Weekly Dose of Optimism #49

source link: https://www.notboring.co/p/weekly-dose-of-optimism-49

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Weekly Dose of Optimism #49

AI Drugs, Obesity Drugs, Wagecession, and J-Pow's Protector, Idiots

Hi friends 👋,

Happy Friday and welcome back to our 49th Weekly Dose of Optimism.

We have a nice, long weekend a head of us and, per usual, much to be optimistic about. America is building again. Our economy is recovering. We’re leading the AI revolution. We’ve never been more optimistic about being American.

U.S.A! U.S.A! U.S.A! 🇺🇸

That’s the vibe all weekend.

Now, let’s get to it.

The Weekly Dose is brought to you by…Percent

Wall Street is optimistic about private credit. And if you’re an accredited investor, you can get in on the action with Percent.

Firms like TPG and Apollo are using private credit to fund acquisitions and BlackRock recently launched a new private credit fund that is targeting institutional investors. Why private credit?

Higher Yields

Lower Correlation to Public Markets

Potential For Higher Returns

Rising Interest Rates

Percent is the only platform exclusively dedicated to private credit. Percent provides accredited investors access to a wide variety of high yield, short duration (9-month average) offerings. Invest in deals like Short-Term Ecommerce Financing, venture debt, and general SMB Financing.

With Percent, you get access to private credit deals that were previously closed off to the average investor. The average current weighted APY and duration of deals on Percent is currently 17.04% APY and 9 months as of May 31, 2023, respectively, making it easier to find yield and redeploy capital in a rising rate environment.

Get started with as little as $500 today and unlock yields up to 20% APY.

(1) Biotech begins human trials of drug designed by artificial intelligence

Jamie Smyth for FT

The company said the drug, INS018_055, was the first entirely “AI-discovered and AI designed” drug to begin a phase 2 clinical trial and represented an important milestone for the industry.

The most interesting stuff happens at the intersections. One particularly interesting intersection is AI x Biotech — where advanced models can help scientists discover new cures, therapies, and drugs. Now, the first mid-stage human trial of a drug discovered and designed by artificial intelligence is officially underway. We believe this is just a glimpse into the future, in which drugs developed with AI will be the rule, not the exception.

Insilico Medicine, the company behind the AI-drug, said it had dosed a patient in China with a novel therapy to treat the chronic lung disease idiopathic pulmonary fibrosis. The company is just one of many biotechs that is chasing down the AI opportunity, which some believe will result in a doubling of productivity vs. traditional pharma companies.

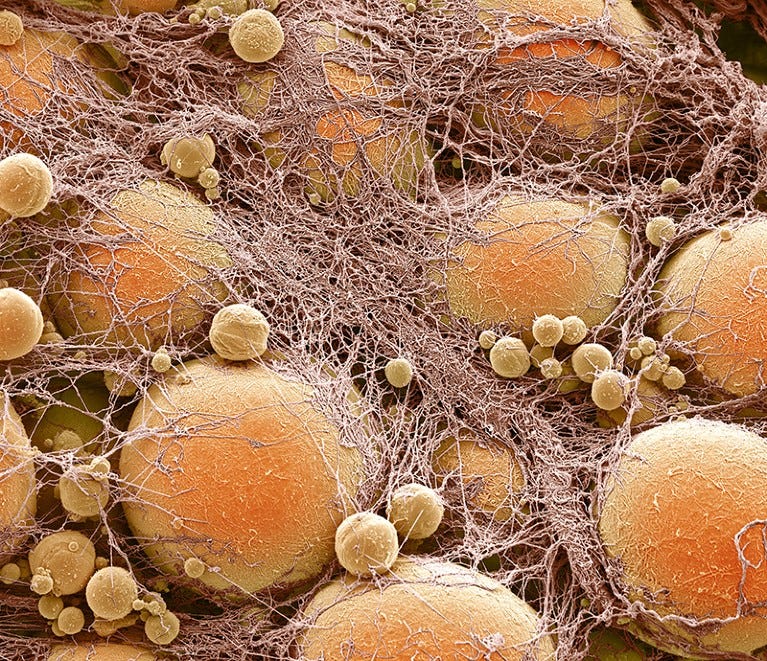

(2) Beyond Ozempic: brand-new obesity drugs will be cheaper and more effective

Saima Sidik for Nature

Two new drugs for treating obesity are on course to become available in the next few years — and they offer advantages beyond those of the highly effective blockbuster drugs already on the market. The first, called orforglipron, is easier to use and to produce, and it will probably be cheaper than existing treatments. The second, retatrutide, has an unprecedented level of efficacy, and could raise the bar for pharmacological obesity treatment.

Back in the world of human-designed drugs, there are two new obesity drugs that just posted impressive Stage II results.

Orforglipron: Unlike existing GLP-1s, this obesity drug is easy to produce and package into a pill, which will significantly decrease the cost of treatment and make the it more accessible to the masses.

Retatrutide: As compared to existing obesity drugs, Retatrutide is significantly more effective. Participants lost an average of 24.2% of their body weight over 11 months, vs. 15-20% for current obesity drugs. That’s 20-60% more weight loss. Additionally, the drug was shown to result in at least 5% weight loss for all participants, whereas 10% of people do not respond to current obesity drugs.

Whatever your opinion of these types of drugs may be, I think we can all agree that developing more effective, reliable, and affordable options for one of our country’s most widespread health issues is a good thing. The curve is pointing towards affordable, easily consumed drugs that result in permanent and healthy weight-loss. We’re not there yet, but as the two new drugs above show, we’re making progress.

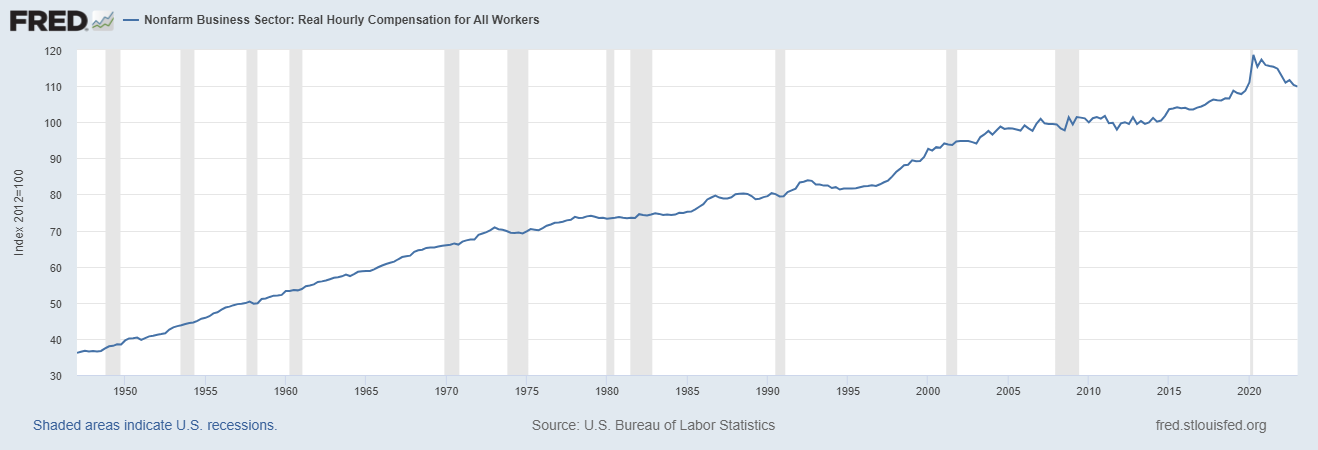

(3) The end of the "vibecession"?

Noah Smith for Noahpinion

We can theorize about the psychology of the vibecession all day long, but maybe in the end it was just a wagecession. And if so, maybe we should be cautiously optimistic, because real wages seem to be rising again, even if only slowly. But in the meantime, we shouldn’t be surprised if people continue feeling grumpy about a seemingly booming economy for a while to come.

Has the economy had you down over the past couple of years? Feeling a bit poorer than you did, say, 2 years ago? Kind of confused by the low levels of unemployment despite headlines of layoffs and slowdowns?

You’re not alone. Over the last 18 months, the American economy has experienced what Kyla Scanlon dubbed a vibecession: people feeling like there’s something off about the economy, even though, by most measures used by economists, there’s not.

What triggered this vibecession is up for debate, but Noah Smith came up with a reasonable explanation: real wages decreasing…or as he termed it, a “wagecession.” In simple terms, Americans have worked more and more for less and less over the past two years. Bad vibes indeed.

The good news, according to Smith, is that real wages are starting to rise once again. So if declining real wages produce bad economic vibes, then maybe rising real wages can pull us out of this vibecession.

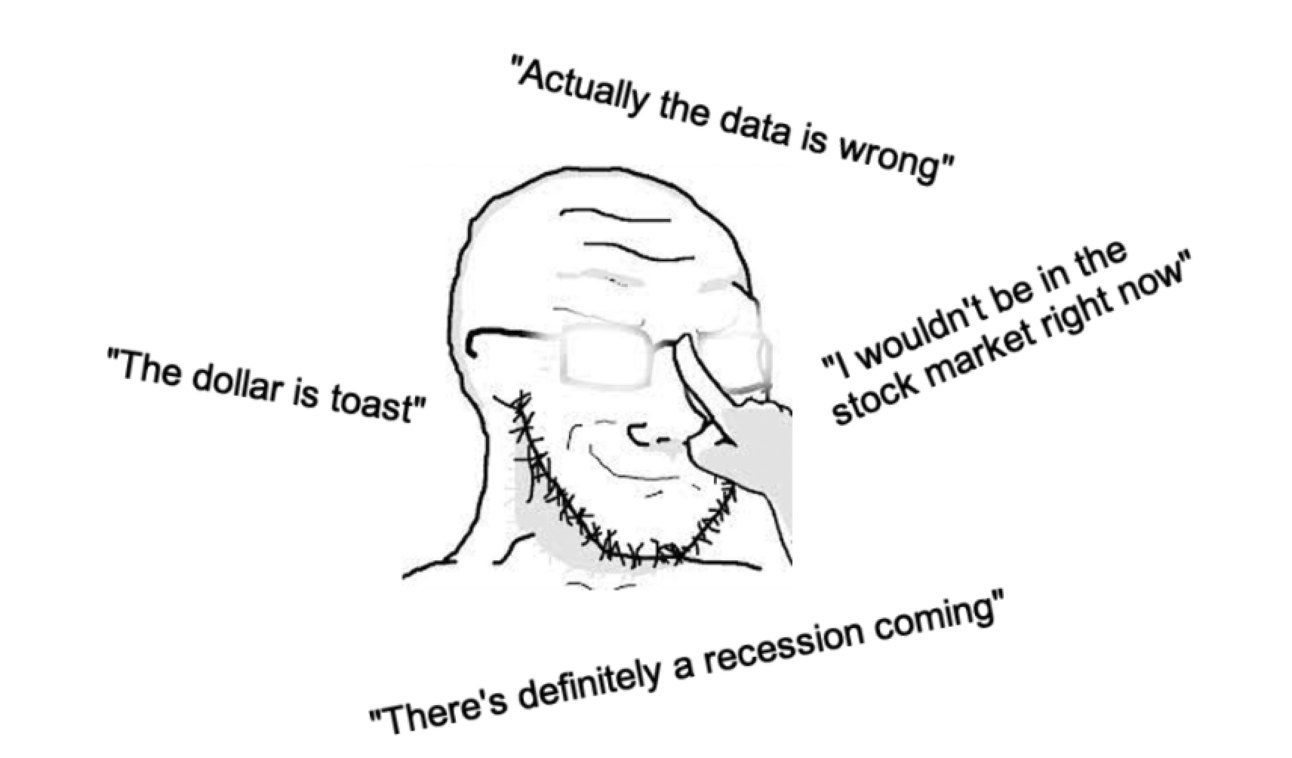

Jack Raines for Young Money

Sitting at the intersection of finance and politics, the Fed is capitalism’s most convenient scapegoat, and hating the Fed allows you to kill two birds with one stone.

Friend of Not Boring, Jack Raines, published a thoughtful defense of the Federal Reserve’s performance over the last couple of years. Thanks to Jack, a 2nd year business school student and part-time travel blogger, perhaps Jerome Powell and the Federal Reserve can sleep a bit easiest at night knowing that, at least in Jack’s eyes, they’ve done a decent job.

Jack’s argument is quite convincing. Despite all of the noise, the Fed currently has a relatively strong economy on its hands:

The S&P 500 is up 56% since March 2020

The US unemployment rate remains near its lowest level in history

Inflation appears to have peaked a year ago

Interest rates are more in-line with their historical norms

So why all the hate for J-Pow and the Fed? Jack offers two explanations:

Government x Wall Street. That’s basically what the Fed is. Can’t find a more hated-on duo than that. No matter what they do or what the results are, the Fed is going to get hate.

Pessimism: It’s seductive. It’s easier to shit on the Fed for everything it’s done wrong or mis-predicted, than it is to acknowledge all of the things it’s gotten right. “Well, of course inflation was going to skyrocket if after they printed all that money!” is far more common than “Wow, pretty amazing that the Fed keeps this extraordinarily complex economy together!”

Feels like we’re getting to the point that the phrase: “pessimism sounds smart, optimists make money” is becoming so common and understood that soon pessimism won’t even sound that smart.

(5) “How to Spot an Idiot", J.B. Prtizker

The best way to spot an idiot? Look for the person who is cruel.

That was the main message of Illinois Governor J.B. Pritzker’s commencement address at Northwestern this week.

When we encounter something or someone that is new or different from us, our first thought is rooted in either fear or judgement — this suspicion is, evolutionarily speaking, what has allowed us as a species to survive for 300,000 years.

It is not natural to be kind or empathetic to new ideas or people. It requires a new way of thinking that overrides our animal tendencies. Cruel people are unable to execute this override.

As Pritzker points out, the kindest people in the room are often the smartest.

Get out there and be kind this weekend 🇺🇸

That’s all for this week. We’re taking off the 4th, so we’ll be back in your inbox Friday! Enjoy the weekend!

Thanks for reading,

-Dan + Packy

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK