Wall Street's new consensus: AI will drive the stock market higher

source link: https://finance.yahoo.com/news/wall-streets-new-consensus-ai-will-drive-the-stock-market-higher-152442760.html?_tsrc=fin-notif

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Wall Street's new consensus: AI will drive the stock market higher

focus today in that department.

Ina Tuesday note, the global markets team at Capital Economics moved up its year-end forecast for the S&P 500 from 4,500 to 5,500 in 2024 and from 5,000 to 6,500 in 2025.

A key driver behind that surge higher will be artificial intelligence, it said.

"We think investors' enthusiasm about AI has room to grow even further over the next couple of years," Capital Economics senior markets economists Thomas Mathews wrote. "New technologies – even those that have turned out to be genuinely transformative – have often manifested in the inflation of 'bubbles' in stock prices in the past. We are increasingly of the view that we're seeing something similar now or, at the very least, that we are in a period in which enthusiasm about AI technology could grow further and provide a strong tailwind for equity indices more broadly. "

Mathews is the latest strategist to get behind what's become a growing consensus among firms discussing the outlook for US equities: AI will drive stocks higher.

Bank of America and RBC both referenced AI when boosting their 2023 year-end price targets for the S&P 500, while Goldman Sachs called the S&P 500 undervalued due to AI.

"We assume that widespread AI adoption occurs in 10 years and lifts trend real GDP growth by 1.1 percentage point for 10 years. In this scenario, earnings per share in 20 years would be 11% greater than our current assumption and the S&P 500 fair value would be 9% higher than today, holding all else equal," Goldman Sachs strategist Ryan Hammond wrote in a note on June 6.

The mentions of AI in Wall Street commentary has followed a first-quarter earnings season littered with the word.

There are companies that have laid out clear revenue streams like Nvidia (NVDA), whose current quarter expectations for $11 billion in revenue topped Street estimates for $7.2 billion. There are others with clear strategies and use cases, like the search wars between Microsoft (MSFT )and Google (GOOGL). And there are even some consumer businesses like Best Buy (BBY) that plan to use AI to help summarize customer calls.

Reuters

ReutersAmazon duped millions of consumers into enrolling in Prime, US FTC says

WASHINGTON (Reuters) -The U.S. Federal Trade Commission on Wednesday accused Amazon.com of enrolling millions of consumers into its paid subscription Amazon Prime service without their consent and making it hard for them to cancel, the latest action by the agency against the ecommerce giant in recent weeks. The FTC sued in Amazon in federal court in Seattle, alleging that "Amazon has knowingly duped millions of consumers into unknowingly enrolling in Amazon Prime." The FTC said Amazon used "manipulative, coercive or deceptive user-interface designs known as 'dark patterns' to trick consumers into enrolling in automatically renewing Prime subscriptions."

3h ago Yahoo Finance

Yahoo FinanceAI snake oil is here, and it’s a distraction

AI snake oil is everywhere, and it's taking away from the broader conversation about the technology's potential pitfalls.

2h ago Yahoo Finance

Yahoo FinanceKevin Hart eyes his next $100 million investment

Entertainer Kevin Hart and the CEO of his production company Hartbeat Thai Randolph take Yahoo Finance Live inside their growing media empire.

2h ago Yahoo Finance

Yahoo FinanceSenate moves closer to a ‘claw back’ of executive pay after bank failures

A bipartisan effort to ‘claw back’ compensation from bank executives is one of the most significant legislative moves to rein in the industry since the collapse of Silicon Valley Bank.

2h ago Reuters

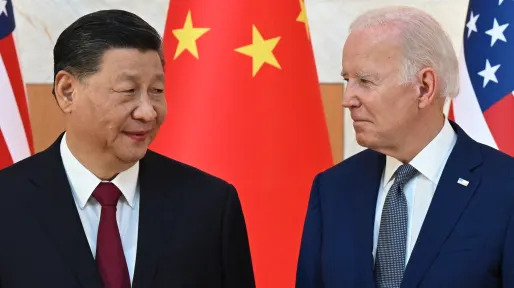

ReutersUPDATE 10-China hits back after Biden calls Xi a 'dictator'

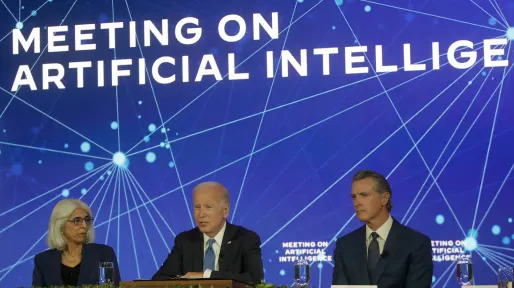

China hit back on Wednesday after U.S. President Joe Biden referred to President Xi Jinping as a "dictator", saying the remarks were absurd and a provocation in an unexpected row following efforts by both sides to lower tensions. Biden made his comments just a day after U.S. Secretary of State Antony Blinken visited Beijing to stabilize relations that China says are at their lowest point since formal ties were established. Attending a fundraiser in California, Biden said Xi was very embarrassed when a suspected Chinese spy balloon was blown off course over U.S. airspace early this year, and suggested Xi's embarrassment was compounded by his grip on power.

17h ago TipRanks

TipRanksDown More Than 40%: Analysts Say Buy These 2 Beaten-Down Stocks Before They Rebound

Watching a stock you own slip and slide to the bottom is no fun. Even worse, watching it fall as the markets are up doubles the pain. Having said that, the ‘buy low, sell high’ maxim is not the worn-out cliché it is for nothing. The savvy investor knows that the best time to pick up shares is when they are lying in the doldrums in anticipation of a turnaround. But how to find the right names that are only temporarily down and due a bounce back? Enter the Wall Street pros. We opened the TipRanks

4h ago The Wall Street Journal

The Wall Street JournalIs SoftBank an AI Stock Now?

There are some clear risks, as well as opportunity, for shareholders of the Japanese tech-investment company.

7h ago Yahoo Finance

Yahoo FinanceCoca-Cola's marketing chief on 2024 political advertising: 'We don't play in that'

Coca-Cola's top marketer tells Yahoo Finance Live at Cannes the consumer products giant will play it safe during the 2024 presidential race.

20h ago Yahoo Finance

Yahoo FinanceThe AI hype bubble is getting out of control: Morning Brief

The AI hype bubble is bordering on out of control. Beware, investors, writes our executive editor Brian Sozzi on assignment in Cannes, France.

1d ago Yahoo Finance

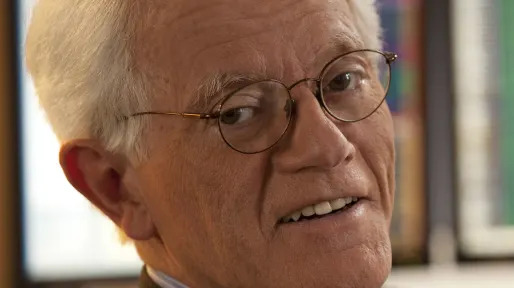

Yahoo FinanceFidelity legend Peter Lynch: 'I never said to invest in the stock market'

Peter Lynch is The legendary former Fidelity Magellan fund manager and author of the pioneering book on investing “One Up On Wall Street,” which will celebrate its 35th anniversary next year, He and Kerry Hannon, among other things, discussed what has changed since that book first came out.

1d ago Reuters

ReutersWall St drops as Powell doubles down on inflation fight

Wall Street's main indexes fell on Wednesday, with the Nasdaq leading declines, as Federal Reserve Chair Jerome Powell struck a hawkish tone in his congressional testimony, while Tesla fell the most among megacap stocks. Powell told lawmakers that the central bank was undeterred from its goal to bring inflation down to the 2% target and, despite a recent pause in rate hikes, officials were in agreement borrowing costs would likely still need to move higher. A majority of money market participants expect only one rate hike of 25 basis points in July by the central bank for the rest of the year, according to CMEGroup's Fedwatch tool.

6h ago Yahoo Finance

Yahoo FinanceFord teams up with veterans' group Team Rubicon to provide natural disaster relief

Ford is again joining forces with veteran-led disaster response outfit Team Rubicon to tackle the rising threats of climate disasters.

21h ago TipRanks

TipRanks‘Load Up,’ Says Raymond James About These 2 ‘Strong Buy’ Stocks

In recent weeks, the market sentiment has undergone a noticeable shift. According to a recent survey conducted by the American Association of Individual Investors (AAII), bullish sentiment has reached ~45%, marking its highest level since November 2021. That has been reflected in the market action, with more than 55% of stocks in the S&P 500 currently trading above their 50- and 200-day moving averages. Larry Adam, the Chief Investment Officer of Raymond James, adds his perspective, stating, “Gi

18h ago Bloomberg

BloombergGoldman Strategists See Many Reasons for Hedging S&P 500 Rally

(Bloomberg) -- Investors should consider hedging the rally in the S&P 500 for recession-related risks, say Goldman Sachs Group Inc. strategists, citing several equity indicators.Most Read from BloombergNoises Detected in Search for Titanic Vessel as Oxygen WanesChina Says Biden Calling Xi a Dictator Is ‘Provocation’These Are World’s Most Expensive Cities for High-Class LivingHedging Failure Exposes Private Equity to Interest-Rate SurgeThe Best Restaurant in the World Is Central in LimaBullish op

9h ago Barrons.com

Barrons.com2 Best Chip Stocks to Play the AI Boom, Says Analyst

Bernstein analyst Stacy Rasgon says Nvidia and Broadcom are the ideal chip stocks to benefit from the rising demand for artificial-intelligence semiconductors.

1d ago Yahoo Finance

Yahoo FinanceUS falls behind in shrinking the gender gap, World Economic Forum says

In the WEF’s 17th annual Global Gender Gap report, the U.S. ranked 43rd in gender equality out of 146 countries – a decline from 27th last year.

20h ago Yahoo Finance

Yahoo FinanceDelta exec foreshadows ‘vitriolic’ 2024 election: Our values 'are not for sale'

Delta's head of marketing affirmed the air carrier is "quite clear about where we are, what we stand for" as US companies brace for another divisive election.

33m ago Business Insider

Business InsiderBill Ackman cites his best investments, praises Elon Musk, and warns against following conventional wisdom. Here are his best 6 quotes.

Bill Ackman cited his top investments, warned against following conventional wisdom, praised Elon Musk, and pointed to the best way to find opportunities for discovery and profit.

22h ago Benzinga

Benzinga'Their Role Isn't To Educate Society': Kevin O'Leary Just Ripped Mark Cuban's Claim That 'Going Woke Is Good For Business,' Warns That You Risk Alienating 50% Of Your Customers

“Shark Tank” reality TV stars Mark Cuban and Kevin O’Leary are both successful businessmen and investors, but they don’t agree on every subject. For instance, Cuban recently said it makes good business sense for companies to embrace “woke” ideology. “There is a reason almost all the top 10 market cap companies in the U.S. can be considered ‘woke.’ It’s good business,” the Dallas Mavericks owner told the Pittsburgh Post-Gazette. O’Leary disagrees. Check out: Investing in real estate just got a wh

1h ago TipRanks

TipRanksThese 10%-Yielding Dividend Stocks Are Bargain Buys, Says Analyst

What to do when the conventional wisdom and the market sentiment are tugging in different directions? It’s happening now, with markets registering strong year-to-date gains even though elevated inflation and high interest rates are threatening a credit crunch and starting to crimp consumer spending. B. Riley’s chief investment strategist, Paul Dietrich, has been watching the markets closely, noting, “The jump in the S&P 500’s big tech stocks is hiding concerns among investors that the U.S. is ab

1d ago TipRanks

TipRanksBillionaire Ken Griffin Says the Chinese Equity Market Is Incredibly Attractive — Here Are 3 Stocks to Take Advantage

The post “zero-Covid” rebound in China has been something of a disappointment so far. Many thought that the removal of the stringent lockdown policies at the back end of 2022 would lead to an economic revival, but the uptick has been rather muted. Despite some decent economic data, other issues have come to the fore, such as elevated rates of unemployment among the younger population, a deceleration in manufacturing operations, a challenging housing market, and ongoing geopolitical tensions with

1h ago South China Morning Post

South China Morning PostAlibaba founders Jack Ma, Joe Tsai appear in Hangzhou in show of confidence amid corporate reshuffling

Founding team members of Alibaba Group Holding converged in Hangzhou on Tuesday, as China's largest e-commerce firm showed a united front after its CEO and chairman announced plans to step aside to focus on the cloud business. Alibaba co-founder Jack Ma and current CEO and chairman Daniel Zhang Yong appeared together at the office of Alibaba Cloud, which Zhang also heads. In photos and videos of the event, the two smiled while chatting over drinks and walking through the company's campus. Ma, wh

8h ago Investor's Business Daily

Investor's Business DailyBoeing Stock: Big Orders At Paris Air Show For Planemakers. But 'Not Much New.'

Plane-makers and their jet-engine suppliers continue to tout a strong demand outlook. But Boeing fell after Airbus' big win.

2h ago The Fly

The FlyTesla downgraded, Adobe upgraded: Wall Street's top analyst calls

Tesla downgraded, Adobe upgraded: Wall Street's top analyst calls

4h ago Zacks

ZacksThe Zacks Analyst Blog Highlights PepsiCo, AbbVie, Honeywell, Salesforce and Goldman Sachs

PepsiCo, AbbVie, Honeywell, Salesforce and Goldman Sachs are included in this Analyst Blog.

9h ago The Wall Street Journal

The Wall Street JournalAt 3M, Lawsuits Threaten to Transform the Company

Analysts say a dividend cut and a heavier debt load loom for the Scotch tape maker amid potential settlement payments costing billions.

14h ago Zacks

ZacksIBM (IBM) Dips More Than Broader Markets: What You Should Know

IBM (IBM) closed the most recent trading day at $135.96, moving -1.11% from the previous trading session.

20h ago Zacks

ZacksBank of America (BAC) Dips More Than Broader Markets: What You Should Know

Bank of America (BAC) closed the most recent trading day at $28.87, moving -1.1% from the previous trading session.

20h ago Zacks

ZacksEnterprise Products Partners L.P. (EPD) is Attracting Investor Attention: Here is What You Should Know

Enterprise Products (EPD) has been one of the stocks most watched by Zacks.com users lately. So, it is worth exploring what lies ahead for the stock.

5h ago Bankrate

BankrateBest monthly dividend stocks

Monthly dividend stocks let you experience the joy of getting paid 12 times a year.

1d ago Investor's Business Daily

Investor's Business DailyC3.ai Investor Day Looms With New AI Features On Watch; Is AI Stock A Buy Now?

C3.ai had sales of $72.4 million in the fiscal fourth quarter — in line with the higher end of its preliminary sales numbers.

5h ago Oilprice.com

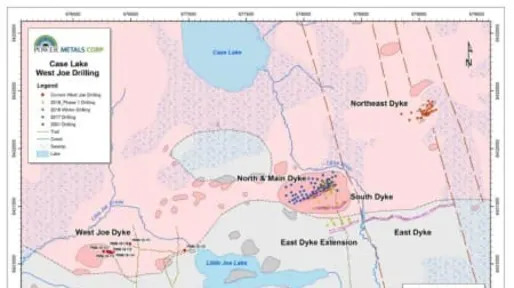

Oilprice.comCesium Wars: Why Are China and North America Fighting Over This Rare Metal?

As the struggle for control of strategically important metals continues between China and North America, Canada has regained full control of a very important deposit of this rare metal

18h ago Investor's Business Daily

Investor's Business DailyIs Palantir Stock A Buy On Its Artificial Intelligence Prospects?

Will generative artificial intelligence boost Palantir stock in the commercial market amid slowing revenue growth for the company?

1d ago Barrons.com

Barrons.comFTC Sues Amazon. The Stock Is Sliding.

[The Federal Trade Commission is suing Amazon](https://www.ftc.gov/news-events/news/press-releases/2023/06/ftc-takes-action-against-amazon-enrolling-consumers-amazon-prime-without-consent-sabotaging-their) for attempting to enroll consumers in Amazon Prime without their consent and complicating efforts to cancel subscriptions.

2h ago Barrons.com

Barrons.comAT&T Sees Drop in Postpaid Subscribers. But It’s Not All Bad News.

AT&T said Tuesday that it anticipates to report a decline in postpaid phone subscriber additions in the second quarter, but the telecommunications company remains on track to deliver full-year free cash flow of $16 billion. AT&T (ticker: T) Chief Financial Officer Pascal Desroches said at a conference Tuesday the company is tracking to report slightly more than 300,000 second-quarter postpaid phone net additions. The telecommunications company also said at the time that the first quarter was the 11th straight quarter with more than 400,000 net adds.

1d ago Zacks

ZacksStratasys (SSYS) Provides Estimates for Desktop Metal Merger

Stratasys (SSYS) files preliminary Form F-4 and provides revenue and EBITDA estimates for its merger with Desktop Metal.

2h ago Zacks

ZacksIs Allegro MicroSystems (ALGM) Outperforming Other Computer and Technology Stocks This Year?

Here is how Allegro MicroSystems, Inc. (ALGM) and Shopify (SHOP) have performed compared to their sector so far this year.

4h ago Benzinga

Benzinga'This Really Needs To Stop': Elon Musk Just Slammed Ireland's Plans To Slaughter 200K Cows For Climate Change — 3 Top Green Stocks That Actually Make A Difference

Cows, like all living mammals, produce greenhouse gases, which could threaten their existence. According to the Telegraph, Ireland is reportedly considering killing 200,000 cows in the country to meet the European Union’s climate targets. Not everyone is a fan of this method. “Reports like this only serve to further fuel the view that the government is working behind the scenes to undermine our dairy and livestock sectors,” said Tim Cullinan, president of the Irish Farmers’ Association. It also

22h ago Reuters

ReutersIntel to sell 20% stake in Austrian chip company

Intel's stake sale of 20% was valued at $860 million, according to Reuters calculations. IMS, which was acquired by Intel in 2015, makes equipment that are critical for companies that make chips. It has delivered a significant return on investment to Intel while growing its workforce and production capacity by four times, Intel said.

5h ago Zacks

ZacksThe Charles Schwab Corporation (SCHW) Dips More Than Broader Markets: What You Should Know

The Charles Schwab Corporation (SCHW) closed the most recent trading day at $53.93, moving -0.86% from the previous trading session.

20h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK