A Successful U.S. Missile Intercept Ends the Era of Nuclear Stability

source link: https://finance.yahoo.com/news/successful-u-missile-intercept-ends-060017616.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

A Successful U.S. Missile Intercept Ends the Era of Nuclear Stability

(Bloomberg Opinion) -- This month, an intercontinental ballistic missile was fired in the general direction of the Hawaiian islands. During its descent a few minutes later, still outside the earth’s atmosphere, it was struck by another missile that destroyed it.

With that detonation, the world’s tenuous nuclear balance suddenly threatened to come out of kilter. The danger of atom bombs being used again was already increasing. Now it’s grown once more.

The ICBM flying over the Pacific was an American dummy designed to test a new kind of interceptor technology. As it flew, satellites spotted it and alerted an Air Force base in Colorado, which in turn communicated with a Navy destroyer positioned northeast of Hawaii. This ship, the USS John Finn, fired its own missile which, in the jargon, hit and killed the incoming one.

At first glimpse, this sort of technological wizardry would seem to be a cause for not only awe but also joy, for it promises to protect the U.S. from missile attacks by North Korea, for example. But in the weird logic of nuclear strategy, a breakthrough intended to make us safer could end up making us less safe.

That’s because the new interception technology cuts the link between offense and defense that underlies all calculations about nuclear scenarios. Since the Cold War, stability — and thus peace — has been preserved through the macabre reality of mutual assured destruction, or MAD. No nation will launch a first strike if it expects immediate retaliation in kind. A different way of describing MAD is mutual vulnerability.

If one player in this game-theory scenario suddenly gets a shield (these American systems are in fact called Aegis), this mutual vulnerability is gone. Adversaries, in this case mainly Russia but increasingly China too, must assume that their own deterrent is no longer effective because they may not be able to successfully strike back.

For this reason defensive escalation has become almost as controversial as the offensive kind. Russia has been railing against land-based American interceptor systems in places like eastern Europe and Alaska. But this month’s test was the first in which a ship did the intercepting. This twist means that before long the U.S. or another nation could protect itself from all sides.

Investor's Business Daily

Investor's Business DailyBank Of America Names Top 11 Stock Picks For 2021

Bank of America just unveiled its top stocks for next year among the 11 S&P 500 sectors. But the bank might hope its picks do better than they did in 2020.

1d ago- Barrons.com

Here Are Barron’s 10 Top Stocks for the New Year

The group offers good appreciation potential, while providing some downside protection if the stock market falters in 2021.

16h ago  MoneyWise

MoneyWiseHow Biden's student loan forgiveness could blow up your tax bill

If the stars don't align, the resulting "tax bomb" would cost you thousands.

1d ago Investor's Business Daily

Investor's Business DailySix High Dividend Stocks You Can Count On

High-dividend stocks can be misleading. Here's a smart way to find stable stocks with high dividends. Watch these three dividend payers on IBD's radar.

22h ago Yahoo Finance

Yahoo FinanceBill Gates-backed electric car battery startup is on the cusp of changing the industry

QuantumScape founder and CEO Jagdeep Singh chats with Yahoo Finance about the company's big battery breakthrough.

2d ago- MarketWatch

Ray Dalio says son killed in Connecticut car accident

Billionaire hedge fund investor Ray Dalio has tweeted about the death of his 42-year-old son, killed this week in a car accident.

1h ago  Benzinga

BenzingaTesla Stops Gigafactory Berlin Construction Due To Missing $100M Deposit: Report

While Gigafactory Berlin construction has been moving at a fast pace, Tesla Inc (NASDAQ: TSLA) has had a few setbacks, including stopping tree clearing due to animal rights activists court cases.Now, a report from Electrek says Tesla has missed a $100 million security deposit, which is causing things to go on hold temporarily. Tesla didn't obtain overall approval to build Gigafactory Berlin, according to Electrek, and is operating with partial approvals to keep advancing the project at a quicker pace.Click here to check out Benzinga's EV Hub for the latest electric vehicle news.The deposit is needed in case the project is never finished. In the event that happens, Tesla would be responsible to pay for the demolition. The $100 million deposit covers that possibility, although at this point it seems unlikely.The payment was supposedly due on Dec. 17.Photo courtesy of TeslaSee more from Benzinga * Click here for options trades from Benzinga * Elon Musk Hopes To Visit China Next Month Amid Start Of Model Y Production * Video Shows Tesla Model Y Production Beginning In China(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1d ago TipRanks

TipRanks2 Big Dividend Stocks Yielding 8%; Wells Fargo Says ‘Buy’

Step back, take a look at the bigger picture. The markets are up this week, with gains in all three main indexes amid optimism over a coronavirus stimulus bill.At times like this, it is tempting to jump on a bandwagon and buy up the growth stocks, aiming to capitalize on the broader trends. But is that really the best play? Analysts from Wells Fargo are pointing out stocks with sky-high dividend yields from companies that have also demonstrated their commitment to keeping the payout reliable.This type of high-yield reliable dividend payer is generally seen as a defensive portfolio move, shoring up income streams during the fat times, to be ready for the lean. After the year we’ve just had, perhaps it’s time to take Wells Fargo’s advice, and get into some old-school portfolio protection. The TipRanks database sheds some additional light on two of Wells Fargo's picks – stocks with dividends yielding 8% – and that the investment firm sees with 15% upside or better.TC Pipelines LP (TCP)Starting in the energy industry, TC Pipelines is, as its name suggests, a player in the midstream sector. The company, through its subsidiaries, owns and operates a network of natural gas pipelines in the US and Canada, and is responsible for transporting as much as 25% of all the natural gas used in North America. The company’s network links northern British Columbia and Alberta with the Great Lakes region and the Appalachian gas regions, and extends to ports on the US Gulf Coast.TCP’s shares tumbled during this ‘corona crisis’ year, showing a 21% year-to-date loss. Revenues, however, have shown much lower volatility. The top line dropped 10% from the end of 2019 to its trough in 2Q20, and in Q3 bounced back to $99 million, a 4.2% sequential gain. Q3 earnings, at 90 cents per share, showed a 13% sequential gain and an 18% year-over-year gain. During the quarter, the company also reported paying out cash distributions totaling $47 million. This included the 65-cent dividend per common share, a payment that has been held steady for over two years. In the longer view, TCP has a 21-year history of dividend reliability. At the current payment, the dividend annualizes to $2.60 per share and yields 8.2%.Wells Fargo analyst Praneeth Satish wrote the review on TC Pipelines, saying, “TCP reported solid Q3 results. For the most part, flows and utilization levels have remained unchanged throughout the pandemic and expansion projects are largely on schedule/budget… We view the stock as fundamentally undervalued, given attractive yield, robust coverage and improved balance sheet.”In line with these comments, Satish rates the stock an Overweight (i.e. Buy) and sets a $41 price target that implies an upside of 35% for the year ahead. (To watch Satish’s track record, click here)The analyst consensus on TCP is not unanimous, but almost. The Strong Buy consensus rating is supported by 3 Buys against a single Hold. Shares sell for $30.39, and the average price target of $40.33 indicates an upside of ~33%. (See TCP stock analysis on TipRanks)Golub Capital BDC (GBDC)The second stock today is Golub Capital, a business development company in the middle market. Golub makes financing and lending solutions available to mid-market companies that might otherwise have difficulty accessing capital markets. Golub’s portfolio totals more than $30 billion in assets under management.The company saw a steep and deep share price loss last winter, when the corona crisis hit the economy. Shares remained depressed until the beginning of May, but since then have been rising slowly. Starting from the May 4 trough, GBDC is up 53%. Year-to-date, however, the stock remains down 17%.Quarterly results have been volatile this year. Q1 saw deep losses, Q2 saw a recovery, and Q3 showed a sequential drop-off to $98.1 million. EPS was solid, at 57 cents, a great improvement from the year-ago EPS loss of $1.02.Golub paid out its common share dividend at 29 cents per share in Q3, the third quarter in a row at that level. The company has a reliable payout history, going back over a decade, and a habit of adjusting the dividend payment to keep it sustainable. The current payment annualizes to $1.16 per common share, and gives a yield of 8.4%.Among the fans is Wells Fargo analyst Finian O’Shea. In his latest note on Golub, the analyst noted, “GBDC continues to see portfolio-level operating performance, constructive sponsor support, and improvement in those companies most affected by shutdowns as the economy reopens… In our view, GBDC is a high-quality Quartile 1 BDC with a shareholder friendly structure, strong asset quality, and scale through resources of the Golub Capital platform.”In line with these upbeat comments, O’Shea rates Golub shares an Overweight (i.e. Buy), and his $16 price target suggests the stock has room for 16% growth next year. (To watch O’Shea’s track record, click here)The Moderate Buy consensus rating on Golub comes from an even split between Buy and Hold reviews. The stock’s average price target is $16, matching O’Shea’s, and the current trading price is $13.75. (See GBDC stock analysis on TipRanks)To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

2d ago Investor's Business Daily

Investor's Business DailyFastest-Growing Stocks: Square Stock Among 8 Stocks Expecting Up To 144% Growth In 2021

What are the fastest-growing stocks to watch in 2021? Here's a list featuring GRWG stock, Square, Micron and five other stocks expecting up to 144% growth.

2d ago Benzinga

BenzingaTilson: Avoid Bitcoin And 'Lead A Happier And More Prosperous Life'

Bitcoin prices pulled back from their all-time highs above $23,000 on Friday, but the Grayscale Bitcoin Trust (OTC: GBTC) traded higher by 1.7% on investor optimism that the huge 2020 bitcoin rally will spill over into 2021.Former hedge fund manager Whitney Tilson predicted the bursting of the bitcoin bubble back in 2017, but Tilson has a different take on the cryptocurrency this time around. On Friday, Tilson said he doesn't recommend shorting bitcoin or any other cryptocurrency, even at all-time highs.Related Link: Will Bitcoin 'Rise 50% And Possibly Double' In 2021? These Pros Think SoBack in 2017, Tilson said bitcoin was demonstrating signs of a classic market bubble. One of the biggest red flags at the time was the type of investors that were asking questions about bitcoin. Tilson noted that 2017 bitcoin investors were among the "least-knowledgeable investors imaginable." This time around, Tilson said much more mainstream investors and firms are involved in the bitcoin rally, which suggests the 2020 gains may be more likely to hold.How To Play It: While 2021 may not bring another 2018-style bitcoin bubble bursting, Tilson still isn't recommending investors buy bitcoin."I would never short any cryptocurrency - ironically, for the exact same reason I would never own one: there's no intrinsic value," Tilson said.Without any intrinsic value, Tilson said the price of bitcoin could literally go anywhere from $100 to $1 million and anywhere in between. Tilson said it's never a good idea to short an open-ended situation like that, but there is also nothing supporting bitcoin's valuation to the downside."In summary, I think you will lead a happier and more prosperous life if you avoid cryptocurrencies altogether," Tilson said.Benzinga's Take: Stocks, bonds, real estate and even gold have long, well-established track records of investment performance, but bitcoin and other cryptocurrencies have only been around for a little over a decade.A cryptocurrency's supply is fixed, it doesn't have the intrinsic value of a share of stock or a plot of real estate, and it doesn't have the yield of a bond or certificate of deposit. Therefore, the prices of cryptocurrencies in the long term will be determined only by changes in long-term demand from investors and users.Latest Ratings for GBTC DateFirmActionFromTo Feb 2018BuckinghamInitiates Coverage OnSell Jul 2015WedbushInitiates Coverage onOutperform View More Analyst Ratings for GBTC View the Latest Analyst RatingsSee more from Benzinga * Click here for options trades from Benzinga * Will Bitcoin 'Rise 50% And Possibly Double' In 2021? These Pros Think So * Bitcoin Crosses K For The First Time. Is This Rally A Repeat Of 2017?(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

21h ago Benzinga

BenzingaWill GE's Stock Reach $20 By 2022?

Every week, Benzinga conducts a sentiment survey to find out what traders are most excited about, interested in or thinking about as they manage and build their personal portfolios.We surveyed a group of over 300 investors on whether shares of General Electric (NYSE: GE) will reach $20 by 2022.GE Stock Forecast General Electric is known for its digital industrial offerings and massive installed base spread across a variety of products and services, including aircraft engines, gas turbines, wind turbines, and medical diagnostic equipment, among others.After the sale of GE Transportation to Wabtec and a majority of its stake in Baker Hughes, as well as the sale of GE Biopharma to Danaher, the company's focus turns to aviation, legacy healthcare, power and renewable energy.See Also: Top 10 Blue Chip StocksGE trades around $11 at publication time, off the 52-week low of $5.48, and about 73% of Benzinga traders and investors said GE will reach $20 per share by 2022.Our study revealed investors saying GE Healthcare's footprint in the health care industry could prove valuable amid increased demand for radiopharmaceuticals and general medical imaging procedures. Others believe GE will see a boost to their core business of gas turbines and jet engines once the pandemic has subsided.This survey was conducted by Benzinga in December 2020 and included the responses of a diverse population of adults 18 or older.Opting into the survey was completely voluntary, with no incentives offered to potential respondents. The study reflects results from over 300 adults.Photo credit: Bubba73, via Wikimedia CommonsSee more from Benzinga * Click here for options trades from Benzinga * Will GE Or Boeing Stock Grow More By 2025?(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1d ago Benzinga

BenzingaChip Stocks Fall On Report Microsoft Will Take Things In House

Microsoft Corp (NASDAQ: MSFT) is designing in-house processors for server computers running on the company's cloud services, a development which will reduce reliance on Intel Corporation's (NASDAQ: INTC) chip technology, according to a Bloomberg report.Several chips stocks fell on the news.Intel shares traded down 6.3% to $47.46. The stock has a 52-week high of $69.29 and a 52-week low of $43.61.Advanced Micro Devices, Inc. (NASDAQ: AMD) closed down 0.95% at $95.92 per share.Nvidia Corporation (NASDAQ: NVDA) shares traded down 0.52% to $530.88. The stock has a 52-week high of $589.07 and a 52-week low of $180.68.Xilinx, Inc. (NASDAQ: XLNX) shares traded down 1.76% to $149.19. The stock has a 52-week high of $154.12 and a 52-week low of $67.68.Micron Technology, Inc. (NASDAQ: MU) shares traded down 1.11% to $71.46. The stock has a 52-week high of $74.60 and a 52-week low of $31.13.See more from Benzinga * Click here for options trades from Benzinga * Why Tesla's Stock Is Trading Higher Today * Why DraftKings And Flutter Are Trading Lower Today(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

19h ago TipRanks

TipRanks3 Stocks Flashing Signs of Strong Insider Buying

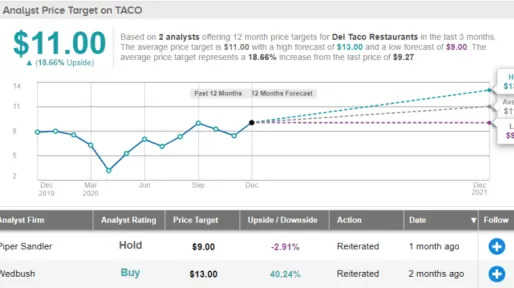

Sometimes, following a leader makes the best investment strategy. And corporate insiders have long been popular leaders to follow. Their combination of responsibility to their stockholders and access to ‘under the hood’ information on their companies gives their personal investment choices an air of authority.The most important thing about these insiders is that whatever else they do, they are expected to shepherd their companies to profitability. Shareholders want a return on investment, Boards of Directors want accountability, and company officers are held to both standards. So, when they start buying up their own company’s stock, it’s a sign that investors should investigate further.Government regulators, in an effort to level the informational playing field, have required that insiders regularly publish their stock transactions, making it a simple matter for investors to follow them. Even better, TipRanks collates the information in the Insiders’ Hot Stocks page, and provide tools and data filters to easily browse through raw data. We’ve picked three stocks with recent informative buys to show how the data works for you.Del Taco Restaurants (TACO)We’ll start with the popular Del Taco, the California-based taco chain. Del Taco boasts a $344 million market cap, over 600 restaurants, and a loyal fan base, giving it a solid foundation in the fast-food franchise market. Most of the company’s locations are west of the Mississippi, but the company has been making inroads to the eastern US.Like many brick-and-mortar, traffic-dependent businesses, Del Taco has had a hard year. The coronavirus crisis had dampened traffic, social and economic lockdown policies have reduced income streams. The company has started to recover, however. After heavy net losses early in the year, EPS has returned to positive numbers, and revenue in Q3, $120 million, was up more than 15% sequentially. The share price, which fell by two-thirds at the height of the economic crisis last winter, has regained its losses. TACO is now trading up 17% for the year.The insiders are bullish on the stock. The most recent purchase, helping tip the sentiment needle into positive territory, is from Board member Eileen Aptman, who bought up 88,952 shares, shelling out over $650,000. Wedbush analyst Nick Setyan covers Del Taco, and he rates the shares an Outperform (i.e. Buy). His $13 shows the extent of his confidence, indicating room for 40% upside growth. (To watch Setyan’s track record click here)Backing his stance, Setyan wrote, “We believe TACO's current valuation is predicated on an overly pessimistic assessment of its medium- to long-term fundamentals in a post-COVID QSR environment… Even with what we believe are conservative comp, unit growth, and margin assumptions through 2022, we estimate 12% EPS growth in 2022. We estimate 1% of incremental comp would equate to $0.04-0.06 in incremental EPS and every 10 bps of incremental margin equates to $0.01 in incremental EPS in our model.”Overall, there is little action on the Street heading Del Taco's way right now, with only one other analyst chiming in with a view on the stock. An additional Hold rating means TACO qualifies as a Moderate Buy. The average price target is $11, and implies a potential upside of ~19%. (See TACO stock analysis on TipRanks)CuriosityStream (CURI)Next up is CuriosityStream, an online video streaming channel in the educational segment. CuriosityStream specializes in factual video content, and offers services by subscription. The channel claims over 13 million subscribers globally. Its founder, John Hendricks, first gained fame creating the Discovery Channel, a similarly themed cable TV channel, in 1985.CuriosityStream is new to the public markets, having IPO’d earlier this year through a merger with Software Acquisition, a special purpose acquisition company (SPAC) formed as a ‘blank check’ company to make the deal. It’s no surprise to see insiders make large purchases in new stocks, but the moves on CuriosityStream deserve note. John Hendricks made three large purchases earlier this month, buying up blocs of 15,473 shares, 26,000 shares, and 11,684 shares over a four-day period. Hendricks paid $473,561 for the new shares.Covering the stock for B. Riley, analyst Zack Silver wrote, “We see CURI as well positioned to capitalize on the burgeoning global streaming market by establishing itself as the go-to factual programmer for the post pay TV era. CURI's subscription video-on-demand (SVOD) service is differentiated not only by the sheer volume of curated factual titles available on the platform but also by its compelling price point… we expect that CURI’s strategy of monetizing its content through multiple revenue streams will enable a more efficient path to scale…”Silver rates the stock a Buy, and his $16 price target implies a 40% one-year upside. (To watch Silver’s track record, click here)CURI has a Moderate Buy analyst consensus rating based on 2 recent Buy reviews. The average price target is $14, suggesting this stock has room to grow ~23% from the current trading price of $11.50. (See CURI stock analysis on TipRanks)Allegheny Technologies (ATI)Last but not least is Allegheny Technologies, a metallurgy company based in Pittsburgh, Pennsylvania. Allegheny has two business segments: High Performance Materials & Components, which specializes in titanium-based and nickel-based alloys, and Advanced Alloys & Solutions, which includes stainless and specialty steels, electrical steels, duplex alloys, and zirconium, hafnium, and niobium alloys. The company’s metal technology is used in the electrical industry, automotive sector, aerospace, and in oil & gas production.Allegheny’s revenues and shares are down this year, as the company has been buffeted by the corona crisis. Disruptions in supply chains, distributions networks, and customer orders have all had a negative impact, as have social and economic shutdown policies. Quarterly revenues have fallen by 37%, from $955 million in Q1 to $598 million in the third quarter. Shares are down 21% year-to-date.All of this would seem to make ATI a poor stock choice, but the company has used the time to retrench wisely, and reorient its production models.Benchmark analyst Josh Sullivan pointed this out when he bumped his stance earlier this month from Neutral to Buy. He wrote, “We are upgrading ATI to Buy from Hold following the Company’s planned exit from commodity stainless. This move alters ATI’s historical risk profile by removing the most volatile vertical… Parting with ATI’s heritage in stainless has been a long sought-after investor goal; exiting now also allows ATI to avoid maintenance and a potential inventory overbuild during the recovery phase.”In addition, Sullivan notes that business in the aerospace sector will likely recover soon, providing a boon for Allegheny: “with the 737-MAX return to service, Airbus A320 production upward pressure, and vaccines at hand the more focused aerospace ATI core will directly correlate to an aero recovery.”Sullivan's Buy rating comes with a $21 price target that implies room for 27% growth over the coming 12 months. (To watch Sullivan’s track record, click here)Turning to the insider trades, we find that the company’s CFO and SVP, Donald Newman, purchased 12,500 shares this month, paying over $210K for the bloc. His total holding is now 80,042 shares, valued at $1.3 million.All in all, Allegheny gets a Moderate Buy consensus rating, based on an even split among 4 reviews, of 2 Buys and 2 Holds. The shares are priced at $16.32 and the $18.25 average price target implies ~12% upside potential.(See ATI stock analysis on TipRanks)To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

1d ago- Barrons.com

8 Tax Breaks That Are Set to Expire on Dec. 31

As year-end rapidly approaches, a bevy of federal tax breaks is set to expire on Dec. 31. Then Congress retroactively resurrected the deduction to cover qualified college expenses incurred in 2018-20. * Taxpayers with modified adjusted gross income (MAGI) up to $65,000, or up to $130,000 if you’re a married joint filer, can deduct qualified expenses up to $4,000.

2d ago  Investor's Business Daily

Investor's Business DailyIs Nio Stock A Buy Now As Extra Capital Raised For Next Stage Of EV Boom?

Supercharged Nio stock taps demand for electric cars. Here is what the fundamentals and technical analysis say about buying Nio shares now.

1d ago Yahoo Finance

Yahoo FinanceFed loosens restrictions on bank share buybacks after second stress test

The Fed concluded after a second round of stress tests that major U.S. banks had “strong capital levels.”

19h ago- Barrons.com

4 Chip Stocks That Can Rise Even More in 2021

The world’s growing appetite for 5G phones and other high-performance technology will mean more demand for semiconductors, according to Wells Fargo.

20h ago - Barrons.com

DraftKings and Square Are Growth Stocks With Ambitions to Be Like Amazon

Hypergrowers can be difficult to value. But understanding where they see opportunities for gains is a start.

15h ago  Investor's Business Daily

Investor's Business DailyDow Jones Futures Rise On Nike Earnings, JPMorgan Buyback, Moderna Vaccine; Tesla Stock Keeps Moving

Futures rose late Friday on Nike earnings, the Fed letting bank stocks like JPMorgan resume buybacks and FDA approving the Moderna vaccine approval. Tesla stock kept moving.

43m ago MarketWatch

MarketWatchThe one instance when you should ignore Warren Buffett

A reader recently wrote to challenge my belief in diversification, citing a couple of accomplished investors who said, in effect, that anybody who diversifies an investment portfolio must be an idiot or a moron. If they are right, then I’ll plead guilty, because I’m a firm believer in diversification — both for myself and for almost all the investors I’ve helped over the past half-century as an adviser and educator. Diversification is one of the most important steps every investor should take.

1d ago- Benzinga

Cramer Gives His Opinion On Cisco, DocuSign And More

On CNBC's "Mad Money Lightning Round," Jim Cramer said Kratos Defense & Security Solutions, Inc (NASDAQ: KTOS) is a very good defense contractor and Cramer is sticking with it.McKesson Corporation (NYSE: MCK) is doing great and it's the linchpin of getting us the vaccine, said Cramer. He likes the stock for more than just the vaccine and he thinks its time has come.Cramer thinks it is not time to sell airlines. He prefers Southwest Airlines Co (NYSE: LUV) over Spirit Airlines Incorporated (NYSE: SAVE).Cramer is not a buyer of Kimball International Inc (NASDAQ: KBAL). He doesn't like the sector.Cisco Systems, Inc. (NASDAQ: CSCO) is fine, said Cramer. The quarter was good, the dividend is good and the company has got a lot of cash.SiteOne Landscape Supply Inc (NYSE: SITE) is fine too, believes Cramer.DocuSign Inc (NASDAQ: DOCU) is revolutionizing the way we buy everything, said Cramer. He loves it.Cramer is a buyer of CVS Health Corp (NYSE: CVS).See more from Benzinga * Click here for options trades from Benzinga * Mike Khouw Sees Unusual Options Activity In Nike * Cramer Weighs In On Plug Power, Marvell And More(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1d ago - TipRanks

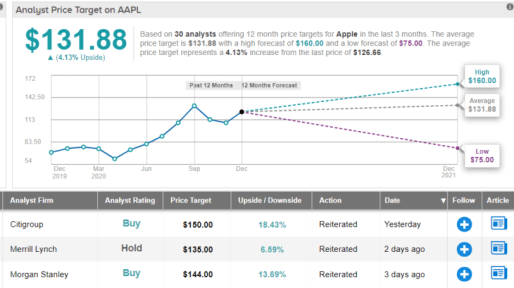

Is Apple Stock a Buy Heading Into 2021? This Is What You Need to Know

Much has been made of the major near term catalyst for Apple (AAPL) -- the iPhone 12 supercycle. The anticipation is for a big chunk of Apple’s global fanbase to upgrade to the new 5G-enabled handsets over the next few years.However, J.P. Morgan analyst Samik Chatterjee says expectations might be a tad optimistic.“While checks indicate robust demand for 5G iPhones, particularly with lead times expanding for iPhone 12 Pro, upside to aggregate volume expectations relative to bullish buy-side expectations appears limited, which have been primed for a strong 5G cycle,” the 5-star analyst said.In fact, heading into the new year, Chatterjee tempers investors’ expectations for Apple stock to deliver the same returns investors have grown accustomed to during the last few years’ bull run. The analyst says shareholders should expect “modest returns in 2021.”That’s not to say Chatterjee thinks Apple’s issues run any deeper. These “modest returns” are in the 20% region (vs. this year’s 74% gain). Moreover, the analyst believes there are other causes for optimism.In contrast to lowered 5G expectations, checks are “indicating better consumer demand for legacy iPhones (particularly iPhone 11),” and there are “WFH tailwinds for Mac/iPad, and anecdotal evidence on strength in Wearables.”The latter, in particular, could be a source of upside in FY21.“Recent promotional activity as well as consumer preference relative to Apple Watch and Airpods suggests upside to consensus estimates for the Wearables segment,” Chatterjee said. “For example, latest IDC forecast estimates Apple Watch volumes to increase +20% y/y in CY21, a mid- to high-single digit increase over forecast earlier in the year.”Overall, Chatterjee reiterated an Overweight (i.e. Buy) rating on Apple shares along with a $150 price target, which implies an 18% upside from current levels. (To watch Chatterjee’s track record, click here)Where does the rest of the Street side on Apple? It appears mostly bullish. Apple's Moderate Buy consensus rating is based on 30 reviews breaking down to 23 Buys, 6 Holds and a single Sell. However, the majority expect shares to stay range bound for now, as the current $131.88 average price target indicates. (See Apple stock analysis on TipRanks)To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

15h ago - Investopedia

What Is the Roth IRA 5-Year Rule?

The Roth IRA 5-year rule applies in three situations and dictates whether withdrawals get dinged with penalties.

2d ago - MarketWatch

I’m retired and won’t live to see my mortgage paid off. Should I refinance to lower my monthly payment?

'I need to lower the principal to help me stay in my home, because the cost of living is increasing every year.'

1d ago - MarketWatch

7 tips for ‘passive income’

Not long ago these were the perfect low-risk, sleep-at-night retirement investment. Treasury inflation-protected securities are Treasury bonds whose interest payments effectively adjust to compensate for rising inflation. Right now TIPS offer inflation minus.

1d ago - TechCrunch

Wish (and Airbnb, and Palantir) investor Justin Fishner-Wolfson doesn't care about first-day pops

It's probably no wonder that when Founders Fund was still a very young venture firm 13 years ago, it brought aboard as its first principal Justin Fishner-Wolfson. Having nabbed two computer science degrees from Stanford and spent two years as CEO of an organization that provides asset management services to the school's student organizations, Fishner-Wolfson wasn't shy about voicing his opinions at the venture fund. In fact, he says Founders Fund made a much bigger bet on SpaceX than it originally planned because he pushed for it.

8h ago - TipRanks

Luminar Technologies: Breaking Down Deutsche Bank’s New Bullish Call

Luminar Technologies (LAZR) is only two weeks old, after going public via a SPAC merger, but already a firm favorite among investors. It appears Wall Street’s analyst corps are now slowly joining the fray.Enter Deutsche Bank analyst Emmanuel Rosner who initiates coverage on LAZR shares with a Buy rating and $37 price target. Investors are looking at upside of 40%, should Rosner’s thesis play out over the coming months. (To watch Rosner’s track record, click here)So, what’s tickling the analyst’s fancy?Rosner explained, “Luminar offers investors an attractive way to invest into higher-level vehicle autonomy whose adoption is poised to take off, as we expect the company to become a leader in LiDAR solutions, with a true addressable market of ~$40bn by 2030."The analyst added, "Its differentiated LiDAR technology, featuring proprietary architecture and components, is essentially the only one delivering the performance needed for highway-speed autonomy at the right cost, and already received external validation from Volvo, Daimler and Mobileye through production contracts.”While the company already boasts an $8 billion market cap and its valuation is “rich by near-term metrics,” Rosner argues it is justified due to Luminar’s “superior technology and the size of the mid-term market opportunity.”The lidar market is still in its early innings and lidar probably won’t be required by sub L3 autonomous vehicles. However, as higher-level vehicle autonomy becomes more commonplace deeper into the decade, the need for Lidar solutions will increase.Apart from Robotaxis -for which Mobileye has already signed on to use Luminar’s lidar in its fleet - Rosner expects commercial trucks will be quick to adopt advanced driverless features “given large operating costs savings.”Rosner expects Luminar’s sales to have a steep upwards curve over the coming years. The analyst thinks the company will shift from selling 500,000 sensors in 2025E to more than 6.5 million in 2030E. Revenue should follow accordingly and climb from $635 million in 2025E to $4.5 billion in 2030E.In terms of other analyst activity, it has been relatively quiet. 2 Buy ratings assigned in the last three months add up to a ‘Moderate Buy’ analyst consensus. In addition, the $39 average price target puts the upside potential at 48%. (See LAZR stock analysis on TipRanks)To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

21h ago - Investor's Business Daily

Is MO Stock A Buy? Tobacco Giant Altria Is In A Buy Zone, But Comes With A Warning Label

Altria is trying to become less of a cigarette company as demand fades. Is MO stock a buy? Its recent breakout comes with a warning label.

23h ago - Investor's Business Daily

This Is Your Last Chance To Buy Tesla Stock Before Its Big Day

Tesla stock rose as funds rush to buy shares on the last trading day before the automaker's debut on the S&P 500 on Monday.

18h ago - Benzinga

Will Xpeng Or Li Auto Stock Grow More By 2022?

Every week, Benzinga conducts a sentiment survey to find out what traders are most excited about, interested in or thinking about as they manage and build their personal portfolios.We surveyed a group of over 200 Benzinga investors on whether shares of Xpeng (NYSE: XPEV) or Li Auto (NASDAQ: LI) stock would grow the most by 2022.XPeng Vs. Li Auto Stock Xpeng is one of China's leading smart electric vehicles, or Smart EV, companies. The company was founded in 2015 with a vision to bring Smart EVs to Chinese consumers through innovation in autonomous driving, smart connectivity and core vehicle systems.Xpeng says its EVs are crafted with the intent of appealing to the large and growing base of technology-savvy middle-class consumers in China. Li Auto is an innovator in China's new energy vehicle market. The company designs, develops, manufactures and sells premium smart electric SUVs.Li Auto is the first to successfully commercialize extended-range electric vehicles in China. It started volume production of its first model, Li ONE, in November 2019. With Li ONE, the company leverages its in-house technology to focus on smart technology and autonomous driving solutions.Several respondents to our study shared a belief Xpeng will lead the future of the autonomous segment of electric vehicles."Xpeng has invested significantly into software development for autonomous driving," one reader said. "I see Xpeng cornering the Chinese EV market with their proprietary XPILOT 3.0 system attracting the most buyers in the near-term."Overall, 59% of respondents said Xpeng will grow more by 2022, while 41% believe Li Auto will grow more by the end of next year.This survey was conducted by Benzinga in December 2020 and included the responses of a diverse population of adults 18 or older.Opting into the survey was completely voluntary, with no incentives offered to potential respondents. The study reflects results from over 200 adults.See more from Benzinga * Click here for options trades from Benzinga * When Will Bitcoin Hit ,000? * Will Alibaba Or Jumia Stock Grow More By 2022?(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1d ago - Barrons.com

Eli Lilly, Amgen, and 2 Other Companies That Raised Their Dividends This Week

Dividend increases, which were very rare early in the pandemic as plenty of firms cut or suspended their payouts, have become more frequent as 2020 has gone along.

4h ago - Bloomberg

Virgin Galactic Falls After Filing for Holders to Sell Stock

(Bloomberg) -- Virgin Galactic Holdings Inc. fell 3.5% on Friday after filing for shareholders to sell as much as 113 million shares.The registration includes up to about 105 million outstanding shares of common stock and up to 8 million shares issuable upon the exercise of warrants that were issued in connection with a private placement, according to a filing with the Securities and Exchange Commission. The filing effectively converts an S-1 statement from May into an S-3 and doesn’t necessarily indicate that a sale has begun, or will occur in the future.Shares of the Las Cruces, New Mexico-based aerospace company have surged 46% since the end of October and speculators have been betting that the stock will fall. Short interest, a measure of bearish bets on the company, has risen to almost 32% of the shares available for trading, according to data from IHS Markit Ltd.Last week, Virgin Galactic sank 17% after efforts to take tourists into space suffered a setback when a test flight was scrubbed shortly after takeoff because of a technical snag.(Updates with latest trading in first paragraph, background on the share registration in second paragraph.)For more articles like this, please visit us at bloomberg.comSubscribe now to stay ahead with the most trusted business news source.©2020 Bloomberg L.P.

22h ago - Investopedia

Why GE Will Never Break Up

GE is the oldest component of the Dow Jones Industrial Average, having joined the index in 1896. Can it continue to thrive as a conglomerate?

20h ago - Barrons.com

Things Will Get Worse From Here for AT&T Stock, Analyst Says

The analysts raised concerns over a range of issues, including whether the company will be able to keep up with rivals that have more ability to spend.

1d ago - Investor's Business Daily

Fisker's Electric SUV Moves Closer To The Assembly Line

Fisker and Magna International reached an agreement to begin the operational phase of manufacturing Fisker's Ocean SUV.

2d ago - Barrons.com

How to Invest in Bitcoin. It Can Be Easy, but Watch Out for Fees.

Around 2013, one common way to buy Bitcoin was to head to a public space like Union Square in lower Manhattan. I’m very frustrated that the SEC has not yet approved a Bitcoin ETF. Today, you can still meet a guy in a park (socially distanced, of course), or go to a Bitcoin ATM, but there are other ways to get cryptocurrencies.

19h ago - TheStreet.com

5 Low-Priced, Small-Cap Stocks That Could See Big Gains in 2021

Want to make it big in the new year? Then think small, says Real Money columnist James 'Rev Shark' DePorre.

1d ago - Benzinga

Watch Out, Elon Musk. These EV Startups Are Trying To Take On Tesla

With a $145.9 billion fortune at press time Elon Musk, the founder of the electric car manufacturer Tesla Inc (NASDAQ: TSLA), has added more than $100 billion to his net worth since January 2020. Tesla's shares have been going up, beating every analyst's expectations and common sense, while its market capitalization reached $600 billion on Dec. 7. The company is aiming to sell 500,000 battery-powered vehicles by the end of this year. Tesla's automotive products include Model 3, Model Y, Model S, and Model X. Model 3 is a four-door sedan. Model Y is a sport utility vehicle (SUV) built on the Model 3 platform. Model S is a four-door sedan. Model X is an SUV.Tesla has changed the auto industry. But it isn't the only electric car manufacturer in the global market. Some of the large, established automakers are making fully electric, and hybrid-electric cars aiming to keep Tesla at bay and are getting ready to enter the automotive industry - to take a pie out of Tesla's growing business. Lucid MotorsEstablished in 2007, electric vehicle provider Lucid Motors is based in the state of California. The company develops software for monitoring individual battery cells, mechanical packaging, and controls for battery packs in plug-in vehicles, automobiles, and aircraft. Expected to launch in early 2021, its first model, the Lucid Air price, will start at $69,000. According to Bloomberg, the customer deliveries of the Lucid Air Dream Edition will be produced at Lucid's new factory in Casa Grande, Arizona, and will begin in the spring of 2021. The manufacturer has planned to open eight showrooms by the end of this year, out of which five showrooms will be in California. Peter Rawlinson, CEO of Lucid Motors, says the company has the technology, cash, and talent to compete with Tesla, and promises to change the world by bringing new electric vehicles into the market, CNBC reports. Nikola CorpBased out of Phoenix, Arizona, Nikola Corporation (NASDAQ: NKLA) designs and plans to manufacture hydrogen-electric trucks, targeting the commercial trucking market. With the hydrogen fuel cell technology, Nikola plans to build vehicles with similar benefits to electric vehicles. The advantage, which it's counting on, is that it will take less time to recharge the vehicle and will have a longer range. The company is a manufacturer of battery-electric and electric vehicle drivetrains, vehicle components, energy storage systems, and hydrogen fueling station infrastructure.Nikola's first model Nikola Tre semi-truck, a pioneer battery-electric semi-truck for the short-haul trucking sector, will be available to customers by 2021, the company claims.The vehicle manufacturer was founded by Trevor Milton in 2015. Interestingly, he named the startup after Nikola Tesla, taking the famous inventor's first name, as the last name was already taken by Elon Musk.Recently Nikola has been in the news for all the wrong reasons, which could hinder its progress in terms of getting further investment and growth. According to short-selling firm Hindenburg Research, the company was misleading its investors about its electric vehicle technology. According to Bloomberg, The Schall law firm has announced a class-action lawsuit against Nikola in connection with false and misleading information about the company's technology. Nikola has denied the accusations and said the information was baseless. Milton resigned in September following the allegations.NIO IncNio Inc - ADR (NYSE: NIO) is a Chinese automobile manufacturer specializing in designing and developing electric vehicles.The company, which was launched in 2014, is headquartered in Shanghai. NIO is one of the top Chinese companies in the EV segment founded by a Chinese entrepreneur William Li. NIO's vehicles are large battery-powered SUVs. What makes NIO's cars different from others is its subscription purchasing model to simplify the ownership of the battery part. It offers to lease it, and if updated batteries are released, you can have them fitted in your car. It also provides a three-minute battery swap-out service, which it calls BaaS. Talking about NIO's revenue, the Q3 numbers reached $666.60 million, a 146.4% gain, by the end of September 2020. The gross profit rose 87.1% sequentially to $86.30 million. The company's stock position in the market is also noticeable as it announced the completion of the offering of 101,775,000 American depositary shares in September. The company is planning to use the net proceeds to repurchase equity interests, reports Yahoo! Finance. NIO started the deliveries of its electric SUV in 2018 and the 6-seater ES8 in 2019 in China. It officially launched the EC6 electric coupe SUV in 2019. Rivian AutomotiveCalifornia-based Rivian Automotive, founded in 2009, offers lightweight and aerodynamic platform cars, SUVs, and trucks. With investment from Amazon.com, Inc. (NASDAQ: AMZN) and Ford Motor Company (NYSE: F), Rivian is set to deliver its two electric vehicles, RT1 pickup truck and R1S SUV by mid-2021 with the price range of around $67,500, TechCrunch reported. The company has committed to 100,000 electric delivery vehicles to Amazon by 2030 as a part of the e-commerce giant's Climate Pledge. In a recent statement, Rivian has said that it will make its hands-free driver assistance system standard in every vehicle it builds. The driver assistance system will automatically steer, adjust speed, and change lanes on command. The vehicles will have a driver-monitoring system with a cabin-facing camera helping the drivers for a better driving experience. Rivian raised $2.5 billion in early 2020 to strengthen its electric vehicle market position and beat Tesla and Nikola, CNBC has reported. The company recently went through a bumpy ride, as it received criticism from Michigan auto dealers for selling vehicles directly to the customers, which Tesla has already been doing.FiskerFounded by Henrik Fisker in 2016, California-based Fisker Inc (NYSE: FSR) focuses on creating luxury plug-in hybrid electric vehicles. Fisker's first model, The Ocean, is an all-electric SUV expected to begin production in 2022. The Ocean will be available to consumers through a leasing package, optimized for driver convenience and accessibility. Its starting price is $37,499, and it has a long driving range up to 300 miles.With a focus on solid-state battery technology, Fisker aims for smaller battery packs and faster charging times.The automotive designer Henrik Fisker has been in the electric vehicles business for more than a decade. Back in 2012, Fisker designed an ultra-luxury electric car called the Fisker Karma. He later stopped the production and sold assets to a Chinese firm after its battery supplier A123 Systems filed for bankruptcy. The company plans to launch three new electronic passenger vehicles by 2025, including a sports sedan based on the EMotion concept, a sports crossover, and a pickup truck.Fisker claims it will deliver each vehicle with platforms, battery packs, and component systems.XpengHeadquartered in China, Xpeng Inc - ADR (NYSE: XPEV) is China's leading smart electric vehicle company. It designs, develops, and manufactures smart vehicles that are integrated with advanced Internet, AI, and autonomous driving technologies. In China, the Xpeng vehicles are considered to be an alternative to Tesla models. Founded in 2015, the current market valuation of the company is around $35.3 billion. In August, the company raised $1.5 billion in its IPO in the US. Xpeng has announced that it is going to implement LiDAR senses into its cars. It says it will improve its next-generation autonomous driving architecture with the vehicle's high-precision object recognition performance. New vehicles will be produced with upgraded hardware, HD cameras, millimeter-wave radars, ultrasonic sensors, Lidar, high-precision positioning, and mapping systems powered by a high-performance computing platform. Tesla sued its former engineer in 2019.for allegedly stealing the Autopilot program secrets and using them at Xpeng. The former employee later admitted to uploading its code to his iCloud.In September 2020, for the first time, Xpeng exported its vehicle outside its home country China. It entered the Norway market with G3 electric SUVs, marking the beginning of the competition with Tesla in Europe.Image: Courtesy of Lucid MotorsSee more from Benzinga * Click here for options trades from Benzinga * UK Braces For Pfizer COVID-19 Vaccine Rollout, Calls It 'Biggest Civilian Logistical' Effort(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2d ago - TechCrunch

Apple puts contract partner Wistron on probation after violence at India plant

Apple has placed its contract manufacturing partner Wistron on probation and won't give the Taiwanese firm any new business until it takes “complete corrective actions” following lapses at its southern India plant earlier this month. The iPhone maker said on Saturday that its employees and independent auditors hired by the company to investigate the issues at Wistron’s Narasapura facility found that Apple’s ‘Supplier Code of Conduct’ was violated at the facility and Wistron failed to implement proper working hour management processes.

6h ago - Benzinga

12 Emerging Technologies To Watch In 2021

Technology stocks have historically led market rallies, and this year has been no exception. The Technology Select Sector SPDR Fund (NYSE: XLK) has advanced about 40% year-to-date, with stocks levered to remote work and study making strong upward moves.As an unusual year draws to a close, here are 12 key technologies compiled by Lux Research that will likely be in the spotlight in 2021.Autonomous Vehicles: Increasing levels of vehicle automation, especially Level 4 and 5 autonomous vehicles, will eventually remove the need for a driver in consumer and commercial vehicles, Lux Research said.Investors can tap into emerging opportunities in areas such as sensors and connectivity for autonomous vehicles, the report said.Some beneficiaries could be lidar solution providers such as Veoneer Inc (NYSE: VNE), ON Semiconductor Corp (NASDAQ: ON), NXP Semiconductors NV (NASDAQ: NXPI), Autoliv Inc. (NYSE: ALV), Texas Instruments Incorporated (NASDAQ: TXN) and NVIDIA Corporation (NASDAQ: NVDA). Natural Language Processing: This is the branch of artificial intelligence that helps computers understand, interpret and manipulate human language. Patents related to this technology, which powers devices such as voice assistants, machine translation and chatbots, have increased at a compounded annual growth rate of 44% annually over the last five years, Lux Research said.Some of the key players in the segment include Apple Inc (NASDAQ: AAPL), Alphabet Inc (NASDAQ: GOOGL), Amazon.com, Inc.'s (NASDAQ: AMZN) AWS, Hewlett Packard Enterprise Co (NYSE: HPE), Intel Corporation (NASDAQ: INTC), IBM (NYSE: IBM), Microsoft Corporation (NASDAQ: MSFT), Adobe Inc (NASDAQ: ADBE) and 3M Co (NYSE: MMM).Plastic Recycling: This comprises of innovations that convert plastic waste into a variety of valuable products, serving the dual purpose of enabling a circular economy and avoiding pollution, Lux Research said.In the last decade, 155 star-ups addressing plastic waste have been founded, the report said. Stocks to play the trend include Loop Industries Inc (NASDAQ: LOOP).AI-Enabled Sensors: AI techniques such as machine learning have provided methods to analyze and derive insight from sensor data, unlocking new sensor capabilities and applications, Lux Research said. This is being used in computer vision for analyzing image sensor data.The firm also sees other sensor types such as mechanical, acoustic and even thermal sensors as being impacted by AI tools.Bioinformatics: This is the application of computer technology to the understanding and effective use of biological and clinical data. Key applications of this technology include diagnostics, discovery, personalization, quality and optimization, risk assessment and safety and traceability.Roche Holdings AG Basel ADR Common Stock (OTC: RHHBY), Bio-Rad Laboratories, Inc. Class A Common Stock (NYSE: BIO) and Irhythm Technologies Inc (NASDAQ: IRTC) are among the bioinformatics plays.Green Hydrogen: This technology is focused on producing clean hydrogen for energy, mobility and industrial uses.Plug Power Inc (NASDAQ: PLUG), Bloom Energy Corp (NYSE: BE) and TM Power plc (OTC: ITMPF) are green hydrogen stocks to capitalize on this emerging trend.Shared Mobility: Shared mobility is an innovative transportation strategy that allows users to gain short-term access to transportation modes on an as-needed basis.The includes various forms of carsharing, bikesharing, ridesharing and on-demand ride services.Shared mobility, according to Lux Research, is poised to disrupt the multibillion-dollar auto industry."Self-driving cars, zero-emission vehicles, connectivity, and innovative materials are defining the future of mobility," the report said.Ride-hailing companies such as Uber Technologies Inc (NYSE: UBER), and LYFT Inc (NASDAQ: LYFT), robotaxi services such as Google's Waymo, Amazon's Zoox, Baidu Inc's (NASDAQ: BIDU) Apollo and electric vehicle stocks are avenues of staying invested in this promising arena.Related Link: How Technology, COVID-19 Are Changing Financial Planning Alternate Proteins: Demand for alternative proteins have been on the rise, supported by factors such as consumer preferences and supply and environmental concerns, according to Lux Research. Alternative proteins are sourced from plants, insects, fungi or through tissue culture to replace conventional animal-based protein. This trend should work in favor of plant meat companies such as Beyond Meat Inc (NASDAQ: BYND).3D Printing: 3D printing is an additive process in which aan object is created by laying down successive layers of material.It is used in industries such as automotive, aviation, construction, consumer products and health care. Some of the listed 3D companies are HP Inc (NYSE: HPQ), Proto Labs Inc (NYSE: PRLB), Materialise NV (NASDAQ: MTLS), Organovo Holdings Inc (NASDAQ: ONVO), Stratasys Ltd (NASDAQ: SSYS) and 3D Systems Corporation (NYSE: DDD).Materials Informatics: It is a field of study that applies the principles of informatics to material science and engineering to better understand the use, selection, development and discovery of materials.Precision Agriculture: It is an approach to farm management that uses information technology to ensure that crops and soil receive exactly what they need for optimum health and productivity with an objective of ensuring profitability, sustainability and protection of the environment.Synthetic Biology: Synthetic Biology combines engineering principles and molecular biology techniques to produce novel biological solutions.This multidisciplinary field brings together engineers and biologists, who are developing these solutions for useful purposes, across numerous areas including diagnostics, therapeutics, manufacturing and agriculture.Twist Bioscience Corp (NASDAQ: TWST), Thermo Fisher Scientific Inc. (NYSE: TMO), Bristol-Myers Squibb Co (NYSE: BMY), Amyris Inc (NASDAQ: AMRS) and Codexis, Inc. (NASDAQ: CDXS) are among the companies that are working on this technology.Related Link: Tech Industry Vets At engin sciences Use AI To Fix Cannabis's Big Problem See more from Benzinga * Click here for options trades from Benzinga * Newly Listed Scopus Biopharma Soars Over 500%: What Investors Need to Know * Novavax Clinches 10.7M-Dose Coronavirus Vaccine Supply Deal With New Zealand(C) 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK