More Americans took out hardship withdrawals from retirement savings last year:...

source link: https://finance.yahoo.com/video/more-americans-took-hardship-withdrawals-220239756.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

More Americans took out hardship withdrawals from retirement savings last year: Report

More Americans took out hardship withdrawals from retirement savings last year: Report

Vanguard's 2023 "How America Saves" report found Americans were saving more for retirement. However, it also revealed that more of them had to take hardship withdrawals from their retirement savings too. Yahoo Finance columnist Kerry Hannon breaks down the report and what it's showing about the retirement landscape.

-

More Americans took out hardship withdrawals from retirement savings last year: Report

-

Putin issues warning, Carnival stocks falls, Tesla downgrade: Top stories

-

Investing in a college savings plan: What you need to know

-

KPMG CEO on closing female leadership gap: Be intentional about creating opportunities, prioritize flexibility

-

Carnival Cruise shares sink despite better than expected earnings report

-

Ryan Reynolds investing in F1 team Alpine

-

How VCs are viewing AI investments right now

-

Meta launches VR game subscription service 'Meta Quest+'

-

Taylor Swift's 'Eras' Tour on pace to be highest grossing music tour in history

-

Tesla & Alphabet downgraded, Carnival shares slide, PacWest stock rises: Trending tickers

-

UPSIDE Foods' lab-cultivated chicken is the first to receive USDA approval

-

Russia turmoil: With oil supply safe, investors are shaking off attempted coup, strategist says

-

Supreme Court case could complicate Dems' efforts to pass a wealth tax

Vanguard's 2023 "How America Saves" report found Americans were saving more for retirement. However, it also revealed that more of them had to take hardship withdrawals from their retirement savings too. Yahoo Finance columnist Kerry Hannon breaks down the report and what it's showing about the retirement landscape.

Video Transcript

SEANA SMITH: Americans are saving for retirement at record rates, according to a recent report from Vanguard. 39% of workers increase the percentage of their paycheck that they said, that they set aside for their 401(k) account last year. Yahoo Finance's Kerry Hannon is following this story for us.

Kerry, finally, some good news on the retirement front in terms of how much people are saving.

KERRY HANNON: I know. I absolutely love it. I mean this is, they're looking back at last year and it was a pretty rough year, wasn't it? I mean, the market volatility. You know, we did see account balances droop.

But you know what? The savers, investors in these 401(k) plans that Vanguard manages stayed the course. And, in fact, the great news is they upped the ante. You know, 8 in 10 are now enrolled in their plan. And that is just gradually been increasing since 2013, which is great news.

And, as you mentioned, 4 in 10 increased how much they set aside. I mean, is really according to Vanguard, these are record highs of the percentage of your paycheck people are putting aside in these retirement accounts. And that's super positive. And I think that when you combine it-- I think the average is like 7.4% when you combine it what the employer matches.

And this is the cool thing, 2/3, I think they said, 2/3 of their fund, companies have 2/3 of the participants are putting enough away to get that match. That is awesome because that is free money, right? That is just a great perk. And so when you put that together, it's like 11.3%. And most financial planners suggest that you set aside anywhere from 12% to 15% of your income for retirement.

Yahoo Finance

Yahoo FinancePfizer stock drops after company picks twice-daily weight loss pill candidate

Pfizer stock fell Monday after the company announced it would pursue a twice-daily weight loss treatment pill in favor of its once-daily alternative amid a booming market for GLP-1 drugs.

10h ago Yahoo Finance

Yahoo FinanceTesla stock drops after Goldman Sachs downgrade

Goldman Sachs became the latest Wall Street firm to downgrade Tesla stock as analysts react to a more than 100% rally in the stock so far this year.

11h ago Reuters

ReutersBOJ member called for early tweak to YCC, yen worries resurface

TOKYO (Reuters) -A Bank of Japan (BOJ) policymaker called for an early revision to its controversial yield curve control, a summary of opinions at the June meeting showed on Monday, suggesting the central bank's ultra-loose monetary settings may be at a crossroads. While analysts see the communication as reflecting only a minority view of the BOJ board, investors are watching to see if similar such commentary comes in the near-term, potentially heralding a shift in policy. The bank's summary of opinions came as Japan's top currency diplomat escalated his warning against falls in the yen on Monday, a signal to markets that authorities could intervene to slow the decline.

1d ago SmartAsset

SmartAssetReport Says "Financial Jargon" Has 34% of Americans Doubting Retirement Plans

Financial jargon is so confusing that 34% of Americans say they "don't know where to start" when it comes to retirement planning, according to a new survey from Unbiased.com. In fact, the analysis found that the majority of adults say … Continue reading → The post Report Says "Financial Jargon" Has 34% of Americans Doubting Retirement Plans appeared first on SmartAsset Blog.

12h ago Fortune

FortuneThe forced return to the office is the definition of insanity

After five consecutive quarters of declining productivity, CEOs must abandon the sinking ship of forced in-office work and embrace flexible work.

15h ago SmartAsset

SmartAssetT. Rowe Price: You Need This Much Saved For Retirement Based on Your Income

Retirement is a big milestone for many, and planning for retirement can constitute a large financial goal that takes years to reach. In fact, data from the Federal Reserve indicates that the majority of Americans only have $65,000 saved for … Continue reading → The post Approaching Retirement? T. Rowe Price Says You Need This Much Saved Based on Your Income appeared first on SmartAsset Blog.

2d ago Yahoo Finance

Yahoo FinanceGen Z is expecting a 40-year retirement. Good luck, experts say.

Not only do Zoomers think they’ll retire at 60 on average, but 2 in 5 of them also expect to live to 100.

2d ago Reuters

ReutersKPMG to cut 5% of US jobs in fresh round of layoffs

The firm had over 39,000 employees in the U.S. at the end of its last fiscal year on Sept. 30. KPMG, which cut about 2% of its U.S. workforce in February as per a Financial Times report, was the first of the world's four biggest accountancy firms to slash jobs in the country. In April, Ernst & Young's U.S. division shed 5% of its workforce.

10h ago USA TODAY

USA TODAYFord job cuts hit contract workers, salaried employee layoffs to follow

Contract workers were notified late Friday that it was their last day of work. Ford also plans to lay off salaried employees as soon as Monday.

13h ago SmartAsset

SmartAssetHow Much Will a $1.5 Million Annuity Earn Me Annually?

Annuities are a form of hybrid financial product. Part investment and part contract, they're primarily sold by insurance companies as a way to save for retirement. While in recent years they have come under criticism for below-market returns, many retirees … Continue reading → The post How Much Would a $1.5 Million Annuity Pay? appeared first on SmartAsset Blog.

2d ago SmartAsset

SmartAssetHow do I Split an Inherited IRA with My Sibling?

Like most assets, you can inherit an individual retirement account (IRA) after the owner's death. And for spouses, inheriting an IRA is a relatively straightforward process. In most cases, you can simply assume ownership or even roll the inherited account over … Continue reading → The post How to Split an Inherited IRA Between Siblings appeared first on SmartAsset Blog.

2d ago Oilprice.com

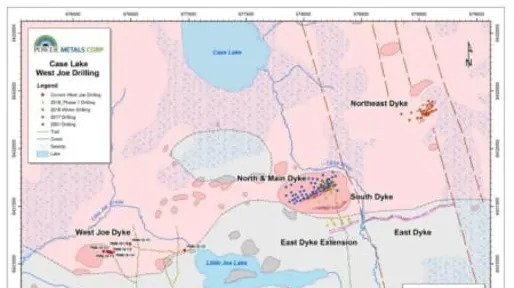

Oilprice.comThe Rare Metal Keeping Xi and Biden Up At Night

Canada’s Case Lake is the center of one of the most exciting rare metal discoveries of the last decade, with a small explorer unearthing what could be the only new cesium play in existence

4h ago The Wall Street Journal

The Wall Street JournalThe Reasons More People Are Working in Their 80s

They joke that retirement is boring, but some acknowledge a deeper fear of becoming irrelevant if they quit.

1d ago Barrons.com

Barrons.comHere’s How Bad the Financial Advisor Talent Shortage Is

The number of U.S. financial advisors grew by only 2,579 last year, Cerulli estimates, with new entrants to the profession barely offsetting the number of retirements and trainee failures.

9h ago USA TODAY

USA TODAYFord salaried layoffs coming over next two days, company announces

With new job cuts, Ford Motor Company says the industry is so dynamic now that it needs to constantly hire and let go employees as technology evolves.

6h ago The Wall Street Journal

The Wall Street JournalOPEC Woos Guyana, Tiny Nation That Sits Atop Massive Oil Field

GEORGETOWN, Guyana—Thanks to a transformational oil find, this tiny nation has built ties in recent years with the world’s most influential energy companies, financiers and governments. Now, it has a powerful new suitor: OPEC. The oil cartel is courting Guyana to become its newest member, in a bid to extend the bloc’s influence into a small South American country that has suddenly become the world’s fastest-growing oil producer, according to people familiar with the matter.

17h ago The Telegraph

The TelegraphKPMG to cut 2,000 jobs in US

Auditor KPMG is to cut around 5pc of US jobs as demand for its consulting services slows.

8h ago Bankrate

BankrateWarren Buffett’s top stock picks of all time and longest held investments

Warren Buffett’s top stock picks and longest held investments.

10h ago Reuters

ReutersIllumina starts job cuts, plans office exit to rein in costs

The company also intends to further cut workforce in the third quarter and reducing its real estate footprint in California as part of a plan to reduce annualized run rate expenses by more than $100 million in 2023. Illumina has begun to lay off 10% of its research and development team, health news website STAT reported on Monday, citing internal emails. Illumina, which had engaged in a proxy battle with activist investor Carl Icahn, earlier this month said CEO Francis deSouza had stepped down.

7h ago The Wall Street Journal

The Wall Street JournalChina’s ‘Tesla Killer’ Stumbles as EV Price War Takes Toll

NIO, which had resisted cutting prices until recently, has become a symbol of the challenges automakers face in the world’s largest electric-vehicle market.

1d ago Yahoo Finance

Yahoo FinanceWhy turmoil in Russia could send oil prices even lower

The developments in Russia have been closely watched, given crude’s volatility in 2022 following Moscow's invasion of Ukraine.

9h ago Fortune

FortuneElite lawyers are cleaning up on Wall Street, bankers not so much

Investment bankers used to be the top dogs when it came to Wall Street compensation. Not anymore.

16h ago The Wall Street Journal

The Wall Street JournalThe Battle for Taco Tuesday Gets Heated

Taco Bell has been fighting a fast-food chain and a New Jersey restaurant over the use of the popular phrase.

6h ago Fortune

FortuneFrom free Stanford courses at Northrop Grumman to revamped internships at Salesforce, here’s how 9 companies are competing on A.I. talent

Companies like Salesforce and Coca-Cola are competing to hire and train the best A.I. talent.

17h ago The Wall Street Journal

The Wall Street JournalRon DeSantis Asks Judge to Toss Disney’s Lawsuit

The Florida governor is arguing that the company lacks standing to sue him and another state official.

3h ago LA Times

LA Times'Deceiving and disgusting': Readers react to the rise of restaurant service fees

A class-action lawsuit filed against the restaurant group that owns Jon & Vinny's has started a larger conversation on the ethics of service fees and tipping. L.A. Times readers share their thoughts.

6h ago Fortune

FortuneIBM’s HR team saved 12,000 hours in 18 months after using A.I. to automate 280 tasks: ‘We’re spending time on things that matter’

IBM is using artificial intelligence to automate HR processes, saving thousands of hours in the last 18 months.

17h ago News Direct

News DirectDavid Tashjian Appointed Regional Senior Vice President of Comcast California

Tashjian Brings Proven Record Leading Comcast in Pacific Northwest Region Previously

12h ago Investopedia

Investopedia10 Biggest Silver Mining Companies

With Industrias Penoles leading the pack, these are the 10 biggest silver mining companies by 12-month trailing revenue.

1d ago Decrypt Media

Decrypt MediaBitcoin Mining Firm Riot Secures 33,000 New Rigs for $162 Million

The firm also claimed an option to potentially purchase another 66,000 machines.

4h ago FreightWaves

FreightWavesRetail diesel drops again as oil futures markets head higher

The benchmark diesel price used for most fuel surcharges declined Monday for the 19th time in 21 weeks. The post Retail diesel drops again as oil futures markets head higher appeared first on FreightWaves.

4h ago Reuters

ReutersAsia lobby group pushes for easing of China's offshore listing rules

China's new offshore listing rules for domestic companies have left bankers and lawyers who work on listings unsure how to take on liabilities and how to avoid breaching tightened confidentially rules, Asia's largest financial lobby group said on Tuesday. China's long-awaited rules for offshore stock exchange listings come into effect on March 31 as part of Beijing's regulatory tightening on cross-border listings after years of a laissez-faire approach. Lobby group ASIFMA (the Asia Securities Industry and Financial Markets Association) counts leading global investment banks Goldman Sachs, JPMorgan Chase & Co, and UBS Group among more than 170 financial firms who are association members.

3h ago Fortune

FortuneA.I. could cut time spent coding by 45%. But even seasoned tech professionals will need ‘extensive’ training to harness its full power, McKinsey experts say

Harnessing the power of A.I. in the workplace requires training employees on how to effectively use the technology.

17h ago The Telegraph

The TelegraphBlow to Canary Wharf as HSBC quits headquarters in net zero push

HSBC is leaving its London docklands headquarters for a new base in the City in a blow to Canary Wharf.

18h ago Bloomberg

BloombergFive Key Charts to Watch in Global Commodities This Week

(Bloomberg) -- Diesel and natural gas markets in Europe are showing increased fragility, while crop conditions in the US are worsening as dry weather hampers growing in key areas. Here are five charts to consider in global commodities markets this week.Most Read from BloombergPutin Blasts Wagner ‘Traitors’ After Prigozhin Denies Coup PlotPutin Faces Historic Threat to Absolute Grip on Power in RussiaRussia Latest: Zelenskiy Adviser Says Wagner Remains in UkraineRussia Latest: Putin Says Mutiny’s

14h ago Fortune

FortuneHow HR became central to the A.I. workplace experiment

HR departments have become an A.I. testing ground, according to the third quarterly Fortune @ Work Playbook.

16h ago Zacks

ZacksSouthwest (LUV) & AMFA Ink Tentative Agreement for Mechanics

The implementation of the provisional deal inked by Southwest (LUV) and mechanics' labor union is subject to a favorable voting outcome.

14h ago Reuters

ReutersJPMorgan Chase $290 million settlement with Epstein accusers wins preliminary approval

NEW YORK (Reuters) -A U.S. judge on Monday granted preliminary approval to JPMorgan Chase's $290 million settlement with women who said Jeffrey Epstein abused them, and that the largest U.S. bank turned a blind eye to the late financier's sex trafficking. The approval was issued by U.S. District Judge Jed Rakoff at a hearing in Manhattan federal court. "This is a really fine settlement," Rakoff said.

6h ago TechCrunch

TechCrunchAdobe indemnity clause designed to ease enterprise fears about AI-generated art

When it comes to artwork created by generative AI, enterprise users have specific legal concerns around permissions -- and Adobe has recognized those worries. The company knows that enterprise customers are worried about creating artwork in this way.

18h ago Fortune

FortuneGenpact is using A.I. to flag employee dissatisfaction and tying leaders’ bonuses to the results

Genpact is using A.I. to pick up on workplace satisfaction and address employee disengagement.

17h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK