Recession risk is rising: BofA

source link: https://finance.yahoo.com/news/bofa-recession-fears-are-up-in-march-113907418.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

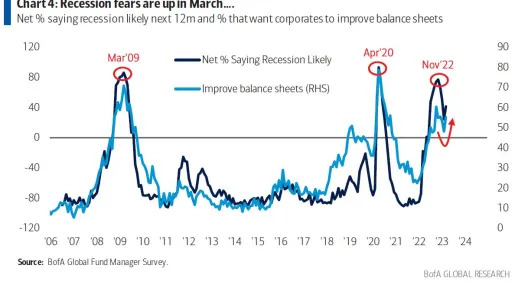

BofA: 'Recession fears are up in March'

SVB, how is gonna affect

Recession chatter is picking back up on Wall Street as markets deal with the blow of several bank failures and the potential economic aftermath.

The likelihood of a U.S. recession is back on the rise for the first time since November 2022, according to the latest BofA fund manager survey released on Tuesday. About 42% of fund managers surveyed see a recession happening within the next 12 months, up from 24% in February.

While fund managers aren't in universal agreement on a recession, they are almost in unison on the economy being stagnant over the next 12 months.

A whopping 80% of those fund managers surveyed expected a stagflationary economy to persist.

Stagflation is where the economy remains stagnant amid relatively high inflation.

The vibe among fund managers comes as economists begin to readjust their economic thinking post the collapses of Credit Suisse (CS), Signature Bank, and Silicon Valley Bank — which pros point out has collectively caused tightening of financial conditions.

Jefferies strategists maintained their 2023 recession call this week, citing tighter lending standards at banks as the crisis continues.

Goldman Sachs Chief Economist Jan Hatzius noted last week he sees a 35% chance of a U.S. recession in the next 12 months, up from 25% previously. The increase in odds reflects "increased near-term uncertainty" around the economic effects of small bank stress.

Hatzius also cut his 2023 GDP forecast by 0.3 percentage points to 1.2%.

"We believe that inflation is already slowing significantly and that a recession is already baked in the cake, probably starting in second half of this year," wrote EvercoreISI chairman Ed Hyman.

Brian Sozzi is Yahoo Finance's Executive Editor. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn. Tips on the banking crisis? Email [email protected]

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Reuters

ReutersFutures rise as bank fears ebb after Credit Suisse rescue, Fed in focus

(Reuters) -U.S. stock index futures gained on Tuesday as the rescue of Credit Suisse allayed some concerns of a bank contagion, while investors awaited the outcome of the Federal Reserve's monetary policy meet. Traders now largely expect a 25-basis-point rate hike after the Fed's two-day meeting concludes on Wednesday, a dramatic turnaround from expectations of a 50 bps increase before the banking crisis triggered by the collapse of Silicon Valley Bank and Signature Bank earlier this month. While the state-backed takeover of Credit Suisse by UBS as well as steps taken by central banks to boost liquidity have eased fears of a contagion to the broader banking sector, analysts still believe the crisis hasn't been fully averted.

3h ago Yahoo Finance

Yahoo FinanceWhat Wall Street is saying about UBS buying Credit Suisse

Wall Street largely sees positive signs while digesting the historic deal.

1d ago Yahoo Finance

Yahoo FinanceA Fed pause could do more harm after banking crisis: Morning Brief

The Fed is in a very delicate position as everyone is on edge.

3h ago Yahoo Finance

Yahoo FinanceTech stocks back as a safe-haven trade as banking crisis unfolds: Analyst

The tech trade comes back.

20h ago Barrons.com

Barrons.comCrypto and Coinbase Bull Run Call. Stock Price Seen Tripling.

Bitcoin is up almost 70% this year and could keep going, says one analyst—a trend that could push Coinbase stock back above levels not seen in 12 months.

40m ago Barrons.com

Barrons.comFirst Republic Stock Fights Back as Jamie Dimon Leads Rescue Talks

First Republic Bank stock regained some ground early Tuesday after a report that JPMorgan Chase CEO Jamie Dimon was leading talks to stabilize the beleaguered regional bank. First Republic stock pointed 16% higher at $14.13 ahead of the open, but is still close to 90% down in March. There were gains for other regional banks too, with New York Community Bancorp (NYCB) up 6%, and Western Alliance (WAL) and PacWest Bancorp (PACW) both climbing around 4% in premarket trading.

46m ago Bloomberg

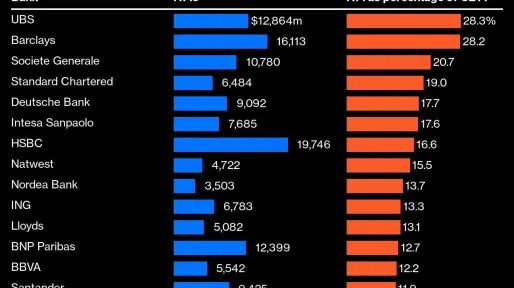

BloombergUBS Most Reliant on AT1 Bonds Wiped Out in Credit Suisse Deal

(Bloomberg) -- UBS Group AG is more reliant for its capital on the type of risky bonds that were wiped out in the Credit Suisse Group AG takeover than any other major lender in Europe.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisUS Studies Ways to Insure All Bank Deposits If Crisis GrowsMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS DealJPMorgan Owned the LME ‘Nickel’ That Was A

3h ago Reuters

ReutersBank stocks steady after Swiss rescue as focus turns to Fed

Investors stepped cautiously into bank stocks on Tuesday, emboldened by the rescue of Credit Suisse, with share prices inching tentatively higher amid continuing concerns about smaller U.S. lenders and further financial market ructions. After a tumultuous 10 days which culminated in the 3 billion Swiss franc ($3.2 billion) Swiss-regulator-engineered takeover of Credit Suisse by its rival UBS, attention has now shifted to this week's meeting of the U.S. Federal Reserve. As concern over the health of U.S. mid-sized lenders lingers, Treasury Secretary Janet Yellen plans to tell bankers later on Tuesday that the country's banking system is stabilizing after strong actions from regulators.

8h ago MarketWatch

MarketWatchU.S. stock market sectors reclassified, with big shifts to financials from tech

The U.S. stock market, which has experienced elevated volatility due to recent bank fears, saw a reclassification of its sectors after Friday’s close.

21h ago TheStreet.com

TheStreet.comElon Musk Warns the Banking Crisis May Lead to Something Bigger

The crisis of confidence affecting regional banks poses a serious risk to the economy, the billionaire entrepreneur warns.

21h ago Bloomberg

BloombergFund Managers’ Biggest Fear Is Now a Systemic Credit Crunch

(Bloomberg) -- A systemic credit event has replaced stubborn inflation as the key risk to markets for increasingly pessimistic investors, according to Bank of America Corp.’s latest global survey of fund managers.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisUS Studies Ways to Insure All Bank Deposits If Crisis GrowsMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS DealJPMorgan Owne

3h ago Bloomberg

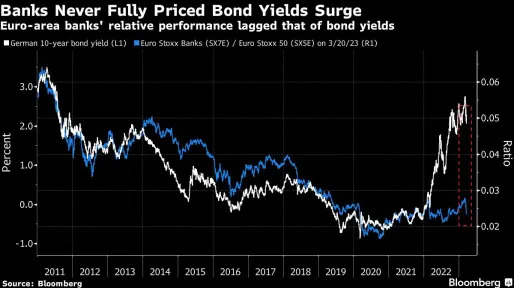

BloombergCase for European Banking Stocks Just Got a Complete Reset

(Bloomberg) -- Thanks to swift central bank action to stamp out financial sector troubles, the investment case for European bank shares could be set for a complete reset. One where bulls are back in charge.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisUS Studies Ways to Insure All Bank Deposits If Crisis GrowsMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS DealJPMorgan Owned the L

3h ago The Wall Street Journal

The Wall Street JournalCredit Suisse Collapse Burns Saudi Investors

Saudi Crown Prince Mohammed bin Salman last year directed government-backed Saudi National Bank to make a $1.5 billion investment in Credit Suisse that his financial advisers harbored doubts about.

15h ago Reuters

ReutersThe canary is alive and chirping a year into Fed's rate hiking cycle

Utah homebuilder Ivory Homes still has a pipeline of several hundred houses under construction, but CEO Clark Ivory isn't pulling permits for any more at this point, and in a year of retrenchment for the single-family home industry, he has laid off just under 10% of his workers. But don't look for that to be reflected in overall U.S. construction employment or spending data, a canary that is very much still breathing inside what would usually be the toxifying air of rising U.S. interest rates. While housing starts are falling, "there is still a fair amount of completion happening," Ivory said, adding that contractors can move on to other jobs once finished with his company's projects.

17h ago Bloomberg

BloombergJPMorgan’s Kolanovic Sees Increasing Chances of ‘Minsky Moment’

(Bloomberg) -- Bank failures, market turmoil and ongoing economic uncertainty as central banks battle high inflation have increased the chances of a “Minsky moment,” according to JPMorgan Chase & Co.’s Marko Kolanovic.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS DealUS Studies Ways to Guarantee All Bank Deposits If Crisis ExpandsThe

16h ago Yahoo Finance

Yahoo FinanceThe banking crisis creates two new questions for investors: Morning Brief

A fork in the road for investors during all this banking turmoil.

1d ago Barrons.com

Barrons.comThese Stocks Are Moving the Most Today: Tesla, Meta, First Republic, Nvidia, GameStop, and More

First Republic Bank is rising after shares of the regional lender lost nearly half their value and sank to a new low on Monday, while Tesla's debt rating is upgraded to investment-grade status by Moody's.

34m ago Yahoo Finance

Yahoo FinanceTesla rolls out Full Self-Driving (FSD) beta update, addresses recall issues

Tesla has started rolling out a huge update to its FSD (Full Self-Driving) software, one that addresses the big recall NHTSA issued for its autonomous driving software.

20h ago FX Empire

FX EmpireEUR/USD Forecast – Euro Has Erratic Trading on Monday

The Euro initially gapped to the upside, before falling rather significantly to pierce the 50-Day EMA. After that, buyers came back in and picked it back up.

23h ago MoneyWise

MoneyWiseFeeling cold and cash-strapped on the first day of spring? These 4 hot states won't tax your pension income at all — no matter how old you are or how much money you've got

You earned that money, might as well hold onto it.

1d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK