Simulate from a bounded distribution that has a specified mean

source link: https://blogs.sas.com/content/iml/2023/02/20/bounded-distrib-mean.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

A SAS programmer asked for help to simulate data from a distribution that has certain properties. The distribution must be supported on the interval [a, b] and have a specified mean, μ, where a < μ < b. It turns out that there are infinitely many distributions that satisfy these conditions. This article describes the shapes for a family of beta distributions that solve this problem.

Common bounded distributions

There are three common distributions that are used to model data on a bounded interval:

- The triangular distribution has a peak (mode) that is easy to specify. The PDF looks like a triangle, so this distribution might not be a good model for real data.

- The PERT distribution also has a mode that is easy to specify. The PERT distribution is a particular example of a beta distribution that is used in decision analysis.

- The two-parameter beta distribution is a flexible family that can model a wide range of distributional shapes.

An interesting fact about the two-parameter beta distribution is that you can model many different shapes. The parameters for the beta distribution enable you to model distributions for which the PDF is decreasing, increasing, U-shaped, and has either positive or negative skewness.

If Y is a beta-distributed random variable on [0,1] that has mean p, then X = (b – a)Y + a is a random variable on [a, b] that has mean μ = (b – a)p + a. Thus, we can simulate beta-distributed data, and then scale and translate the data to any other bounded interval.

Beta distributions that have a common mean

Let's examine the shapes of some beta distributions that all have the same mean, p, in [0,1]. The mean of the Beta(α, β) distribution is p = α/(α+β). Thus, for any specified mean, there is a one-parameter family of beta distributions, each with a different shape, that all have the same mean. For any value of the β parameter, choose α = p / (1 – p) β to ensure that the Beta(α, β) distribution has mean p.

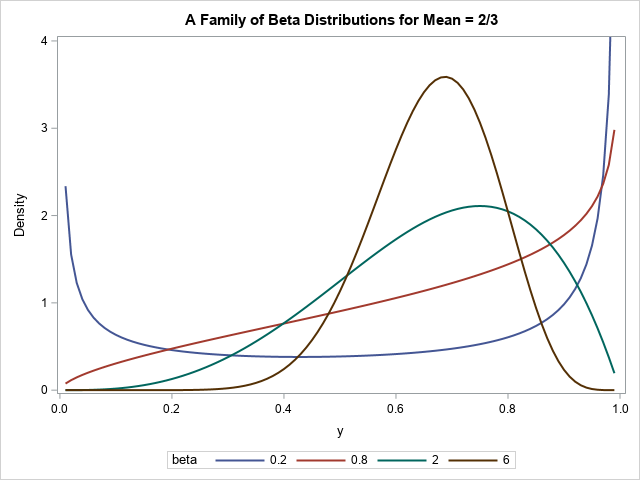

Let's compute the PDF for a few members of the family to see what they look like. In the following program, I specify that I want a beta distribution that has mean value p = 2/3, which forces α = 2 β. I then plot the PDF for several values of β to visualize the different shapes:

/* show PDFs for a sample of (alpha, beta) values such that the

Beta(alpha, beta) distribution has mean=2/3 */

data BetaPDF;

keep alpha beta y pdf;

p = 2/3; /* mean of Y ~ Beta(alpha, beta) distribution */

do beta = 0.2, 0.8, 2, 6;

alpha = p/(1-p) * beta; /* choose alpha so that distrib has mean p */

do y = 0.01 to 0.99 by 0.01;

PDF = pdf("beta", y, alpha, beta);

output;

end;

end;

run;

title "A Family of Beta Distributions for Mean = 2/3";

proc sgplot data=BetaPDF;

series x=y y=PDF / group=beta lineattrs=(thickness=2);

yaxis min=0 max=4 label="Density";

run; |

Notice the shapes of the resulting beta distributions:

- The PDF for β=0.2 is U-shaped.

- The PDF for β=0.8 is monotonic increasing.

- The PDF for β=2 has a mode at 0.75.

- The PDF for β=6 has a mode at 0.6875. It appears to be approximately bell-shaped.

All these distributions have the same mean, which is p = 2/3. As β increases, the distribution becomes nearly normal, and the mode approaches the mean.

Simulate data from a bounded distribution with a specified mean

The PDF of the distributions is easier to visualize than a random sample. But you can modify the program to generate random variates instead of a PDF. To obtain a random sample on [a, b] that has mean μ, you can transform the problem: use the beta distribution to simulate a sample on [0, 1], then transform the data into the interval [a, b].

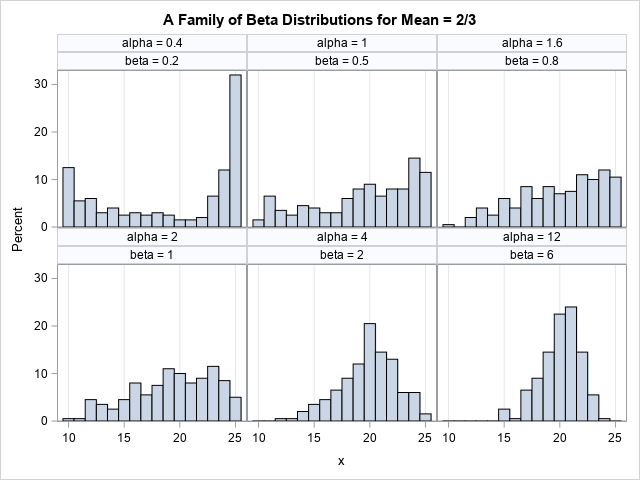

For example, suppose you want a random sample from a distribution that has mean 20 and is bounded on the interval [10, 25]. Because 20 is two-thirds of the way between 10 and 25, you can simulate from a beta distribution on [0, 1] that has mean p = 2/3. If Y is a beta-distributed random variable on [0, 1], then X = (25-10)*Y + 10 is a random variable on [10, 25].

The following SAS DATA step demonstrates this technique. Because the problem does not have a unique solution, the program generates six random samples, each with N=200 observations. Each sample has a different shape, but they are all generated from a distribution whose mean is 20.

/* Define interval [a,b] and mean, mu */

%let a = 10;

%let b = 25;

%let mu = 20; /* note that mu is 2/3 of the way from a to b */

/* if X is r.v. on [a,b] with mean mu, then

Y = (X-a)/(b-a) is r.v. on [0,1] with mean p=a + (b-a)*mu */

data BetaSim;

call streaminit(1234);

keep alpha beta x y;

a = &a; b = &b; mu = μ

p = (mu - a)/(b-a); /* mean of Y ~ Beta in [0, 1] */

do beta = 0.2, 0.5, 0.8, 1, 2, 6;

alpha = p/(1-p) * beta; /* choose alpha so that distrib has mean p */

do i = 1 to 200; /* N = 200 for this example */

y = rand("beta", alpha, beta); /* Y ~ Beta(alpha, beta) on [0,1] */

x = (b-a)*y + a; /* transform values into [a,b] */

output;

end;

end;

run;

proc sgpanel data=BetaSim;

panelby alpha beta / columns=3;

histogram x;

colaxis grid;

run; |

The panel shows six different samples. Each sample is drawn from a distribution that has mean 20. Four of the samples are generated from a (rescaled) distribution that was shown in the previous section. As you can see, the shape of the distributions vary. Some are U-shaped, some are nearly linear, and some are bell-shaped.

If you want a unique solution to this problem, you must add an additional constraint. A common choice is to match not just the mean of some sample data, but also the variance. These beta distributions all have different variances, so adding a constraint on the variance ensures a unique beta distribution.

Summary

This article shows how to simulate data from a distribution on the interval [a, b] that has a specified mean, μ. There are infinitely many distributions that satisfy these constraints. This article visualizes the shapes for a family of beta distributions that you can use to solve this problem. To get a unique solution, you can specify an additional requirement, such as a value for the variance.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK