Felix Capital closes fourth fund at $600M, its biggest yet

source link: https://finance.yahoo.com/news/felix-capital-closes-fourth-fund-072014952.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Felix Capital closes fourth fund at $600M, its biggest yet

S&P Futures

4,144.25-14.50(-0.35%)Dow Futures

33,023.00-142.00(-0.43%)Nasdaq Futures

12,685.50-26.00(-0.20%)Russell 2000 Futures

1,909.70-8.90(-0.46%)Crude Oil

120.65+1.24(+1.04%)- 1,848.00+0.50(+0.03%)

Silver

21.92-0.26(-1.19%)EUR/USD

1.0733+0.0026(+0.2410%)10-Yr Bond

2.97200.0000(0.00%)- 24.45-0.62(-2.47%)

GBP/USD

1.2549-0.0040(-0.3146%)USD/JPY

133.8980+1.2820(+0.9667%)BTC-USD

30,414.46+973.53(+3.31%)CMC Crypto 200

658.41+19.77(+3.10%)FTSE 100

7,567.66-31.27(-0.41%)Nikkei 225

28,234.29+290.34(+1.04%)

Felix Capital closes fourth fund at $600M, its biggest yet

Amid rising uncertainty about how financing will look for tech in the months and maybe years to come, one of the newer kids on the VC block in Europe is today announcing the closing of its latest and largest fund to date. Felix Capital -- the London-based firm founded and headed by Frederic Court -- has raised $600 million. It plans to use the money to continue investing mainly in its sweet spot of commerce-driven startups, complemented by businesses building tools to help run those (including new spins on finance around cryptocurrency and Web3) and the future of work overall, which includes sustainability, too.

Felix believes that the collective experiences of its investors, combined with its investment focus, will help carry it through times that are decidedly more challenging for the world of startup finance and growth, maybe laying more groundwork for healthier approaches overall.

"I've lived through a couple of downturns starting in 2000," Court said in an interview. "I've spent a lot of time undoing what had been done before. Complex terms like preferred returns, we’d never do that now. For all the money coming in very quickly to the industry, say from hedge funds or others not in industry, they came in with a short-term-gains mantra. But our business is fundamentally a long-term business, and it takes a long time to build a great company. That's even more true on the consumer side, you can’t just over-accelerate a brand."

Felix's portfolio includes companies that have now gone public like Farfetch and Deliveroo, as well as the likes of Sorare, Papier, Juni, Cocomelon owner Moonbug, scooter startup Dott and Goop. Felix invests both at the early stage, and in growth rounds. Its plan is to double down on existing bets, as well as bring 20-25 more companies, mostly in Europe but also North America, into the fold.

The fund will take the total managed by Felix to $1.2 billion. That's not only big leap from the $120 million the firm launched with in 2015, but it's also a leap from what Felix had wanted to raise. Court said that its original target was $500 million.

Forkast News

Forkast NewsFTX, OpenSea make the cut to Forbes Fintech 50

Nine cryptocurrency and blockchain companies, including crypto exchange FTX, made it to the 2022 list of the Forbes Fintech 50 released Tuesday, with all nine raising a total of US$6.5 billion in venture capital, according to the business magazine. See related article: FTX.US forays into stock trading Fast facts The latest list features private companies […]

8h ago Reuters

ReutersAustralia's energy woes deliver inflationary shock to RBA

A recent spike in Australia's energy prices is threatening to keep inflation higher for longer, a major reason policymakers this week felt compelled to hike interest rates by the most in two decades and warn of a lot more to come. Among the justifications cited by the Reserve Bank of Australia (RBA) was that rising energy prices meant inflation was now set to be higher than expected just a month ago. "The energy market has been hit by a perfect storm of rising demand, a reduction in output from coal fired base load generation plus record high coal and gas prices," says Justin Smirk, a senior economist at Westpac.

8h ago Reuters

ReutersAustralian lenders lift variable mortgage rates after RBA hike

The Reserve Bank of Australia (RBA) at its June policy meeting on Tuesday hiked interest rates by the most in 22 years, as it battles to restrain surging inflation. Commonwealth Bank of Australia, National Australia Bank and Australia and New Zealand Banking Group lifted their mortgage rates to pass on the full 50 basis-point raise to customers from June 17. Westpac Banking Corp was the first bank to raise its home loan rates by 0.5%, effective from June 21, soon after the RBA's decision on Tuesday.

4h ago FX Empire

FX EmpireCrude Oil Price Forecast – Crude Oil Markets Continue to Power Higher

Crude oil markets have initially fallen a bit during the trading session on Tuesday but found enough buyers underneath the term the entire thing around.

20h ago Motley Fool

Motley FoolWhy Nio Shares Rose Tuesday

Nio (NYSE: NIO) releases its first-quarter update Thursday morning, and investors should be expecting added volatility. The report comes after some of its Chinese peers released their own updates, so investors have some ideas on what to expect. Nio's American depositary shares (ADSs) are moving higher today in anticipation.

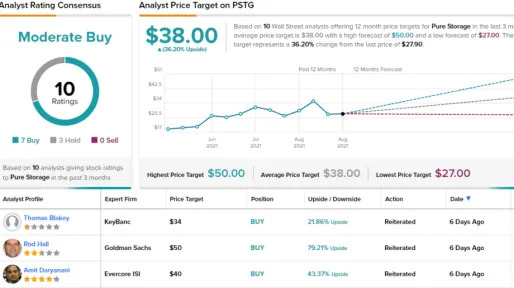

16h ago TipRanks

TipRanksJim Cramer Says Buy Any Dip in Oil Stocks; Here Are 3 Names Analysts Like

Stocks have sold off heavily since the start of this year, with a 14% decline in the S&P 500 and a bearish 22% drop in the NASDAQ. But while the selloff is broad-based, it’s not affecting everything. Oil stocks have proven resistant to the downward trend, buoyed by high prices for crude at the wellhead and gasoline at the pump. And with summer driving season underway to goose demand, and inflation rising steadily, we can expect that the high energy prices will continue for the foreseeable future

20h ago TipRanks

TipRanksGoldman Sachs: Buy These 2 Stocks Before They Surge Over 40%

Uncertainty has been the name of the game in 2022. A combination of negative macro developments – a slowing global economy, the geopolitical ramifications following Russia’s invasion of Ukraine and - possibly most of all - the prospect of the Fed seriously tightening its monetary policy to combat inflation – have all been weighing heavily on investors’ minds. That doesn’t necessarily mean there aren’t good opportunities to take advantage of right now. The analysts at banking giant Goldman Sachs

11h ago Barrons.com

Barrons.comExxon Gets an Upgrade to Buy, but Analyst Takes ‘Chips Off Table’ for 2 Other Oil Stocks

Energy stocks have emerged winners in this period of volatility and historically high inflation, reporting record profits and boosting shareholder returns as oil prices have surged. For Evercore ISI analyst Stephen Richardson, that time may be nearing. The backdrop for energy stocks remains solid, Richardson added, but the industry will soon have to navigate higher operating costs, capital expenditure inflation, cash taxes, and the eventual deflation of gas prices — and investors should be prepared.

20h ago Motley Fool

Motley FoolWhy It's Not Too Late to Buy Amazon After the Stock Split

After months of anticipation, Amazon.com (NASDAQ: AMZN) conducted a 20-for-1 stock split that went into effect on Monday. Amazon stock is now available for below $130 per share. Anyone hoping for a big bounce after the stock split was disappointed.

1h ago Motley Fool

Motley FoolCathie Wood Goes Bargain Hunting: 3 Stocks She Just Bought

Cathie Wood kicked off the new trading week on a buying spree. The CEO and co-founder of ARK Invest was busy buying stocks on Monday, picking up the pace after laying low on a lot of market days over the past month. Wood added to her existing exchange-traded fund stakes in Twilio (NYSE: TWLO), Roku (NASDAQ: ROKU), and Tesla (NASDAQ: TSLA) on Monday.

21h ago Bloomberg

BloombergSurge in China Tech Stocks Kindles Hopes for Sustained Rally

(Bloomberg) -- Alibaba Group Holding Ltd. and Bilibili Inc. led another rally in China tech stocks on Wednesday, giving stock bulls renewed hope that a nascent rebound in tech shares could sustain. Most Read from BloombergAmazon’s Stock Split Delivers More Than Bargained ForTarget Tries to Save Itself by Putting Everything on SaleTarget's Oversupply Problem Should Scare All RetailersApple Products Set to Use Common Charging Point After EU DealTop Economist Urges China to Seize TSMC If US Ramps U

1h ago Investor's Business Daily

Investor's Business Daily5 Best Chinese Stocks To Buy And Watch Gain Momentum

Hundreds of Chinese companies are listed on U.S. markets. But which are the best Chinese stocks to buy or watch right now? Among the best are JD.com, NetEase, Li Auto, Xpeng and BYD Co.. China is the world's most-populous nation and the second-largest economy, with a booming urban middle class and amazing entrepreneurial activity.

2h ago Motley Fool

Motley FoolWarren Buffett Has Gained Over $171 Billion On These 4 Stocks

Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett has a knack for making money. Since taking the reins of Berkshire Hathaway in 1965, he's led the company's Class A shares (BRK.A) to an annualized return of 20.1%. Although there are a number of factors that play an important role in the Oracle of Omaha's success, a strong case can be made that his willingness to hold onto his winners for extended periods is the foundation that Buffett's massive outperformance has been built upon.

2h ago Insider Monkey

Insider Monkey10 Undervalued Blue Chip Stocks to Buy Now

In this article, we discuss the 10 undervalued blue-chip stocks to buy now. If you want to skip our analysis of these stocks, go directly to the 5 Undervalued Blue Chip Stocks to Buy Now. Blue-chip companies are considered to be established and large-scale organizations with a rich history of long-term stable financial performance. These […]

22h ago Motley Fool

Motley FoolWhy GameStop Stock Is Rising Today

Investors in the video game retailer might be reacting to reports that they are tiring of waiting for a huge short squeeze.

19h ago Quartz

QuartzInside Elon Musk’s new legal strategy for ditching his Twitter deal

Elon Musk has buyer’s remorse. On April 25, the billionaire Tesla and SpaceX CEO agreed to buy Twitter for $44 billion, but since then the stock market has tanked. Twitter agreed to sell to Musk at $54.20 per share, a 38% premium at the time; today it’s trading around $40.

18h ago Barrons.com

Barrons.comPlug Power to Build Green Hydrogen Plant at Belgium Port

Plug Power signs an agreement to build a 100-megawatt green hydrogen plant at the Port of Antwerp-Bruges in Belgium, the second-largest seaport in Europe.

4m ago TipRanks

TipRanksTesla: Musk’s Economy Warning Demands Attention, Says Morgan Stanley

As if investors weren’t jittery enough about the state of the global economy, Tesla (TSLA) CEO Elon Musk has now further added to the heebie-jeebies. In an email to Tesla employees, Musk said the company will not only pause hiring but that it will have to let go of 10% of the workforce. If that wasn’t bad enough, Musk also said he had a “super bad feeling” regarding the economy. Should investors go into panic mode, then? Maybe not quite yet, although according to Morgan Stanley’s Adam Jonas, wit

2d ago Bloomberg

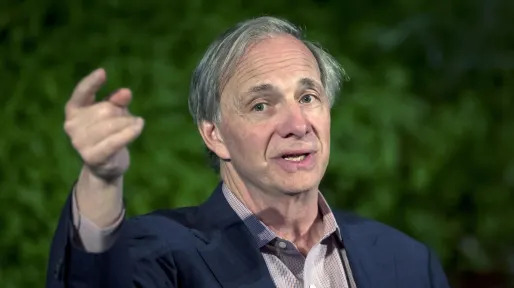

BloombergRay Dalio Says Central Banks to Cut Rates in 2024, AFR Reports

(Bloomberg) -- Billionaire hedge fund founder Ray Dalio said central banks across the globe will be required to cut interest rates in 2024 after a period of stagflation constrains their economies, according to the Australian Financial Review.Most Read from BloombergAmazon’s Stock Split Delivers More Than Bargained ForTarget Tries to Save Itself by Putting Everything on SaleTarget's Oversupply Problem Should Scare All RetailersApple Products Set to Use Common Charging Point After EU DealTop Econo

9h ago TheStreet.com

TheStreet.comTop 10 Stocks by Searches; One Guess Which is No. 1

A brokerage house's recent survey of the most frequently searched stocks in the U.S. turned up some familiar names, but the top one blew away even the second place name.

13h ago- Evening Standard

Credit Suisse to increase cost cuts in wake of latest profit warning

CREDIT Suisse issued its third profit warning this year today, blaming volatile markets and caution from clients who are trading less in the wake of the Ukraine war. The scandal torn bank, which employs thousands of people at Canary Wharf in London, has been in something close to crisis for several years. It has been hit by fines for money laundering, was embroiled in the high-profile collapses of Archegos Capital and Greensill, and saw an internal corporate espionage scandal lead to the departure of CEO Tidjane Thiam.

2h ago - Benzinga

JP Morgan Sees Buying Opportunities In Alibaba And Other Chinese Stocks Citing These Reasons

The 2021's deep selloff in Chinese stocks could finally be on the verge of a turnaround, Bloomberg quoted JP Morgan Chase & Co (NYSE: JPM) strategist Marko Kolanovic. Kolanovic expected the Chinese equities to have reached their turning point with ease in lockdowns, continued growth support measures, and possible relaxation in the regulatory crackdown. Recently reports surfaced regarding China looking to end its yearlong regulatory probe on DiDi Global Inc (NYSE: DIDI) and two other companies by

23h ago - Motley Fool

Warren Buffett Just Sold This Popular Stock -- Should You?

When it comes to success with investing, Warren Buffett is hard to one-up, to say the least. On that note, in the first quarter of this year, the Oracle of Omaha's company, Berkshire Hathaway (NYSE: BRK.A, BRK.B), sold 100% of his three million AbbVie (NYSE: ABBV) shares with a total value of around $410 million. Contrary to his stated preference of holding stocks for extraordinarily long periods, Buffett only established his position in the company in the third quarter of 2020.

19h ago - Yahoo Finance Video

Shopify shareholders approve 10:1 stock split

Yahoo Finance Live’s Julie Hyman discusses the rise in shares for Shopify amid shareholder approval for 10:1 stock split.

20h ago - Motley Fool

Why Peabody Energy Stock Jumped 14.5% Today

The stock of Peabody Energy (NYSE: BTU) was on fire today, trading 9% higher as of 1:50 p.m. ET. With today's move, Peabody stock is now up almost 21% this month as of this writing. Peabody Energy stock received a huge analyst upgrade this morning, and I believe it is one of the highest price targets accorded to the coal stock in recent memory.

16h ago - Bloomberg

Cathie Wood’s Asset Plunge Is Biggest Among ETF Issuers in 2022

(Bloomberg) -- Cathie Wood’s Ark Investment Management is suffering a steeper drop in assets than almost any other US exchange-traded fund issuer this year.Most Read from BloombergAmazon’s Stock Split Delivers More Than Bargained ForApple Products Set to Use Common Charging Point After EU DealTarget Tries to Save Itself by Putting Everything on SaleTop Economist Urges China to Seize TSMC If US Ramps Up SanctionsTarget's Oversupply Problem Should Scare All RetailersArk’s lineup holds $15.3 billio

22h ago - Insider Monkey

10 Best Recession Stocks to Buy According to Jim Cramer

In this article, we discuss the 10 best recession stocks to buy according to Jim Cramer. If you want to read about some more recession stocks to buy according to Jim Cramer, go directly to 5 Best Recession Stocks to Buy According to Jim Cramer. Economic pessimism is growing in the United States amid high […]

22h ago - MarketWatch

I lived in motels and ‘forgot to live’ – I’m 48, have almost $900,000 and want to retire next year. What can I do?

A lot of people wish they had enjoyed life more when they were younger, and want to strike some sort of balance between living in the moment and paying for the necessities now and in the future. First, you need to think about what your annual income needs to be in retirement to meet your cost of living, plus any emergencies, such as a health crisis or an unexpected move. Also, ask yourself what your own plan is for this money – are you just trying to make it last until Social Security kicks in, or are you intending to see this money last your lifetime?

44m ago - MarketWatch

My parents-in-law sold their home and bought an RV. They have $200K in the bank. How can they protect their assets from being used for nursing-home costs?

‘If my father-in-law has to go into a nursing home and his assets are surrendered for his care, his wife has no income.’

2h ago - Motley Fool

Why Aurora Cannabis Was a Hot Stock Today

Shares of Aurora Cannabis (NASDAQ: ACB) wafted nicely higher on the second day of the trading week. Interestingly, the latest analysis from Stifel is based largely on one habit of marijuana companies considered by many investors to be negative: a secondary share issue. Analyst W. Andrew Carter cited Aurora's latest financing effort, in which it raised gross proceeds of $173 million from a flotation of units consisting of common shares and warrants, as a key reason for his upgrade.

13h ago - Motley Fool

3 High-Risk, High-Reward Stocks That Are Screaming Buys in June

What follows are three promising stocks selected by a team of Fool.com contributors that could deliver similar returns on the other side of the market madness. John Ballard (Alibaba): The leading e-commerce platform in China has been through the gauntlet over the last 12 months. Over the last year, shares of Alibaba Group Holding (NYSE: BABA) are down 53% following the Chinese government's recent scrutiny over large internet platforms.

15h ago - TheStreet.com

Cramer's Mad Money Recap 6/7: Target, Smucker, Eli Lilly

Jim Cramer says smart investing is as simple as buying growth stocks when interest rates begin to fall.

12h ago - Investor's Business Daily

Freeport McMoRan Stock Digs Out Of Hole, Key Rating Soars

Mining giant Freeport McMoRan got a huge rating lift on Tuesday. The new 85 Relative Strength Rating shows that Freeport stock is performing in the top 15% of all stocks in IBD's database. Market research reveals that the best stocks often have an RS Rating north of 80 as they begin their biggest climbs.

14h ago - MarketWatch

Peak U.S. inflation? This obscure corner of the financial market says otherwise

Fixings imply that May's year-over-year CPI rate release on Friday will surpass the 8.2% median forecast of economists.

17h ago - MarketWatch

Home affordability has ‘collapsed’ in 2022. What to expect next, according to BofA

Housing affordability hasn't been this bad since around 1987 or 2005, says Chris Flanagan's team at BofA Global Research.

19h ago - Yahoo Finance Video

Vitamin Shoppe owner in talks to buy Kohl’s for $8 billion

Yahoo Finance Live anchors discuss reports that Franchise Group is looking to purchase Kohl’s for nearly $8 billion.

21h ago - Investor's Business Daily

Is Google A Buy Or Sell As Stock Split Approaches?

Here's what a fundamental and technical analysis says about Google stock. GOOGL stock buybacks remain high as web search and YouTube advertising rebound. But cloud computing growth is key.

23h ago - Motley Fool

Rivian Updates Its Growth Plan: Why Investors Should Hit the Brakes

Rivian's roadmap is similar to a name we all know, and there are important lessons for investors there.

2h ago - Motley Fool

3 Robinhood Stocks to Buy and Hold Forever

In an earlier time, the term "Robinhood stock" may have conveyed images of frenzied day traders pounding the buy button for meme stocks like GameStop and AMC. Starbucks (NASDAQ: SBUX) has hit a rough patch in 2022 so far, but savvy investors know that the company has proven to be a winner over the long term. The poor results in China overshadowed the fact that Starbucks is actually firing on all cylinders elsewhere.

20h ago - TipRanks

Is Gevo Stock a Buy Following Public Offering? This Analyst Thinks So

Share and dilution are two words which investors do not like to see sitting next to each other. Unfortunately, for those backing Gevo (GEVO), that’s what they got on Monday. Investors showed their disapproval of the combination by sending shares down by 33% in the session. The drop came after the company announced a massive public offering. The renewable fuel start-up has entered an agreement with a number of institutional investors for the purchase of 33,333,336 Gevo shares. These will be sold

14h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK