From using multiple banks to managing VC relationships, these are the 5 lessons...

source link: https://finance.yahoo.com/news/using-multiple-banks-managing-vc-211318036.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

From using multiple banks to managing VC relationships, these are the 5 lessons every founder should have learned from the Silicon Valley Bank nightmare

The Silicon Valley Bank crisis has deescalated and depositors will not lose their money.

Now is the time for founders to change things to be better prepared for next time.

Here are the 5 top lessons every founder should have learned.

With the most immediate crises from the Silicon Valley Bank run averted in as elegant a way as possible, founders can wipe the sweat from their brow and focus on what they learned that will protect them in the future.

To recap: On Friday, the bank that famously served the tech startup community with loans and other banking services experienced an honest-to-goodness, It's-a-Wonderful-Life-esq bank run, and was taken over by the FDIC. Thousands of startups lost access to all of their money over the weekend, and many of their VC firm investors — who also used the bank — were in a similar boat. The weekend was a wild ride of analysis, CAPS LOCK PANIC TWEETING and organizing and lobbying, largely by the venture capital community aimed at bank regulators asking for help.

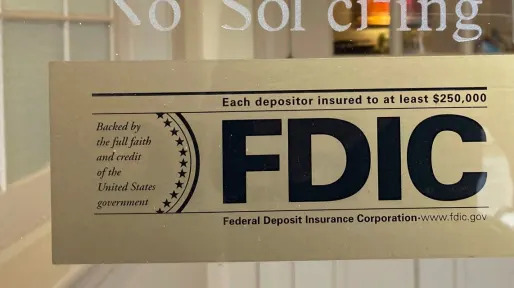

Regulators listened and opted to ensure that every penny that was on deposit in accounts was preserved for the bank's customers, even though most accounts were in excess of the $250,000 FDIC insurance limit.

The FDIC will cover the expense, should it have to, by increasing fees from banks for the FDIC insurance program, it said. (Fees from banks already fund the program) The agency is also searching for a buyer of the bank and short of that it will auction off assets to cover such costs. Stockholders of the bank are getting no help if a sale doesn't materialize, and no tax dollars are being used.

But every founder who experienced the bank failure, or witnessed it, should be using this life-flashing-before-our-eyes moment to look around and make changes. Here's the top lessons that every founder should have learned:

1. Use multiple banks to store cash if your balance exceeds $250,000, the limit of the FDIC depositor insurance. If something happens to one bank, such as a bank run, your company won't face ruin. There are a multitude of options to help manage this, such as Certificate of Deposit Account Registry Service (CDARS).

Bloomberg

Bloomberg‘Help Us Rebuild’ Deposit Base: Silicon Valley Bridge Bank CEO

(Bloomberg) -- The new chief executive officer of Silicon Valley Bridge Bank Tim Mayopoulos has one ask: that depositors pivot back to the lender.Most Read from Bloomberg‘Old-School’ Signature Bank Collapsed After Its Big Crypto LeapRussian Fighter Jet Collides With US Drone Over Black SeaUS Core CPI Tops Estimates, Pressuring Fed as It Weighs HikeCredit Suisse Finds ‘Material’ Control Lapses After SEC PromptBofA Gets More Than $15 Billion in Deposits After SVB Fails“The number one thing you can

11h ago TechCrunch

TechCrunchGPT-4's new capabilities power a 'virtual volunteer' for the visually impaired

OpenAI has introduced the world to its latest powerful AI model, GPT-4, and refreshingly the first thing they partnered up on with its new capabilities is helping people with visual impairments. Be My Eyes, which lets blind and low vision folks ask sighted people to describe what their phone sees, is getting a "virtual volunteer" that offers AI-powered help at any time.

15h ago Benzinga

BenzingaWhy Bunge Share Are Surging Today

Bunge Ltd (NYSE: BG) is set to replace Signature Bank (NASDAQ: SBNY) in the S&P 500 effective prior to the opening of trading on Wednesday, March 15. The Federal Deposit Insurance Corporation (FDIC) has taken Signature Bank into FDIC Receivership, and therefore Signature Bank is no longer eligible for inclusion. Also Read: What is the FDIC? And Why Is It Related To SVB, Signature Bank Collapses? Corteva Inc (NYSE: CTVA), Bunge and Chevron U.S.A. Inc, a subsidiary of Chevron Corporation (NYSE: CV

17h ago TechCrunch

TechCrunchLexxPluss expands into US with its warehouse robots

When Masaya Aso worked on autonomous driving technology at Bosch in Japan and Germany, he realized that "many tasks were still manual as over 85% of warehouses have almost no automation at all." To help address the problem, Aso co-founded LexxPluss, a now two-year-old, Japan-based startup that designs and develop autonomous mobile robots to transport loads and optimize workflows within warehouses and logistic sites. Aso, who is CEO of the outfit, co-founded it with robotics and autonomous vehicle veterans from Bosch, Amazon, Honda and more, and now the Japanese outfit is preparing to enter the U.S. with a fresh injection of about $10.7 million (1.45 billion JPY) of Series A funding that values the company at approximately $38.8 million (5.26 billion yen).

8h ago Fox Business

Fox BusinessSilicon Valley Bank committed 'one of the most elementary errors in banking,' Larry Summers says

Former Treasury Secretary Larry Summers said Silicon Valley Bank made an "elementary" mistake in banking that led to its collapse and takeover by federal regulators.

19h ago Fortune

FortuneCharles Schwab’s fortune battered by SVB collapse, with his wealth plunging more than any other American billionaire’s in 2023

The failure of Silicon Valley Bank has had a widespread impact.

20h ago TipRanks

TipRanksKevin O’Leary Says Avoid Bank Stocks and Buy Energy Instead. Here Are 2 Names to Consider

In the wake of multiple bank collapses over the past week, many banking stocks’ valuations have fallen sharply and are trading at deep discounts right now. One investor, however, that definitely won’t be looking for any bargains amongst the carnage is ‘Shark Tank’ star Kevin O’Leary. With the government having stepped in to ensure depositors walk away unscathed from the SVB and Signature Bank debacles, O’Leary anticipates a flurry of tighter regulation around banks, regional or not, and that wil

13h ago Fortune

FortuneHere are all the banks getting crushed right now—and what to do if your money is there

“Consumers need to separate falling stock prices and volatile trading from their actual deposits in the bank,” explained Mark Neuman, financial advisor and CIO of Constrained Capital.

1d ago TheStreet.com

TheStreet.comSVB Can't Find a Buyer Because of One Issue

SVB Financial Group , the parent company of Silicon Valley Bank, has put itself and its subsidiaries up for sale. The parent company, whose stock will be delisted by the Nasdaq, is selling its subsidiaries, SVB Capital and SVB Securities, plus additional assets and investments. SVB Securities operates as its investment banking division while SVB Capital serves as a venture capital and private credit fund, and SVB Securities is the investment banking business.

10h ago MarketWatch

MarketWatchThese 3 banks now offer 5% on checking and savings accounts: A ‘potential measure of protection against financial instability.’

It’s been over a decade since savings rates have been this high. Balances up to $10,000 are eligible for one of the highest available rates in the high-yield savings market today with this high-yield checking account from Consumers Credit Union.

23h ago MarketWatch

MarketWatch‘Very important for your cash.’ Here’s what accounts are, and are not, insured by the FDIC

Depositors at Silicon Valley Bank watched this week as their bank’s market value plummeted more than 60%, and it was later shuttered by regulators. Meanwhile, regional bank stocks from the likes of KeyCorp, Truist Financial, Fifth Third Bancorp, and Citizens Financial Group also tumbled. “All customers who had deposits in these banks can rest assured … they’ll be protected and they’ll have access to their money as of today.”

14h ago Fox Business

Fox BusinessInvestor who called Lehman collapse predicts the next big US bank failure

Robert Kiyosaki, who originally forecasted the Lehman 2008 crisis, predicts the next bank to collapse in the Silicon Valley Bank contagion will be Credit Suisse.

2d ago Benzinga

BenzingaYou'll Never Guess the Top-Performing Stock of the Last 20 Years

If a time machine could take you back to the start of the 2000s — without the desire to open up a crypto wallet — what’s the No. 1 investment you would make? Maybe Apple Inc. (NASDAQ: AAPL), which has sold 1.3 billion iPhones since 2007 and reported a $19.4 billion profit last quarter? Or Tesla Inc. (NASDAQ: TSLA), which went from selling just 937 cars in 2009 to over 300,000 last year? Some savvy income investors might consider Altria Group Inc. (NYSE: MO). The tobacco giant, formerly Phillip M

15h ago Investopedia

InvestopediaTop 5 Positions in Warren Buffett's Portfolio

Warren Buffett is undeniably the most famous and influential investor in modern history, based on his extraordinary performance record. Not surprisingly, the investment portfolio of Berkshire Hathaway Inc. (BRK.A), the holding company employing the Oracle of Omaha as chairman and CEO, receives wide media attention and scrutiny, even though Buffett is no longer making every investment decision. Despite his unparalleled success, Buffett's investment model has long been transparent, straightforward, and consistent.

2d ago Yahoo Finance

Yahoo FinanceStocks moving in after-hours: Guess, Lennar, Freshpet, First Republic

These are the stocks moving in after-hours trade on March 14, 2023.

11h ago SmartAsset

SmartAssetAre You Rich? Biden Wants to Double Your Capital Gains Taxes and Implement a Wealth Tax

While social issues have dominated news coverage recently, one of the most contentious and important issues in Washington never changes - tax policy. One of former President Donald Trump's biggest victories was his 2017 tax plan that drastically reduced taxes … Continue reading → The post Are You Rich? Biden Wants to Double Your Capital Gains Taxes and Implement a Wealth Tax appeared first on SmartAsset Blog.

13h ago Zacks

ZacksTop Stock Reports for Microsoft, Alibaba & Medtronic

Today's Research Daily features new research reports on 16 major stocks, including Microsoft Corporation (MSFT), Alibaba Group Holding Limited (BABA) and Medtronic plc (MDT).

13h ago TipRanks

TipRanksDown More Than 30%: Insiders Buy the Dip in These 2 Beaten-Down Regional Bank Stocks

The week got off to a rocky start as the markets digested the collapse of Silicon Valley Bank last week, and the Federal regulators’ shutdown of Signature Bank over the weekend. Sparking fears of contagion, on Monday, stocks in the banking sector saw shares drop dramatically, as investors scrambled to figure out the new patterns of risk and reward. The effect was most pronounced among the mid-sized and regional banking firms. In that niche, sudden drops in share value prompted trading halts for

23h ago TheStreet.com

TheStreet.comSVB: Moody's Delivers Bad News to First Republic and 5 Other Banks

The credit-rating company plans to downgrade the ratings of U.S. regional banks after Silicon Valley Bank collapsed.

15h ago Zacks

Zacks3M (MMM) Stock Sinks As Market Gains: What You Should Know

3M (MMM) closed the most recent trading day at $102.78, moving -0.7% from the previous trading session.

11h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK