The Nasdaq is in an A.I.-led bubble

source link: https://www.philoinvestor.com/p/downside-at-nvidia-and-the-nasdaq

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Downside at NVIDIA (and the Nasdaq at large)

No, A.I. isn't a fad, but so what?

“Before we work on artificial intelligence why don’t we do something about natural stupidity?”

—Steve Polyak

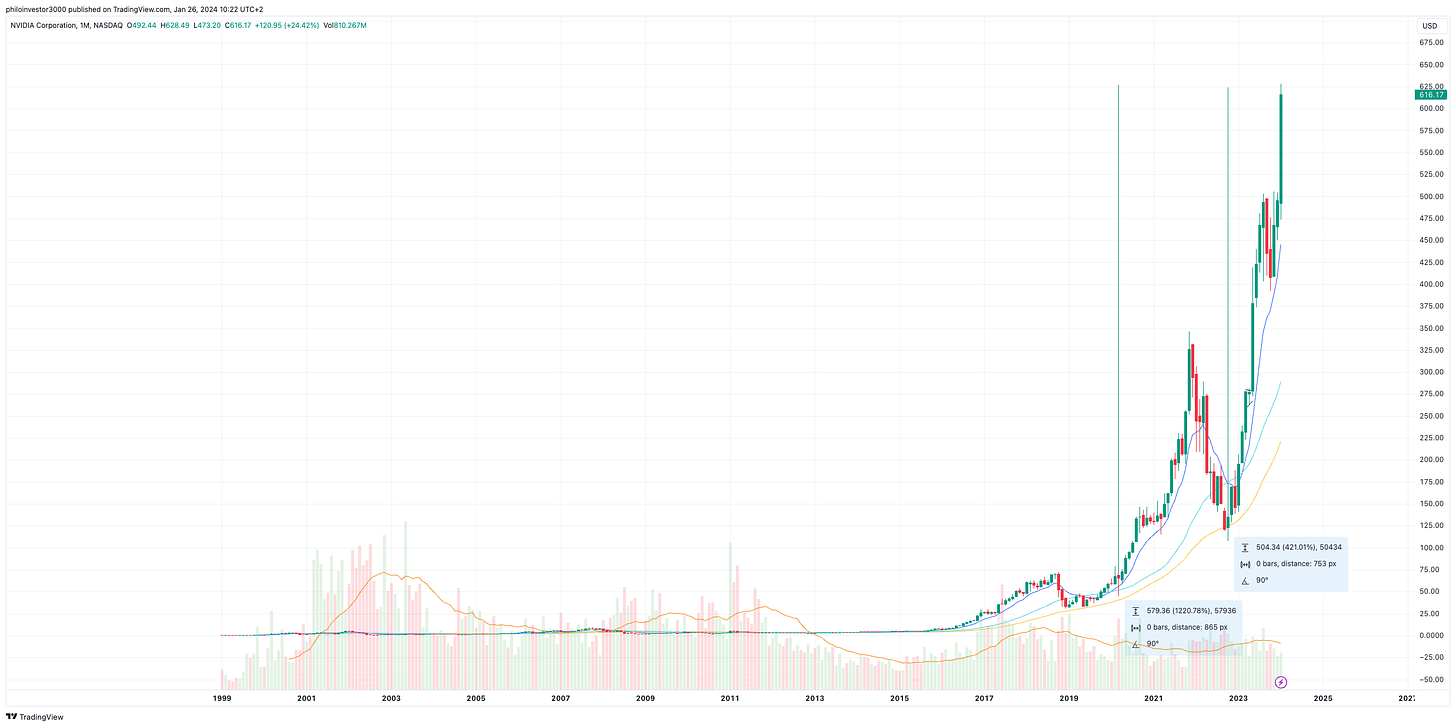

You don’t need to be an expert in semiconductors or A.I. to know that something is not quite right with the Nvidia valuation. As of yesterday’s market close, Nvidia was selling for a market cap of $1.5 trillion, up 420% since October 2022. Trailing twelve months (TTM), Nvidia EPS (earnings per shares) was $7.58 and the share price now sits at $616.

This means that NVIDIA stock is selling for 81 times TTM earnings…

Sure, one may say that the company has a lot of future growth and the valuation is “fair” — but is it really? Let’s have a look.

In the past decade, EPS went from $0.20 to $7.58 (a 38X!), but the share price did a 168X in the same time period.

Therefore, a simple calculation tells us that the share price increased 4.4 times faster than the bottom line. Prima facie, it doesn’t exactly look like a bargain, right?

So, what caused this massive explosion in earnings? 🚀

—> An insatiable demand for semiconductors to be used in gaming, cryptocurrency mining, A.I. applications, high-performance computing etc. NVIDIA is the main beneficiary of this A.I. or semiconductor boom, and its share price and bottom line shows it.

Enter Chat GPT

The launch of Chat GPT basically made A.I. applications available to the masses, like us.

And with that event, markets started to get high on A.I., stock valuations be damned!

In fact, NVIDIA stock was down 67% in just one year, until the launch of Chat GPT in November of 2022. Since then, the stock is up 420%.

The launch of Chat GPT did precipitate a massive turn by VC investments into AI startups for sure, and those startups use their VC-funded cash to buy GPUs —> causing a spike in GPU demand.

SEMIS ARE CYCLICAL ⭕️ ⭕️ ⭕️

In fact, before the Chat GPT boom, Nvidia had trouble selling its chips. This is from August 2022.

Nvidia had built too many GPUs, and started price discounting to get rid of its excess inventory. Remember that share price of 67%?

Semis may be cyclical, but the industry is now in an uptick.

The AI hype train isn’t just any old train, it’s a high-speed bullet train!

Enter the AI hype train…

See below a 10-year chart of NVIDIA’s EPS and stock price moves.

AI investment is booming. How much is hype?

This article from CNN business gives strong indications that there is a massive hype (bubble?) in AI investments — with industry sources even commenting on how many Crypto funds pivoted to AI.

The point is…the funding raised by these startups is what’s causing the explosive earnings in Nvidia (and others)..causing one to ponder:

“Are these explosive earnings for Nvidia an aberration? Has it gone too far? Will demand for GPUs taper down after all these new AI startups buy the chips they need? Isn’t GPU life span 5 to 7 years?…Even if growth stays relatively high for the next decade, why am I paying almost 100 times earnings for this?!”

One simple chart shows the explosive flow of VC money into Generative AI startups — a 5X since last year, no wonder semiconductor earnings are booming!

From the same CNN article:

The release of ChatGPT to the public in November was the catalyst for the current buzz, according to Moyroud at Lightspeed. He has seen an increasing number of founders mention generative AI in their pitches for funding — but he takes some of those pitches with a pinch of salt.

“We’ve [seen] some people that haven’t necessarily spent a lot of time in the industry and are adding — if you could say so — a bit of generative AI sparkle” to their pitches, Moyroud said, noting that it takes time to tease out the “substance” behind some founders’ claims.

The Microsoft Involvement

Microsoft first invested in Open AI in 2019, with a $1 billion cash infusion. But since the launch of Chat GPT and the boom around A.I. applications, Microsoft wanted to tighten its grip around Sam Altman and Open AI.

In January of ‘23, Microsoft and Open AI announced an extension of their partnership and a further investment into Open AI of $10 billion.

Microsoft is competing in the Cloud space with Amazon, Google et al., and they want to have the best AI capabilities for not only their Cloud offering (Azure) but all their spectrum of products.

That’s all well and good I guess, but what does the $10 billion investment entail?

Semafor, quoting industry sources, has reported that only a fraction of that investment has been wired to Open AI and the rest is in the form of cloud compute purchases…

Reflexive Bubble

So you’re telling me Microsoft invested $10 billion dollars into Open AI, of which only a fraction is in cash and the rest is in credits exchangeable with Microsoft services, that MICROSOFT will most probably recognise as revenue, adding 7 or 8bln dollars in Cloud segment revenues by the time that Open AI uses it all?

Which means Microsoft (9% of the Nasdaq 100), is using its cash and services to power an AI company which touched $1.6billion in ARR for 2023 but is raising money at a $100 billion valuation.. (raising money at >50X non-profitable sales)

And that same AI company is buying GPUs from NVIDIA (4.3% of the Nasdaq 100),to power its non-profit making activities, while leading the pack into an across the board VC-led investment frenzy into other AI-related companies that also need funding and also need GPUs?

And NVIDIA is selling for 100X Chat GPT-pumped-up earnings while Microsoft is selling for 42X earnings?

I think this warrants further research on my part and I will start working on a piece that will assess whether the NASDAQ (primarily) and hence passive investing as a whole is in a tech and AI-infused reflexive bubble.

The article will be made available to subscribers only.

Further Reading

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK