Dave Ramsey: ‘Make Stupid Hard’ — Pay Off Your Mortgage Before Saving Another Do...

source link: https://finance.yahoo.com/news/dave-ramsey-stupid-hard-pay-180017561.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Dave Ramsey: ‘Make Stupid Hard’ — Pay Off Your Mortgage Before Saving Another Down Payment

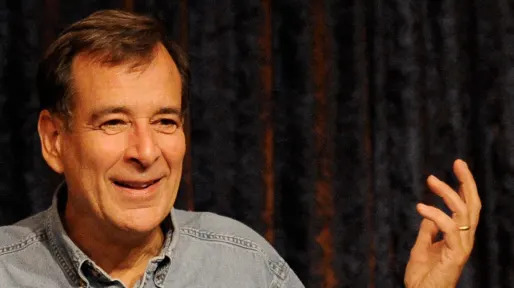

Should you pay off a mortgage or save money for a down payment on a new house? In a YouTube clip from “The Ramsey Show,” money expert Dave Ramsey shares his recommendation with a caller struggling with this dilemma.

The caller, Anthony, told Ramsey he and his wife recently became consumer debt-free and will have their emergency fund built up in the next two months. Anthony isn’t sure if it’s better to build equity in the existing mortgage or save up cash for a sizable down payment on a new home.

Which is more financially beneficial? Here’s why Ramsey recommends paying off your mortgage before saving another down payment.

‘Get Rich Slow’: Dave Ramsey Offers the Key to Lasting Wealth

Find Out: How To Build Generational Wealth From Scratch

‘Forced Savings Plan’

In the video, Ramsey said a guy he used to work with referred to paying extra on a mortgage as a forced savings account. Personally, Ramsey likes the forced aspect of this savings plan because you know you’ll stay on task.

“The weird thing about paying down your mortgage is it feels like the money’s gone, but it’s not,” said Ramsey. “It’s just saved in the equity because you get the money when you sell the house.”

The key is to trick yourself into as many smart money decisions as you can. Ramsey recommends the “automate smart and make stupid hard” approach. Because of all the autodrafts he has set up to automatically pay for bills, Ramsey said he hasn’t paid a utility bill in years.

Read More: Dave Ramsey Says ‘Money Is Not Just Math, It’s Behavior’ — 5 Bad Habits To Break Today

Tips for Paying Off Your Mortgage Early

You know you want to pay your mortgage off before saving money to buy a new house. What are some of the best ways to expedite this process? A blog post from Ramsey Solutions shares three approaches to quickly paying off your mortgage.

Making extra payments. If your mortgage company offers the ability to sign up for extra payments, you can use this opportunity to pay off your mortgage early. Ramsey Solutions recommends specifying that you want your extra payment applied to the mortgage’s principal balance. This ensures it goes toward paying off the balance instead of being used for next month’s payment.

Making your own lunch every day. Bringing your lunch to work might not be as fun as dining out but doing it every day helps you save a lot of money. As the post on Ramsey Solutions reads, in a situation where packing your lunch frees up $100 each month to put toward your mortgage and your mortgage is $220,000, you’ll be able to pay off your mortgage almost five years ahead of schedule.

Refinance. See if your existing home loan can be refinanced for a lower interest rate and a shorter term. Even though a short term means making a larger monthly payment, the post on Ramsey Solutions says it will be worth it if the amount fits in your housing budget.

Benzinga

BenzingaWarren Buffett Says Winning This 'Lottery' Is Most Important Thing In Life, And You Have No Control Over it — 'I Am In The Luckiest 1% Of The World Right Now'

Renowned investor and billionaire Chairman and CEO of Berkshire Hathaway Inc. Warren Buffett often discusses what he calls "the ovarian lottery" — the random chance of being born into a particular time, place and identity. The concept is not new; it echoes ideas discussed by economist Adam Smith in the 1700s. During a lecture to business school students at the University of Florida in 1998, Buffett vividly portrayed the lottery, which he explained would be the "most important thing in life." He

13h ago Fortune

FortuneUPS drivers’ new $170k per year deal shows that unions (and Joe Biden) may just save the middle class after all

Bidenomics and a strong labor movement are in full effect as full-time UPS drivers win a high six figures.

9h ago Fortune

FortuneBosses, beware: The ‘sickest day of the year’ for American workers is coming this month

When and why employees call out sick

2d ago Business Insider

Business InsiderBeer billionaire Jim Koch buys a random stock every 2 weeks - and trusts his former babysitter to execute his trades

Boston Beer Company's cofounder spent about $140 on two shares of Procter & Gamble more than six decades ago. They're worth $20,000 today.

9h ago Business Insider

Business InsiderUS companies are barreling towards a $1.8 trillion wall of maturing corporate debt

The mountain of corporate debt could weigh on investment and hiring plans by US corporations, Goldman Sachs said.

5h ago Benzinga

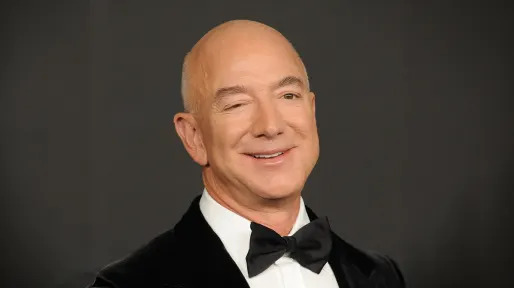

BenzingaJeff Bezos's Single Teen Mother Brought Him To School With Her As A Baby. They Couldn't Afford A Phone — Now She's Worth $30 Billion

Jeff Bezos, the world's third-richest person with a net worth of $162.1 billion, defies the stereotype of a privileged upbringing. He was born to a teen mom who struggled to make ends meet, unable to even afford a telephone. But it's not just Bezos's success story that is inspiring — his mother's journey is equally remarkable. In a 2019 commencement address at Cambridge College, Jacklyn Bezos shared her tale, prompting her proud son to tweet, M"y mom’s incredible story. Wow. So grateful. So prou

11h ago Fortune

FortuneCoinbase wants its junk back: Top U.S. crypto exchange may buy back up to $150 million of its bonds

The value of the firm’s stock has almost tripled since the beginning of the year.

16h ago Fortune

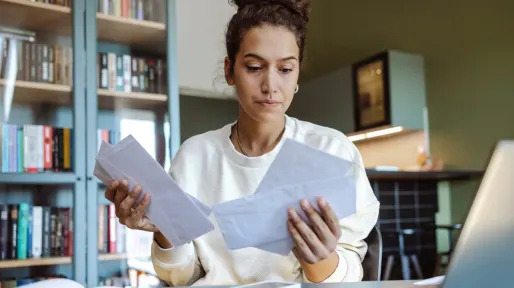

FortuneMillennials and Gen Z are filled with financial regrets, and it’s sending them into a stress spiral

Nothing hurts like an empty nest egg.

11h ago Zacks

ZacksSuper Micro Computer (SMCI) Surpasses Q4 Earnings and Revenue Estimates

Super Micro (SMCI) delivered earnings and revenue surprises of 3.24% and 0.92%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock?

8h ago Benzinga

BenzingaBud Light May Never Recover From The Controversy That Cost $400 Million In Lost US Sales – 'They Want To Enjoy Their Beer Without A Debate,' Anheuser-Busch CEO Says

Bud Light may never recover from the ongoing controversy surrounding the brand, according to an anonymous beer distributor who spoke to the New York Post on July 31. Many more Anheuser-Busch InBev distributors have resigned themselves to their painful Bud Light losses and have given up on luring customers back following the controversial ad campaign. During the past few months, the company experienced hiring freezes and mass layoffs. Beer truck drivers face heckling and harassment. The revelatio

8h ago Business Insider

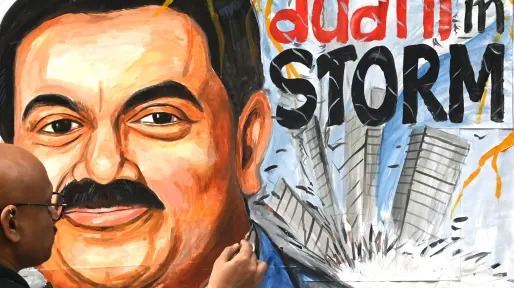

Business InsiderShort-seller Hindenburg has fueled a massive wealth wipeout for 3 of the world's richest men this year

Hindenburg Research has made high-profile bets against Gautam Adani, Jack Dorsey, and Carl Icahn in 2023.

12h ago The Telegraph

The TelegraphTesla’s ‘Master of Coin’ unexpectedly leaves with £130m fortune

Tesla’s 39-year-old chief financial officer has left the company with a $170m (£130m) fortune after just four years in the post.

2d ago Investor's Business Daily

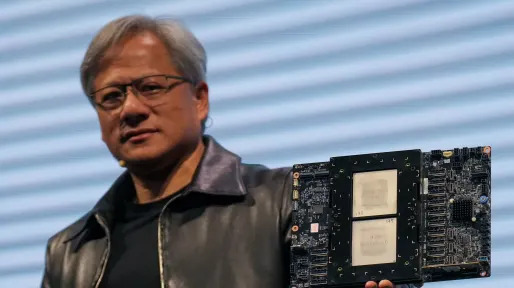

Investor's Business DailyNvidia Reveals New AI Chip For Data Centers — Is NVDA Stock A Buy?

Nvidia continues to skyrocket on blowout earnings and guidance due to its AI leadership. But is NVDA a buy?

10h ago SmartAsset

SmartAssetWhy JPMorgan Says To Avoid Withdrawing This Much From Your Retirement Accounts

JPMorgan Chase says ongoing inflation and an outlook for sharply lower returns for investors means that retirees should toss the long-standing 4% rule. That's the rule that says retirees can safely draw down their savings by 4% per year without … Continue reading → The post JPMorgan Says You Can Safely Withdraw This Much From Your Retirement Accounts Yearly appeared first on SmartAsset Blog.

17h ago TipRanks

TipRanks2 ‘Strong Buy’ Penny Stocks That Could Rally All the Way to $10 (or More)

Finding solid returns is the key to success in stock investing, but there are almost as many paths to that as there are investors. You can pack your portfolio with long-term stocks featuring slow appreciation; you can invest heavily in trending stocks that are riding a bubble, hoping to cash out at the right time; or you can buy into low-cost equities that feature high potential to boom. That last is the allure behind the penny stocks. Traditionally priced for a dollar or less per share, today t

17h ago TipRanks

TipRanksThis Is the Biggest Investment in High-Speed Internet Ever — and These Stocks Are Set to Reap the Rewards

At the end of June, the Biden Administration unveiled an ambitious goal to ensure reliable broadband internet access for the entire US, even the most remote rural areas. The project will involve a federal outlay of $42 billion, allocated to the states over the next two years. The President touts the initiative as a move to close the ‘digital gap’ that separates the haves and have-nots in the world of high-speed connectivity. “It’s the biggest investment in high-speed internet ever, because for t

6h ago Barrons.com

Barrons.comThe S&P 500 Is Falling Again. Here’s How Much Further It Could Slide.

The S&P 500 is falling, and if it doesn’t hold at a key level, more declines could be on the way. At home, Moody’s Investors Service downgraded its ratings for some U.S. banks, saying that high interest rates are eating into profitability. The stock market fears that more constraints on lending will follow, which could limit spending in the economy.

15h ago Yahoo Finance

Yahoo Finance3 reasons why the stock market rally may be stopped in its tracks

One top Wall Street strategist makes a compelling case for a pause in the market rally.

17h ago Reuters

ReutersMoody's downgrades US banks, warns of possible cuts to others

Moody's cut the ratings of 10 banks by one notch and placed six banking giants, including Bank of New York Mellon, US Bancorp, State Street and Truist Financial on review for potential downgrades.

1d ago Investor's Business Daily

Investor's Business DailyJust 5 Stocks Produce 10% Of $75.7 Trillion Global Stock Market Wealth, Study Shows

5 stocks accounted for 10.3% of total global wealth created between 1990 and 2020. 159 stocks accounted for 50%.

16h ago Yahoo Finance

Yahoo FinanceA record share of Americans think it's a bad time to buy a home

In the latest survey from Fannie Mae measuring housing sentiment, 82% of respondents said now is a bad time to purchase a house — a record high.

10h ago Zacks

ZacksTwilio (TWLO) Beats Q2 Earnings and Revenue Estimates

Twilio (TWLO) delivered earnings and revenue surprises of 86.21% and 5.41%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock?

9h ago Yahoo Finance

Yahoo FinanceStocks trending in afternoon trading: Beyond Meat, Eli Lilly, and Palantir

Several stocks moved near 20% in either direction on Tuesday afternoon following earlier earnings reports.

13h ago Bloomberg

BloombergAlibaba, Tencent’s $66 Billion Party Starts to Fade

(Bloomberg) -- China’s largest tech companies Alibaba Group Holding Ltd. and Tencent Holdings Ltd. have gained $66 billion in market value since May’s end, propelled by expectations of a gradual return to pre-crackdown growth and a litany of official promises to unshackle the private sector. Yet some investors warn the celebration may be premature.Most Read from BloombergEveryone Wants to Work at UPS After Teamsters DealWeWork Tumbles After Raising ‘Substantial Doubt’ About FutureUS Bank Shares

4h ago Investopedia

InvestopediaNvidia Launches New Chip Platform To Cash In on Generative AI Demand

Chipmaker Nvidia has announced the release of its next-generation chip to capitalize on the demand for AI models and lower costs for developers.

11h ago Investor's Business Daily

Investor's Business DailyIs TLRY Stock A Buy After Tilray Buys Beer Brands From Anheuser-Busch?

TLRY stock is off its all-time low after the company posted a smaller loss and higher sales in its latest earnings report.

11h ago Barrons.com

Barrons.comJ&J’s $40 Billion Kenvue Stock Swap: What You Need to Know

Johnson & Johnson is allowing shareholders to swap for shares of Kenvue, which has brands like Tylenol, at a discount.

11h ago The Wall Street Journal

The Wall Street JournalWeWork Raises Doubt About Its Survival

WeWork on Tuesday raised doubt about its ability to stay in business as the co-working space provider faces losses and a dwindling cash pile amid major changes in the way people work.

7h ago American City Business Journals

American City Business JournalsOccidental Petroleum raises full-year production guidance after bountiful Q2

Houston-based Occidental Petroleum Corp. (NYSE: OXY) has raised its full-year production guidance after production volumes in the Permian Basin and Rockies exceeded guidance for the second quarter.

11h ago Investor's Business Daily

Investor's Business DailySuper Micro Computer Revenue Outlook Disappoints Amid AI Buzz

Super Micro Computer reported fiscal fourth-quarter results that topped views but shares plunged as its fiscal 2024 outlook disappointed.

10h ago Fortune

FortuneThe world’s third-biggest company just saw its profits plummet 38%—but still paid shareholders $19.5 billion in dividends

The company said boosting dividends was part of a “sustainable and progressive” approach to investor payouts.

2d ago Reuters

ReutersChina's consumer prices fall in July as deflation risks build

BEIJING (Reuters) -China's consumer prices posted their first annual decline in more than two years in July, while factory gate prices extended their falls, data showed on Wednesday, as lacklustre demand weighed on the economy. The only bright spot was that the core CPI rebounded to 0.8% due to seasonal tourism during the summer, but I am afraid that it may lack sustainability.

4h ago Zacks

ZacksPalantir Earnings Review: Buy the Dip on a Leading AI Platform?

Palantir Technologies is one of the best opportunities for investors to get exposure to AI

9h ago Zacks

ZacksArray Technologies, Inc. (ARRY) Tops Q2 Earnings and Revenue Estimates

Array Technologies, Inc. (ARRY) delivered earnings and revenue surprises of 147.37% and 13.88%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock?

9h ago Zacks

ZacksAxon (AXON) Reports Q2 Earnings: What Key Metrics Have to Say

Although the revenue and EPS for Axon (AXON) give a sense of how its business performed in the quarter ended June 2023, it might be worth considering how some key metrics compare with Wall Street estimates and the year-ago numbers.

9h ago Benzinga

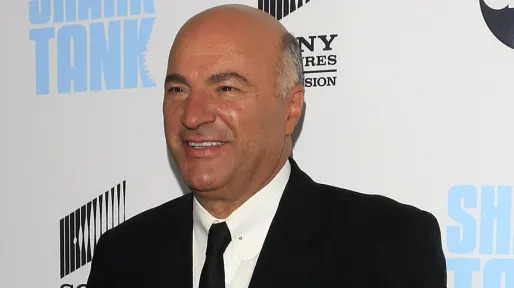

Benzinga'We've Got A Real Crisis Coming Here — There's No Cash,' Says Shark Tank's Kevin O'Leary, Urging Small Businesses To Apply For This Government Program To Survive

Kevin O'Leary, the entrepreneur and "Shark Tank" television star, expressed concern over a "crisis emerging" in the United States during a recent interview on Fox Business. O'Leary, who works closely with small and mid-sized businesses, said he doesn't see optimism increasing in the economy as some may suggest. Despite reports of optimism in the data, O'Leary's interactions with businesses across various states reveal a different reality — entrepreneurs are far from content with the prevailing e

2d ago Benzinga

Benzinga3 REITs With Over 6% Dividend Yields That Smashed Earnings

Nothing warms an investor's heart more than seeing companies in their portfolio with consistently increasing earnings that also beat the analysts' expectations. With dozens of second-quarter real estate investment trust (REIT) earning reports coming out this week, take a look at three REITs with dividend yields above 6% that just beat Wall Street's second-quarter estimates for earnings and revenue. EPR Properties (NYSE:EPR) is a Kansas City, Missouri-based diversified experiential REIT that owns

1d ago Investor's Business Daily

Investor's Business DailyLi Auto Earnings Boom. Tesla Rival Sinks Despite Strong Outlook, Mega Update.

Li Auto earnings boomed on soaring sales, with the Tesla rival's delivery outlook strong. Li Auto stock fell but has more than doubled in 2023.

10h ago Zacks

Zacks8x8 (EGHT) Q1 Earnings and Revenues Lag Estimates

8x8 (EGHT) delivered earnings and revenue surprises of -7.14% and 1.94%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock?

8h ago Zacks

ZacksHere's What Key Metrics Tell Us About Dutch Bros (BROS) Q2 Earnings

While the top- and bottom-line numbers for Dutch Bros (BROS) give a sense of how the business performed in the quarter ended June 2023, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

6h ago Zacks

ZacksUnity Software (U) Q2 Earnings Beat Estimates, Revenues Rise Y/Y (Revised)

Unity Software's (U) second-quarter 2023 results reflect year-over-year improvement in the top and bottom lines.

16h ago CBS MoneyWatch

CBS MoneyWatchMoody's downgrades banks over risks. Here are the 10 impacted.

Ratings agency says its also watching some of nation's biggest lenders for possible cuts amid ongoing financial strain.

11h ago Zacks

ZacksTopgolf Callaway Brands (MODG) Surpasses Q2 Earnings Estimates

Topgolf Callaway (MODG) delivered earnings and revenue surprises of 18.18% and 0.68%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock?

7h ago Fortune

FortuneWhat drove the departure of Tesla’s CFO Zach Kirkhorn?

Kirkhorn was a key part of Tesla's turnaround over the last five years, says Dan Ives of Wedbush Securities.

20h ago American City Business Journals

American City Business JournalsNovavax reports surprise Q2 profit but reiterates 'going concern' warning

The Gaithersburg biotech says a successful fall launch of a new Covid-19 vaccine could be crucial to its survival.

12h ago Barrons.com

Barrons.comTesla CFO Departure Means Stock Sales Could Be Coming

Outgoing Tesla Chief Financial Officer Zachary Kirkhorn is the beneficial owner of about 2.7 million shares of Tesla stock. He could choose to monetize them soon.

15h ago Zacks

ZacksRoblox (RBLX) to Report Q2 Earnings: What's in the Cards?

Roblox's (RBLX) second-quarter 2023 performance is expected to have benefited from steady growth in engagement hours and daily active users.

2d ago Investor's Business Daily

Investor's Business DailyPalantir Shares Tumble As Analysts Question Growth And AI Pricing Strategy

Palantir stock fell after the company's second-quarter results met analyst estimates. The company announced a $1 billion buyback.

10h ago Zacks

ZacksNektar Therapeutics (NKTR) Reports Q2 Loss, Lags Revenue Estimates

Nektar (NKTR) delivered earnings and revenue surprises of 10% and 2.13%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock?

9h ago Barrons.com

Barrons.comIt’s Disney Earnings Day. The Kingdom’s Magic Is Missing.

Wall Street has many worries, including softer demand for Disney+ and weak performance by the company's movies at the box office.

1h ago Zacks

ZacksSeres Therapeutics (MCRB) Misses Q2 Earnings Estimates

Seres Therapeutics (MCRB) delivered earnings and revenue surprises of -34.55% and 0.78%, respectively, for the quarter ended June 2023. Do the numbers hold clues to what lies ahead for the stock?

18h ago Investor's Business Daily

Investor's Business DailyBest Dow Jones Stocks To Buy And Watch In August 2023: Microsoft Sells Off

The best Dow Jones stocks to buy and watch in August 2023 include Apple stock, Boeing and Microsoft in today's stock market.

13h ago Zacks

ZacksCelsius Holdings Inc. (CELH) Reports Q2 Earnings: What Key Metrics Have to Say

While the top- and bottom-line numbers for Celsius Holdings Inc. (CELH) give a sense of how the business performed in the quarter ended June 2023, it could be worth looking at how some of its key metrics compare to Wall Street estimates and year-ago values.

6h ago Bloomberg

BloombergCoupang Sustains Profit Streak, Sees Logistics Investments Pay Off

(Bloomberg) -- Coupang Inc., the online retailer popular in South Korea for early and one-day delivery, posted its fourth straight quarterly profit after investments in logistics and membership programs helped shore up margins.Most Read from BloombergEveryone Wants to Work at UPS After Teamsters DealWeWork Tumbles After Raising ‘Substantial Doubt’ About FutureUS Bank Shares Drop as Moody’s Cuts Ratings, Warns on RisksWall Street WhatsApp, Texting Fines Exceed $2.5 BillionTesla CFO Kirkhorn Exits

4h ago Exec Edge

Exec EdgeINTERVIEW: Dutch Bros Raises Guidance as Profit Doubles, Chooses Christine Barone as Next CEO

Dutch Bros Inc. (NYSE: BROS) posts 103% rise in second-quarter Ebitda Revenue rose 34% in second quarter to $250 million on new locations, same shop sales Raises full-year Ebitda guidance to $135 million and $140 million President Christine Barone will become CEO and President in January 2024 Current CEO Joth Ricci to leave after five […]

10h ago Investor's Business Daily

Investor's Business DailyThese Are The 5 Best Stocks To Buy And Watch Now

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist?

11h ago Bloomberg

BloombergInternational Flavors Drops 20% on Softening Consumer Demand

(Bloomberg) -- International Flavors and Fragrances Inc. posted its biggest drop since at least 1980 after slashing its full-year sales guidance as customers pull back on spending while working through their stashes of products instead of replenishing their pantries. Most Read from BloombergUS Bank Shares Drop as Moody’s Cuts Ratings, Warns on RisksWall Street WhatsApp, Texting Fines Exceed $2.5 BillionMusk Says He May Need Surgery, Will Get MRI on Back and NeckThe Global South Breaks Away From

16h ago The Wall Street Journal

The Wall Street JournalRivian’s Losses Narrow as Production Speeds Up

The EV truck and sport-utility maker raised its production guidance for the year after a better-than-expected second quarter.

8h ago American City Business Journals

American City Business JournalsBoeing says incentives needed to compete for Pentagon's 'next franchise programs'

A Boeing official told the county council that sites other than St. Louis have been considered for the aerospace manufacturer's proposed $1.8 billion expansion project, which would include construction of multiple buildings totaling one million square feet.

6h ago Business Insider

Business InsiderChina's property sector is in dire straits as yet another developer reportedly runs into trouble

Enormous losses, heavy debt burdens, and low demand plague China's property sector – and firms keep failing.

9h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK