The housing market is so detached from fundamentals that a leading research firm...

source link: https://finance.yahoo.com/news/housing-market-detached-fundamentals-leading-122712553.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

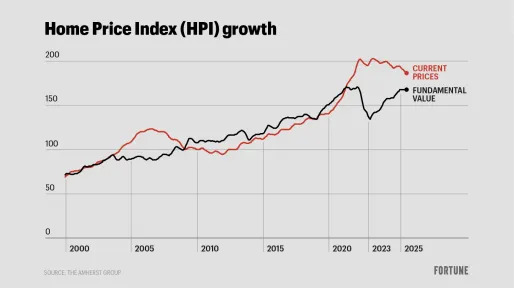

The housing market is so detached from fundamentals that a leading research firm predicts the pause in home price declines is about to ‘prove temporary’

Back in early January, economists at Capital Economics put out a report arguing that U.S. housing market demand had finally bottomed out following last year's mortgage rate induced pullback.

Not long after that report was published, housing metrics began to show a bounce back up as the 2023 spring housing market came to life. After falling for seven straight months between July 2022 and January 2023, U.S. home prices as measured by the seasonally adjusted Case-Shiller National Home Price Index rose in February and March.

However, in that January report, the U.K. research firm predicted that U.S. home prices had not reached the bottom. Peak to trough, Capital Economics expected U.S. home prices to fall 8%.

Fast-forward to June, and Capital Economics put out a new report titled “Pause in house price declines to prove temporary.” The report argues that following the resilient 2023 spring housing market, home prices in the second half of the year will revert back into correction mode.

"The seven-month run of house price declines recently ground to a halt, with the Case-Shiller index showing an increase in prices in both February and March. This was partly driven by the temporary boost to demand at the start of the year from declining mortgage rates," wrote researchers at Capital Economics. "But rates have since returned close to the double-decade highs set in October, which has caused demand to fall to its lowest levels in almost 30 years. Given this and a weakening economy, we expect sales will remain low and that price growth will turn negative again later this year."

View this interactive chart on Fortune.com

With the exception of CoreLogic and Zillow, most economic models continue to project house price declines in 2023. The underlying reason is that housing affordability (or, better put, the lack of affordability) has become strained at levels not seen since the housing bubble.

In order for those forecasters to be right, they'll need home price declines in the seasonally slow second half of the year to be big enough to wipe out all the gains accrued during the seasonally warmer first half of the year.

Fortune

FortuneWall Street’s biggest bull called this year’s stock market rally—now instead of a recession, he says ‘the economy is actually slipping into an expansion’

Fundstrat’s Tom Lee is known for his bullish takes. He called a 20% S&P 500 rebound this year, and it’s up over 14% so far.

1d ago Fortune

FortuneGen Z is incredibly ambitious. They’re just not interested in climbing your corporate ladder

Young workers and their efforts to redefine what success looks like will significantly transform how companies retain and develop talent.

1d ago Business Insider

Business InsiderThe stock rally will end soon, recession will hit, and the Fed won't hike interest rates again, markets guru Jeremy Siegel predicts

The stock-market boom won't last, the economy will suffer a mild recession, and the Fed won't raise interest rates any higher, Jeremy Siegel says.

3h ago Business Insider

Business InsiderHome prices are set to tumble in the 2nd half of 2023 as mortgage rates rebound and the economy slows, economists say

The housing market's resilience to start the year is going to reverse in the coming months, according to a Capital Economics report.

1d ago Fortune

FortuneJerome Powell just admitted that some banks are in trouble with their commercial real estate holdings: ‘We do expect that there will be losses’

“There will be banks that have concentrations, and those banks will experience larger losses,” Powell told reporters on Wednesday.

6h ago Benzinga

Benzinga'I Told You So!' — Dave Ramsey's Accurate Call on Real Estate 18 Months Ago. What Does The Money Expert Say Is Next?

Who can forget the Great Recession? For those heavily involved in real estate or grappling with the aftermath of underwater mortgages, the memories may still sting. The subprime mortgage crash of 2008 inflicted a harsh reality as housing prices plummeted by one-third, leaving lasting scars in its wake. Today, with mortgage rates skyrocketing and high-profile bank failures still fresh in the collective consciousness, Americans find themselves approaching the housing market with a healthy dose of

1d ago Benzinga

Benzinga3 REITs Hit With New Downgrades To Start The Week

Wall Street analysts wield a lot of influence. A favorable or unfavorable mention of a stock by a well-known analyst or brokerage can move a stock up or down by several percentage points overnight. In the case of a downgrade or severe price target slash, it can take weeks or longer for a stock to recover. An upgrade or downgrade can also spur other analysts to announce similar new ratings, leading to even larger gains or losses. This week, three very different real estate investment trusts (REIT

1d ago Fortune

FortuneSupreme Court Justice Clarence Thomas had a secret real estate billionaire benefactor. We just got a look at the other justices’ holdings

Sonia Sotomayor's more than $1 million apartment in New York City's West Village was disclosed—and John Roberts's house in Ireland.

9h ago Business Insider

Business InsiderThe housing market is so tight because 90% of homeowners locked in lower mortgage rates before last year's surge

Nearly a quarter of homeowners have a mortgage rate below 3%, close to the highest percentage with a rate that low on record.

5h ago Fortune

FortuneTop real estate CEO––and AI whiz––shares data showing America’s housing market is significantly overvalued. The headline number may shock you.

Sean Dobson, founder and CEO of property powerhouse Amherst, has access to unique data as one of the largest owners of single-family homes in the U.S.

2d ago Yahoo Finance

Yahoo FinanceIt hasn’t been this hard for homebuyers to get a mortgage since 2013

An index measuring mortgage availability overall slid for the third month in a row to the lowest level since January 2013.

7h ago Reuters

ReutersHomebuilder Lennar raises full-year forecast for home deliveries

Existing homes inventory remains 44% below pre-pandemic levels, according to data from the National Association of Realtors, resulting in price rises in some parts of the country, multiple offers and homes being sold above list price. The perennial shortage of homes on the market is frustrating would-be buyers eager to take advantage of dips in mortgage rates. "As consumers have come to accept a "new normal" range for interest rates, demand has accelerated, leaving the market to reconcile the chronic supply shortage derived from over a decade of production deficits," said Stuart Miller, executive chairman at Lennar.

6h ago Yahoo Finance

Yahoo FinanceHousing data shows that Americans still love the South

Four Southeast cities of the 20 nationwide tracked by S&P CoreLogic Case-Shiller index led year-over-year price growth in March. The cities are Miami, Tampa, Charlotte, and Atlanta.

1d ago Business Insider

Business InsiderLow housing supply could squeeze home prices up 5% in 2023 even though mortgage rates have spiked, Zillow economist says

Falling inventory levels are "a big, huge, massive part of the picture," Skylar Olsen said on Monday.

8h ago Bloomberg

BloombergSternlicht’s Starwood Eyes Sale of More Than 2,000 Rental Homes

(Bloomberg) -- Starwood Capital Group, led by Barry Sternlicht, is exploring a sale of more than 2,000 single-family rental homes. Most Read from BloombergElizabeth Holmes Objects to $250-a-Month Victim Payments After PrisonInstant Pot and Pyrex Maker Instant Brands Files BankruptcyUS Inflation Slows, Giving Room for Fed to Pause Rate HikesPutin’s Economic Forum Puts Russia’s Isolation on DisplayAmericans Say They Need $2.2 Million to Be Considered WealthyMany of the homes being offered for sale

1d ago The Wall Street Journal

The Wall Street JournalHow Many Pavilions Is Too Many Pavilions? For This Homeowner, Three Was Just Right

Julieann Shanahan spent $1.6 million to build a trio of these freestanding structures in the backyard of her Villanova, Pa., home.

7h ago SmartAsset

SmartAssetHow Can I Peacefully Handle Inheriting a Home With My Siblings?

Inheriting a house with siblings can raise some questions about what it means for each of you financially. For example, will one of you live in the home and buy out the others? Or will you sell it and split … Continue reading → The post What to Do When Inheriting a House With Siblings appeared first on SmartAsset Blog.

2d ago Benzinga

Benzinga10 States With The Highest Rent Increases

Rising home values coupled with increased interest rates are causing many people to rethink whether now is the right time to buy a house, and that’s pushed lease rates higher than they’ve been in years. Florida and Colorado have seen rent prices increase by more than 45% since 2020, according to an analysis of Zillow data from luxury real estate experts at RubyHome in California. Florida’s average rent increased to $2,128 in 2023 — an increase of 45.77% over 2020. Because Florida doesn’t have re

7h ago Business Insider

Business InsiderRenters about to catch a break as rents post their biggest drop in 3 years

Growing vacancies and a decline in people looking to move brought down the asking rent price in May, Redfin reports.

1d ago The Wall Street Journal

The Wall Street JournalWealthy Buyers Are Turning This Region Into One of Italy’s Hottest Home Markets

The area has seen an influx of high-end buyers willing to spend millions on historic farmhouses and villas.

23h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK