The card economy in FinTech

source link: https://uxdesign.cc/the-card-economy-in-fintech-a1bd4bebe066

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The card economy in FinTech

FinTech companies today are introducing something new — yet familiar. They are inspiring product teams to reinvent a core financial product that has served as the backbone of payments, banking, and financial transactions: the credit card.

The Growth of the Global Credit Card Market

Credit cards are becoming more popular today. Companies are finding ways to get more cards in the hands of consumers. They are designing new experiences that are both seamless and end-to-end, along with supporting software, to assist businesses & consumers.

Why this is important and how they are being designed the way they are today are critical to understand. The underlying payments infrastructure of our global economy is being redesigned and transformed.

Let’s start with understanding why the credit card market is important. First, it’s a large and growing market:

“The global credit card payments market revenue was valued at $138.43 billion in 2020, and is projected to reach $263.47 billion by 2028, growing at a CAGR of 8.5% from 2021 to 2028.” (Source)

Further, credit cards are a cornerstone of our global economy. Here are a few statistics from Fundera:

“80% [of consumers] prefer card payments over cash.”

“76% of consumers have at least one credit card.”

“Only 10% of consumers make all of their purchases with cash […] but 88% of consumers use cash at least sometimes.”

“The average credit card user has 4 credit cards.”

When you think of credit cards, you always wonder — which one should I get? As a consumer, you’re presented with a multitude of credit cards: they have varying cashback options, rewards, loyalty programs, and more. You’re either trying to find the best card for yourself or for your business. There are endless options and use cases for credit cards.

The problem is that consumers may be daunted by the multitude of choices when it comes to credit cards: as a consumer, you want to find the best credit card for your needs — but you don’t know where to start and may not be able to find the right card for your exact use case. FinTech companies are flourishing because of these reasons: they are consciously helping consumers of various backgrounds find the right card for them.

How are Cards Changing?

There are a plethora of co-branded credit cards coming into the market today. Credit cards are undergoing a redesign, and we are seeing FinTech companies rise up to the challenge of disrupting how payments work in other industries.

“A co-branded card is the result of a partnership between a merchant, network and issuer. For a merchant, a co-brand product can have several benefits including but not limited to: increasing sales, attracting new customers and delivering value to your most loyal customers” (Source).

The New Generation of Branded Card Companies

There are several branded card companies out there in the market that are designed to help consumers and businesses save money, build credit, and be more efficient with their capital.

1. Petal: “Bringing financial opportunity and innovation to everyone.”

Petal partnered with Visa to offer two credit cards: Petal 1 and Petal 2. Both cards offer a route to increasing your personal credit limit. Petal offers a unique Cash Score that uses banking history to give individuals access to credit, analyzing factors such as income, spending, and savings.

- Petal 1 focuses on “expanding access through technology.” It’s a card with no annual fees, a credit limit of $300–$5,000, APRs ranging from 20.24%-29.74%, and cash back of 2%-10% at select merchants.

- Petal 2 focuses on “responsible credit without fees.” It’s a card with no fees, a larger credit limit of 1%–10,000%, APRs ranging from 13.24%-27.24%, and 1%-1.15% cashback as well as additional offers.

2. Bilt: “Finally. A card that lets you earn points on rent. And more.”

Source: https://www.youtube.com/watch?v=Zf2QISb0dbQ&Bilt partnered with Mastercard to offer the BILT card. The goal is to help individuals build credit by paying rent and making other related purchases.

- With the BILT card, you can earn 1X points on rent payments without a transaction fee, 2X points on travel (flights, hotels, rental cars, etc), 3X points on dining — all with a $0 annual fee.

- Individuals can also join the Bilt Rewards Alliance, which allows card users to use points towards travel, paying rent, and workouts. One goal of Bilt is to put its users on a path to homeownership.

3. Ramp: “Time is money. Save both.”

Ramp provides branded cards for businesses in the form of corporate cards and has partnered with Visa to achieve this. The core value add of Ramp is the software it provides to finance teams. Their solutions are geared towards a variety of personas: startups, small businesses, and enterprises.

- Ramp is a spend management platform that offers 1.5% cash back on every purchase. The primary differentiator is the software and automation it provides. It offers receipt handling/matching, advanced accounting integrations, savings tools, vendor subscription management, trend analysis, slack integrations, and more.

- https://ramp.com/corporate-cards

4. TryKarat:“The Card for Creators.”

Karat partnered with Stripe to create a card for content creators, including those on YouTube, TikTok, streaming platforms, and more. Karat offers a different take on credit: it offers a corporate card that is based on social media statistics and cashflow. Follower growth, likes, and more are now being used to issue credit. The Karat card is a metal card that etches a creator’s logo, and it also provides spend management tracking through its software.

- The Karat card comes without fees and interest, with an average of 3%-5% cashback, as long as you pay off the card in full at the end of of the month. Additional benefits include access to Karat’s rewards program, limits that are influenced by social media stats, exclusive events for creators, and consultations with a certified financial planner.

- A few creators have been featured as users of the Karat card: Graham Stephan (YouTuber), Alexandra Botez (Twitch Streamer + YouTuber), 3LAU (Music Artist), Nas Daily (Facebook Influencer), Real Engineering (YouTuber), Lenny Rachitsky (Substack writer), and more.

FinTechs Helping Companies Create Branded Cards

1. Imprint: “Build the future of payments.”

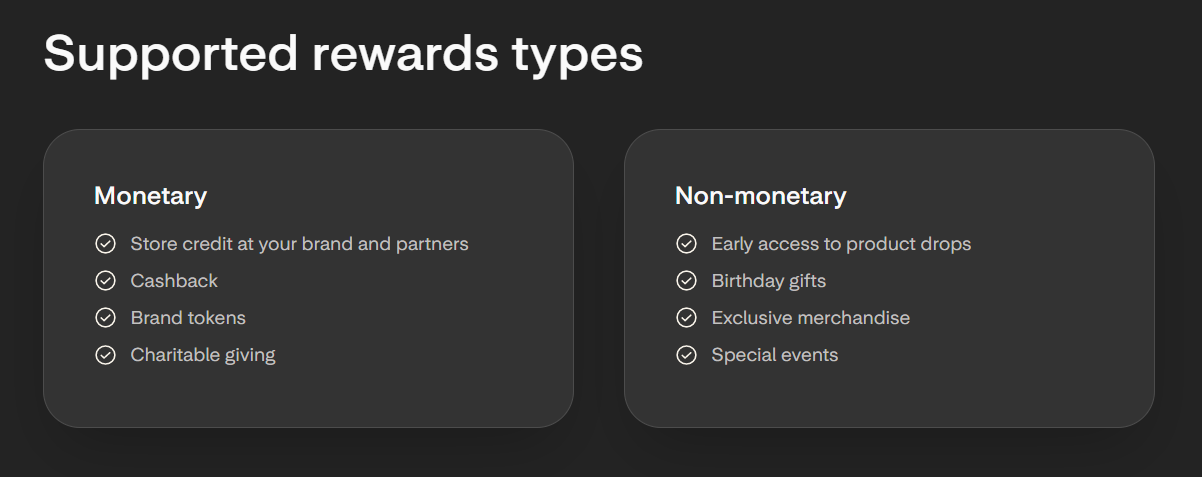

Imprint has partnered with Visa to help build the future of branded credit cards and debit cards. Imprint enables businesses to start their own card programs. It creates infrastructure for payments and loyalty programs, as well as allows companies to offer cards. Businesses that use Imprint can create customized rewards programs:

They have found a few statistics to support the rise of The Card Economy in Fintech:

“38% higher annual spend per customer

20% more frequent shopping

15% higher average order value per customer” (Source)

2. Cardless: “We can launch credit cards for most industries.”

Cardless is similar to Imprint in that it helps brands across various industries start their own card programs. They have built card programs for notable sports franchises, such as the Boston Celtics, Manchester United, Cleveland Cavaliers, Miami Marlins, and more. Their goals are to minimize costs to start a card program, ensure quick time to launch, prioritize a tech-first approach, and offer a flexible rewards program.

The Future of the Card Economy

The Card Economy is starting to thrive and go mainstream in FinTech. It is becoming significantly easier for an individuals or businesses to start their own card programs — as well as for consumers or businesses to find cards that match their unique needs. We are beginning to witness the widespread emergence of a reinvented financial product that will transform how consumers and businesses interact with payments. Over the next few years, we will increasingly see more cards that match the needs that people have — and a faster time-to-market for creating industry-specific cards.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK