Capitalism Onchained

source link: https://www.notboring.co/p/capitalism-onchained

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Capitalism Onchained

What is the ideal state of crypto?

Welcome to the 645 newly Not Boring people who have joined us since last Tuesday! If you haven’t subscribed, join 211,724 smart, curious folks by subscribing here:

Today’s Not Boring is brought to you by... Tegus

You know you’re a smart investor. Tegus is here to make you even smarter.

Tegus gives you valuable primary research and call transcripts — collected, curated, and distilled for easy access. With full transcripts of earnings calls plus financial models and easy-to-cite SEC data, you can make bold, high-yield investment decisions with confidence.

And the stakes just got a little lower – you can trial Tegus for free today.

Hi friends 👋,

Happy Tuesday and welcome back to Not Boring! Hope your Falls are fantastic.

I haven’t written about crypto for a minute, and a bunch of people have asked me whether it’s because I’m less excited about it now than I was before.

While I’ve spent more time writing about atoms-based companies and exponential curves over the past few months, doing so has actually helped me see crypto’s potential more clearly. If we want to accelerate, we’re going to need capitalism to keep up, and I think crypto is uniquely positioned to make that happen.

Let’s get to it.

Capitalism Onchained

Any technology that is sufficiently valuable in its ideal state will eventually reach that ideal state.

By ideal state, I mean the imagined end goal or highest potential that technology could achieve if all the kinks were worked out and it was deployed ubiquitously.

Understanding the ideal state is maybe the most important thing to do early in the life of a technology, because if that ideal state represents enough value to enough people, the kinks will be worked out and the technology will be deployed ubiquitously.

Boom and bust cycles for such technologies are useful noise. The booms are useful for attracting resources. The busts are useful for regrouping, fixing problems, and mapping the next leg.

Through any market cycle, the promise of the ideal state acts like a magnet, attracting new researchers, entrepreneurs, and investors to improve upon the work of those who’ve failed to reach it. If you believe the ideal state is possible, then you chalk up previous failures to poor timing or implementation and keep trying new approaches.

AI, AV, and AR/VR are three technologies that wandered through the desert burning billions of dollars for decades and now look to be breaking out. It’s capitalism: if the opportunity is big enough if it works, ambitious people will continue to try to figure out how to make it work. These dreams can’t die, even if thousands of dreamers do on the way.

Recently, there have been fresh calls that crypto is dead. Prices are down, activity is down, people are leaving. I get it. It’s been brutal, and even worse, boring. But I’m more convinced now, as of two weeks ago, that crypto is one of those dreams that can’t die.

As soon as I hit send on I, Exponential, an ode to capitalism, it snapped into place for me.

Crypto’s ideal state is to make capitalism more effective.

That’s a big claim that risks being overly grandiose. Crypto isn’t short on grandiose claims. So I’ll be as specific as possible, laying out my thinking in two parts:

Capitalism is good and capitalism evolves.

How crypto can make capitalism more effective.

Capitalism is Good and Capitalism Evolves

Capitalism works by incentivizing people to act in their own self-interest and making it as easy as possible to do so.

Unlike a centrally planned system like socialism, which trusts that a planning body knows both the problems to work on and the ideal solutions to those problems, capitalism works by letting anyone bring their best solution to whatever problem they see in the market. Many will fail, some will succeed wildly.

This is a core tenet of capitalism: that incentivizing entrepreneurship and increasing the variance of inputs leads to better outcomes.

To believe my argument that making capitalism more effective would make crypto sufficiently valuable, we need to agree on the two premises: capitalism is good and capitalism evolves.

Capitalism is good.

I doubt many socialists read Not Boring at this point, so I’ll keep this section short.

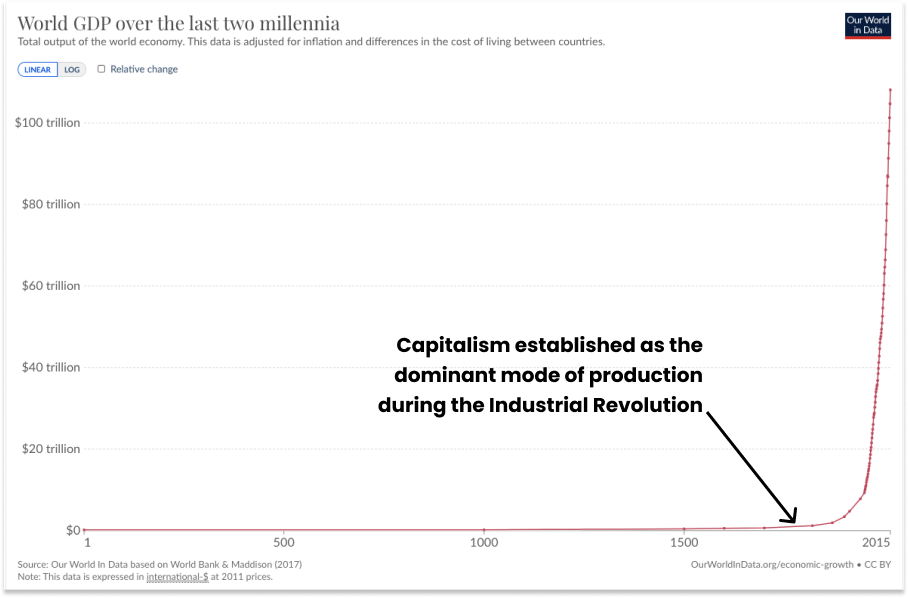

The invisible hand produces modern miracles by invisibly coordinating the actions of billions of self-interested people. Progress improves the living standards and quality of life for billions of people around the world, as seen in the World GDP over the last two centuries (capitalism started in earnest in the 18th century).

Not only has GDP per capita improved, as Robert Zubrin point out, it has “risen in proportion to the size of the population cubed.” What Malthus got wrong is that under capitalism, more people aren’t a drain on resources; more people, each able to contribute his or her best efforts or ideas, are the resources.

I could go on, but if you’re still on the fence, read I, Exponential.

Capitalism is good. But capitalism is not perfect. Luckily, capitalism evolves.

Capitalism evolves.

It’s easy to think of capitalism as a static system that enables the evolution of the goods and services available to humanity, but capitalism itself evolves, too.

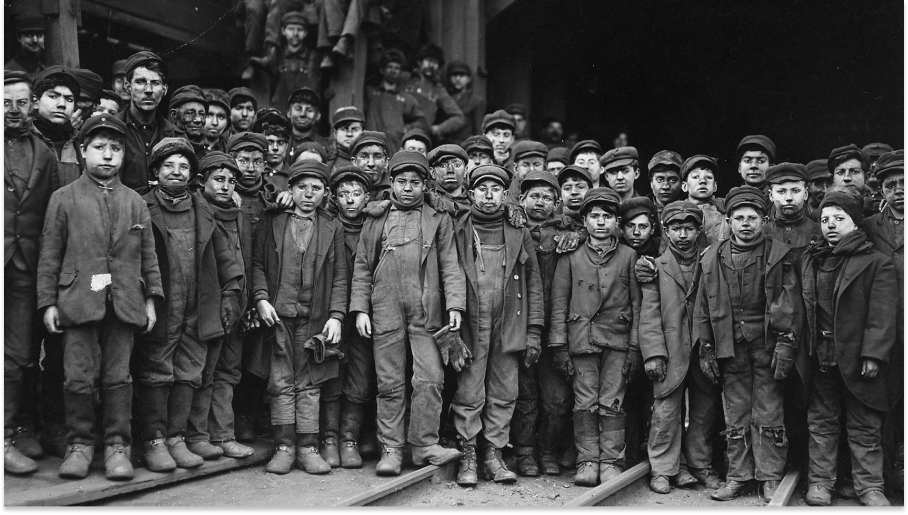

Consider the Industrial Revolution. Wonderful results. Just look at that GDP chart! But it was also brutal. Among many issues, children as young as five or six worked twelve to sixteen hours a day, often seven days a week, in conditions unsafe for workers of any age.

Today, it is still better to own the means of production than to operate them, but the efforts of labor unions, journalists, regulators, and even progressive businesses responding to market forces have contributed to a vast improvement in worker’s conditions. Henry Ford, for example, implemented a five-day, 40-hour workweek in 1926 not out of benevolence, but to test his theory that reducing hours would improve worker morale and productivity.

Or consider the way ambitious technology businesses are financed. Prior to the 1950s, in order to develop and scale a new technology, you’d either need to have been rich enough to fund it yourself, convince a bank to give you a loan, or build inside of an existing company. That constrained who could create what and how. When Sherman Fairchild wrote a $1.4 million check to the “Traitorous Eight” to form Fairchild Semiconductor, a new funding model was born.

Adventure capital or liberation capital, now known as venture capital, ignited the tech industry as we know it today. As Sebastian Mallaby writes in his excellent book, The Power Law, “By freeing talent to convert ideas into products, and by marrying unconventional experiments with hard commercial targets, this distinctive form of finance fostered the business culture that made the Valley so fertile.”

The exponential curves I included in I, Exponential wouldn’t have been possible without capitalism, but they also wouldn’t have been possible without the evolved form of capitalism that includes venture capital.

I don’t believe that we’ve reached the end of history or the end of capitalism.

I think crypto can make capitalism more effective.

How Crypto Can Make Capitalism More Effective

What makes capitalism more effective?

As the two examples above show, capitalism doesn’t evolve along a single axis. Improved working conditions and new funding models both made capitalism more effective.

Crypto could potentially improve capitalism along a number of different axes. I asked Anthropic’s AI, Claude, what ideal capitalism would look like, and it told me that while economists don’t agree on an answer, there are some basic principles that would apply:

Strong property rights and contract enforcement.

Free markets with prices set by supply and demand.

Low barriers to starting a business.

Healthy competition among firms with low concentration of power.

Open trade and capital flow between nations.

Democratic processes that reflect popular input and interests.

Equality of opportunity regardless of identity or background.

Alignment of business interests with long-term societal welfare.

Limited regulation focused on correcting market failures and protecting rights.

Sufficient government revenue to fund public goods like infrastructure, education, basic research, and a social safety net to moderate capitalism’s structural challenges.

We can quibble with specifics, but it’s close enough. And what’s striking to me is that the first seven read like a list of crypto’s ideal-world features.

Crypto strengthens digital property rights and features smart contracts that self-enforce.

Right now, I can find the current price for HarryPotterObamaSonic10Inu or a jpeg of a monkey, based purely on supply and demand.

Composability, open source code, and shared infrastructure make it relatively easy to spin up a new app and begin collecting payments.

Competition forces protocols to be minimally extractive.

Crypto is a 24/7, global marketplace with users and developers around the world.

Decentralized protocols rely on the governance of their holders.

The most popular new app in crypto was built by anonymous developers.

If you’re reading closely, you’ll notice that not all of these have, uhhh, reached their ideal state.

HarryPotterObamaSonic10Inu is a shitcoin; who cares if you can find the price and trade it right now?

Governance has certainly not been figured out; voter turnout is anemic, and votes are susceptible to domination by whales.

We can debate whether friend.tech is good, bad, or neutral, but that it’s the most popular new app the space has to show for all of the money and effort poured in so far is not cause for celebration.

But in the midst of all of the chaos, there are signs of progress towards the ideal state. There are a few avenues I find particularly compelling.

First, if you take the internet seriously, and I do, then giving digital assets physical properties, like property rights, is a big deal.

I wrote about the need for crypto in giving people control over their personal AI models, for example, an idea that seems strange now but won’t pretty soon. It’s one thing to have the @x handle taken from you, it’s another to have your girlfriend taken from you.

Computers that can make commitments are even more important if you’re building a company. Just as entrepreneurial activity in a society is shaped by the property rights structure, giving digital entrepreneurs guarantees that a protocol can’t revoke their access or throttle their distribution should encourage more entrepreneurial activity and investment.

There are early signs in the companies building onchain – on L1s like Ethereum and Solana, L2s like Base, Optimism, and zkSync Eras, and on protocols like Farcaster – although performance will have to improve on a number of dimensions – cost, speed, security, UX – before onchain becomes the default. The fact that protocols can incentivize developers to build on top of them and align incentives long-term through protocol token ownership, an idea I wrote about in Small Apps, Growing Protocols, should accelerate that transition when the performance trade-offs fade.

Digital property rights uniquely guaranteed by blockchains have the potential to increase entrepreneurial activity online in the same way physical property rights do offline. Incentivizing entrepreneurship and increasing the variance of inputs leads to better outcomes. Or as Chamath would say, “Some will work, some won’t, but always learning.”

Second, crypto can create global free markets based on supply and demand more easily than any other technology or platform to date, even for things that don’t exist.

Crypto provides the opportunity to apply free markets to nearly anything. Decentralized exchanges like Uniswap are the first products that allow anyone to list any digital asset, provide initial liquidity, and create a market without an intermediary.

To be sure, the vast majority of the stuff that trades on crypto markets today is garbage – 99% or more of all tokens and NFTs ever created will be practically worthless – but the noisiness is a feature, not a bug. 99% or more of all websites on the internet are garbage. 99% or more of the ideas people have about what company to build, how to explain natural phenomena, or how to engineer the next big technology have been garbage. Capitalism works because it allows the less than 1% of really great ones to emerge.

Molecule is one of my favorite examples of new free market creation onchain. It’s using what it calls IP-NFTs to fund scientific research by bringing “rights to IP and R&D data on-chain, unifying the legal rights, data access, and economics around research projects into cryptographic tokens on Ethereum.” It’s funded research into longevity, hair regrowth, autophagy, and Alzheimer’s.

Importantly, Molecule’s potential is to move the impact of free markets down to the research level so that scientists can research what the market finds important, even if their university or publications don’t.

Onchain, it’s possible to create free markets for even less obvious assets, like ideas. I love Jacob Horne’s idea of Prophecy Markets and played around with my own idea for Startup Prophecies. You could imagine letting people stake their ETH on ideas that they want to see built, providing price signal before the entrepreneur decides to take the leap. PartyDAO’s John Palmer is playing around with a toy model of this with Idea Guy Summer: buy an NFT to join the DAO, propose ideas, holders vote on them, the ones with enough votes execute, all ETH must be spent by the last day of summer (September 23rd). Right now, people are proposing things like buying NFTs and swapping ETH for USDC, but as more of the economy moves onchain, the ideas can become more substantial.

Allowing any arbitrary digital asset to find a free market based on supply and demand is likely useful in unpredictable ways, but what would be predictably useful would be to bring existing assets onchain. That’s starting to happen.

Third, real-world assets are coming onchain, which could lower the cost of capital for businesses and projects, increase liquidity by tapping into 24/7 global markets, and lower barriers to starting a business.

This is the big potential unlock, and I think it’s how crypto can most obviously make capitalism more effective. Capitalism is more efficient when capital can more easily find the right opportunity, frictionlessly and with as few transaction fees as possible. When funding flows freely to the most promising businesses, products, or ideas, productivity and progress are maximized. Frictionless movement of capital allows it to be redeployed rapidly as new opportunities emerge, meaning less deadweight loss as capital languishes. Lower transaction fees mean more capital for value-generating activities instead of being extracted by middlemen.

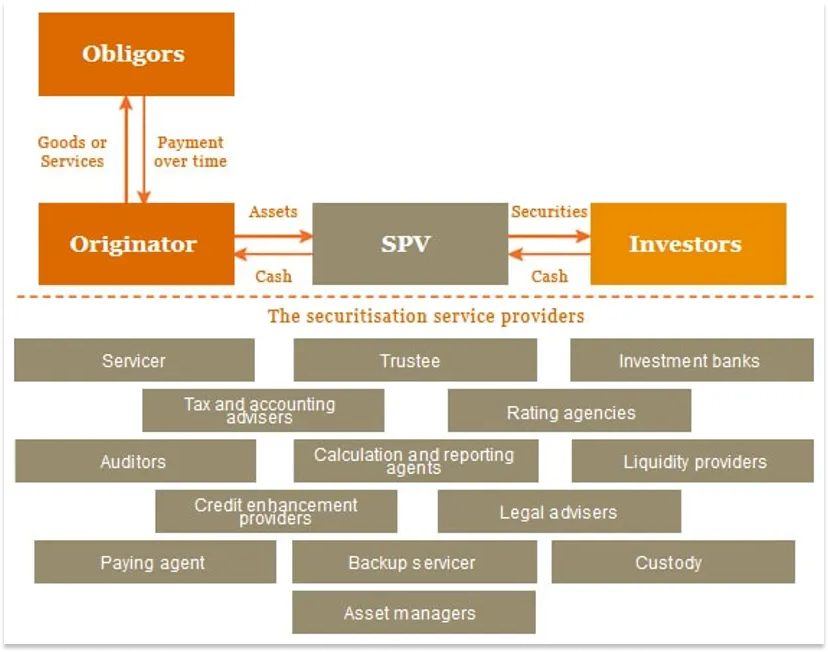

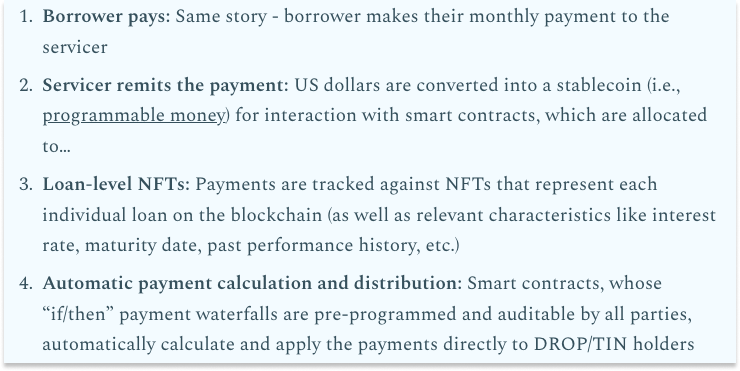

In a Not Boring guest post, Everything is Broken, Blocktower’s Kevin Miao explained his excitement about moving securitization onchain. Real-World Asset (“RWA”) DeFi protocol Centrifuge turns the traditional nine-step monthly flow of funds for a securitization, involving 14 parties…

… into a four-step process managed by code:

He points out that not only does the streamlined process shave basis points of the cost of capital - “at the scale of our $14 trillion securitization market, even a 25bps efficiency gain amounts to $35 billion a year back in borrower’s pockets” – building on a credibly neutral, public, and open blockchain means that developers can compete to provide value-added services on top of Centrifuge.

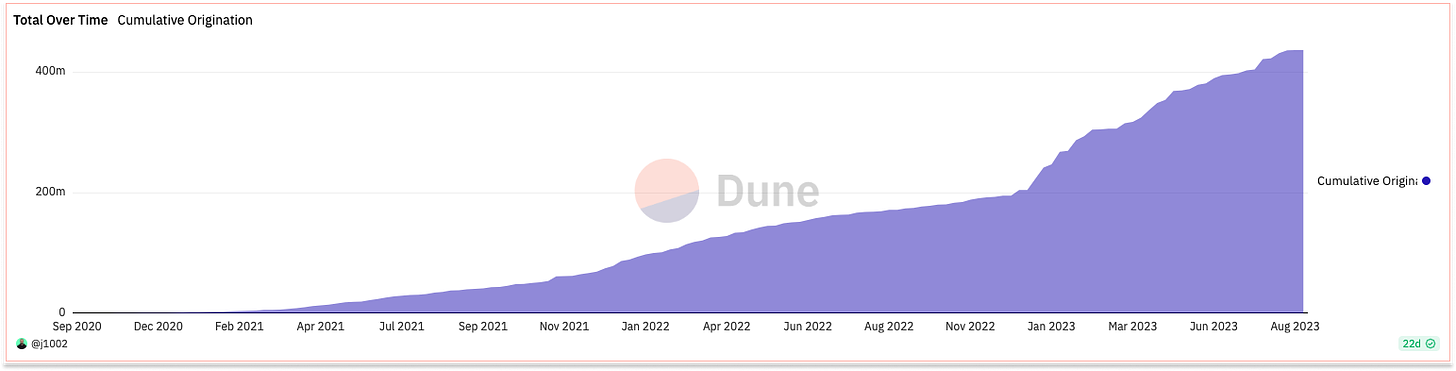

Despite the bear market, Centrifuge has more than doubled its cumulative origination in 2023 to $436 million. Small potatoes against the total securitization market, but growing quickly.

RWA DeFi may have an even larger impact on markets that have traditionally suffered from a lack of liquidity and accessibility.

Goldfinch and Jia (a Not Boring Capital portfolio company) offer loans to small businesses around the world. My sister works in SME lending in Africa, so I’ve heard horror stories of the extractive rates businesses have to pay to access capital – sometimes up to 12% monthly interest. Both Goldfinch and Jia allow these small businesses to access global liquidity, and a much cheaper cost of capital, onchain, and back the loans with assets and income off-chain. Over time, as they repay on-time, they can let small businesses build up onchain credit scores and access lower rates. Jia even rewards borrowers, and those who vouch for them, with an ownership stake in Jia’s long-term growth, which it believes will lead to better borrowing behavior.

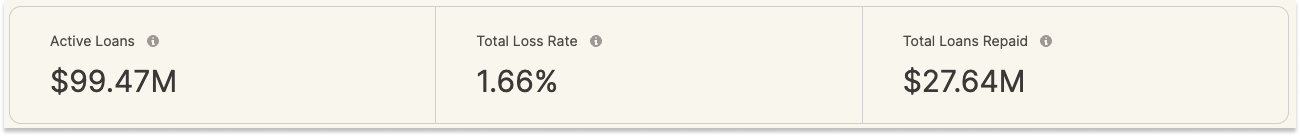

Jia just launched its first pools this summer in Kenya and the Philippines, and is already seeing strong early results. Goldfinch, which started lending in December 2020, has $100 million in outstanding loans, with a 1.66% loss rate after suffering its first loss this summer, and has already had $27.6 million repaid.

Back at home, another project that’s caught my eye is Plural Energy, which lets people invest in solar fields, wind farms, and battery storage projects with as little as $10 as opposed to typical $50k minimums. Plural is focusing on small and medium-sized projects that struggle with a lack of liquidity – they’re too small for traditional infrastructure investors – and long, complex underwriting processes, driving up project developers’ cost of capital to as high as 30%.

By filing with the SEC under Reg A+, Plural can tokenize equity in the projects and use that equity as a wedge into DeFi. Over time, since developers will hold equity in their projects onchain in the form of tokens, they’ll be able to borrow against that equity onchain for things like construction loans at a lower cost of capital than they can find off-chain.

Those are just a few examples of RWA DeFi projects that are building onchain to remove friction, increase liquidity, and lower the cost of capital. They’re early signs of the opportunity to help global capital find the right opportunities and grease the wheels of capitalism.

Over time, I expect to see more types of projects and assets come onchain. In the ideal state, capital can flow into and out of opportunities at the speed of the internet, making capitalism more efficient in the process.

Regulation is still a big bottleneck here. It’s complicated to bring assets that represent something like shares in a company onchain, particularly in the United States, but with time, I the size of the opportunity should pressure regulators into establishing sensible regulation. Big players like Visa and JP Morgan both announced onchain settlement products in the past week, Blackrock and others have applied for Bitcoin and Ethereum ETFs. As large institutions continue to see the opportunity to lower costs and increase liquidity, I expect they’ll bring their lobbying efforts to bear.

The early signs of crypto’s ideal state – making capitalism more effective – are there. Crypto can provide property rights to developers, encouraging more people to experiment and start businesses and increasing the variance that is the lifeblood of capitalism. It can create free markets for anything, from files to tokens to ideas. And it’s beginning to bring real world assets onchain, enabling capital to flow more freely to the right opportunities and lowering the barriers to starting a business.

The signs are there, even if they’re hidden by the bear market.

We’re Still So Early

Let’s be honest: crypto in reality has yet to meet crypto’s on-paper promise. There are bright spots, but they’re often overwhelmed by the bad actors, scams, bots, pumps, and dumps.

I’ve spent a lot of time in Not Boring trying to explain what crypto has built to date – talking about the “real use cases” (see: here and here) – but the more I’ve thought about it, the less I think that matters, for now.

Crypto’s lack of broad usefulness is to be expected at this point in the game. “We’re so early!” is oft-repeated and kind of cope, but I think it also happens to be true.

Ethereum launched less than a decade ago. It’s the newest major technology platform we have – AI has been under development for nearly seven decades, VR traces its roots back to Headsight and Sensorama in the 1960s – and even sci-fi authors barely anticipated it. Something like Bitcoin first appeared as Electronic Cash in Bruce Sterling’s 1994 Heavy Weather. Smart contracts didn’t really show up until Charles Stross’ Accelerando in 2005 and Daniel Suarez’s Daemon in 2006.

Crypto hasn’t had very much time to figure itself out, even in the idea phase, and the time it’s had has been spent in the maelstrom of the internet, with money baked in, a recipe for both very good things and very bad.

The lack of sci-fi mentions could mean a couple of things:

It’s not a valuable enough technology for sci-fi authors to bother imagining it.

It’s a rare genuinely new idea.

I think it’s the latter, obviously. If that’s the case, then I think we’re still in the sci-fi ideation stage for crypto – the period in which people dream up the potential use cases and ideal state that would be possible if the technology worked perfectly – people just happened to be building through it.

H.G. Wells dreamed up the “Networked World,” a very early precursor idea to the internet, in 1899. We had a century to think through the internet’s implications before the Dot Com Boom, and we ended up with this:

Despite the internet’s awkward beginnings, and the billions of dollars lit on fire in any company that threw a “.com” in its name, the ideal state of the internet – connecting everyone in the world to communicate and transact – was so obviously valuable that researchers, entrepreneurs, and investors persisted through the crash and built the internet we know and (mostly) love today.

In this phase, the most important thing is to grok the ideal state. With a valuable enough ideal state, everything else is (challenging, messy, uncertain) implementation.

Crypto’s ideal state is that it will make capitalism more efficient and accelerate progress across industries. That’s civilizationally valuable enough that people will pursue it through booms and busts.

This is actually happening. It’s cliche to talk about investing in infrastructure at this point in the cycle, but onchain infrastructure has made huge improvements over the past year.

Layer 2’s (L2) like Optimism, Base, Arbitrum, zkSync, and StarkNet are making blockspace cheaper. Innovations like account abstraction, Supersends, embedded wallets, and multi-party computation give developers tools to create smoother user experiences while retaining crypto’s benefits. Stablecoins are becoming infrastructure, as highlighted by Visa’s announcement that it’s using USDC on Solana to speed up merchant settlement. Stanford researchers even proposed an ERC-xR standard that would make certain transactions reversible. I’ve spoken to a ton of smart teams working on correcting crypto’s obvious shortcomings.

Progress on infrastructure despite low prices and slow activity is a sign that there are smart people who still believe enough in crypto’s ideal state to bet their careers on it. It’s also an acknowledgement that the average user isn’t going to want to make trade-offs: they’ll want the benefits of web3 with the convenience of web2. While I don’t think mass adoption is important yet, it will be crucial at some point if crypto is going to reach its ideal state. Entrepreneurs will need to get unique value from building onchain. Businesses will need to turn to crypto to finance their projects, and lenders will need to be there with capital seeking opportunity.

I think that this coming decade will see faster progress, and more economic opportunity, than any previous decade. The wheels are in motion, and that will happen with crypto or without it. My hope, however, is that by bringing more of the capitalist engine onchain, we’ll accelerate progress, let wilder ideas flourish, and give more people ownership in the upside.

As everything decentralizes, crypto can push capitalism further towards the edges, diminishing the role of Coase’s firm to the benefit of individuals and entrepreneurs.

Capitalism is good. Capitalism evolves. And I think crypto has a role to play in that evolution. With a valuable enough ideal state, it’s inevitable.

Thanks to Dan for editing!

That’s all for today! We’ll be back in your inbox on Friday with the Weekly Dose before taking next week’s essay off for Labor Day Weekend.

Thanks for reading,

Packy

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK