Compound 代币和价格预言

source link: https://learnblockchain.cn/article/3160

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Compound 代币和价格预言

Compound 中 COMP 代币挖矿 和 价格预言机的实现

Compound 白皮书和核心代码,大佬已经写了很详细的文档,见

Compound 从白皮书看业务逻辑

Compound 合约部署

合约升级模式-以 compound 为例

这里补充下周边: COMP 代币 和 价格预言

为了激励用户,用户每次存款或者借款,Compound 都会奖励 COMP 代币,可以用于治理投票

COMP 每日总产出约为 2312 枚,各市场的分布见 文档,部分市场如下

Market Per Day DAI 880.38 Ether 141.25 USDC 880.38 USDT 126.80每个市场,借款和存款产出的 COMP,分别占 50%

以 USDC 市场为例,每日共产出 880.38 枚 COMP,其中通过借款的方式投放 440.19 枚 COMP,借款用户按其借款额度占总借款额度的比例分配;存款同理

如上所述,根据各市场每日产出的 COMP 数量,按每 15 秒一个区块的假设,可以得到每个区块产出的 COMP 数量,记录在 ComptrollerV6Storage 中

contract ComptrollerV6Storage is ComptrollerV5Storage {

// https://compound.finance/governance/comp

/// @notice The rate at which comp is distributed to the corresponding borrow market (per block)

mapping(address => uint) public compBorrowSpeeds;

/// @notice The rate at which comp is distributed to the corresponding supply market (per block)

mapping(address => uint) public compSupplySpeeds;

}

compBorrowSpeeds 和 comSupplySpeeds 为 cToken 到每区块产出 COMP 数量的映射

比如对 cUSDC 来说,它在两个映射表中的值都为 67000000000000000 (COMP 的精度为 1018)

用户每次操作,只要可能更新存款,如存款操作,会触发 mintAllowed(),它进一步

- 调用

updateCompSupplyIndex()更新当前市场的 COMP 存款指数 - 调用

distributeSupplierComp()分发当前用户此前未结算的存款产出的 COMP

function mintAllowed(address cToken, address minter, uint mintAmount) external returns (uint) {

// Keep the flywheel moving

updateCompSupplyIndex(cToken);

distributeSupplierComp(cToken, minter);

return uint(Error.NO_ERROR);

}

当前市场的 COMP 存款指数更新逻辑如下

/**

* @notice Accrue COMP to the market by updating the supply index

* @param cToken The market whose supply index to update

* @dev Index is a cumulative sum of the COMP per cToken accrued.

*/

function updateCompSupplyIndex(address cToken) internal {

CompMarketState storage supplyState = compSupplyState[cToken];

uint supplySpeed = compSupplySpeeds[cToken];

uint32 blockNumber = safe32(getBlockNumber(), "block number exceeds 32 bits");

uint deltaBlocks = sub_(uint(blockNumber), uint(supplyState.block));

if (deltaBlocks > 0 && supplySpeed > 0) {

uint supplyTokens = CToken(cToken).totalSupply();

uint compAccrued = mul_(deltaBlocks, supplySpeed);

Double memory ratio = supplyTokens > 0 ? fraction(compAccrued, supplyTokens) : Double({mantissa: 0});

supplyState.index = safe224(add_(Double({mantissa: supplyState.index}), ratio).mantissa, "new index exceeds 224 bits");

supplyState.block = blockNumber;

} else if (deltaBlocks > 0) {

supplyState.block = blockNumber;

}

}

首先判断距离上次更新指数,经过了几个区块 deltaBlocks,另外根据 supplySpeed 判断当前市场是否产出 COMP (0x, Aave 等配置为 0,表示不产出)

条件都满足后,计算 COMP 产出数量,除以 cToken 总供给,得到这几个区块间,平均每个 cToken 对应的 COMP 产出,即代码中的 ratio

也就是说,ratio 可以理解为每持有一个 cToken ,可以得到多少 COMP

最后将 ratio 累加进 COMP 存款指数

当前用户此前未结算的 COMP 分发逻辑如下

/**

* @notice Calculate COMP accrued by a supplier and possibly transfer it to them

* @param cToken The market in which the supplier is interacting

* @param supplier The address of the supplier to distribute COMP to

*/

function distributeSupplierComp(address cToken, address supplier) internal {

// TODO: Don't distribute supplier COMP if the user is not in the supplier market.

// This check should be as gas efficient as possible as distributeSupplierComp is called in many places.

// - We really don't want to call an external contract as that's quite expensive.

CompMarketState storage supplyState = compSupplyState[cToken];

uint supplyIndex = supplyState.index;

uint supplierIndex = compSupplierIndex[cToken][supplier];

// Update supplier's index to the current index since we are distributing accrued COMP

compSupplierIndex[cToken][supplier] = supplyIndex;

if (supplierIndex == 0 && supplyIndex >= compInitialIndex) {

// Covers the case where users supplied tokens before the market's supply state index was set.

// Rewards the user with COMP accrued from the start of when supplier rewards were first

// set for the market.

supplierIndex = compInitialIndex;

}

// Calculate change in the cumulative sum of the COMP per cToken accrued

Double memory deltaIndex = Double({mantissa: sub_(supplyIndex, supplierIndex)});

uint supplierTokens = CToken(cToken).balanceOf(supplier);

// Calculate COMP accrued: cTokenAmount * accruedPerCToken

uint supplierDelta = mul_(supplierTokens, deltaIndex);

uint supplierAccrued = add_(compAccrued[supplier], supplierDelta);

compAccrued[supplier] = supplierAccrued;

emit DistributedSupplierComp(CToken(cToken), supplier, supplierDelta, supplyIndex);

}

首先获取市场最新的 COMP 存款指数,以及用户此前结算时的指数,相减得到 deltaIndex

然后乘以用户持有的 cToken 数量,得到用户这段时间应该获得的 COMP

需要说明的是,这里结算的是用户之前的存款,占当前总供给的百分比,不会算入用户接下来马上将改变的存款

换句话说,存款余额的修改,要在至少一个区块之后才会被用于结算 COMP,即用户操作与 COMP 结算是跨区块的

算是降低了被闪电贷攻击的风险

与存款挖矿大同小异,稍微复杂一些,这里不再赘述

根据 messari,COMP 的 Inflation Rate 为 27.50%

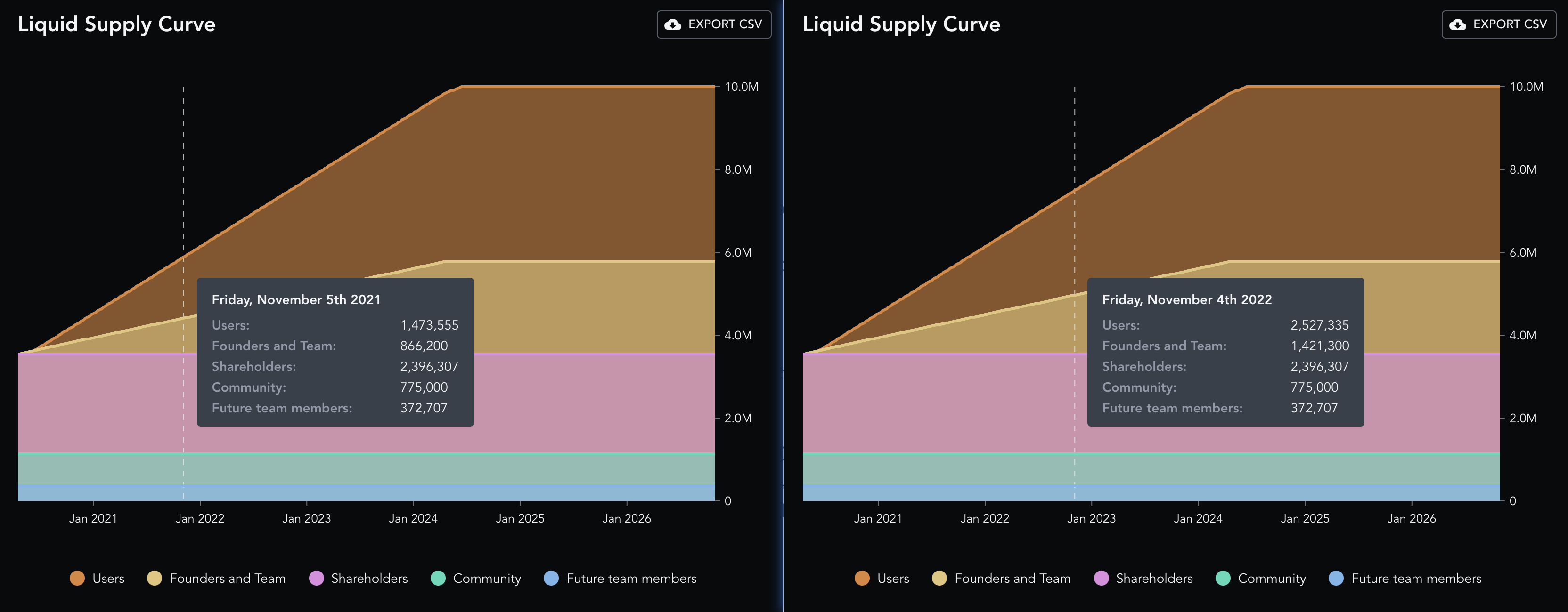

我没找到其确切公式,不过我们可以自行计算,根据 2021-11-05 和 2022-11-04 的 流动性投放计划 ,简单相除得到通胀系数为 27.34%;和 messari 数据相比,算是大差不差了

- 2021-11-05 2022-11-04 Inflation Rate User 1,473,555 2,527,335

Founder and Team 866,200 1,421,300

Shareholders 2,396,307 2,396,307

Community 775,000 775,000

Future team members 372,797 372,797

∑ 5,883,859 7,492,379 +27.34%

但是,这里有个统计陷阱:Founders & team 分批 vest 且 Future team members 也未兑现,部分流动性没有进入市场,因此分母偏大了

也就是说,实际通胀率还要高出不少

不管怎样,通胀率接近甚至超过 30% 的资产,价格稳定在 $100 ~ $300;我看不懂,但我大受震撼~

9月29日 Compound 发生一起安全事件,详见 [事件分析] 9月29日 Compound 62号提案 所引发的可怕Bug

其中,Robert Leshner 提到的 Reservori 合约 (地址),就是上面投放计划中 User (借贷挖矿) 的 COMP 来源

价格预言机

Compound 同时使用 Uniswap v2 和 Chainlink v2 作为价格预言机

Chainlink 价格以 Uniswap 价格为锚,前者作为实际价格,后者作为基准价格

Chainlink 价格需要在 Uniswap 价格的某段浮动范围内,才能作为有效价格被更新到预言机

compound-finance/open-oracle 中只有 Uniswap 相关代码,我找遍 branches 和 tags 都没找到 Chainlink 部分

最后在 Compound 社区找到这个关于添加 Chainlink 预言机提案的精彩讨论 Oracle Infrastructure: Chainlink Proposal

成果是 Chainlink 团队在 Compound 原有 Open Price Feed 的代码基础上,集成了 Chainlink 聚合器的报价,并进一步做了部署和测试;Compound 社区通过治理,应用了新的预言机

然而,Chainlink 提交的 PR:Oracle Improvement (Chainlink Price Feeds) #150,改动较多,还卡在审核阶段,未被合并..

因此,最新代码不在官方仓库中

审计报告见 Trail of Bits: Chainlink Open-Oracle Summary Report

以下分析基于 Chainklink fork 的仓库 smartcontractkit/open-source

/**

* @notice This is called by the reporter whenever a new price is posted on-chain

* @dev called by AccessControlledOffchainAggregator

* @param currentAnswer the price

* @return valid bool

*/

function validate(uint256/* previousRoundId */,

int256 /* previousAnswer */,

uint256 /* currentRoundId */,

int256 currentAnswer) external override returns (bool valid) {

// NOTE: We don't do any access control on msg.sender here. The access control is done in getTokenConfigByReporter,

// which will REVERT if an unauthorized address is passed.

TokenConfig memory config = getTokenConfigByReporter(msg.sender);

uint256 reportedPrice = convertReportedPrice(config, currentAnswer);

uint256 anchorPrice = calculateAnchorPriceFromEthPrice(config);

PriceData memory priceData = prices[config.symbolHash];

if (priceData.failoverActive) {

require(anchorPrice < 2**248, "Anchor price too large");

prices[config.symbolHash].price = uint248(anchorPrice);

emit PriceUpdated(config.symbolHash, anchorPrice);

} else if (isWithinAnchor(reportedPrice, anchorPrice)) {

require(reportedPrice < 2**248, "Reported price too large");

prices[config.symbolHash].price = uint248(reportedPrice);

emit PriceUpdated(config.symbolHash, reportedPrice);

valid = true;

} else {

emit PriceGuarded(config.symbolHash, reportedPrice, anchorPrice);

}

}

核心代码如上所示

validate() 由 Chainlink 调用,参数 currentAnswer 表示 Chainlink 链下统计的价格,单位由 Chainlink 控制

以 DAI 为例,假设 currentAnswer 为 100055330

为了方便处理,convertReportedPrice() 将其转为内部单位,得到 1000553

calculateAnchorPriceFromEthPrice() 通过向交易对询价得到链上 Uniswap 交易所的价格,比如为 1001190

接下来判断 failoverActive,这是由社区投票决定的一项配置,表示当前市场 (DAI) 是否忽略 Chainlink 价格,以 Uniswap 价格为准

否则,通过 isWithAnchor() 确认 Chainlink 价格在 Uniswap 价格浮动范围内 ([85%, 115%])

/**

* @notice Calculate the anchor price by fetching price data from the TWAP

* @param config TokenConfig

* @return anchorPrice uint

*/

function calculateAnchorPriceFromEthPrice(TokenConfig memory config) internal returns (uint anchorPrice) {

uint ethPrice = fetchEthAnchorPrice();

require(config.priceSource == PriceSource.REPORTER, "only reporter prices get posted");

if (config.symbolHash == ethHash) {

anchorPrice = ethPrice;

} else {

anchorPrice = fetchAnchorPrice(config.symbolHash, config, ethPrice);

}

}

/**

* @dev Fetches the current eth/usd price from uniswap, with 6 decimals of precision.

* Conversion factor is 1e18 for eth/usdc market, since we decode uniswap price statically with 18 decimals.

*/

function fetchEthAnchorPrice() internal returns (uint) {

return fetchAnchorPrice(ethHash, getTokenConfigBySymbolHash(ethHash), ethBaseUnit);

}

/**

* @dev Fetches the current token/usd price from uniswap, with 6 decimals of precision.

* @param conversionFactor 1e18 if seeking the ETH price, and a 6 decimal ETH-USDC price in the case of other assets

*/

function fetchAnchorPrice(bytes32 symbolHash, TokenConfig memory config, uint conversionFactor) internal virtual returns (uint) {

(uint nowCumulativePrice, uint oldCumulativePrice, uint oldTimestamp) = pokeWindowValues(config);

// This should be impossible, but better safe than sorry

require(block.timestamp > oldTimestamp, "now must come after before");

uint timeElapsed = block.timestamp - oldTimestamp;

// Calculate uniswap time-weighted average price

// Underflow is a property of the accumulators: https://uniswap.org/audit.html#orgc9b3190

FixedPoint.uq112x112 memory priceAverage = FixedPoint.uq112x112(uint224((nowCumulativePrice - oldCumulativePrice) / timeElapsed));

uint rawUniswapPriceMantissa = priceAverage.decode112with18();

uint unscaledPriceMantissa = mul(rawUniswapPriceMantissa, conversionFactor);

uint anchorPrice;

// Adjust rawUniswapPrice according to the units of the non-ETH asset

// In the case of ETH, we would have to scale by 1e6 / USDC_UNITS, but since baseUnit2 is 1e6 (USDC), it cancels

// In the case of non-ETH tokens

// a. pokeWindowValues already handled uniswap reversed cases, so priceAverage will always be Token/ETH TWAP price.

// b. conversionFactor = ETH price * 1e6

// unscaledPriceMantissa = priceAverage(token/ETH TWAP price) * expScale * conversionFactor

// so ->

// anchorPrice = priceAverage * tokenBaseUnit / ethBaseUnit * ETH_price * 1e6

// = priceAverage * conversionFactor * tokenBaseUnit / ethBaseUnit

// = unscaledPriceMantissa / expScale * tokenBaseUnit / ethBaseUnit

anchorPrice = mul(unscaledPriceMantissa, config.baseUnit) / ethBaseUnit / expScale;

emit AnchorPriceUpdated(symbolHash, anchorPrice, oldTimestamp, block.timestamp);

return anchorPrice;

}

接下来,简单看下 Uniswap 询价逻辑

首先通过 fetchEthAnchorPrice() 从交易对 USDC-WETH 获得按 USDC 计价 (单位 $10^{6}$) 的 WETH 的价格,比如为 4351156768

然后通过 fetchAnchorPrice() 从交易对 DAI-WETH 获得按 WETH 计价 (单位 $10^{18}$) 的 DAI 的价格,比如为 230097482692738

上面两个价格相乘,得到 1001190219118269813150784

最后,转换单位,得到按 USDC 计价的 DAI 价格,即上面的 1001190

UniswapAnchoredView 自身可能升级,因此会存在新旧合约实例;升级过程中,我们必须保证两个合约的价格预言同步,且经过一段时间验证后,经由社区投票,用新合约代替旧合约,以此完成升级

然而,依据 Chainlink 的设计,聚合器只能向一个合约地址发送喂价

为了解决这个问题,在 Chainlink 聚合器与 Compound 之间,引入了一层代理合约 ValidatorProxy,它将聚合器的报价同时转发给新旧 UniswapAnchoredView 合约

由于采用的是 报价 (push) 而非 询价 (pull) 的方式,更新价格的成本由 Chainlink 承担,因此 Compound 用户无须额外支付代理层带来的 gas

审计报告见 Sigma Prime: Chainlink ValidatorProxy Security Assessment Report

代码在另一个仓库中: smartcontractkit/chainlink

function validate(

uint256 previousRoundId,

int256 previousAnswer,

uint256 currentRoundId,

int256 currentAnswer

) external override returns (bool)

{

// Send the validate call to the current validator

ValidatorConfiguration memory currentValidator = s_currentValidator;

address currentValidatorAddress = address(currentValidator.target);

require(currentValidatorAddress != address(0), "No validator set");

currentValidatorAddress.call(

abi.encodeWithSelector(

AggregatorValidatorInterface.validate.selector,

previousRoundId,

previousAnswer,

currentRoundId,

currentAnswer

)

);

// If there is a new proposed validator, send the validate call to that validator also

if (currentValidator.hasNewProposal) {

address(s_proposedValidator).call(

abi.encodeWithSelector(

AggregatorValidatorInterface.validate.selector,

previousRoundId,

previousAnswer,

currentRoundId,

currentAnswer

)

);

}

return true;

}

逻辑非常直白了..

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK