IMF Advises Nigeria to Consider Mobile Money Integration to Boost Slow eNaira Ad...

source link: https://bitcoinke.io/2023/06/papss-mou-with-african-banks/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

5 of Africa’s Largest Banks Sign Up to Use the Pan-African Payment and Settlement System (PAPSS) – BitcoinKE

Togo’s Ecobank Group is one of 5 major African commercial banks that have committed to the network of the Pan-African Payment and Settlement System (PAPSS) to facilitate cross-border financial exchanges.

The financial institutions signed a Memorandum of Understanding (MoU) which will facilitate Ecobank and its subsidiaries in conducting cross-border transactions using the Pan-African Payment and Settlement System (PAPSS).

Other banks signing included:

- Ecobank (Togo)

- Access Bank (Nigeria)

- UBA Group (Nigeria)

- Kenya Commercial Bank (Kenya)

- Standard Bank (South Africa)

The signing occurred during the opening ceremony of the 30th Annual Assembly of Afreximbank (AAM) held in Accra, Ghana.

The above banks were represented by their CEO’s while the Secretary-General of the African Continental Free Trade Area (AfCFTA), Wamkele Mene, represented the intercontinental bodies. Also present was Mike Ogbalu III, who is the CEO of PAPSS.

Changing the way we process #payments throughout #Africa.

We are proud and grateful for this partnership with 5 of the largest African Group #Banks which will pave the way to instant cross border payments in local currencies for the implementation of the @AfCFTA. pic.twitter.com/iYBlyxbrvZ

— Pan-African Payment And Settlement System – PAPSS (@papss_africa) June 20, 2023

PAPSS is a financial market infrastructure established by the African Export-Import Bank (AfreximBank) and the African Continental Free Trade Area (AfCFTA). PAPSS aims to promote seamless and efficient cross-border payments and settlements within Africa.

“Partnerships such as the one we have signed on PAPSS are crucial for the implementation and success of the AfCFTA as well as for financial integration and economic development on our continent. We are committed to the success of PAPSS and are pleased to bring our expertise in payments and collections, across the 33 markets where we operate in Africa,” said Jeremy Awori, CEO of Ecobank Group.

The implementation of the MoU is expected to be a gradual process with the involvement and support of the relevant Central Banks of the countries involved. The target date for the online availability of the service is set for January 2024.

PAPSS has come to the limelight in recent times after President of Kenya, William Ruto, urged African leaders to ditch the US dollar by signing up to the Pan-African Payments System (PAPSS) in order to faciliate trade within the continent.

Ruto urged Africa to mobilize central and commercial banks to join PAPSS which was launched in 2022 to faciliate intra-Africa trade.

Follow us on Twitter for latest posts and updates

___________________________________

___________________________________

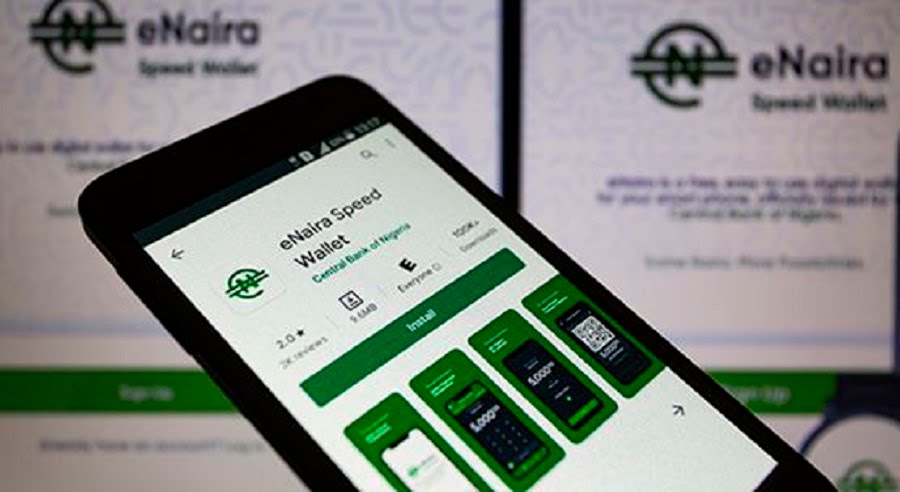

IMF Advises Nigeria to Consider Mobile Money Integration to Boost Slow eNaira Adoption

According to a paper published in May 2023, merchants, in particular, have exhibited a sluggish uptake of the Central Bank Digital Currency (CBDC), contributing to the overall slow adoption. Furthermore, retail customers have generally shown a lack of interest in signing up, resulting in the total number of onboarded clients struggling to surpass 1% of active bank accounts.

The International Monetary Fund (IMF) has expressed disappointment over the relatively low adoption of Nigeria’s Central Bank Digital Currency (CBDC) more than a year since its launch.

Initially, there was some success with wallet downloads, which reached 500,000 units within the first 25 days. However, the rate of adoption slowed significantly over time, with the number of downloads reaching 860,000 by November 2022.

The volume and value of transactions involving the #eNaira CBDC have been relatively constrained.

While the eNaira experienced a recent surge in usage due to cash shortages, the majority of wallets (98.5%) remain inactive on a weekly basis, indicating limited regular usage. pic.twitter.com/K06IleLfnQ

— BitKE (@BitcoinKE) June 28, 2023

According to a paper published in May 2023, merchants, in particular, have exhibited a sluggish uptake of the Central Bank Digital Currency (CBDC), contributing to the overall slow adoption. Furthermore, retail customers have generally shown a lack of interest in signing up, resulting in the total number of onboarded clients struggling to surpass 1% of active bank accounts.

Likewise, the volume and value of transactions involving the CBDC have been relatively constrained. While the eNaira experienced a recent surge in usage due to cash shortages, the majority of wallets (98.5%) remain inactive on a weekly basis, indicating limited regular usage.

Furthermore, the paper highlights that the total number of eNaira transactions since its launch, approximately 802,000, is lower than the number of eNaira wallets. This suggests that a significant portion of current wallet holders have not utilized their wallets beyond the initial usage after opening them.

The IMF posits that one possible reason for the sluggish adoption of the eNaira could be Nigeria’s phased approach to the CBDC implementation. Initially, access to the eNaira was limited to bank account holders which may have hindered broader adoption and usage among the general population.

In order to address the core objective of financial inclusion, the central bank of Nigeria has progressed to phase 2 of the CBDC implementation. This phase involves extending coverage to the unbanked population and individuals without internet access through a tiered Know Your Customer (KYC) system.

Over 4 million Nigerian

farmers to benefit from the Association of Northern Agricultural and Allied Commodities Practitioners (ANAACOP) under the 'Agro e-Naira Engagement' Program in collaboration with the @cenbank pic.twitter.com/Sx7WHKdHGO

— BitKE (@BitcoinKE) May 11, 2023

Depending on the level of information provided, the system incorporates transaction and balance caps to ensure appropriate controls are in place.

In terms on improving adoption, one recommendation put forth is to integrate the eNaira with Nigeria’s fragmented mobile money system to improve the efficiency of social cash transfers. This integration would enable government aid programs to leverage the eNaira, which has been instrumental in driving adoption and usage of the digital currency.

In addition, the IMF highlights that incorporating features like programmable payments or cash rebates into the eNaira could potentially address the slow consumer adoption and expedite private sector investment.

According to the IMF, the eNaira holds significant potential for streamlining the remittance process. This has the potential to enhance transparency, expand Nigeria’s tax base, and, importantly, reduce costs for remittance senders. However IMF says that for the eNaira to gain user adoption, the exchange rates associated with any conversion would need to closely align with parallel market rates.

By offering additional benefits and incentives, these enhancements could encourage wider acceptance and usage of the digital currency among consumers and stimulate increased investment from the private sector.

Follow us on Twitter for latest posts and updates

____________________________________

____________________________________

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK