Stock market news today: Stocks wobble as investors evaluate Fed minutes

source link: https://finance.yahoo.com/news/stock-market-news-today-february-22-2023-120842564.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Stock market news today: Stocks waver as investors evaluate Fed minutes

Here's what's moving markets on Wednesday, February 22, 2023.

U.S. stocks zigzagged between small gains and losses Wednesday as investors pored over minutes from the Federal Reserve's last meeting earlier this month.

The latest readout from the U.S. central bank's Jan. 31- Feb. 1 gathering indicated officials were intent on proceeding with "ongoing increases" but open to reaching an endpoint later this year.

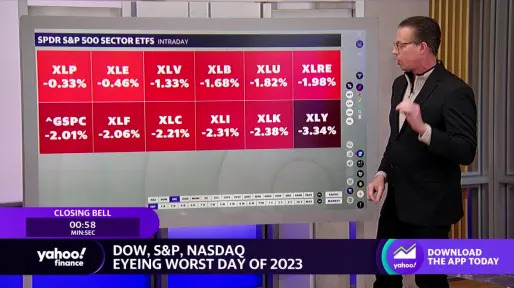

The S&P 500 (^GSPC) teetered up 0.1%, while the Dow Jones Industrial Average (^DJI) turned negative. The technology-heavy Nasdaq Composite (^IXIC) was a modest 0.3% higher.

"Participants concurred that the Federal Open Market Committee had made significant progress over the past year in moving toward a sufficiently restrictive stance of monetary policy," the minutes said.

"Even so, participants agreed that, while there were signs that the cumulative effect of the Committee's tightening of the stance of monetary policy had begun to moderate inflationary pressures, inflation remained well above the Committee's longer-run goal of 2% and the labor market remained very tight."

Discussions also reflected that most members favored the smaller 0.25% increase delivered during the latest policy decision but some in the group preferred raising rates by 50 basis points.

Cleveland Fed President Loretta Mester admitted in a speech last week she would have favored the more sizable hike but officials did not want to surprise the markets, which were pricing in 0.25%.

"The worst of inflation may be in the rear view but it remains well-above the Fed’s target," Mike Loewengart, head of model portfolio construction at Morgan Stanley's Global Investment Office said in a note. "Bottom line is that many market headwinds aren’t going away and investors should expect volatility to stay as they parse over the impact rates being higher for longer will have."

Earlier in the day, St. Louis Fed President James Bullard in a televised interview with CNBC said the U.S. central bank must bring the federal funds rate to a range of 5.25% to 5.5% in order to bring inflation back down to its 2% target.

AP Finance

AP FinanceFed Minutes: Almost all officials backed quarter-point hike

Nearly all Federal Reserve policymakers agreed earlier this month to slow the pace of their rate increases to a quarter-point, with only “a few” supporting a larger half-point hike. The minutes from the Fed’s Jan. 31-Feb.1 meeting said most of the officials supported the quarter-point increase because a slower pace “would better allow them to assess the economy’s progress” toward reducing inflation to their 2% target. The increase raised the Fed’s benchmark rate to a range of 4.5% to 4.75%, the highest level in 15 years.

1h ago Yahoo Finance

Yahoo FinanceDoubleLine’s Jeffrey Sherman cautions Fed shouldn't push rates above 6%

The Federal Reserve is likely to take its federal funds rate beyond 5% but must assess the impact of such a level before pressing higher, according to DoubleLine Capital’s deputy chief investment officer Jeffrey Sherman.

2h ago MarketWatch

MarketWatchU.S. stocks cling to gains as Fed minutes show most officials favored 25 basis point hike

U.S. stocks whipsawed but remained in the green on Wednesday after minutes from the Federal Reserve’s February meeting showed most officials supported a 25 basis point rate hike. The Dow Jones Industrial Average (DJIA) rose 63 points, or 0.2%, to 33,182. The Dow briefly turned red after the minutes were released at 2 p.m. Eastern Time as stocks kneejerked lower.

1h ago Reuters

Reuters'Almost all' Fed officials favored 25-basis-point rate hike at last meeting, minutes show

WASHINGTON (Reuters) -A solid majority of Federal Reserve officials agreed at their last policy meeting to slow the pace of increases in the U.S. central bank's benchmark overnight interest rate to a quarter of a percentage point, but also said the risks of high inflation remained a "key factor" shaping monetary policy and warranted continued hikes in borrowing costs until it was controlled. "Almost all participants agreed that it was appropriate to raise the target range of the federal funds rate 25 basis points," with many of those saying that would let the Fed better "determine the extent" of future increases, according to the minutes from the Jan. 31-Feb. 1 meeting which were released on Wednesday. But as well, "participants generally noted that upside risks to the inflation outlook remained a key factor shaping the policy outlook," and that interest rates would need to move higher and stay elevated "until inflation is clearly on a path to 2%."

9h ago Investor's Business Daily

Investor's Business DailyDow Jones Reverses Ahead Of Fed Minutes; Baidu Surges On Earnings; Nvidia Earnings On Deck

The Dow Jones reversed lower Wednesday ahead of minutes from the Federal Reserve's latest policy meeting. Nvidia earnings are due out late.

5h ago Yahoo Finance

Yahoo FinanceStarbucks bets big on olive oil-infused Oleato coffee line

Starbucks debuts olive-oil infused coffee in Italy.

6h ago TheStreet.com

TheStreet.comCathie Wood Watch: Ark Snags a Top Chipmaker, Pares Another

Famed money manager Cathie Wood, chief executive of Ark Investment Management, sold some of her stock-in-trade names and bought another one Tuesday. On the sell side, Ark funds dumped 33,704 shares of streaming platform Roku , valued at $2.2 million as of Tuesday's close.

2h ago Yahoo Finance

Yahoo FinanceStock market news today: Stocks slide after economic warnings from Walmart, Home Depot

U.S. stocks plunged Tuesday as the prospect of higher-for-longer interest rates and letdowns from big-box retailers dampened the mood on Wall Street to start a busy holiday-shortened week.

23h ago Yahoo Finance

Yahoo FinanceApple TV+ growth has 'flat-lined' as users say service lacks value: UBS

Apple TV+'s "Ted Lasso" may be making its triumphant return next month — but a new survey hints not even the Emmy Award-winning series will be be enough to boost the streamer's clout with consumers.

7h ago Barrons.com

Barrons.comFed Officials See Peak in Interest Rates This Year, Minutes Show

The official record of the central bank's latest policy meeting gives investors a look into the FOMC's decision to slow its pace of rate increases.

43m ago Yahoo Finance

Yahoo FinanceWhy the 2023 rally might be in trouble: Morning Brief

Everyone's looking at the same market but people are seeing different things.

10h ago Reuters

ReutersBullard calls on Fed to get inflation under control this year

"If inflation doesn't start to come down, you risk this replay of the 1970s where you had 15 years where you're trying to battle the inflation drag," Bullard told broadcaster CNBC in an interview. Bullard also repeated his view that a Fed policy rate in the range of 5.25% to 5.5% would be adequate for the task. Minutes from the U.S. central bank's latest meeting released later on Wednesday are expected to detail the breadth of debate among Fed officials over how much further interest rates may need to rise to slow inflation and cool an economy that has remained stronger than expected despite tighter monetary policy.

7h ago Bloomberg

BloombergDomino’s Plunges Most on Record as Customers Shun Price Hikes

(Bloomberg) -- Shares of Domino’s Pizza Enterprises Ltd. plummeted the most on record in Sydney after the pizza chain operator said its first-half earnings fell as customers spurned price increases meant to offset inflationary pressures.Most Read from BloombergMcKinsey Plans to Eliminate About 2,000 Jobs in One of Its Biggest Rounds of CutsHow Much Do Investors Say They Need to Retire? At Least $3 MillionChina Urges State Firms to Drop Big Four Auditors on Data RiskRussia’s War on Ukraine, China

14h ago Yahoo Finance

Yahoo FinanceToll Brothers stock jumps amid 'marked increase in demand' to start 2023

Toll Brothers reported results on Tuesday that beat expectations in another sign the housing market continues to show signs of life after a challenging 2022.

5h ago Zacks

ZacksNikola (NKLA) to Report Q4 Earnings: Here's What to Expect

The Zacks Consensus Estimate for Nikola's (NKLA) loss per share and revenues is pegged at 46 cents and $34.12 million, respectively, for the fourth quarter of 2022.

3h ago Zacks

ZacksTilray Brands, Inc. (TLRY) is Attracting Investor Attention: Here is What You Should Know

Tilray Brands, Inc. (TLRY) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

6h ago Yahoo Finance

Yahoo FinanceIntel dividend cut a result of 'very specific issues': DoubleLine's Monica Erickson

Intel brings out the hatchet to its dividend.

2h ago TipRanks

TipRanksSeeking at Least 7% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

Inflation, interest rates, and recession – these are the bogeymen of investing, and they’ve been watching over our shoulders for the past year. We all know the story by now, the rate of inflation, at 6.4%, is still high, the Federal Reserve is hiking rates in an attempt to push back against high prices, and that could tip the economy into recession. At a time like this, investors are showing a growing interest in finding strong defensive portfolio moves. It’s a mindset that naturally turns us to

18h ago Yahoo Finance

Yahoo FinanceLucid earnings preview: Production, ownership structure in focus

When California-based EV-maker Lucid announces Q4 financial results after the bell on Wednesday, the production guidance, and questions of its future ownership structure, may dominate the headlines.

3h ago Bloomberg

BloombergBill Gates Buys Stake in Heineken for $902 Million

(Bloomberg) -- Bill Gates has acquired a minority stake in Heineken Holding NV, the controlling shareholder of the world’s second-largest brewer, for about $902 million.Most Read from BloombergMcKinsey Plans to Eliminate About 2,000 Jobs in One of Its Biggest Rounds of CutsChina Urges State Firms to Drop Big Four Auditors on Data RiskHow Much Do Investors Say They Need to Retire? At Least $3 MillionApple Makes Major Progress on No-Prick Blood Glucose Tracking for Its WatchPutin Has Decided to No

4h ago

Recommend

-

11

11

Wobble in the Standard Model April 12, 2021 Prediction is very difficult, especially if it’s about the future—Niels Bohr Lisa Randall is a professor of theoretical...

-

4

4

-

9

9

-

3

3

Stocks rebound to close higher as investors weigh flurry of earnings reportsS&P Futures4,444.50-14.75 (-0.33%)Dow Futures34,806.00-3...

-

6

6

11:32...

-

7

7

The Fed's environment is 'demand destruction by design': Strategist - There you have it, your closing bell for July 7.

-

4

4

Yahoo Finance LIVE - July 19 PM IT IS A LARGE SUBSIDY FOR DOMESTIC CHIP MANUFACTURING.

-

7

7

September PPI data surpasses expectations Producer price index increased 0.4%

-

2

2

-

1

1

...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK