Why turmoil in Russia could be bearish for oil: strategist

source link: https://finance.yahoo.com/news/why-turmoil-in-russia-could-send-oil-prices-even-lower-184518853.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Why turmoil in Russia could send oil prices even lower

this won't shield the asset

Crude oil prices were trading as much as 1% higher on Monday after Russia's private army Wagner Group aborted itsmarch towards Moscow, averting what may have been an attempted coup on Russian leader Vladimir Putin.

The price action going forward depends on how the weekend's short-lived turmoil plays out from here.

“The events in Russia lead the market to consider how much Russian oil production and exports could have been affected if Wagner took more territory or if Russia fell into a civil war,” Andy Lipow of Lipow Oil Associates told Yahoo Finance.

“A contrarian view is that this is bearish [for] the oil markets because Putin will try to export every bit of Russian oil he can sell in order to raise money to pay off his supporters and keep the army on his side,” added the analyst.

The developments in Russia have been closely watched, given crude’s volatility in 2022 following Moscow's invasion of Ukraine.

Prices have declined considerably since their peak last year when West Texas Intermediate (CL=F) went past $120 per barrel and Brent (BZ-F) futures surpassed $130.

On Monday WTI was trading around $70/barrel while Brent hovered above $74/barrel.

"Crude oil - commodities are in a bear market,” Mike McGlone, Bloomberg Intelligence senior macro analyst, told Yahoo Finance Live on Monday.

“The key question you have to ask yourself is what’s going to stop this and save it," he added.

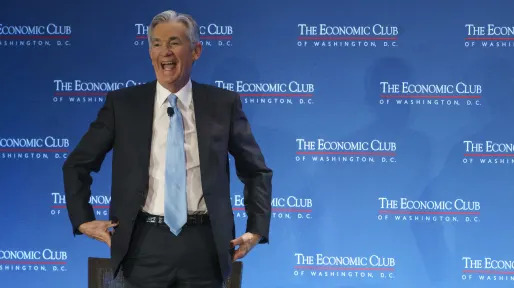

McGlone believes oil is far from bottoming, given that the Federal Reserve is still tightening its monetary policy in an effort to cool the economy and bring inflation back down to 2%.

“I see crude oil heading towards $50, maybe even $40. Natural gas has already done that. It went from $10 to $2," he added.

Crude's pullback over the last year comes as central banks raise interest rates to try to tame inflation, resulting in tighter credit conditions and raising concerns of a recession. China’s recovery from strict COVID lockdowns last year has also been lackluster, hurting demand.

Engadget

EngadgetA 5G deadline could ground some US flights starting July 1st

Planes without compatible altimeters won't be allowed to fly in low visibility.

15h ago Yahoo Finance

Yahoo FinanceStocks slip, tech drags to start last week of June trading: Stock market news today

Stocks slipped to start the new week Monday as tech stocks fell and investors considered what the weekend's short-lived challenge to Vladimir Putin by armed mercenaries in Russia means for markets.

8h ago Yahoo Finance

Yahoo FinancePfizer stock drops after company picks twice-daily weight loss pill candidate

Pfizer stock fell Monday after the company announced it would pursue a twice-daily weight loss treatment pill in favor of its once-daily alternative amid a booming market for GLP-1 drugs.

10h ago Yahoo Finance

Yahoo FinanceFederal Reserve's message to the bullish stock market: We will break you

Fight the Fed at your own risk.

15h ago Yahoo Finance

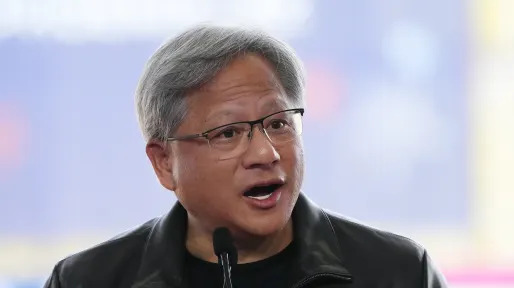

Yahoo FinanceNvidia, Snowflake announce partnership for custom generative AI models

Nvidia and Snowflake are entering a partnership that will let Snowflake customers build custom generative AI models.

4h ago Investor's Business Daily

Investor's Business DailyMarket Shrugs Off Wagner Insurrection - These Stocks Could Surge If Putin Is Overthrown

The stock market shrugged off the failed Wagner insurrection attempt, but if President Vladimir Putin is overthrown some stocks could rally.

8h ago Reuters

ReutersCarnival forecasts lower profit as costs bite, shares drop 11%

(Reuters) -Cruise operator Carnival on Monday forecast third-quarter profit largely below estimates as rising marketing and labor costs eat into gains from higher ticket prices and strong demand. Carnival has increased marketing spend to attract new customers and gain an edge over its competitors even as it faces elevated labor costs as it adds staff to manage higher occupancy levels and battles higher fuel prices. Chief Financial Officer David Bernstein said a slower-than-expected drop in inflation with respect to port expenses, freight, crew travel has pushed the company to raise its cost outlook.

14h ago Reuters

ReutersSaudi Aramco sees 'sound' oil outlook for H2 on China, India demand

KUALA LUMPUR (Reuters) -Saudi Aramco believes market fundamentals remain "sound" for the second half as demand from emerging markets led by China and India will offset recession risk in developed markets, CEO Amin Nasser told an industry gathering on Monday. But other executives at the Energy Asia conference in Kuala Lumpur were divided, with Malaysia state oil firm Petronas reporting a slowdown in demand for petroleum and petrochemicals in the second quarter and growing refinery capacity putting pressure on the market. "Overall, we believe that oil market fundamentals remain generally sound for the rest of the year," said Nasser, who heads the world's largest oil company.

1d ago Bloomberg

BloombergGoldman Joins Brokers Predicting an End to Tesla Rally

(Bloomberg) -- Goldman Sachs Group Inc. joined a list of brokers turning less bullish on Tesla Inc. shares after the electric-vehicle maker’s blistering rally this year. Most Read from BloombergPutin Blasts Wagner ‘Traitors’ After Prigozhin Denies Coup PlotThe 10 Worst US Airports for Flight Disruptions This SummerStudent Loan-Relief Backers Warn Biden ‘Failure Isn’t an Option’Putin Faces Historic Threat to Absolute Grip on Power in RussiaRussia Latest: Zelenskiy Adviser Says Wagner Remains in U

7h ago Bloomberg

BloombergBillionaire Miner Friedland Warns of a Copper ‘Train Wreck’ as Supply Stalls

(Bloomberg) -- Copper is poised to follow other commodities upended by recent price surges as the mining industry struggles to expand ahead of accelerating demand, warns the man behind some of the world’s biggest mines.Most Read from BloombergPutin Blasts Wagner ‘Traitors’ After Prigozhin Denies Coup PlotThe 10 Worst US Airports for Flight Disruptions This SummerStudent Loan-Relief Backers Warn Biden ‘Failure Isn’t an Option’Putin Faces Historic Threat to Absolute Grip on Power in RussiaRussia L

11h ago Business Insider

Business InsiderNancy Pelosi's husband just snapped up $2.6 million of Apple and Microsoft stock, closing out an options bet that the shares would soar

Paul Pelosi bought 5,000 shares of both Apple and Microsoft stocks on June 15, exercising 50 call options purchased on May 24, 2022.

4h ago Benzinga

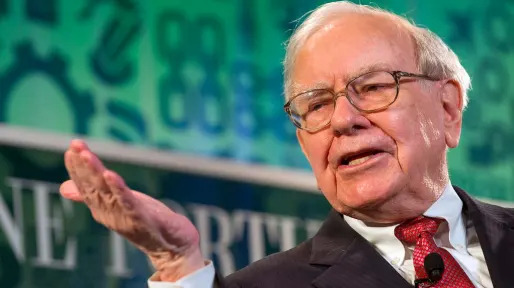

BenzingaFrugal Billionaire Warren Buffett Drives A 2014 Car And Looks For Hail-Damaged Deals

Warren Buffett's choice of vehicle has become a topic of interest among many people. Renowned for his frugal and simple lifestyle, the billionaire investor drives a 2014 Cadillac XTS. While some billionaires indulge in extravagant cars as a visible symbol of wealth and success, Buffett's preference for older models reflects his unique approach to life and finances. Buffett's frugality and minimalist mindset have been key factors in his tremendous success as an investor. His ability to seek value

7h ago Investor's Business Daily

Investor's Business DailyAnalysts Are Almost 100% Certain You Should Buy These 10 Stocks

Analysts rarely agree on much. So when they do — especially on the best S&P 500 stocks to buy — it's worth hearing them out.

16h ago Benzinga

BenzingaIt'll 'Upset A Lot Of Donors': Elon Musk Mocks Joe Biden's Tweet Calling On The Super Rich To Pay 'Their Fair Share.' Here's How Some Billionaires Pay Less Income Tax Than You

The fairness of the U.S. tax system has long been debated. Earlier this month, President Joe Biden tweeted, “It’s about time the super-wealthy start paying their fair share.” The message caught the attention of Tesla Inc. CEO and Twitter Inc. owner Elon Musk. “Please give him the password, so he can do his own tweets,” Musk replied, implying that the tweet wasn’t written by the commander in chief himself. But the billionaire business tycoon actually agrees with Biden’s view. “In all seriousness,

11h ago TipRanks

TipRanks‘When Overbought Is Bullish’: Oppenheimer Sees S&P Uptrend Reaching 4,600 — Here Are 2 ‘Strong Buy’ Stocks to Bet on It

Investors will never stop looking for the best time to enter or exit the markets, but it is a very difficult move to get right. As fabled investor Peter Lynch has put it, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” With this in mind, Ari Wald, the Head of Technical Analysis at Oppenheimer says a better way to assess where the market is at is to follow the trend. More specifically, from a

1d ago Business Insider

Business InsiderWarren Buffett's global market gauge soars to nearly 110%, signaling stocks are overvalued and might crash

Warren Buffett has cautioned that a spike in the so-called Buffett indicator is a "very strong warning signal" for the stock market.

5h ago Zacks

ZacksMicrosoft (MSFT) Dips More Than Broader Markets: What You Should Know

Microsoft (MSFT) closed the most recent trading day at $328.60, moving -1.92% from the previous trading session.

6h ago Zacks

ZacksRithm Capital (RITM) Reveals Q2 Dividends: What We Think

The stress in the banking system will drive more assets to the marketplace, creating tremendous opportunities for companies like Rithm Capital (RITM) to boost their portfolio.

13h ago Investopedia

InvestopediaTop CD Rates Today, June 26, 2023

See what today's top nationwide rate is for every CD term, and how it compares to the previous business day's top rate. We collect data from more than 200 financial institutions.

6h ago The Wall Street Journal

The Wall Street JournalChina’s ‘Tesla Killer’ Stumbles as EV Price War Takes Toll

NIO, which had resisted cutting prices until recently, has become a symbol of the challenges automakers face in the world’s largest electric-vehicle market.

1d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK