Mortgage rates surge closer to 7%

source link: https://finance.yahoo.com/news/mortgage-rates-surge-closer-to-7-170022384.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Mortgage rates surge closer to 7%

Mortgage rates jumped higher this week, getting even closer to 7% and crushing homebuyer activity, which hit a 28-year low.

The average rate on the 30-year fixed mortgage increased to 6.65% from 6.50% the week prior, according to Freddie Mac. Rates have climbed over a half-point in February, reversing declines since mid-November.

The spike in rates is another blow to would-be buyers, who are also facing still-high home prices and a shortage of affordable homes for sale. Sellers also appear to be pulling their listings, rather than cutting prices further to spur interest.

“I think the biggest concern is buying into a market that would continue to go down,” Jeff Reynolds, broker at Compass and founder of UrbanCondoSpaces, recently told Yahoo Finance. “In my 18-year career, I have never seen rate moves like we are seeing now.”

The volume of applications to purchase a home slid by 6% from one week earlier, the Mortgage Bankers Association’s survey of applications for the week ending Feb. 24 found. Overall, demand was 44% lower than the same week a year ago and has nosedived to a 28-year low.

The drop in demand registered this past month is a sign that affordability remains a top concern, according to Redfin Deputy Chief Economist Taylor Marr.

“The housing market took two steps forward in December and January, but has taken one step back in February,” Marr said in a statement. “Mortgage rates crept back this month, which is prompting more buyers and sellers to back off.”

Another reason for the pullback in demand is rising home prices. The national median list price increased to $415,000 in February, Realtor.com data showed, up from $406,000 in January. While that’s down 7.6% from June’s peak of $449,000 – it still represents a yearly growth rate of 7.8%.

That translates to out-of-pocket costs for buyers.

According to Realtor.com, the monthly cost of financing 80% of the typical home is roughly $630 higher than a year ago. That puts the monthly mortgage payment 45.1% higher than a year ago, exceeding rent growth, up 2.9% from a year ago, and inflation, up 6.4%.

Yahoo Finance

Yahoo FinanceStock market news today: Stocks mixed as Salesforce lifts Dow, Treasury slide continues

Stocks traded mixed early Thursday with a rally in Salesforce stock lifting the Dow while higher interest rates weighed on the S&P 500 and Nasdaq.

24m ago Yahoo Finance

Yahoo FinanceWhat the end of the 'Great Moderation Era' means for investors: Morning Brief

The calm investing era is over. Expect volatility.

7h ago Yahoo Finance

Yahoo FinanceStudent loans: Biden takes steps to hold private college leaders personally liable for unpaid debt

The Biden administration announced plans to hold owners of private colleges personally liable for student loan debts left unpaid to the federal government.

1h ago Yahoo Finance

Yahoo FinanceMicrosoft's Activision Blizzard acquisition is looking more likely: Report

The Eurpoean Commission is leaning toward approving Microsoft's $69 billion acquisition of Activision Blizzard, Reuters reports.

50m ago Yahoo Finance

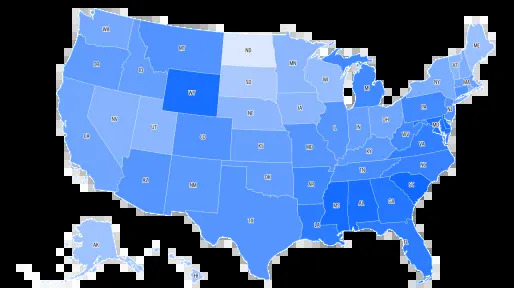

Yahoo FinanceMap: Racial homeownership gap widened in last 10 years, new data shows

The racial homeownership gap widened over the last decade, new data from the National Association of Realtors showed on Thursday.

4h ago SmartAsset

SmartAssetAsk an Advisor: Should I Pay off My Mortgage or Invest in CDs? I Refinanced My Mortgage at 2.375%, But I Can Get a CD at 4%. Plus, I Want to Retire in 7 Years.

I've been debating whether to pay off my mortgage. I've refinanced at 2.375% and can get a certificate of deposit (CD) for a year at 4%. I was adding to my mortgage payment by about $1,000 a month to pay … Continue reading → The post Ask an Advisor: Should I Pay off My Mortgage or Invest in CDs? I Refinanced My Mortgage at 2.375%, But I Can Get a CD at 4%. Plus, I Want to Retire in 7 Years. appeared first on SmartAsset Blog.

1d ago Bloomberg

BloombergCar Debt Is Piling Up as More Americans Owe Thousands More Than Vehicles Are Worth

(Bloomberg) -- Chris Martin knew he needed a bigger car as the birth of his fourth child approached, but he and his wife were already $14,000 underwater on their two vehicles.Most Read from BloombergHow to Get a Free Flight to Hong Kong in 500,000 Airline Ticket GiveawaySorry, Twitter. Elon Found His Next Shiny Object.Lightfoot Is First Chicago Mayor to Lose Reelection in 40 YearsWorld’s Rich Take Advantage as $1 Trillion Property Market CratersElon Musk Regains His Spot as the World’s Richest P

1d ago SmartAsset

SmartAssetI Have a $1 Million Portfolio. Will I Be Able to Live Off The Interest It Produces?

Once you have $1 million in assets, you can look seriously at living entirely off the returns of a portfolio. After all, the S&P 500 alone averages 10% returns per year. Setting aside taxes and down-year investment portfolio management, a … Continue reading → The post How Much Interest Can You Earn on $1 million? appeared first on SmartAsset Blog.

4h ago Barrons.com

Barrons.comAMC Stock Falls After CEO Warns Company Could Be Forced to Sell More ‘APEs’

Shares of the movie theater chain finished sharply lower Wednesday after CEO Adam Aron told investors that failure to authorize more common stock could result in even more dilution.

19h ago TipRanks

TipRanksSeeking at Least 11% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

Do you love dividends? Of course you do -- and rightly so! Scholars who study the stock market's historical performance estimate that over time, the payment (and reinvestment, and compounding) of dividends have contributed anywhere from 30% to 90% of the S&P 500's total returns. Simply put, if you're not investing in dividend stocks, you're doing it wrong. Using the TipRanks platform, we’ve looked up two stocks that are offering dividends of at least 11% yield – that’s almost 6x higher the avera

3h ago MarketWatch

MarketWatch‘I’m holding my breath’: What will happen if the Supreme Court blocks Biden’s student-loan forgiveness plan?

'Their financial situation will be even worse because once you default, the hardship on you is exponentially greater,' said Justice Sonia Sotomayor.

13h ago Reuters

ReutersMajor central banks return to inflation fight in February

Major central banks resumed their quest to ramp up interest rates in February after a tepid start to the year with price pressures proving more sticky than markets and many policy makers had hoped for. February saw six interest rate hikes across six meetings by central banks overseeing the 10 most heavily traded currencies. Policy makers in Australia, Sweden, New Zealand and Britain joined the U.S. Federal Reserve and the European Central Bank in lifting key lending rates by a total of 250 basis points (bps).

37m ago AP Finance

AP FinanceAverage long-term US mortgage rate hits 3-month high

The average long-term U.S. mortgage rate hit a three-month high this week, reflecting higher Treasury yields and expectations that the Federal Reserve will continue to raise its benchmark rate and keep it there until inflation recedes. Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate rose to 6.65% from 6.5% last week. The average long-term rate reached a two-decade high of 7.08% in the fall as the Fed continued to raise its key lending rate in a bid to cool the economy and quash persistent, four-decade high inflation.

36m ago Yahoo Finance

Yahoo FinanceSilvergate stock crashes after company delays annual report, reveals new losses

Troubled lender Silvergate disclosed further losses on Wednesday and delayed the filing of its annual report as the fallout from its entanglement with the crypto industry continues.

5h ago Benzinga

BenzingaPennsylvania Farmer Behind $5 Trillion Trend Speaks Out: I Created A Monster

Add up the market valuation of Apple Inc. (NASDAQ: AAPL), all the cryptos in the world and entrepreneur Jeff Bezos’s fortune, and you get to over $3 trillion. But one 80-year-old man has created something bigger than all three of these combined. These days, he shuns the spotlight and lives on a modest farm in rural Pennsylvania. You would never guess the farm’s owner set in motion a $5 trillion force that grows each fortnight. It’s a comfortable enough retirement, but Ted Benna has some regrets.

20h ago Zacks

ZacksDesktop Metal, Inc. (DM) Reports Q4 Loss, Tops Revenue Estimates

Desktop Metal, Inc. (DM) delivered earnings and revenue surprises of 10% and 10.54%, respectively, for the quarter ended December 2022. Do the numbers hold clues to what lies ahead for the stock?

19h ago MoneyWise

MoneyWiseWill Bitcoin mint more millionaires or is this just a 'dead cat bounce'? Here are Warren Buffett's 3 reasons for why he believes crypto 'will come to a very bad ending'

The Oracle of Omaha never saw a future in cryptocurrency.

1d ago Zacks

ZacksInvestors Heavily Search Johnson & Johnson (JNJ): Here is What You Need to Know

Zacks.com users have recently been watching Johnson & Johnson (JNJ) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

4h ago 7h ago

7h ago Zacks

ZacksZIM Integrated Shipping Services (ZIM) Gains As Market Dips: What You Should Know

ZIM Integrated Shipping Services (ZIM) closed the most recent trading day at $23.95, moving +1.23% from the previous trading session.

19h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK