Cost of Price Manipulation in Uniswap and Balancer

source link: https://blog.coinfabrik.com/cost-of-price-manipulation-in-uniswap-and-balancer/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

- Shares

Introduction

Our last blog post discussed the basic mechanisms of the automated market makers (AMMs) in Uniswap, Balancer, and Curve. These projects have achieved to construct purely peer-to-peer exchanges which do not require any intermediary, and attracted already many users (e.g. Uniswap has a total of $4.12 B in its exchange). The essential ideas behind their solutions are based on reserve pools to provide liquidity to the exchange, and to make use of simple mathematical formulas for price discovery. We invite you to read our previous post to get more background about this matter, if needed.

The fact that these AMMs provide – by their nature – token prices onchain, has invited other DeFi projects to make use of them as price oracles. Instead of consulting external exchanges for token prices via price oracles such as Chainlink, it is a more economic and simpler solution to consume the data from, for example, the Uniswap Version 2 AMM. The lending platform Compound for example makes use of Uniswap, although not directly as a price oracle. It is important to bear in mind that things could go wrong when using AMMs naively as a price oracle (read here). One aspect of it is the possibility to manipulate the prices by making large trades due to deterministic slippage effects. These trades can be reverted incurring little cost, and in the meanwhile other DeFi projects may take the altered price paying out a profit to the attacker.

The cost of price manipulation depends on the sizes of the reserves and the formula defining the mechanism of the AMM. We will recall the cost of manipulation for Uniswap derived in [2], and extend it to the case of Balancer. In the last section we evaluate the findings with actual exchange data. If you are not interested in the derivation of the mathematical formulas, you can skip the middle part and jump right away to the discussion part.

A Quick Recap of Uniswap and Balancer

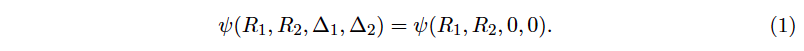

In both protocols, Uniswap and Balancer, liquidity for trades are provided by so-called liquidity providers who deposit tokens t1 and t2 in a prescribed proportion to reserve pools R1 and R2. Liquidity providers have an interest in depositing tokens, since each executed trade brings them a return from the trading fees. When traders want to buy an amount ∆1 ≤ R1 of token t1, the AMM determines the cost in terms of the amount ∆2 of token t2. This price calculation is achieved by restricting the trading function ψ to be constant, i.e. the trading function has the same value before and after the trade. Mathematically speaking, we require the following equation to hold true

Let’s check what this means in the case of Uniswap and Balancer. The trading function of Uniswap is given by the product of the updated reserves

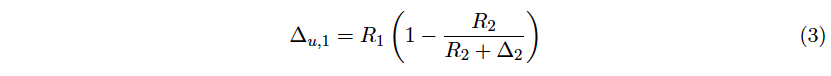

so that the constraint of (2) becomes (R1 – ∆1)(R2 + ∆2) = R1R2. With this at hand, the price of buying ∆1 can be determined as

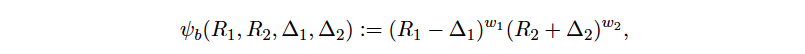

In the case of Balancer, the trading function is given by the weighted product of the reserves

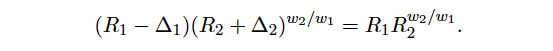

where wi are in the interval [0, 1] such that w1 + w2 = 1. The constraint (2) becomes (R1 – ∆1)w1(R2 + ∆2)w2 = R1w1R2w2, and the price for 1 is

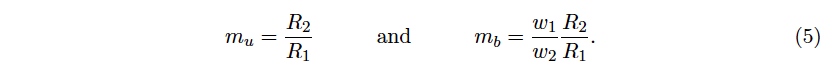

We close this recap by mentioning a result described in our previous post. The marginal prices of the token t1, i.e. the price when performing an infinitesimal small trade where no slippage appears. We found the following formulas for the marginal price mu (Uniswap) and mb (Balancer)

Balancer can be considered to be a generalization of Uniswap, since the choice of w1 =w2 = 1/2 is basically the Uniswap case (taking the square of ψ).

Cost of Manipulation in Uniswap

The above price formulas do not take into account eventual fees for the trades. This keeps the calculation simpler, and provides anyway a useful lower bound to the cost calculations. Furthermore, we assume that an arbitrageur will correct price differences with an (infinite) reference market. Hence, the reference market price mp is the same as the marginal price, i.e. mu = mp (Uniswap) and mb = mp (Balancer). Now let us state what the attacker wants to achieve. Namely, (s)he wants to increase the Uniswap AMM price of t1 by adding ∆2 such that munew= (1 + ε)mp. For example, if ε = 0,05, then (s)he tries to increase the Uniswap price by 5% compared to reference price mp. But this reads by definition of the marginal price for the updated reserve sizes as

What we have to do is to determine 1 using the above equation (6). Therefore, we can use the constraint (2) for Uniswap

where in the last three equation we just make use of (5). Multiplying (7) to both sides of (6), we get

From this we deduce

where we made use of mpR1 = R2 in the second equation. We have also to take into account that the attacker receives ∆1 tokens for the trade which can be determined by plugging the above ∆2 in (3) which is

Hence, the total cost becomes

You can find this equation in [2], Appendix E.

Cost of Manipulation in Balancer

Similarly as above, we start with the mathematical formulation of what the attacker wants to achieve, i.e. an increase of the Balancer AMM price of t1 by adding ∆2 such that mbnew= (1 + ε)mp. Again, by definition of the marginal price, this means

The constraint of satisfying the market maker condition is

which can be transformed to

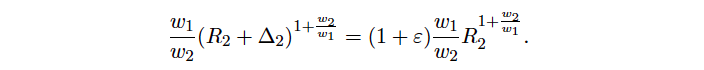

Using the simple relation mb = mp = w1/w2 R2/R1 to get mpR1 = w1/w2 R2, we can derive by multiplying the above equation on both sides of (9)

Since 1 + w2/w1 =1/w1 , we get

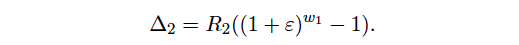

From this we deduce the amount ∆2 to be

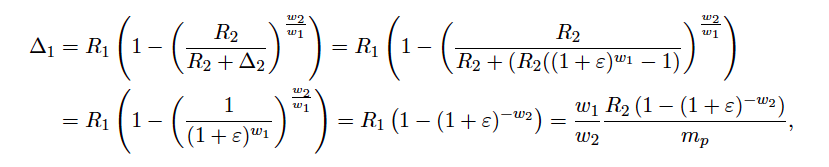

Since the attacker receives in return (plugging ∆2 = R2((1 + ε)w1 – 1) in equation (4))

the total cost becomes

Choosing w1 = 1/2 we get back the cost formula for Uniswap (8).

Evaluation

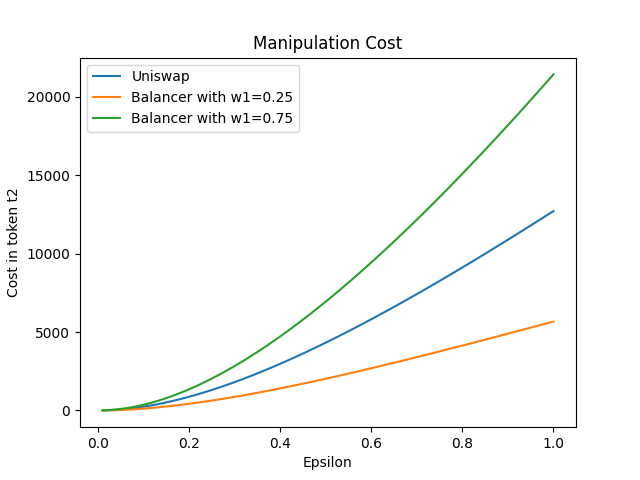

Now let us interpret the formulas from the previous two sections in two examples by taking data from the Uniswap exchange. The first example takes the reserve size of the WBTC-ETH pair from 9th of March 2021: the pool held 3542 WBTC and 104,823 ETH with a total liquidity of 382,183,185 USD. The following chart shows the manipulation costs ranging from 1 to 100%, and compares the costs to Balancer when choosing w1 = 1/4 and w1 = 3/4.

For example, taking the ETH price of 1823 USD as of March 9th, a change of WBTC price in Uniswap would have incurred a minimum costs of:

Percentage\CostUniswapBalancer (w1 = 3/4)1 %4729 USD7106 USD5 %113,728 USD171,986 USD10 %434,054 USD661,517 USD50 %7,880,925 USD12,652,035 USDTable 1: Manipulation costs for an increase in x % in Uniswap and Balancer (w1 = 3/4). Reserve sizes are chosen as in the Uniswap for the pair WBTC-ETH.

In the second example we consider the case of the token pair Ocean-ETH in Uniswap. The reserve sizes of the Ocean-ETH pair from 9th of March 2021 are: the pools held 1,774,033 Ocean and 1407 ETH. Taking again the ETH price of 1823 USD as of March 9th, a change of Ocean price in Uniswap would have incurred a minimum costs of:

Percentage\CostUniswapBalancer (w1 = 3/4)1 %63 USD95 USD5 %2177 USD2308 USD10 %5826 USD8879 USD50 %105,782 USD169,823 USDTable 2: Manipulation costs for an increase in x % in Uniswap and Balancer (w1 = 3/4). Reserve sizes are chosen as in the Uniswap for the pair Ocean-ETH.

The calculated costs presented above are, as mentioned earlier, lower bounds of the real costs since we do not take the trading fees into account. Anyway the results provide the correct order of magnitude of the manipulation costs. It is also important to mention that this are the costs for a one-time change. Keeping this attack over a longer time period will have an accumulated cost, since arbitageurs will take this price changes as an arbitrage opportunity.

It is noticeable that for pairs with a small total liquidity, price manipulations can be achieved with relatively low costs. For example, changing the Ocean price by 5% in Uniswap costs only 2177 USD, and in a similar situation in Balancer a price change woud have just a slightly higher cost of 2308 USD. Hence, using AMMs of Uniswap and Balancer as price oracles must be considered as very risky, especially when the reserve pools have small total liquidity.

- Shares

Related Posts

- Automated Market Making Mechanisms and Issues in Uniswap, Balancer, and Curve

Early decentralized exchange (DEX) proposals took their inspiration from classical exchange markets and made use…

-

Money on Chain Gas Cost

The purpose of this document is to offer different alternatives to reduce gas cost in…

- Market Making in Crypto Exchanges: An Introduction

Market makers at stock exchanges are companies or individuals who stand ready to buy and…

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK