The ultimate insider's guide to the dramatic downfall of Sam Bankman-Fried, Caro...

source link: https://finance.yahoo.com/news/ultimate-insiders-guide-dramatic-downfall-130200501.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The ultimate insider's guide to the dramatic downfall of Sam Bankman-Fried, Caroline Ellison, and FTX

Sam Bankman-Fried is facing criminal charges and is expected to enter a plea on Jan. 3.

The FTX founder's dramatic arrest in the Bahamas followed an odd media tour and damning court filings.

Here's the guide to everything that's happened so far in the FTX saga.

In just a few years since founding the crypto exchange FTX in 2019, Sam Bankman-Fried built a reverent audience among the US political and financial establishment.

Then it all came crashing down.

Often dressed like he'd just come from a pick-up squash game, the 30-year-old onetime crypto billionaire had appeared with the likes of Bill Clinton and the Davos elite, evangelizing about the future of crypto.

FTX represented a new kind of exchange that promised a safe and efficient way for traders to make transactions around various cryptocurrencies. That vision and its customer growth drew investments from top VCs like Sequoia Capital, Tiger Global, and SoftBank, helping the company quickly reach a stunning $32 billion valuation. Bankman-Fried's own worth was once pegged at around $20 billion, according to Bloomberg.

With some $8 billion in customer funds seemingly gone, financial regulators alleged that what happened at FTX wasn't some novel and complex financial engineering, but a simple and daring fraud scheme along with straightforward mismanagement.

Bankman-Fried, with the obliging support of his lieutenants, sent FTX customer funds to his other company Alameda Research, which allegedly squandered that bounty on risky investments and also served as his "personal piggy bank," according to the US Securities and Exchange Commission.

Federal prosecutors in Manhattan also ensnared Bankman-Fried, with what turned out to be the cooperation of his ex-girlfriend and former Alameda CEO Caroline Ellison and former FTX co-founder Gary Wang. All three have been hit with serious criminal charges for fraud and conspiracy.

Bankman-Fried's project was also about cultivating a sense of legitimacy and ethics around the theoretically lucrative and practically unsupervised scheme that is crypto. He was the rare CEO in the industry who actively courted regulation amid the mainstreaming of a shadowy economy where lack of oversight had been central to its appeal.

CBS MoneyWatch

CBS MoneyWatchSam Bankman-Fried set to plead not guilty to fraud, report says

Prosecutors will have to prove the cryptocurrency company founder intentionally duped customers, legal analysts said.

8h ago Fox Business

Fox BusinessFTX founder Sam Bankman-Fried to plead not guilty at scheduled New York City arraignment: reports

Sam Bankman-Fried, at his arraignment in U.S. District Court in Manhattan Tuesday, will likely plead not guilty to fraud, money laundering and other charges over FTX's collapse.

11h ago AZCentral | The Arizona Republic

AZCentral | The Arizona RepublicKatie Hobbs sworn in as Arizona's 24th governor in brief ceremony

Gov. Katie Hobbs and a new slate of leaders for Arizona were sworn in Monday in a brief ceremony at the state Capitol. Hobbs is now Arizona's 24th governor.

6h ago CoinDesk

CoinDeskGemini Co-Founder Accuses DCG’s Silbert of 'Bad Faith' Stalling in $900M Locked Funds Dispute

The co-founder of crypto exchange Gemini has accused Digital Currency Group CEO Barry Silbert of “bad faith stall tactics” as their respective companies lock horns over a business disagreement precipitated by FTX’s multi-billion-dollar implosion late last year. Cameron Winklevoss blasted Silbert in an open letter posted to Twitter, alleging crypto broker Genesis Global Capital and its parent company, DCG, owe Gemini’s clients $900 million. DCG is also CoinDesk’s parent company.

9h ago TheStreet.com

TheStreet.comGood News For FTX Customers: The Bahamas Seized $3.5 billion in Assets

The Securities Commission of The Bahamas says it is holding these assets pending transfer to clients and creditors.

16h ago The Montgomery Advertiser

The Montgomery AdvertiserMontgomery airport reopens after American Airlines employee killed

Montgomery Regional Airport has resumed operations. American Airlines on Sunday released luggage for pickup by passengers of flight 3408.

1d ago The Hill

The HillHope Hicks to aide on Jan. 6: ‘We all look like domestic terrorists now’

Former White House aide Hope Hicks told a fellow aide in text messages during the Jan. 6, 2021, insurrection that “we all look like domestic terrorists now” as Trump supporters stormed the Capitol. Texts released by the House select committee investigating that day show Hicks texting with Julie Radford, former chief of staff to Ivanka…

14h ago MarketWatch

MarketWatchIsraeli missile strikes put Damascus airport out of service

Israel’s military fired missiles toward the international airport of Syria's capital early Monday, putting it out of service and killing two soldiers and wounding two others, the Syrian army said.

1d ago What To Watch

What To WatchThe Best Josh Brolin Movies

Josh Brolin has no shortage of great movies. For the past nearly 40 years, the best Josh Brolin movies have been those that have allowed the second-generation actor to show off his dynamic and versatile acting skills, charm, and all-around likability. No matter if he’s playing a teenage heartthrob in The Goonies, the Mad Titan himself in the Marvel Cinematic Universe, or an everyman who find himself in the wrong place at the wrong time in No Country For Old Men, Brolin continues to be one of the most exciting names in show business.

1d ago The Telegraph

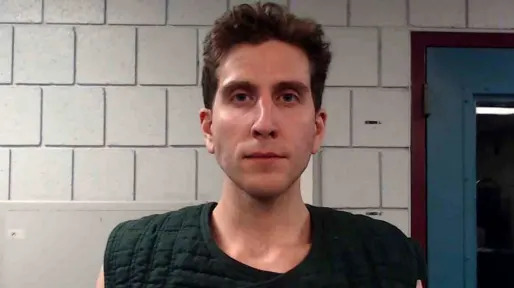

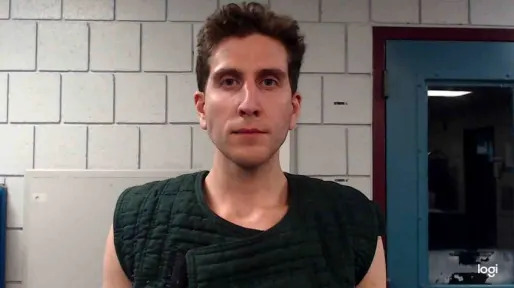

The TelegraphMan accused of Idaho murders allegedly stalked students for weeks

The criminology student arrested on suspicion of murdering four people in Idaho allegedly stalked the victims “for weeks” before they were killed and allegedly wore gloves in a supermarket long afterwards, according to reports.

1d ago Investor's Business Daily

Investor's Business DailyStock Market Holidays 2023: When Does Wall Street Reopen After New Year's?

Take a look at this list of stock market holidays in 2023 to find out whether the market will be open on days like Labor Day, Black Friday, Christmas Eve and more.

12h ago The Independent

The IndependentHorrifying moment woman pushes three-year-old onto train tracks

Brianna Lace Workman was arrested and charged

13h ago

Pope Emeritus Benedict XVI body lying in state at Vatican

Pope Emeritus Benedict XVI ‘s body, his head resting on a pair of crimson pillows, lay in state in St. Peter’s Basilica on Monday as thousands of people filed by to pay tribute to the pontiff who shocked the world by retiring a decade ago.

14h ago Fox News

Fox NewsNYC millionaire pharma executive convicted of killing autistic son found dead after Supreme Court revokes bail

New York City pharmaceutical executive Gigi Jordan, convicted of killing her 8-year-old autistic son, was found dead after Supreme Court Justice Sonia Sotomayor revoked bail.

14h ago Miami Herald

Miami HeraldA Florida lawyer pleaded guilty to 34 counts of child porn charges. He got probation

A Tampa attorney who was sentenced to eight years of sex offender probation and no prison time after pleading guilty to 34 counts of child pornography charges still will not “acknowledge the wrongful nature of his conduct,” a Florida judge said.

1d ago Reuters Videos

Reuters VideosFour dead as two helicopters collide in Australia

STORY: Two helicopters collided mid-air on Australia's Gold Coast on Monday (January 2) leaving at least four people dead. Three others were taken to the hospital in a critical condition. The crash took place close to Sea World Resort Australia.Police said one of the helicopters managed to land safely on a sandbank, but the other crashed. Gary Worrell is Queensland Police Acting Inspector: “Our initial inquiries it would appear that one has been taking off and one has been landing. At this stage, it’s my understanding that with the seven people that are injured are from just one helicopter, and all the others are still injured. But, obviously, further inquiries are being conducted.”The Australian Transport Safety Bureau has launched an investigation into the accident.

14h ago CBS News

CBS News1 officer killed, 1 wounded in Pennsylvania shooting

The suspect was killed in a shootout with police after initially fleeing in a carjacked vehicle, sources told CBS Pittsburgh.

3h ago WSB Cox articles

WSB Cox articles‘It’s a sad day’: Tire shop employee killed by customer who thought car was being stolen, police say

One person is dead and another currently behind bars after a shooting at a tire shop Saturday afternoon.

2d ago MMA Junkie

MMA JunkieUFC president Dana White admits he hit wife in New Year’s Eve altercation: ‘There’s no excuse’

UFC president Dana White was caught on camera in physical altercation with his wife at a night club in Mexico on New Year's Eve.

2h ago The Monroe News

The Monroe NewsKojo Quartey: Kwanzaa: What it is and what it is not

Throughout the years, I have been asked to speak on Kwanzaa, primarily because of my African background, though it is not an African celebration.

2d ago Bloomberg

BloombergUK Strikes and Crumbling Health Service Add Headaches for Sunak

(Bloomberg) -- British rail workers will walk off the job much of this week, paralyzing transport and adding to the troubles piling up for Prime Minister Rishi Sunak’s government.Most Read from BloombergElon Musk Becomes First Person Ever to Lose $200 BillionUkraine Latest: Strike Kills 63 Russian Troops in Occupied TownXi Warns of Tough Covid Fight, Acknowledges Divisions in ChinaGemini’s Cameron Winklevoss Slams Crypto Exec Barry Silbert Over Frozen FundsUnion workers will strike for five days

4h ago Reuters

ReutersAt least 14 dead in armed attack on prison in Mexican border city Juarez

Mexican authorities said on Sunday at least 14 people died in an armed attack at a prison in the northern border city Juarez and two more died during a later armed aggression elsewhere in the city. The Chihuahua state prosecutor said in a statement that among those who died in the prison attack were 10 security personnel and four inmates, while another 13 were hurt and at least 24 escaped. The prosecutor said initial investigations found the attackers arrived at around 7 a.m. local time at the prison in armored vehicles and opened fire.

1d ago CBS-Newyork

CBS-NewyorkPolice seek suspect who punched Chelsea bar bouncer who later died

The search is on for the man who police say punched a beloved Chelsea bar bouncer who died from his injuries. The NYPD has released video of the suspect, and CBS2's Lisa Rozner spoke to the victim's grieving wife.

3h ago CBS News

CBS NewsColorado man with nearly 6,000 fentanyl pills sentenced to 40 years

The 27-year-old sold some of the fentanyl to undercover officers last year.

14h ago TODAY

TODAYSuspect in Idaho killings had made ‘creepy’ comments to brewery staff, customers, owner says

The suspect in the killings of four University of Idaho students was known to make inappropriate comments.

1d ago The Independent

The IndependentVoices: The Idaho murders case is getting murkier, but patience is of the essence

The more details emerge, the more I have to remind myself to be wary of tunnel vision

5h ago The Independent

The IndependentA Pocono mountain raid and months of questions: How police finally made an arrest in the Idaho murders

For nearly seven weeks police gave little information on what they knew about the murders of Ethan Chapin, Madison Mogen, Xana Kernodle, and Kaylee Goncalves, writes Io Dodds

13h ago Associated Press

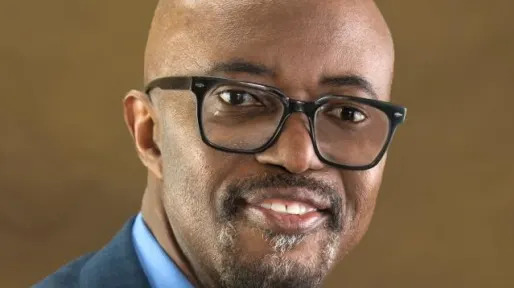

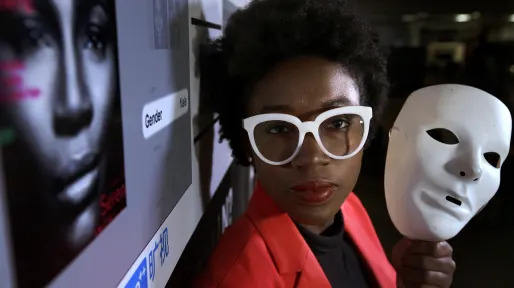

Associated PressFacial recognition tool led to mistaken arrest, lawyer says

Louisiana authorities’ use of facial recognition technology led to the mistaken-identity arrest of a Georgia man on a fugitive warrant, an attorney said in a case that renews attention to racial disparities in the use of the digital tool. Randall Reid, 28, was jailed in late November in DeKalb County, Georgia, The Times-Picayune/The New Orleans Advocate reported.

8h ago

Father of Idaho murder victim says he hopes police "picked the right guy"

Following the arrest of suspect Bryan Kohberger in the murders of four University of Idaho students in Moscow, Idaho, investigators are combing through every aspect of his life.

6h ago The Conversation

The ConversationDid the assault weapons ban of 1994 bring down mass shootings? Here's what the data tells us

The Clinton-era ban on assault weapons ushered in a period of fewer mass shooting deaths. AP Photo/Dennis CookA spate of high-profile mass shootings in the U.S. in 2022 sparked calls for Congress to look at imposing a ban on so-called assault weapons – covering the types of guns used in both the recent Buffalo grocery attack and that on an elementary school in Uvalde, Texas. Such a prohibition has been in place before. As President Joe Biden noted in his June 2, 2022, speech addressing gun viole

1d ago Associated Press

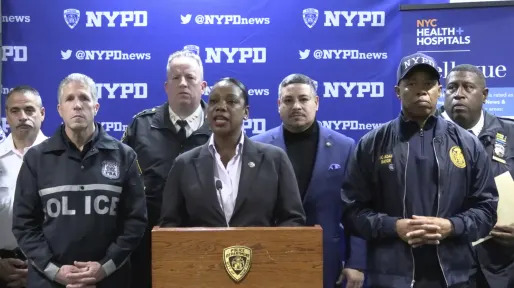

Associated PressNYC machete attack: Man arrested on attempted murder charges

A man accused of attacking police with a machete near New York’s Times Square on New Year’s Eve was arrested on charges of attempting to murder police officers, authorities said Monday as they continued to investigate whether he was motivated by Islamic extremism. Trevor Bickford, 19, also faces attempted assault charges from the attack that injured two officers at the edge of the high-security zone where throngs of new year's revelers were gathered, the New York Police Department said in a news release. Bickford, who lives in Wells, Maine, remained hospitalized Monday with a gunshot wound to the shoulder from police fire during the confrontation.

9h ago The Independent

The IndependentUS federal holidays 2023: Full list and calendar dates

The list of US federal holidays is made up of 11 days of significance that Americans recognise and celebrate

14h ago NY Daily News

NY Daily NewsSuspect converted to jihadism before New Year’s Eve machete attack on NYPD Times Square cops: sources

A young Maine man who recently became fixated with radical Islamic jihadism wounded two NYPD cops with a massive curved knife just outside the Times Square New Year’s Eve celebration, fracturing a rookie officer’s skull before being shot by police, law enforcement sources said Sunday. Cops and federal investigators are now taking a hard look at the internet history of the 19-year-old suspect, ...

2d ago The Independent

The IndependentGirl, 5, saved toddler brothers after Christmas Day car crash killed both parents

Jake Day, 28, and Cindy Braddock, 25, died in the crash in Western Australia - the children were left to fend for themselves for two days in the outback

2d ago The Telegraph

The TelegraphFormer Pope Benedict to have 'solemn but simple' funeral

Pope Emeritus Benedict XVI will have a “solemn but simple” funeral this week, the Vatican said, in a ceremony that will be presided over by a sitting pope for the first time in centuries.

20h ago The Independent

The IndependentMoscow murders suspect Bryan Kohberger will ‘waive right to extradition hearing’ to expedite return to Idaho

Mr Kohberger’s public defender has said the suspected murderer is “eager to be exonerated”

14h ago The Independent

The IndependentPope Benedict XVI’s lying in state begins in Vatican as thousands expected to pay their respects

Former pope’s body will lie in state until his funeral on Thursday

17h ago Best Life

Best LifeMother Run Over by Two Subway Trains Says She Is "Grateful to Be Alive." "I Could Have Died At Least 10 Times."

A London mother of two lost an arm and a leg after falling onto a subway track—but she's just grateful to be alive after experts said she "could have died at least ten times." Sarah de Lagarde, from Camden, north London, was traveling home from work when she slipped and fell into the space between the train and the platform, where two passing trains caused grievous injuries. Read on to find out what happened in those unfathomable moments and how she's doing today. 1 "I Could Have Died At Least 1

2d ago The Des Moines Register

The Des Moines RegisterPolice cite self-defense in Des Moines' first homicide of 2023

The killing comes after a series of December homicides, closing out a bloody 2022, with 22 Des Moines killings

5h ago Reuters

ReutersMastermind of Banksy removal could face years in jail, Ukraine says

The suspected mastermind behind the removal of a Banksy mural in a Ukrainian town could face up to 12 years in prison if found guilty, Ukraine's interior ministry said on Monday. The artwork, depicting a woman in a gas mask and a dressing gown holding a fire extinguisher, was taken off a wall in the town of Hostomel on Dec. 2, according to officials. The mural was retrieved.

9h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK