Microsoft Plans to Contest IRS Claim It Owes $28.9 Billion in Back Taxes

source link: https://finance.yahoo.com/news/microsoft-plans-contest-irs-claim-203611158.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Microsoft Plans to Contest IRS Claim It Owes $28.9 Billion in Back Taxes

(Bloomberg) -- Microsoft Corp. will appeal a decision by the US Internal Revenue Service that the software maker owes at least $28.9 billion in taxes related to how it allocated income and expenses among global subsidiaries from 2004 to 2013.

Most Read from Bloomberg

The company said Wednesday in a regulatory filing that it disagreed with the “notices of proposed adjustment” to its federal tax filings and will appeal the decision.

The dispute centers on a 2012 IRS audit into transfer pricing, a method used by companies to shift profits to tax havens and avoid the US corporate tax rate. At the time, Microsoft had been moving billions of dollars in profits to such jurisdictions as Puerto Rico, a US territory that levies a much lower corporate rate.

The company has changed its corporate structure and practices since the years covered by the audit, so the issues raised by the IRS aren’t relevant to the way income is recorded currently, Daniel Goff, a Microsoft vice president, said in a blog post.

Goff wrote that Microsoft has been working with the IRS for almost a decade to address questions about how the company allocates income and expenses for tax purposes. The Redmond, Washington-based company said the proposed additional tax bill of $28.9 billion doesn’t include taxes paid under the Tax Cuts and Jobs Act of 2017, which could reduce the tally by as much as $10 billion.

“We strongly believe we have acted in accordance with IRS rules and regulations and that our position is supported by case law,” Goff said in the post. “We welcome the IRS’s conclusion of its audit phase which will provide us with the opportunity to work through these issues at IRS Appeals, a separate division of the IRS charged with resolving tax disputes.”

Zacks

ZacksMicrosoft (MSFT) May Contest IRS Claim of $28.9B in Back Taxes

Microsoft (MSFT) receives a tax notice from the U.S. Internal Revenue Service requesting the added payment of $28.9 billion in relation to its 2004 to 2013 tax years.

5h ago Fox Business

Fox BusinessMicrosoft discloses IRS says the tech giant owes nearly $29 billion in unpaid taxes

Microsoft just disclosed that the Internal Revenue Service (IRS) has asked for a hefty sum of taxes that it believes the tech company has not paid. The total was $28.9 billion.

21h ago

Emerson Closes NI Acquisition, Creates New Test & Measurement Segment

The deal will help Emerson capitalize on key trends, like nearshoring, digital transformation and sustainability.

23h ago Bloomberg

BloombergCFTC Sues Former CEO of Bankrupt Crypto Lender Voyager

(Bloomberg) -- The co-founder and former chief executive officer of Voyager Digital Ltd. broke derivatives rules while at the helm of the crypto lender, leading to its bankruptcy and $1.7 billion in customer losses, US regulators alleged Thursday. Most Read from BloombergIsrael Latest: France’s Macron Voices Full Support for IsraelIsrael Latest: Hamas Leaders Targeted as Ground War LoomsApollo CEO Marc Rowan Demands UPenn Leaders Quit Over ‘Antisemitism’Stocks Drop as CPI, Weak Bond Auction Lift

2h ago Zacks

ZacksQualcomm (QCOM) Stock Falls Amid Market Uptick: What Investors Need to Know

The latest trading day saw Qualcomm (QCOM) settling at $111.12, representing a -1.06% change from its previous close.

23h ago Reuters

ReutersTesla to offer German workers pay rise this year

Tesla said on Thursday it will offer a pay rise to workers at its German plant, where unions have said they earn below the industry average. The U.S. electric vehicle maker said it will inform staff in November of the level of the pay rise, adding it raised wages by 6% last year. Tesla, unlike other carmakers in Germany, does not have a collective bargaining agreement governing wages.

2h ago Zacks

ZacksIs a Surprise Coming for Bank of America (BAC) This Earnings Season??

Bank of America (BAC) is seeing favorable earnings estimate revision activity and has a positive Zacks Earnings ESP heading into earnings season.

8h ago Reuters

ReutersBirkenstock's stock loses footing in second day on Wall Street

In its first session on Wall Street on Wednesday, Birkenstock tumbled over 12% from the $46 price set in its initial public offer, raising $1.48 billion. It had aimed to price the IPO for as much as $49 a share. Last trading at about $37.79 on Thursday, the stock has now dropped 18% from its IPO price.

2h ago Reuters

ReutersAnalysis-US stock market technicals suggest possible rebound as earnings, CPI loom

Technical and seasonal indicators that investors use to gauge the U.S. stock market's health show it may be time to buy, though upcoming inflation data and the third-quarter earnings season could still throw Wall Street a curveball. The S&P 500 has slid about 5% since reaching its late-July high, but so far this month the benchmark index has rebounded. Technical analysts see a case for the rally to continue, pointing to indicators showing stocks may be oversold and historical evidence showing year-end is typically a strong period for equities.

1d ago Fortune

FortuneWith Israel and Gaza at war, there’s no smoking gun pointing to Iran yet, but that doesn’t stop some from seeing it

The worst fighting in Israel in at least 50 years led to speculation Iran was backing Hamas, but it’s not visible so far in the fog of war.

1d ago The Telegraph

The TelegraphUS refuses to rule out tougher sanctions on Iran following ‘barbaric’ Hamas attack on Israel

The US could impose additional sanctions against Iran in the wake of a deadly Hamas terrorist attack in Israel, the country’s Treasury Secretary has said.

1d ago Bloomberg

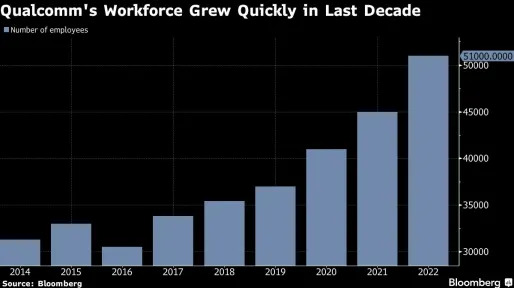

BloombergQualcomm Cuts Jobs in California in Pledge to Reduce Costs

(Bloomberg) -- Qualcomm Inc., the largest maker of chips that run smartphones, is reducing its workforce to cope with lackluster demand for its main product. Most Read from BloombergIsrael Latest: France’s Macron Voices Full Support for IsraelIsrael Latest: Hamas Leaders Targeted as Ground War LoomsApollo CEO Marc Rowan Demands UPenn Leaders Quit Over ‘Antisemitism’Stocks Drop as CPI, Weak Bond Auction Lift Yields: Markets WrapGhost in the Machine: How Fake Parts Infiltrated Airline FleetsThe co

1h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK