Florida Governor Ron DeSantis Introduces State Legislation Banning CBDCs

source link: https://finance.yahoo.com/news/florida-governor-ron-desantis-introduces-203003528.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Florida Governor Ron DeSantis Introduces State Legislation Banning CBDCs

Florida Governor Ron DeSantis proposed legislation on Monday that would ban central bank digital currencies (CBDCs) from the Sunshine State, portraying it as a measure to safeguard Floridians’ financial privacy.

The legislation would prohibit in Florida any CBDC that the U.S. Federal Reserve could introduce and any created by a foreign government, outlawing the technology entirely from being used as a form of money within the state.

DeSantis introduced the legislation from behind a podium with the phrase “Big Brother’s Digital Dollar” plastered across it. He skewered the technology as a vehicle that could lead to government overreach and pave the way for financial surveillance.

“What [a] central bank digital currency is all about is surveilling Americans and controlling Americans,” he said. “You're opening up a major can of worms, and you're handing a central bank huge, huge amounts of power, and they will use that power.”

In interviews with Decrypt, ShapeShift founder Erik Voorhees has also called CBDCs “Orwellian,” and whistleblower Edward Snowden has called them “cryptofascist currencies.”

CBDCs are similar to stablecoins in that they are pegged to the price of a sovereign currency like the U.S. dollar. But CBDCs are issued and maintained by a nation state or central bank instead of minted by private companies on decentralized networks like Tether’s USDT or Circle’s USDC, the two largest stablecoins by market cap.

The Fed has explored the idea of a CBDC since 2016, and the U.S. central bank has repeatedly said it would need approval from congress before launching one. Analysts have said the technology could foster more financial inclusion—banking the unbanked—but critics oppose it due to the possibility of financial surveillance and an expansion of government control.

Though the Fed has said it’s still in the early stages of researching a CBDC and hasn’t determined whether launching one would be worth it, the idea that a digital dollar is a threat to civil liberties has gained traction in Republican circles. China launched its own CBDC, the Digital Yuan, last year, which supporters of a U.S. CBDC have referenced to suggest the U.S. risks falling behind on the technology, while critics have said it simply illustrates China’s continued capital controls.

MoneyWise

MoneyWiseHome Depot co-founder blames ‘woke diversity’ for businesses failing to ‘hit the bottom line’ — don't sleep on these 3 stock picks if you agree

Invest in what matters to you.

20h ago The Telegraph

The TelegraphUS firm agrees to sell 24 mini nuclear reactors to UK customers

A US-based developer of small nuclear reactors has signed a deal to sell 24 of its power plants to UK customers, putting pressure on rival makers including Rolls-Royce.

17h ago Investor's Business Daily

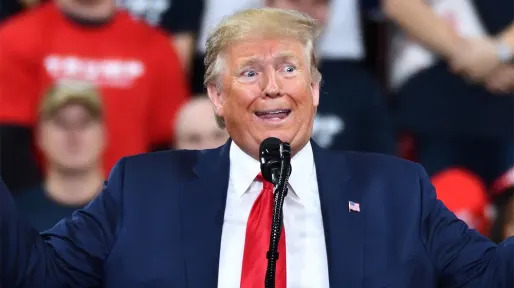

Investor's Business DailyDWAC Stock Under The Microscope As Donald Trump Expects Arrest Tuesday

A Manhattan grand jury is expected to indict Donald Trump. How will DWAC, the special acquisition looking to take Truth Social public, respond?

16h ago Bloomberg

BloombergApple Seeks India Labor Reform in Push to Diversify Beyond China

(Bloomberg) -- Apple Inc. is seeking changes in India’s labor laws as part of its effort to expand local production, and regional governments are yielding to its request as they are eager to snatch iPhone assembly from China.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisUS Studies Ways to Insure All Bank Deposits If Crisis GrowsMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS DealJ

2h ago Reuters

ReutersHardline US Republicans oppose bank deposit guarantees beyond $250,000 limit

Hardline Republicans in the House of Representatives on Monday vowed to oppose any universal federal guarantee on bank deposits above the current $250,000 limit, throwing a major roadblock to a key tool regulators could deploy if bank runs re-emerge as financial confidence wobbles. The Republican House Freedom Caucus said in a statement the Federal Reserve "must unwind" its extraordinary funding facility created on March 12 that allows banks to boost borrowing from the Federal Reserve to cover deposit outflows. "Any universal guarantee on all bank deposits, whether implicit or explicit, enshrines a dangerous precedent that simply encourages future irresponsible behavior to be paid for by those not involved who followed the rules," the group said.

11h ago Reuters

ReutersEV charger makers brace for slowdown as new Made In America rules kick in

Manufacturers and operators of electric vehicle chargers in the United States are bracing for a slowdown in production and deployment as they scramble to comply with "Made in America" terms of a $7.5 billion federal program meant to accelerate the industry. Long-awaited rules laid out by the White House last month are part of President Joe Biden's effort to build an electric-friendly highway system by 2030, tackling climate change and creating local jobs. Requirements to immediately start assembling the chargers at U.S. factories and to use U.S.-made iron or steel enclosures have caught many in the EV charging industry off guard, according to company executives and industry experts.

2h ago The Wall Street Journal

The Wall Street JournalAt the China-Russia Border, the Xi-Putin Partnership Shows Signs of Fraying

The meeting between the two leaders this week is expected to showcase unity, but a view of cities along the border reveals divisions that challenge the relationship.

23h ago Bloomberg

BloombergChina Condemns German Minister’s Taiwan Visit as ‘Egregious Act’

(Bloomberg) -- China reacted furiously to a visit to Taiwan by a German cabinet minister aimed at expanding technology cooperation, calling it an “egregious act” and accusing the government in Berlin of meddling in China’s domestic affairs.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisUS Studies Ways to Insure All Bank Deposits If Crisis GrowsMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days B

1h ago The Wall Street Journal

The Wall Street JournalMacron’s Government Survives No-Confidence Vote in National Assembly

The French president fended off an effort to halt his contentious pension revamp and topple his administration.

16h ago Yahoo Finance

Yahoo FinanceBofA: 'Recession fears are up in March'

With the banking crisis rolling alone, recession risk comes back into focus.

28m ago Bloomberg

BloombergUS Studies Ways to Insure All Bank Deposits If Crisis Grows

(Bloomberg) -- US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisUS Studies Ways to Insure All Bank Deposits If Crisis GrowsMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Bef

16m ago Reuters

ReutersTexas adds HSBC to energy sanctions list

Republican-led U.S. states have alleged companies are prioritizing environmental, social and governance policies (ESG) over their financial responsibilities to their shareholders. The move could prohibit Texas' governmental entities from investing in one of Europe's biggest banks. "HSBC's new energy policy is a prime example of a broader movement in the financial sector to push a social agenda and prioritize political goals over the economic health of their clients," Texas Comptroller Glenn Hegar said.

11h ago South China Morning Post

South China Morning PostXi Jinping calls for 'severe punishment' after Chinese killed in mine attack in Central African Republic

President Xi Jinping has called for "severe punishment" for those behind an attack on a gold mine in the Central African Republic that left nine Chinese nationals dead and two others injured on Sunday, China's foreign ministry said. In a statement on Monday, the foreign ministry said it had dispatched a team to the Chimbolo mine run by the Gold Coast Group, a Chinese company, following Xi's "important directive" that also called for the wounded to be rescued and treated. "Our ambassador ... has

1d ago Fortune

FortuneThe Fed’s ‘stress tests’ were supposed to save banks from the exact crisis now engulfing markets. Here’s how they were so spectacularly wrong

“What the Fed saw as the big potential threats didn’t materialize, and the threat that did materialize they didn’t see coming,” says Thomas Hogan, a senior fellow at the American Institute for Economic Research.

17h ago AP Finance

AP FinanceYellen says bank situation 'stabilizing,' system is 'sound'

Treasury Secretary Janet Yellen is trying project calm after regional bank failures, saying the U.S. banking system is “sound” but additional rescue arrangements “could be warranted” if any new failures at smaller institutions pose a risk to financial stability. Yellen, in an excerpt of remarks prepared for delivery to the American Bankers Association on Tuesday, says that overall “the situation is stabilizing." "And the U.S. banking system remains sound,” Yellen says.

1h ago Bloomberg

BloombergUS Lawmaker Divisions Over FDIC Cap Threaten Action on Failing Banks

(Bloomberg) -- House conservatives said they would oppose any universal guarantee of bank deposits above the current $250,000 FDIC insurance cap, even as other lawmakers said they’re weighing a statutory increase in the limit following two recent bank collapses.Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS DealMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndUS Studies Ways to Guar

14h ago Barrons.com

Barrons.comNike, Chevron, Nvidia, Altria, Adobe, and More Stocks to Watch This Week

The Federal Reserve makes a policy decision on Wednesday, as Treasury Secretary Janet Yellen testifies. Plus, the latest earnings reports and PMI data.

2d ago Reuters

ReutersBiden uses first veto to defend rule on ESG investing

WASHINGTON (Reuters) -U.S. President Joe Biden on Monday rejected a Republican proposal to prevent pension fund managers from basing investment decisions on factors like climate change, in the first veto of his presidency. "I just signed this veto because the legislation passed by the Congress would put at risk the retirement savings of individuals across the country," Biden said in a video posted on Twitter. The bill cleared Congress on March 1, when the Senate voted 50-46 to adopt a measure to overturn a Labor Department rule making it easier for fund managers to consider environmental, social and corporate governance, or ESG, issues for investments and shareholder rights decisions, such as through proxy voting.

19h ago Bloomberg

BloombergUkraine Latest: US Offers More Ammunition; Xi Is Visiting Russia

(Bloomberg) -- The US announced that it will send $350 million in ammunition, river boats and other equipment for Ukraine’s military, while the European Union agreed on plans to jointly procure 1 million rounds to support Kyiv. Most Read from BloombergUBS to Buy Credit Suisse in $3.3 Billion Deal to End CrisisUS Studies Ways to Insure All Bank Deposits If Crisis GrowsMorgan Stanley Strategist Says Bank Stress Signals Bear Market EndCredit Suisse’s Fate Was Sealed by Regulators Days Before UBS De

9h ago Quartz

QuartzA happiness survey found that acts of kindness rose in Ukraine last year—and fell in Russia

Over the course of a year of cruel war, Ukrainians grew kinder to each other, according to the 2023 edition of the World Happiness Report, released today (March 20). Acts of benevolence proliferated in Ukraine through 2022—and they fell almost as dramatically in Russia over the same year.

18h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK