IDC research identifies how businesses can gain consumer trust on digital identi...

source link: https://itwire.com/guest-articles/idc-research-identifies-how-businesses-can-gain-consumer-trust-on-digital-verification.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Thursday, 11 November 2021 12:42

IDC research identifies how businesses can gain consumer trust on digital identity verification

IDC research today released its findings on how to close the trust gap between businesses and consumers in the digital economy. The findings reveal consumers are on the verge of adopting more advanced forms of ID verification but still require a high standard of secure, straightforward processes from institutions.

IDC research, commissioned by GBG, sought to understand the key digital identity mechanism of the future, how it would be supported by businesses, and how consumers would receive it and be likely to adopt it.

The research revealed a range of acceptable and desirable digital identity verification methods, however also revealed businesses still have work to do in helping educate and guiding customers, as well as assuring their data is safe from leak and misuse.

The research findings were outlined by Michael Araneta, associate vice president, head of advisory and research, IDC Financial Insights Asia Pacific. A panel made up of Carol Chris, regional general manager, ANZ, GBG; Ian Hendley, chief executive officer, thelawstore and live-sign.com; and Steve Shipley, adjunct chief information officer, IDC Financial Insights Asia Pacific, provided greater clarity around these findings.

The research consisted of two surveys, one aimed at Australian consumers and one aimed at Australian businesses, over the third quarter of 2021. Consumer data was split by age and income while business data was split by industry type with 45% being fintechs and payment businesses, 31% being professional and personal services, and 24% being banks and financial services.

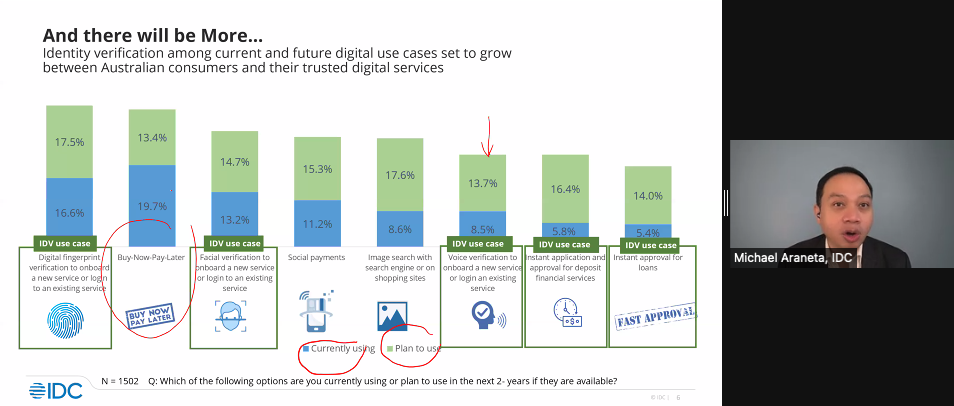

The key theme that came out of the research results, Araneta explained, is "more" - that more and more we will see digital fingerprints or voice and facial verifications to onboard new services or log on to existing services. More and more we will see digital identity verification among current and future digital use cases with Australian consumers poised to trust digital services.

The top use cases IDC found for digital identity verification were buy-now/pay-later purchasing scenarios, approving deposit-based financial services, and the instant approval of loans. In each case, IDC found consumers and businesses were aligned in finding these desirable situations for the use of digital identity verification - provided trust is in place, and with the caveat consumers expect digital identity verification to lead to near-instantaneous results.

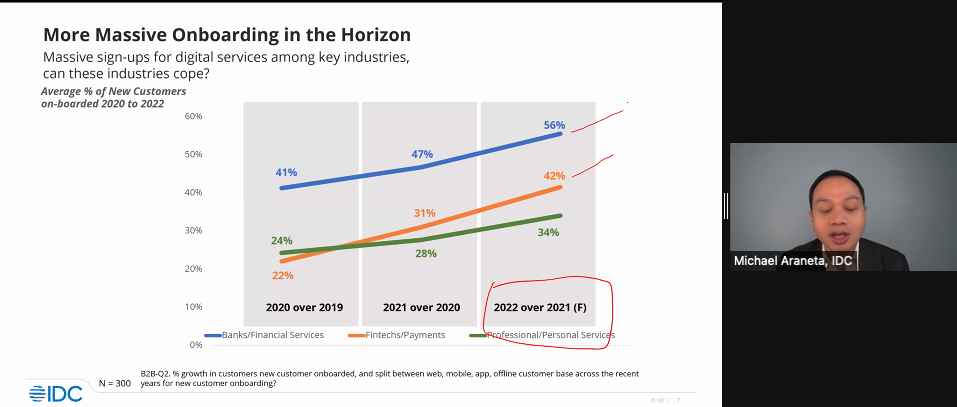

Continuing with the theme, IDC sees more sign-ups for digital services among key industries, and in fact, massive onboarding on the horizon with increasing demand growing each day.

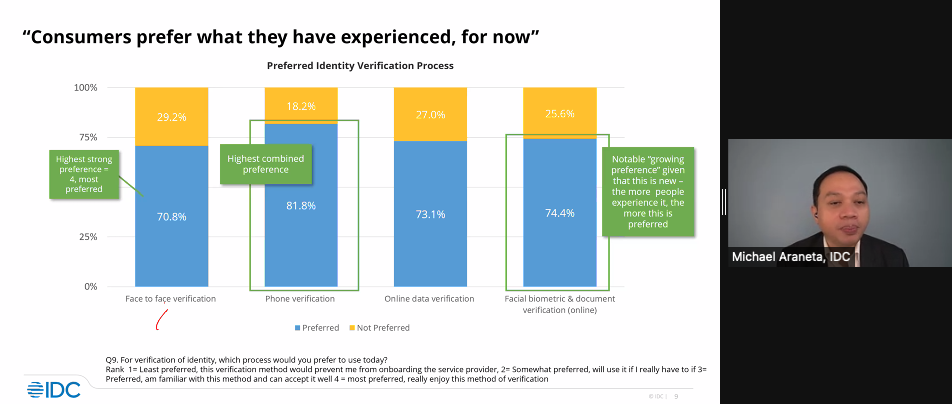

However, all this said, despite a desire for digital identity verification and the ramifications it means, IDC’s research found consumers still prefer face-to-face at this time.

In fact, while IDC found the more that people are experiencing facial biometric and online document identity verification they are preferring it, the research still found 54% of consumers aged 18-44 years old prefer face-to-face, and 67.3% of consumers aged 45 and over prefer face-to-face.

Thus, there is a clear disconnect between the desire to digitally transact and the preference for face-to-face, and IDC found it came down to trust.

In their research, IDC found consumers aged 45 and over are looking to large and reputable organisations, such as government and big banks, to lead the way.

Among the 18-44-year-old cohort, the preference was divided among other factors such as increased education on the security of digital identity verification and how data will be used, and being able to continue accessing and using essential services with the pandemic, among other concerns.

Meanwhile, IDC's research found businesses have much to gain when it comes to digital identity verification due to the prominence of fraud. This fraud includes impersonation, account takeover, spoofing, scams, a stolen identity, and other issues, and Araneta said getting digital identity verification right means businesses can fight fraud where it matters, and they can fight worsening fraud.

Financial institutions have procedures to deal with money laundering, terrorism financing, and similar risks known as KYC - or “know your customer.” According to IDC's research, 67.4% of fintech and payment organisations reported an estimated monetary loss of over $50K incurred due to fraudulent incidents in their KYC processes during 2020. 49.6% of fintech and payment companies said identity theft makes up 10-20% of fraud, with 20% saying it makes up 20-30% of fraud. Banks and financial services were similar with 37% reporting 10-20%, and 20.5% reporting 20-30%.

Digital identity verification methods can aid institutions in combatting such fraud, as well as provide consumer benefits. However, organisations still need to invest in gaining trust through increased and open communication around how data is stored and secured, and for what purposes it will be used.

IDC's key findings from the research were:

- Australian customers on the verge of adopting more advanced digital identity verification

- Use is not preference is not trust - that is, using something doesn't imply it's the preference, nor does it imply trust, so simply tracking adoption is not in itself a measure of preference or trust

- Biometrics and online digital identity verification are seen as the better way, leading to good customer experiences, speed and trust - and converting customers to this better way will be based on their experience

- Customers can quickly change preferences

- Businesses want to support the preferences of customers for a better way - but are overwhelmed with options

- Regulatory mandates will accelerate the adoption of solutions

- New capabilities in biometrics and online digital identity verification have emerged and an end-to-end value proposition is possible now

- There is a link between digital identity verification and fraud reduction

The IDC research was commissioned by GDG.

Please join our community here and become a VIP.

Subscribe to ITWIRE UPDATE Newsletter hereJOIN our iTWireTV our YouTube Community here

BACK TO LATEST NEWS here

PROMOTE YOUR WEBINAR ON ITWIRE

It's all about Webinars.Marketing budgets are now focused on Webinars combined with Lead Generation.

If you wish to promote a Webinar we recommend at least a 3 to 4 week campaign prior to your event.

The iTWire campaign will include extensive adverts on our News Site itwire.com and prominent Newsletter promotion https://itwire.com/itwire-update.html and Promotional News & Editorial. Plus a video interview of the key speaker on iTWire TV https://www.youtube.com/c/iTWireTV/videos which will be used in Promotional Posts on the iTWire Home Page.

Now we are coming out of Lockdown iTWire will be focussed to assisting with your webinatrs and campaigns and assassistance via part payments and extended terms, a Webinar Business Booster Pack and other supportive programs. We can also create your adverts and written content plus coordinate your video interview.

We look forward to discussing your campaign goals with you. Please click the button below.

INTRODUCING ITWIRE TV

iTWire TV offers a unique value to the Tech Sector by providing a range of video interviews, news, views and reviews, and also provides the opportunity for vendors to promote your company and your marketing messages.We work with you to develop the message and conduct the interview or product review in a safe and collaborative way. Unlike other Tech YouTube channels, we create a story around your message and post that on the homepage of ITWire, linking to your message.

In addition, your interview post message can be displayed in up to 7 different post displays on our the iTWire.com site to drive traffic and readers to your video content and downloads. This can be a significant Lead Generation opportunity for your business.

We also provide 3 videos in one recording/sitting if you require so that you have a series of videos to promote to your customers. Your sales team can add your emails to sales collateral and to the footer of their sales and marketing emails.

See the latest in Tech News, Views, Interviews, Reviews, Product Promos and Events. Plus funny videos from our readers and customers.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK