You need an income of over $300K in New York City, San Francisco and Honolulu ju...

source link: https://finance.yahoo.com/news/income-over-300k-york-city-113000417.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

You need an income of over $300K in New York City, San Francisco and Honolulu just to bring home $100K — once taxes, costs are factored in. 3 simple tips to keep more of your paycheck

Many people find tax season to be a stressful time of year. But individuals living in some of the most popular cities in America may find paying taxes to be an even more discouraging experience — even if they are wealthy.

SmartAsset, a financial research firm, analyzed the impact of taxes and living costs on individuals living in America’s biggest cities. Their research found that an annual salary of $300,000 in New York, San Francisco and Honolulu is required just to bring home $100,000 after taxes and cost-of-living adjustments.

Don't miss

Rich young Americans have lost confidence in the stock market — and are betting on these 3 assets instead. Get in now for strong long-term tailwinds

Here's how much money the average middle-class American household makes — how do you stack up?

You could be the landlord of Walmart, Whole Foods and CVS (and collect fat grocery store-anchored income on a quarterly basis)

For context, the median American household income is $70,784 (adjusted for inflation). But SmartAsset’s research shows that a family living in the Big Apple or Silicon Valley would need more than four times that amount to feel like they are in the "middle class."

Regardless of income level or location, it's always a good idea to save money. With that in mind, here are five ways to stretch your paycheck.

Minimize housing costs

Housing expenses can be the most significant drain on your finances. Making adjustments to these costs can be an effective way to stretch your paycheck further.

If you're looking to buy a home, it's important to stay well below your mortgage approval amount to ensure you don't stretch your finances too thin. Locking in at a good interest rate can also save you money in the long run.

According to a study by Freddie Mac, borrowers who obtain at least five quotes when shopping for a mortgage save an average of $3,000 in their first five years of homeownership.

It's important to ensure that your monthly payments are stable and less than one-third of your monthly income. This is known as the 30% rule and is widely recommended by financial experts. By adhering to the rule, you make sure that your housing costs are not eating up too much of your budget, leaving you with more money to save or invest.

Benzinga

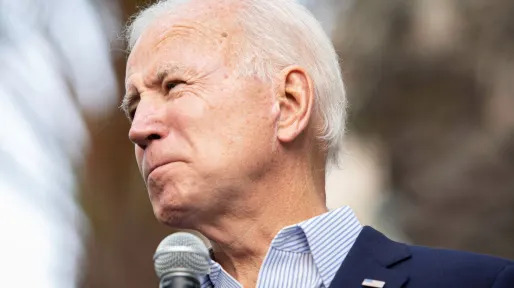

BenzingaBiden Administration Paying Americans Thousands of Dollars to Upgrade Their Homes

On Aug. 16, President Joe Biden signed the Inflation Reduction Act into law, directing billions of dollars to Americans looking to upgrade their homes, businesses and cars. Don’t Miss: The House-Printing Robot Shaking Up a $7.28 Trillion Industry One provision of the law allows Americans making less than $150,000 a year to claim a $7,500 tax credit for buying an electric car. The law also provides $9 billion in rebates to help people electrify their home appliances and make their houses more ene

8h ago Fortune

FortuneElon Musk loses $13 billion in 24 hours after SpaceX rocket explosion and disappointing Tesla earnings

The CEO of Tesla and Twitter has seen his net worth battered in recent years.

19h ago AP Finance

AP Finance'The Champagne of Beers' leaves French producers frothing

The guardians of Champagne will let no one take the name of the bubbly beverage in vain, not even a U.S. beer behemoth. For years, Miller High Life has used the “Champagne of Beers” slogan. At the request of the trade body defending the interests of houses and growers of the northeastern French sparkling wine, Belgian customs crushed more than 2,000 cans of Miller High Life advertised as such.

16h ago Engadget

EngadgetApple's iPad Air drops back to $500, plus the rest of the week's best tech deals

This week's best tech deals include the Apple iPad Air for $500, LG C2 OLED TV for $1,067 and a buy-one-get-one-free sale for various video games at GameStop.

12h ago Fortune

FortuneAfter Disney flubbed the most basic equation in finance, Bob Iger has to dig out of deep hole to move the stock price

In its rush into streaming, Disney mishandled three big initiatives. Those unforced errors account for its shockingly poor financial performance over the past three years.

2d ago Fortune

FortuneUtah CEO under fire after praising employee who sold their dog to return to the office

He also questioned whether working moms were being “fair” to their employers and their children.

15h ago Quartz

QuartzMcDonald’s wants to tighten franchise rules, and restaurant owners are not lovin’ it

It’s not all happy meals these days in the land of Ronald McDonald.

17h ago Bankrate

BankrateHere’s how much investing $10,000 in a CD right now could earn you in 1 year

If you have $10,000 to invest in a CD right now, here’s how much you could earn.

2d ago Bloomberg

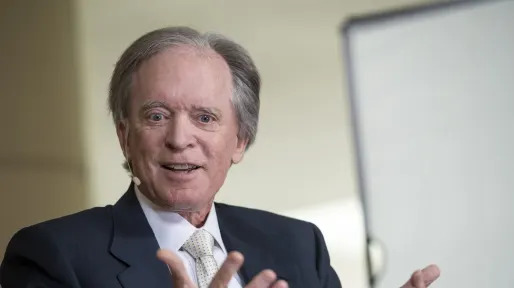

BloombergBill Gross Scoops up Regional Bank Stocks

(Bloomberg) -- Battered regional banks got a vote of confidence from the one-time king of the bond world. Most Read from BloombergElon Musk’s Wealth Plunges $13 Billion as Drama Unfolds Across EmpireAlphabet CEO’s Pay Soars to $226 Million on Huge Stock AwardCities Keep Building Luxury Apartments Almost No One Can AffordEuropeans Are Rethinking Summer Vacations Because of OvercrowdingUS Supreme Court Keeps Abortion Pill Fully Available for NowIn his investment outlook published Friday, Bill Gros

12h ago Business Insider

Business InsiderThe I-Bond boom is about to end with rates on the inflation-protected assets set to plunge below cash yields

The surge in I-Bond interest rates to levels that were competitive with stock market returns attracted more than $40 billion of inflows last year.

1d ago SmartAsset

SmartAssetWill CD Rates Continue to Go Up in 2023?

The Federal Reserve hiked interest rates seven times in 2022 in an attempt to combat inflation, a fight that has proved daunting. Continuing its hawkish stance in 2023, the Fed raised rates at the first two Federal Open Market Committee (FOMC) … Continue reading → The post Will CD Rates Continue to Go Up in 2023? appeared first on SmartAsset Blog.

1d ago SmartAsset

SmartAssetVanguard: This Is the Ideal Tipping Point For Your Roth Conversion

Deciding between a traditional individual retirement account (IRA) and a Roth IRA can be difficult. Choosing when or if you should convert your IRA funds to a Roth account can be even more daunting. Experts commonly recommend that investors compare … Continue reading → The post When Should You Consider a Roth Conversion? Vanguard Has an Answer appeared first on SmartAsset Blog.

15h ago SmartAsset

SmartAssetHow to Turn a $200,000 Investment Into $1 Million

If you're ready to invest $200,000 (or something close to it) with the goal of turning it into $1 million, this article will help you understand your options and focus your investment strategy. If you're not sure what you should do, … Continue reading → The post How to Invest $200K and Turn It Into $1 Million appeared first on SmartAsset Blog.

15h ago Barrons.com

Barrons.comBuy AT&T’s Stock After Plunge. J.P. Morgan Expects a ‘Gradual Rebound.’

The stock fell the most in a single day since 2000 on Thursday after the telecom company reported far less free cash flow than expected.

14h ago Bloomberg

BloombergArgentina Central Bank Lifts Rate to 81% as Inflation Jumps

(Bloomberg) -- Argentina’s central bank increased its benchmark interest rate by 300 basis points Thursday after annual inflation soared in March and foreign currency reserves slumped.Most Read from BloombergElon Musk’s Wealth Plunges $13 Billion as Drama Unfolds Across EmpireAirline Blunder Sells $10,000 Asia-US Business Class Tickets for $300SpaceX Says It Blew Up Starship Rocket After Engine MishapMeet the Guy Who Scored $250,000 of Tickets for $17,000 After Airline ErrorUS, Ukraine Allies Co

1d ago Business Insider

Business InsiderThe US economy is facing the ultimate 'trilemma' as the Fed desperately tries to get inflation down, Mohamed El-Erian says

The Fed is navigating bank turmoil, a resilient labor market, and high inflation while deciding their next policy move to stabilize the economy.

1d ago Zacks

ZacksIs Valero Energy (VLO) Stock Undervalued Right Now?

Here at Zacks, our focus is on the proven Zacks Rank system, which emphasizes earnings estimates and estimate revisions to find great stocks. Nevertheless, we are always paying attention to the latest value, growth, and momentum trends to underscore strong picks.

15h ago Bloomberg

BloombergPacWest Bancorp Explores Sale of Its Lender Finance Division

(Bloomberg) -- PacWest Bancorp, a regional bank left reeling following the collapse of two rival lenders last month, is exploring a sale of its lender finance arm, according to people familiar with the matter. Most Read from BloombergElon Musk’s Wealth Plunges $13 Billion as Drama Unfolds Across EmpireAlphabet CEO’s Pay Soars to $226 Million on Huge Stock AwardCities Keep Building Luxury Apartments Almost No One Can AffordEuropeans Are Rethinking Summer Vacations Because of OvercrowdingUS Suprem

5h ago Reuters

ReutersBed Bath & Beyond considers asset sales, Sixth Street bankruptcy loan - Bloomberg News

The home goods retailer is also looking to secure funding from U.S.-based investment firm Sixth Street Partners to support its operations through Chapter 11 proceedings but the plans could still change, Bloomberg News reported on Friday. Bed Bath and Beyond did not respond to a request for comment, while Sixth Street Partners declined to comment. In January, Reuters reported that the embattled retailer was negotiating a loan to help it navigate bankruptcy proceedings, with Sixth Street in talks to provide some funding.

1h ago Reuters

ReutersNorway's wealth fund posts $84 billion quarterly profit

OSLO (Reuters) -Norway's $1.4 trillion sovereign wealth fund, one of the world's largest investors, on Friday posted a 5.9% return on investment for the first quarter boosted by rising equity markets. "It's actually one of the strongest quarters we ever had," Deputy CEO Trond Grande said in a video posted on LinkedIn. Despite market turmoil in March amid concerns of a new banking crisis, equity markets provided the biggest boost for the fund, with a nearly 8% gain, he said.

20h ago Zacks

ZacksAmerican Airlines (AAL) Outpaces Stock Market Gains: What You Should Know

American Airlines (AAL) closed at $13.40 in the latest trading session, marking a +0.6% move from the prior day.

6h ago Fortune

FortuneCEO Bob Iger is trying to recapture Disney’s magic. 3 big problems stand in his way

Whether Iger can pull off a turnaround may ultimately define his legacy.

20h ago Bloomberg

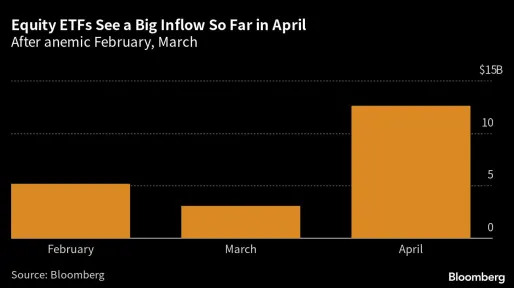

BloombergMoney Is Pouring Into Stock ETFs at a Time When Bearish Warnings Soar

(Bloomberg) -- Investors are losing their ability to resist a stock rally that much of Wall Street is convinced is doomed.Most Read from BloombergElon Musk’s Wealth Plunges $13 Billion as Drama Unfolds Across EmpireAlphabet CEO’s Pay Soars to $226 Million on Huge Stock AwardCities Keep Building Luxury Apartments Almost No One Can AffordEuropeans Are Rethinking Summer Vacations Because of OvercrowdingUS Supreme Court Keeps Abortion Pill Fully Available for NowMore than $12.6 billion has been sent

8h ago Yahoo Finance

Yahoo FinanceMillennials are sabotaging their retirement with poor investing moves, study finds

Workers between ages 27 and 42 allocated a third of their retirement assets on average to cash last year.

11h ago Zacks

ZacksRivian Automotive (RIVN) Stock Sinks As Market Gains: What You Should Know

In the latest trading session, Rivian Automotive (RIVN) closed at $12.25, marking a -0.81% move from the previous day.

6h ago Fortune

FortuneTesla’s stock is plummeting. Here’s why one analyst thinks it’s ‘one of the most overvalued’ on the market and could drop another 80%

David Trainer, CEO of investment research firm New Constructs, warns that Tesla stock is “highly overvalued” and could sink to $28 per share.

1d ago Investopedia

InvestopediaTop CD Rates Today, April 21

See what today's top nationwide rate is for every CD term, and how it compares to the previous business day's top rate. We collect data from more than 200 financial institutions.

11h ago Decrypt Media

Decrypt MediaBitcoin Whale Moves Nearly $8M After 10 Years of Inactivity

A holder who hadn’t touched their crypto for a decade just moved over 279 BTC, or $7.8 million worth of the crypto, to new wallets.

10h ago Barrons.com

Barrons.comHow a Disappointing Tax Season Has Increased the Risk of a U.S. Default

What happens when an unflappable stock market meets an intractable Congress? With the debt ceiling’s X-date fast approaching and a disappointing tax season in the books, we may get the answer sooner than expected. At first glance, it looks like progress is being made on the debt ceiling.

8h ago Zacks

ZacksSnap (SNAP) Stock Sinks As Market Gains: What You Should Know

Snap (SNAP) closed the most recent trading day at $10.01, moving -1.28% from the previous trading session.

6h ago SmartAsset

SmartAssetDo This Right Now to Potentially Boost Your 401(k) By 8%

If you've looked at the investment options in your workplace 401(k) retirement plan, chances are you'll see mutual funds that put your money into stocks, bonds or cash and cash equivalents. Those have been the options available ever since 401(k) … Continue reading → The post Here's One Easy Way to Boost Your 401(k) By 8% appeared first on SmartAsset Blog.

15h ago CoinDesk

CoinDeskEther Erases All Gains From Shanghai Rally as Bitcoin, Other Crypto Prices Also Fall

The second largest cryptocurrency by market capitalization has dropped to its lowest since April 9, CoinDesk data shows.

7h ago Investor's Business Daily

Investor's Business DailyCould 256% Growth Ignite The Afterburners On This Hot Chip Stock?

As fabless semiconductor stocks like Mobileye show strength, RFID and IoT leader Impinj etches a buy point with earnings due.

8h ago Zacks

ZacksAdvanced Micro Devices, Inc. (AMD) is Attracting Investor Attention: Here is What You Should Know

Advanced Micro (AMD) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

15h ago Zacks

ZacksDon't Ignore the Relative Strength of These 2 Defense Stocks

Targeting stocks displaying relative strength is a great way for investors to insert themselves in favorable trends where buyers are in control.

1d ago Zacks

ZacksStrength Seen in EyePoint Pharmaceuticals (EYPT): Can Its 9.6% Jump Turn into More Strength?

EyePoint Pharmaceuticals (EYPT) witnessed a jump in share price last session on above-average trading volume. The latest trend in earnings estimate revisions for the stock doesn't suggest further strength down the road.

2d ago Zacks

ZacksBuy These 2 Oil Giants Before They Report Earnings?

Energy has been the best-performing sector in the market for two years, but can it continue?

12h ago Forkast News

Forkast NewsWeekly Market Wrap: Can Bitcoin float above US$27,500 after sinking below US$30,000?

Bitcoin fell to US$28,000 in the same week the European Parliament passed its landmark crypto framework. Industry analysts told Forkast that holding US$27,500 will be crucial for Bitcoin in order to spark an upward momentum.

14h ago Zacks

ZacksZacks Industry Outlook Highlights AnheuserBusch InBev, Constellation Brands, Brown-Forman, Molson Coors and The Duckhorn Portfolio

AnheuserBusch InBev, Constellation Brands, Brown-Forman, Molson Coors and The Duckhorn Portfolio are part of the Zacks Industry Outlook article.

16h ago Barrons.com

Barrons.comStocks Are a Little Too Calm. Are You Ready for a Shakeup?

Stocks have barely budged so far this month. That could be the calm before the storm—or the calm that persists for years. Investors won’t like either.

5h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK