The VIX index just hit its lowest level since January 2020

source link: https://finance.yahoo.com/news/the-markets-fear-gauge-just-hit-its-lowest-level-since-january-2020-morning-brief-100023019.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The market's 'fear gauge' just hit its lowest level since January 2020: Morning Brief

don't fight the Fed,

This is The Takeaway from today's Morning Brief, which you can sign up to receive in your inbox every morning along with:

The chart of the day

What we're watching

What we're reading

Economic data releases and earnings

Wall Street's so-called "fear index" — the CBOE Volatility Index (^VIX) — fell to 12.73 Thursday, the lowest reading since January 2020.

As stocks snap a three-day losing streak and return to climbing the proverbial wall of worry, the VIX is signaling the most complacency in stocks since just prior to the pandemic.

It may not signal the all-clear, the low VIX reading does underscore the powerful rally U.S. large cap equities have mounted this year. While the rally was largely concentrated in growth tech names and mega cap stocks through May, cyclical sectors have joined the party since the last jobs report dropped in early June.

The VIX is perhaps most famous for its skyward spikes during periods of market turmoil. But sustained, lower readings are a hallmark of bull markets.

Former options market maker and current chief strategist at Interactive Brokers, Steve Sosnick, explains the dynamic between the VIX, which is derived from the options market on S&P 500 stocks, and the underlying stocks.

"VIX is a key tool for portfolio managers who want to hedge their risks. The low level of VIX tells us that there is not much demand for protection from institutions," writes Sosnick.

Yet, a similar gauge in the bond market shows a different story.

Above shows the BofA ICE Move Index (^MOVE), which has come well off its highs this year. However, it remains quite elevated relative to readings prior to the pandemic.

And comparing sentiment in the stock market to sentiment among consumers illustrates an even more divergent story.

The University of Michigan consumer sentiment index (blue, above), is coming off the lowest level since its start in 1977. The VIX index (orange, above) is inverted such that spikes lower indicate panic in stocks.

Yahoo Finance

Yahoo FinanceStocks sink, on track for losing week: Stock market news today

Stock futures slipped on Friday, setting the major US benchmarks up for a losing week as investors come to terms with the prospect of more interest-rate hikes ahead from the Federal Reserve.

5m ago Reuters

ReutersStarbucks workers at over 150 stores to strike over Pride decor dispute

Starbucks Workers United union said earlier this month the company took down Pride Month decorations and flags at several stores, while some workers took to social media to report the same. Starbucks on Friday denied the claims as "false information". It said last week there had been "no change to any policy on this matter" and that it was still encouraging store managers to celebrate Pride Month as long as store safety guidelines were followed.

2h ago Yahoo Finance

Yahoo FinanceThis is how much Americans think they need for a comfortable retirement

On average, Americans expect they should save $1.27 million for a comfortable retirement. But they're far from that goal.

1h ago AP Finance

AP Finance3M reaches $10.3 billion settlement over contamination of water systems with 'forever chemicals'

Chemical manufacturer 3M Co. will pay at least $10.3 billion to settle lawsuits over contamination of many U.S. public drinking water systems with potentially harmful compounds used in firefighting foam and a host of consumer products, the company said Thursday.

13h ago The Telegraph

The TelegraphMortgage crisis to wipe out savings of 1.2m households as repayments set to surge

The mortgage crisis will wipe out the savings of 1.2m families this year and push many into insolvency, economists have warned.

20h ago Benzinga

Benzinga'F--king Grifters': Spotify Exec Slams Prince Harry And Meghan Markle After Parting Ways — Here's How Much The Royal Couple Could Have Made From Their Podcast Deal

After just one season, Prince Harry and Meghan Markle’s podcast deal with Spotify has come to an end. Bill Simmons, head of podcast innovation and monetization at Spotify, is not pleased with the royal couple. “I wish I had been involved in the ‘Meghan and Harry leave Spotify’ negotiation. ‘The F--king Grifters.’ That’s the podcast we should have launched with them,” Simmons said during his podcast last week. “I have got to get drunk one night and tell the story of the Zoom I had with Harry to t

21h ago TipRanks

TipRanksCathie Wood Doubles Down on These 2 Innovation Stocks — Here’s Why You Might Want to Ride Her Coattails

Backing innovation has been core to Cathie Wood’s investing style. It’s not always been a winning strategy – as illustrated by last year’s disappointing performance of her Ark Invest fund – but her conviction in the potential of disruptors has never wavered, even in the face of negative market action. Sticking to what she believes in, though, has been paying off this year; her Ark Invest fund’s flagship Ark Innovation ETF is up by 40% year-to-date. That said, some of the names forming a part of

1d ago Investor's Business Daily

Investor's Business DailyDow Jones Falls 225 Points Ahead Of Key Economic Data, Set For Losing Week

The Dow Jones Industrial Average fell 225 points Friday ahead of key data, set for a losing week as investors prepared for rate hikes from the Federal Reserve,

6m ago Benzinga

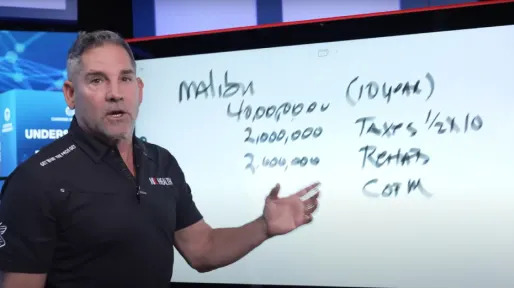

Benzinga'The Worst Investment You Can Make' That Americans Are Obsessed With: How To Avoid The 'Dead Money' Trap, According to Billionaire Financial Guru Grant Cardone

Homeownership has long been regarded as an integral part of the American dream, symbolizing independence, financial security and prosperity — aspirations shared by many. But renowned real estate investment guru Grant Cardone challenges this notion. In an Instagram post earlier this month, he wrote, “Buying a home without a doubt is the WORST investment people can make, yet it’s also the most common one.” Cardone, also known as Uncle G, aims to alter this perspective and change the trajectory of

20h ago Investor's Business Daily

Investor's Business DailyThis Fidelity Fund Quietly Beats Cathie Wood At Her Own Game

ARK Invest's Cathie Wood is the one to beat when it comes to growth stocks. But it looks like Fidelity found a way to do it with S&P 500 stocks.

2h ago Yahoo Finance

Yahoo FinanceTesla: How one analyst missed the boat and now regrets it

Threadneedle Strategies Founder Ann Berry speculated that Tesla’s plan is to become the long-term winner through its data-gathering operations.

18h ago Investor's Business Daily

Investor's Business DailySupreme Court Student Loan Ruling May Raise U.S. Recession Risk

The Supreme Court ruling on President Biden's student loan forgiveness may be unprecedented in its impact on consumer finances.

2h ago SmartAsset

SmartAssetRich & Wealthy Americans Are Moving to These States

Households that make over $200,000 annually comprise just a sliver of all tax returns that are filed in a given year, but their movement between states can have a significant financial impact. When a state loses more high-earning tax filers … Continue reading → The post Where High-Earning Households Are Moving – 2022 Study appeared first on SmartAsset Blog.

1d ago SmartAsset

SmartAssetThe 'Do Nothing' Portfolio That Can Help You Get Rich Without Doing Much At All

A hypothetical stock portfolio has taken hands-off investing to a whole new level. Jeffrey Ptak, a chartered financial analyst (CFA) for Morningstar, recently devised a passive investment portfolio that's based on the composition of the S&P 500. But instead of … Continue reading → The post How This ‘Do Nothing Portfolio' Can Beat the S&P 500: Sit Back and Get Rich appeared first on SmartAsset Blog.

1d ago Bloomberg

BloombergLarry Ellison Scores $482 Million Gain by Cashing in Expiring Options

(Bloomberg) -- Larry Ellison, the world’s fourth-richest person, exercised expiring options and sold $640 million of Oracle Corp. shares this week after the company’s stock surged to a record.Most Read from BloombergTitanic Sub Crew Dead After Vessel’s Catastrophic ImplosionThese Are the World’s Most (and Least) Liveable Cities in 2023US Treasury Secretary Yellen Sees Lower US Recession Risk, Says Consumer Slowdown NeededFive-Star Hotel Guest Leaves Without Paying After 603-Night StayUS Navy Det

11h ago Bloomberg

BloombergBonds Surge as Euro-Area Data Raise Recession Fear: Markets Wrap

(Bloomberg) -- Investors fled into the safety of bonds while stocks fell, as a lurch toward higher interest rates together with weak euro-area activity data heightened anxiety that aggressive central bank policy will tip economies into recession.Most Read from BloombergTitanic Sub Crew Dead After Vessel’s Catastrophic ImplosionThese Are the World’s Most (and Least) Liveable Cities in 2023US Treasury Secretary Yellen Sees Lower US Recession Risk, Says Consumer Slowdown NeededFive-Star Hotel Guest

25m ago Investor's Business Daily

Investor's Business DailyDow Jones Futures Fall; Market Pullback Set To Resume After Nasdaq Bounces

Futures fell after the Nasdaq bounced with Amazon jumping and some leaders flashing buy signals. Don't get too excited.

1h ago Zacks

ZacksZIM Integrated Shipping Services (ZIM) Stock Sinks As Market Gains: What You Should Know

ZIM Integrated Shipping Services (ZIM) closed at $12.19 in the latest trading session, marking a -1.22% move from the prior day.

16h ago Zacks

ZacksEnphase Energy, Inc. (ENPH) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Enphase Energy (ENPH) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

1d ago Barrons.com

Barrons.comTesla Stock Catches a Double Downgrade. It’s Analysts vs. a Golden Cross.

Tesla stock is falling after the third Wall Street downgrade in as many days, but analysts are turning negative just as a technical indicator is turning positive. Friday, DZ Bank analyst Matthias Volkert double downgraded Tesla to Sell from Buy, skipping a Hold rating, according to Fly on the Wall, a stock ratings and news aggregation site. While Tesla stock was below his price target less than three weeks ago, it is now 26% above it, closing at $264.61 Thursday.

26m ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK