest held investments

Warren Buffett’s top stock picks and longest held investments.

11h ago The Wall Street Journal

The Wall Street JournalCarnival Shares Fall, Drag Down Royal Caribbean, Norwegian

Shares of Carnival and its rivals dropped on Monday after the world’s largest cruise company said costs have been climbing and are expected to exceed previous estimates for the year. The selloff started after Carnival reported that its loss in the quarter ended May 31 narrowed by more than 77% from a year ago, while revenue doubled to $4.91 billion, topping analyst forecasts on both the top and bottom lines, according to FactSet. At the same time, adjusted cruise costs for the most recently completed quarter, excluding fuel, were up 13.5% from the same period in 2019, before the pandemic.

7h ago Zacks

ZacksIf You Invested $1000 in Nvidia a Decade Ago, This is How Much It'd Be Worth Now

Why investing for the long run, especially if you buy certain popular stocks, could reap huge rewards.

15h ago Investor's Business Daily

Investor's Business DailyStock Market Closes Mixed As Small Caps Led The Day; Swiss Shoe Company Jumps

The major stock market indexes closed mostly lower on Monday as the last trading week of the second quarter got under way. The Russell 2000 Index closed higher after a five-day losing streak, while the Dow Jones couldn't quite get in the green. The Nasdaq dropped 1.2%, as the indexes deteriorated in the last hour of trading.

7h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK