The Business of Online Education: A Deep Dive Into Thinkific’s Financials

source link: https://www.classcentral.com/report/thinkific-economics/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

The Business of Online Education: A Deep Dive Into Thinkific’s Financials

From IPO success to stabilization efforts, explore the journey of Thinkific, an ecommerce platform for online course creators, as they navigate growth, setbacks, and strive for profitability.

The simplest way to describe Thinkific is as an ecommerce platform for creators to launch online courses under their own brand.

Thinkific is part of a group of companies that lets anyone offer online courses and collect payments, and that provides tools to market and acquire students. Their main audiences aren’t traditional educators, but “businesses and entrepreneurs”.

Thinkific customers include course creators ranging from individual entrepreneurs to large enterprises like Shopify, Hootsuite, Petco, and Fiverr. Some of these platforms offer their courses for free.

“Thinkific was founded to solve problems for entrepreneurs and businesses seeking to use online education for growth.”

– Thinkific IPO Prospectus

Two years ago, Vancouver-based company Thinkific made its debut on the Toronto Stock Exchange (TSX), successfully raising over $150 million. At that time, I conducted an analysis of their initial public offering (IPO) filings. Now, I am expanding my analysis to encompass the most recent public filings and annual reports released by the company.

As part of my ongoing series for Class Central, I am dissecting the online education businesses. In the past, I scrutinized the finances of Coursera, Udemy, and Khan Academy. If you have any specific request for other companies that you would like me to analyze, please don’t hesitate to leave a note in the comments section.

Thinkific: By The Numbers

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| GMV | $68M | $112M | $276M | $414.8M | $409.8M |

| Revenues | $6M | $9.8M | $21M | $38.1M | $51.5M |

| Net profit (loss) | $230k | $291k | ($1.3M) | ($26.4M) | ($36.4M) |

| Paying Customers | 7.1k | 10.9k | 24.6k | 32.3K | 33.6K |

| Headcount | 70 | 102 | 223 | 450 | NA |

In 2020, Thinkific boasted 50,000 active creators and an impressive 66 million course enrollments from 21 million students. Regrettably, I was unable to locate the most recent data on student numbers and enrollments.

Thinkific’s Gross Merchandise Value (GMV), which represents the total revenue earned by course creators, amounted to $276 million in 2020, a significant surge from just $1 million in 2015.

However, Thinkific experienced a sobering year in 2022. In the pursuit of growth, the company had been sacrificing profitability. In 2019, they generated $291,000 in profit with revenues of $9.8 million. The following year, their revenues more than doubled to $21 million, and their employee count rose from 102 to 223, but this expansion resulted in a loss of $1.3 million.

The trend continued in 2021, the year Thinkific went public. Revenues saw an 80% increase, and the employee headcount doubled, but the losses skyrocketed to an astonishing 20-fold increase, reaching $26.4 million. On the brighter side, GMV rose to $414.8 million.

When analyzing Thinkific’s numbers, their journey bears a striking resemblance to that of FutureLearn. Both companies pursued growth aggressively, but the resultant losses outweighed the favorable impact on revenue. In fact, Class Central reported last year that FutureLearn had exhausted the £50 million it raised from SEEK and required an additional £15 million to stay afloat.

| Revenue | Losses | Learners | |

| 2021 | £11.3M | £16.1M | 16.5M |

| 2020 | £9.9M | £13.3M | 13.5M |

| 2019 | £7.9M | £6.6M | 9.5M |

| 2018 | £8.2M | £4.1M | 8.0M |

In my analysis titled “The ‘New Normal’ that Wasn’t,” I discussed the challenges faced by several companies in 2022, particularly those focused on growth. Online learning companies, including Thinkific, were among those that experienced significant setbacks, resulting in layoffs and a decline in stock prices.

Thinkific: Stock price decline

Since going public, Thinkific’s stock price plummeted by 85%, prompting the company to take drastic measures to stabilize and prevent further decline. To address the situation, Thinkific implemented two rounds of layoffs. The first round, involving 100 employees, took place in March 2022, followed by another round affecting 75 employees in January 2023.

Despite these measures, Thinkific incurred a loss of $36.4 million in 2022, while generating a revenue of $51.5 million. Additionally, its Gross Merchandise Volume (GMV) experienced a slight drop to $409.8 million.

According to a letter published by Thinkific’s CEO and Co-Founder, Greg Smith, these measures are aimed at making the company profitable by the end of 2023. Signs of reduced losses are already evident in the financial results for Q4 2022 and Q1 2023.

| Revenue | Net (Loss) | |

| Q1 2019 | $2.0M | $366k |

| Q2 2019 | $2.3M | $99k |

| Q3 2019 | $2.55M | $25k |

| Q4 2019 | $2.95M | ($201k) |

| Q1 2020 | $3.3M | ($420k) |

| Q2 2020 | $4.5M | ($386K) |

| Q3 2020 | $6.0M | ($112k) |

| Q4 2020 | $7.2M | ($375k) |

| Q1 2021 | $8.3M | ($986K) |

| Q2 2021 | $9.1M | ($5.3M) |

| Q3 2021 | $9.9M | ($10.7M) |

| Q4 2021 | $10.8M | ($9.4M) |

| Q1 2022 | $11.8M | ($12.0M) |

| Q2 2022 | $12.6M | ($10.1M) |

| Q3 2022 | $13.3M | ($10.7M) |

| Q4 2022 | $13.8M | ($3.7M) |

| Q1 2023 | $14.1M | ($7.0M) |

Udemy vs Thinkific

Udemy: Catalog growth

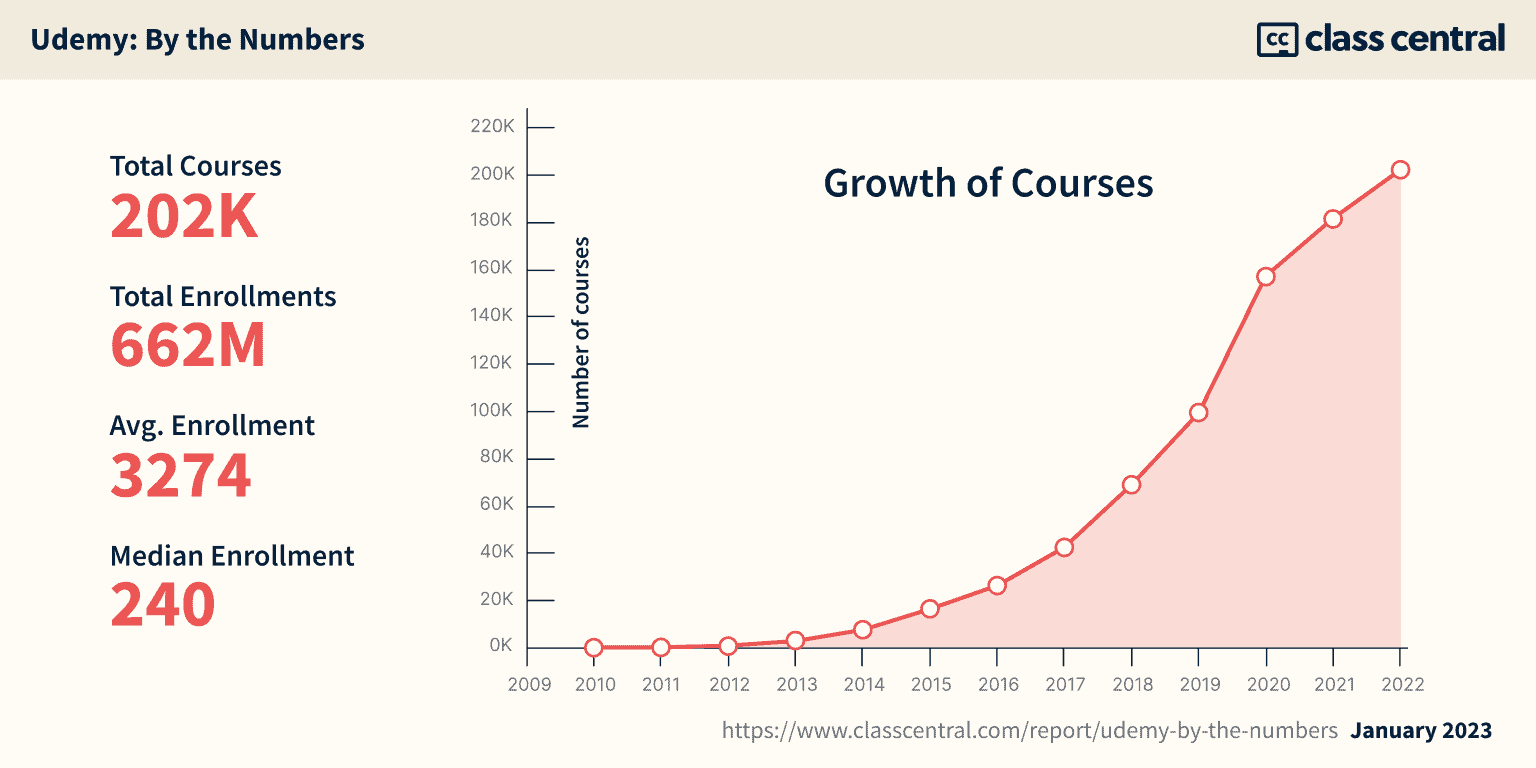

Udemy also lets anyone launch online courses. The big difference is that in Thinkific’s case, you can launch these courses under your own brand. Creators also don’t have to share a significant percentage of their revenue like they do with Udemy, and they get access to their own students.

Udemy’s advantage is its immense marketing power, making it one of the most visited websites on the Web. But when I analyzed Udemy’s catalog, I found that Udemy’s top 20% courses by enrollment account for 90% of all enrollments. The median enrollment for a Udemy course was just 240. And creators are subject to Udemy’s changing policies on revenue sharing.

If you can market your own courses or have a following on major social media platforms, Thinkific and its competitors may be a way to go.

The dynamics at play are very similar to Amazon vs Shopify (which allows you to launch your own ecommerce platform). Udemy is Amazon while Thinkific is Shopify.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK