Zillow's Chief Economist says short-term money-making tactics like house flippin...

source link: https://finance.yahoo.com/news/zillows-chief-economist-says-short-110000772.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Zillow's Chief Economist says short-term money-making tactics like house flipping won't work anymore — use these 3 simple methods to build your real estate riches instead

In the current U.S. housing market, your chances of finding the ‘get-rich-quick’ card as a real estate investor are slim, according to Zillow Chief Economist Skylar Olsen.

Don't miss

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Here's how much money the average middle-class American household makes — how do you stack up?

Owning real estate for passive income is one of the biggest myths in investing — but here is 1 simple way to really make it work

Olsen told Business Insider she believes the party’s over for short-term real estate investors who rely on tactics like house-flipping (when you buy a property, fix it up and then sell it for a profit) to make a quick buck.

She blamed her bearish outlook on mortgage rates — which she expects to hover around 5.5% to 6% in the “long run” — and the fact that elevated house prices have kept homebuyers out of the market.

If you’re a real estate investor looking to keep some skin in the game, here’s three ways you can generate positive cash flow.

Buy, hold and build equity

The simple fact is that people can’t afford to buy houses. As mortgage rates hover above 6% and house prices remain high, affordability and demand have suppressed.

Olsen thinks real estate investors should adopt a buy-and-hold strategy to ride out the tumultuous market — and build cash flow along the way.

By holding onto your home and putting more money toward paying off your mortgage, you can build home equity — the difference between how much your home is worth and how much you owe on your mortgage.

This is an attractive prospect for the roughly 40% of current U.S. mortgage holders who secured low fixed-mortgage rates of 3% to 4% in 2020 and 2021, when the COVID-19 pandemic drove borrowing costs to historic lows.

Desperate to hold onto their low mortgage rates, they’re choosing not to sell their properties, instead building their home equity. This comes with benefits.

Benzinga

BenzingaElon Musk Says Neuralink Is The Only Way To Survive And Compete With AI

Elon Musk, the genius behind SpaceX and Tesla Inc., has declared that humanity must embrace the merging of man and machine if we hope to survive in a world dominated by artificial intelligence (AI). In a 2018 appearance on the "Joe Rogan Experience," Musk teased his company Neuralink has something exciting in store for us. He believes his technology will allow humans to achieve a state of "symbiosis" with AI, where we’ll be able to effortlessly combine our brains with computers. Neuralink has be

6h ago Barrons.com

Barrons.comFord Introduces a New Gas-Powered Truck Aimed at Global Dominance

The all-new Ranger pickup will help Ford extend its leadership in the lucrative truck segment around the world.

7h ago Fortune

FortuneIBM’s CEO says its new A.I. tools will be able to do ’30 – 50%’ of ‘repetitive’ office work after indicating his own company will pause some hiring

Arvind Krishna thinks A.I. will become integral to many office tasks.

6h ago SmartAsset

SmartAssetPotential Good News: You Can Make a $10,000 Bonus Contribution to Your 401(k), But You Need to Fit Into This Narrow Age Window

If you're behind on your retirement savings, you got some welcome news in December when President Biden signed the SECURE 2.0 Act into law. The landmark legislation establishes a higher limit on catch-up contributions for people between 60 and 63 … Continue reading → The post You Can Make a $10,000 Bonus Contribution to Your 401(k), But You Need to Fit Into This Narrow Age Window appeared first on SmartAsset Blog.

10h ago Business Insider

Business InsiderStocks will drop as the economy is either about to enter a recession or the Fed is poised to keep rates higher for longer, Morgan Stanley CIO says

Morgan Stanley has previously warned of the worst earnings recession since 2008 to hit stocks, which could send the S&P 500 tumbling by mid-year.

20h ago Barrons.com

Barrons.comBud Light Controversy Hits Anheuser-Busch’s Other Beer Brands

Nationwide retail sales of Budweiser and Bud Light are down both year to date and over the four-week period ended April 29—in contrast to the industry and peers.

5h ago Benzinga

Benzinga$100,000 Salaries No Longer Enough — Majority Living Paycheck To Paycheck With No Savings

Earning a six-figure salary was once the gold standard for achieving a comfortable middle-class lifestyle, but times have changed. Today, even those making $100,000 a year are finding it difficult to afford the things that used to be synonymous with financial security. See Next: Gamers Making Thousands Selling Gaming Skins And Assets: Gameflip’s Bold Vision For The Future Of Gaming Commerce Inflation is still a major issue and "high earners" are feeling the pinch. According to a recent study by

1d ago TipRanks

TipRanks‘Shocking Deterioration’: Bud Light Sales Hit Hard in April Amid Dylan Mulvaney Controversy — Here Are 2 Stocks That Are Poised to Benefit

No matter what your personal view is on celebrity endorsements, there’s no denying that their support can significantly boost the visibility of a product. That is the point after all in getting a well-known figure for some promotional activities. But what happens when the chosen celebrity happens to be the wrong fit? Well, Anheuser-Busch can tell you all about that. The Bud Light-owner decided to run a promotional push for the beer by bringing on board transgender ‘influencer’ Dylan Mulvaney, wh

10h ago SmartAsset

SmartAssetAsk an Advisor: I Want to Give Money to My Son and Daughter-in-Law. How Much Money Can I Give Away Without ‘Incurring a Tax Issue With the IRS?'

How much money can I give to my son and daughter-in-law without incurring a tax issue with the IRS? -Irwin For 2023, you can give your son and daughter-in-law each $17,000 without having to deal with the IRS. But even … Continue reading → The post Ask an Advisor: I Want to Give Money to My Son and Daughter-in-Law. How Much Money Can I Give Away Without ‘Incurring a Tax Issue With the IRS?' appeared first on SmartAsset Blog.

1d ago Benzinga

BenzingaWarren Buffett Says, 'There's Nothing Better' Than This Strategy If You 'Do It At The Right Price.' Here Are 3 Companies Leading The Pack In This Area

Companies can allocate their funds in various ways to create shareholder value. But in the eyes of legendary investor Warren Buffett, one method stands out above all others. “If you do it at the right price, there’s nothing better than buying in your own business,” the Berkshire Hathaway CEO said during his company’s annual shareholders meeting in 2022. Buffett was referring to stock buybacks. Basically, a company can repurchase its own shares from the open market, effectively reducing the numbe

8h ago SmartAsset

SmartAssetAsk an Advisor: ‘I Am Giving Away 25% of My Return.' Why Does a Financial Advisor Earn a 1% Fee, Even in a Bear Market?

Why does a financial advisor get a fee of 1% or more? That seems really high. If my return is only 4% (for example, in dividends), I am giving away 25% of my return, which is even worse with a … Continue reading → The post Ask an Advisor: ‘I Am Giving Away 25% of My Return.' Why Does a Financial Advisor Earn a 1% Fee, Even in a Bear Market? appeared first on SmartAsset Blog.

10h ago Bloomberg

BloombergApple may be bigger but Aramco’s soaring dividend is unmatched

(Bloomberg) -- Saudi Aramco already shells out a dividend that’s worth more than payouts from the next five largest global payers combined. That gap is now set to widen.Most Read from BloombergVanguard’s Trillion-Dollar Man Leads a Fixed-Income RevolutionTrump Liable for Sex Abuse, Must Pay $5 Million to CarrollItaly Intends to Exit China Belt and Road Pact as Relations SourSteve Schwarzman Holds Off Giving Money to DeSantis After Meeting HimGoldman to Pay $215 Million to End Case on Underpaying

1d ago The Wall Street Journal

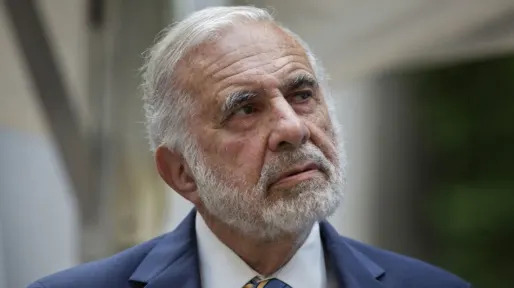

The Wall Street JournalIcahn, Under Federal Investigation, Blasts Short Seller

Activist investor Carl Icahn disclosed that his investment company is under investigation by federal prosecutors and went on the attack against the short seller that likely spurred the inquiry.

2h ago Benzinga

Benzinga'The Fed Will Not Raise Rates Again': Bond King Jeffrey Gundlach Says Rate Hikes Are Done — Is It Time For These 2 Sectors To Shine?

The Federal Reserve announced another 25 basis point rate hike last week, bringing the federal funds rate to its highest level since 2007. But according to DoubleLine Capital Founder Jeffrey Gundlach, this should mark the end of the U.S. central bank’s hawkish stance. “The Fed will not raise rates again,” he said in a tweet. This is not the first time for Gundlach to predict that the Fed will pivot. “I predict the Federal Reserve will be cutting rates substantially soon,” he said in a tweet in M

8h ago Investor's Business Daily

Investor's Business Daily8 'Pure' Growth Stocks Are Stealthily Making Investors Rich Fast

Everyone knows just a handful of giant stocks are driving the S&P 500's market value gains. But investors are making gains on pure growth.

11h ago American City Business Journals

American City Business JournalsWarren Buffett on pain in commercial real estate amid tightening credit: ‘Too bad’

The legendary investor offered little comfort to those unable to extend their commercial real estate loans.

1d ago Benzinga

BenzingaWhat's Going On With AMD Stock Wednesday

Advanced Micro Devices, Inc (NASDAQ: AMD) shares are trading higher Wednesday. The positive movement could also be in sympathy with peer chipmakers, as a lot is brewing in the space. Peer chipmaker NVIDIA Corp (NASDAQ: NVDA) is also trading higher on reports of additional orders for AI chips that require Taiwan Semiconductor Manufacturing Company Ltd's (NYSE: TSM) CoWoS (chip on wafer on substrate) packaging. A lso, reports suggest that Nvidia might launch its GeForce RTX 4060-series graphics ca

7h ago SmartAsset

SmartAssetSchwab: Do To Potentially Double Your Retirement Savings

After beginning the year at record levels, global events have caused market volatility to jump and equities to fall. The S&P 500 Index is experiencing its first major correction since 2020, so investors are understandably looking to safeguard their assets. … Continue reading → The post Schwab Says This Can Double Your Retirement Savings appeared first on SmartAsset Blog.

10h ago Investor's Business Daily

Investor's Business DailySonos Stock Tumbles After Speaker Maker Cuts Sales Outlook

Premium speaker maker Sonos cut its sales outlook for the rest of the year on softening demand. Sonos stock tumbled on the news.

1h ago Zacks

ZacksBloom Energy (BE) Reports Q1 Loss, Tops Revenue Estimates

Bloom Energy (BE) delivered earnings and revenue surprises of -10% and 7.32%, respectively, for the quarter ended March 2023. Do the numbers hold clues to what lies ahead for the stock?

1d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK