Nigeria Inflation Hits 21.8% in January 2023 – The Highest Increase Since Septem...

source link: https://bitcoinke.io/2023/02/cbk-approves-more-digital-lenders/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

There are Only 22 Licensed Digital Credit Providers as of January 2023, Says Central Bank of Kenya – BitcoinKE

The Central Bank of Kenya has announced the licensing of 12 more applicants to offer digital lending services in Kenya.

The 12, that include Pezesha and Tala, are classified as Digital Credit Providers (DCPs) and brings to 22 the total number of licensed applicants since September 2022 when the first batch of applicants were approved.

Press Release: Licensing of Digital Credit Providers – January 2023https://t.co/V9PWGg5m8T pic.twitter.com/t5ryzGqcqx

— Central Bank of Kenya (@CBKKenya) January 30, 2023

“CBK has received 381 applications since March 2022 and has worked closely with the applicants in reviewing their applications. Additionally, CBK has engaged other regulators and agencies pertinent to the licensing process, including the Office of the Data Protection Commissioner,” the bank said.

The new list includes:

- Jijenge Credit Limited

- Jumo Kenya Limited

- Letshego Kenya Ltd

- MFS Technologies Limited

- M-Kopa Loan Kenya Limited

- Inventure Mobile Limited (Trading as Tala)

- Natal Tech Company Limited

- Ngao Credit Limited

- Pezesha Africa Limited

- Tenakata Enterprises Limited

- Umoja Fanisi Limited

- Zanifu Limited

The CBK got the mandate to regulate and oversee the lending sector through legislative amendments to the Central Bank of Kenya (CBK) Act which came into effect in December 2021. In March 2022, the bank published fresh regulations requiring all digital lenders to apply for licenses within 6 months.

Under the new regulations, providers are expected to comply with several expectations including:

- Lenders will not use obscene or profane language with the customer or the customer’s contacts for purposes of shaming them

- Lenders will not use threats, violence, or other means to harm a customer, or his reputation or property, if they do not settle their loans

- Lenders are barred from posting a customer’s personal or sensitive information online or on any other forum or medium for purposes of shaming them

- Lenders will not engage in any other conduct whose consequence is to harass, oppress, or abuse any person in connection with the collection of a debt

Failure to comply with the above regulations will incur a monetary penalty on a digital credit provider in an amount not exceeding KES 500,000 (Appromately $4,372).

The regulation came following concerns from the public about poor practices from digital lenders. Some of the practices that irked Kenyans include:

- High-interest rates

- Over-indebtedness

- Unethical collection practices

- Personal data abuse

“Other applicants are at different stages in the process, largely awaiting the submission of requisite documentation. We urge these applicants to submit the pending documentation expeditiously to enable completion of the review of their applications,” the bank says.

________________________________________

Follow us on Twitter for the latest posts and updates

Join and interact with our Telegram community

________________________________________

________________________________________

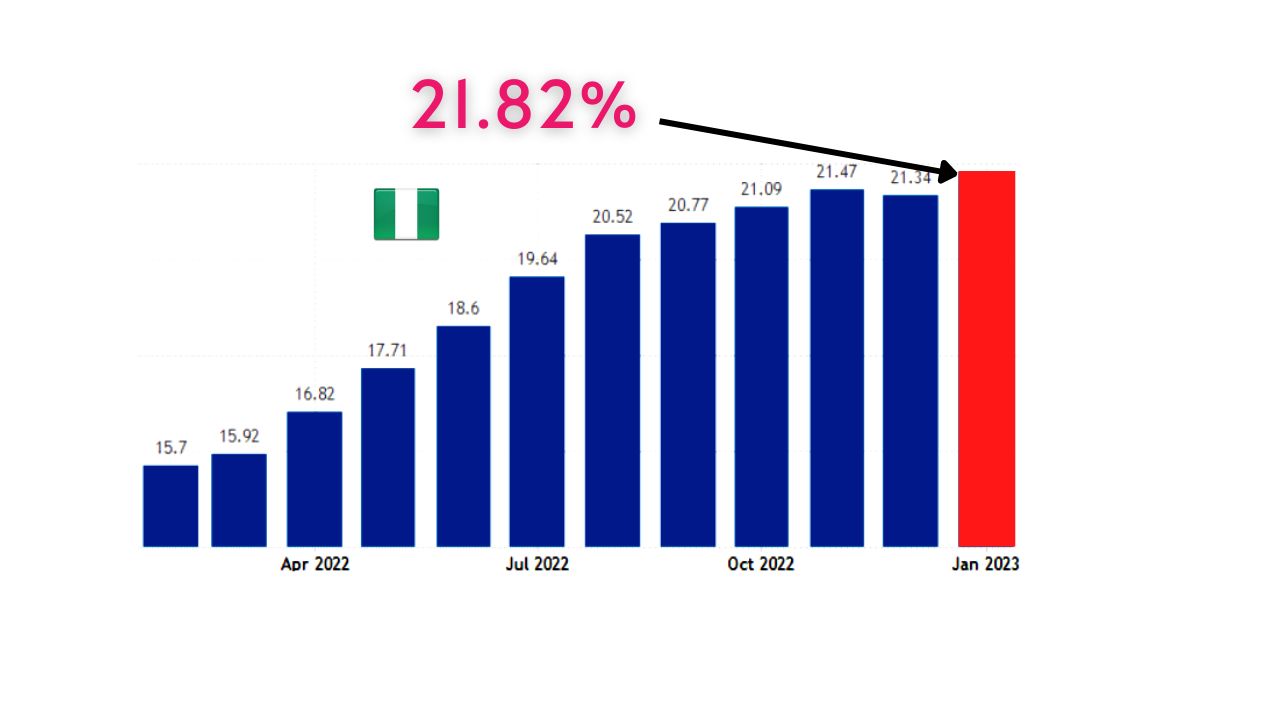

Nigeria’s inflation rate increased to 21.8% in January 2023 from 21.34% in the prior month, the highest increase since September 2005.

Headline Inflation for January 2023 was 21.82%, from 21.34% in December 2022.

Food Inflation was 24.32% in January 2023 from 23.74% in December 2022.

Urban inflation was 22.55%. Rural Inflation was 21.13%.

Read the full CPI report for January 2023 here: https://t.co/ResHYKcEhK pic.twitter.com/E4r5X6CzPr— NBS Nigeria (@NBS_Nigeria) February 15, 2023

On a monthly basis, consumer prices rose sharply by 1.87% marking the highest increase in nearly 16 years, following a 1.71% rise in the previous month.

The primary factors contributing to the surge in inflation were the significant increases in food prices and the depreciation of the Nigerian currency, the Naira.

Food prices, which have the highest weight in the consumer price index (CPI) basket, rose to 24.32% in January 2023 from 23.75% in the preceding month. The contributions of items on a class basis to the increase in the headline index are:

- Bread and Cereal (21.67%)

- Actual and Imputed Rent (7.74%)

- Potatoes

- Yam and Tuber (6.06%)

- Vegetable (5.44%)

- Meat (4.78%).

Outside of food, the highest increases were recorded in prices of gas, liquid fuel, passenger transport by air, vehicles spare parts, fuels, and lubricants for personal transport equipment, solid fuel.

Inflation, which had been on the rise for 10 consecutive months, experienced a temporary dip to 21.34% in December 2022, however, it is back up ahead of the upcoming general election in February 2023.

Nigeria inflation over the last 12 monthsHigh inflation, weak economic growth, and mounting insecurity are at the forefront of the minds of many voters and are likely to play a major role in determining the outcome of the elections.

Policymakers have attributed Nigeria’s inflationary pressures to its infrastructure problems and the country’s reliance on imports for many consumer goods.

The Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, has stated that the bank will continue to adopt a hawkish stance on interest rates if inflation remains at an elevated level.

In January 2023, the Central Bank of Nigeria increased its key interest rate to 17.5% marking a total of 600 basis points of rate hikes since May 2022.

__________________________________

Follow us on Twitter for latest posts and updates

Join and interact with our Telegram community

__________________________________

__________________________________

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK