MILESTONE: Digital Remittances Surpass Non-Digital Ones Globally for the First T...

source link: https://bitcoinke.io/2023/05/south-africa-introduces-new-banknotes/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

South Africa Joins Nigeria with New Banknotes to Tackle Counterfeiting – BitcoinKE

South Africa has become the latest African country to release new banknotes and coins as it aims to fight counterfeiting and keep up with technology.

The new coin and note series have been four years in the making.

The notes, which went into circulation in May 2023, contain enhanced security features, including color-changing ink, to prevent counterfeiting.

- The notes retain the image of Nelson Mandela, the country’s first democratically elected president who died in 2013

- Africa’s ‘Big Five’ wild animals – rhino, elephant, lion, buffalo and leopard – are now depicted with their young on the banknotes

The notes are also rolling out in Namibia, Eswatini and Lesotho that are in a common monetary area with South Africa and where the Rand is considered legal tender alongside their own currencies, said Fundi Tshazibana, Deputy Governor of the Reserve Bank of South Africa (SARB).

#DidYouKnow that the SA Reserve Bank has upgraded the security features on our banknotes to protect them against counterfeiting? Counterfeiting diminishes the value of money and tarnishes the credibility of a currency, costing countries billions. The enhanced security features… pic.twitter.com/ufQJ0VmVNc

— SA Reserve Bank (@SAReserveBank) May 18, 2023

Existing banknotes and coins continue to remain legal tender and can be used alongside the upgraded banknotes, said the South Africa Reserve Bank.

In November 2022, Central Bank of Nigeria, for the first time in 19 years, unveiled re-designed notes to replace the previous N1,000, N500 and N200 notes. However the government came under pressure when it set a deadline of January 31 2023 for the termination of the old notes.

The bank later extended the deadline to February 2023 amid numerous complaints with Nigerians saying they could not access the new notes. Commercial banks were also said to lack the new notes to offer in exchange despite the Central Bank’s insistence that they had notes sitting in their vaults.

Eventually the country’s supreme court ruled that the old banknotes will remain as legal tender alongside the new Naira currency, at least until December 2023.

While the countries have employed different strategies to phase out their old money at the onset, both efforts are targeting counterfeiting whereby currency is produced without the legal sanction of the state or government.

In February 2023, the two countries were in the headlines after global watchdog, the Financial Action Taskforce (FATF), added them to its ‘grey list’ – a list composed of countries under special scrutiny for failing to implement standards to prevent money laundering and terrorism financing.

Follow us on Twitter for the latest posts and updates

_____________________________________

_____________________________________

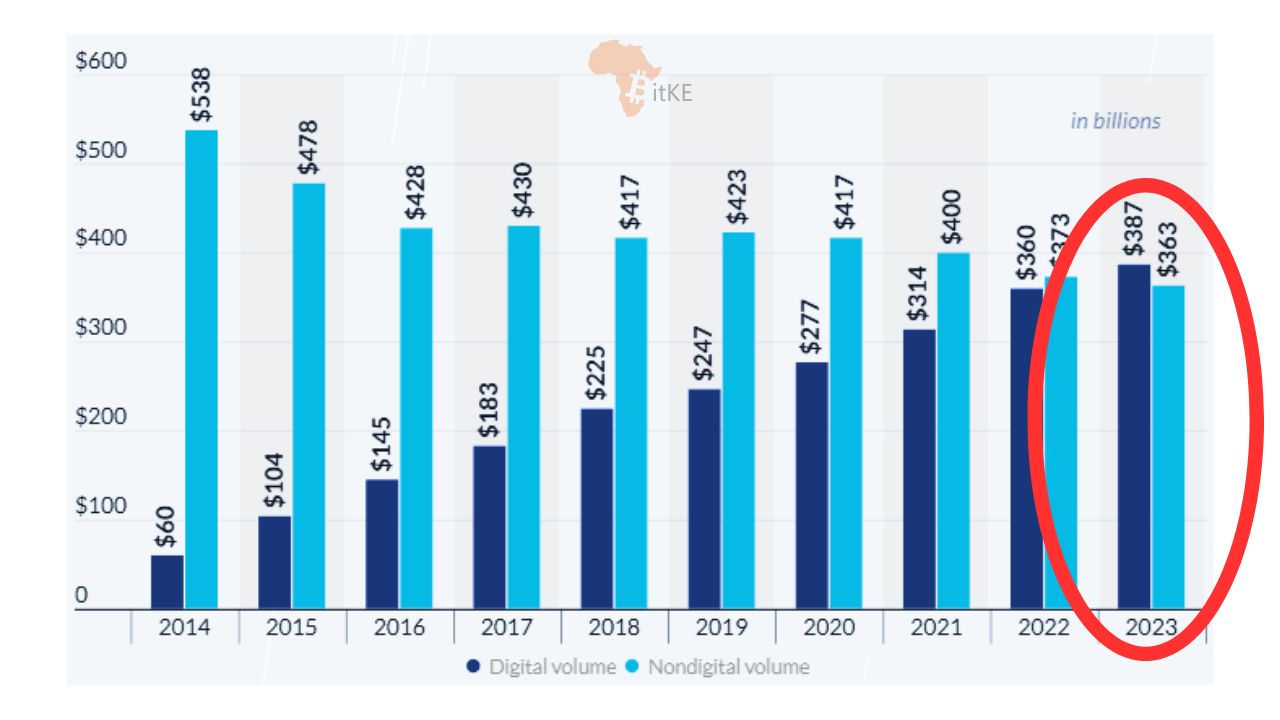

2023 is the first year that digital remittances have overtaken offline remittances as the preferred way to send money abroad, a survey by Statista has revealed.

Based on the data, 2020 was a turning point as with 90% of all remittances leaving the sender as cash and reaching the recipient as cash in 2019. But in 2020 40.2% of remittances that were previously made in cash suddenly went digital.

Taken together, remittances are believed to directly touch the lives of 1 billion people on earth. pic.twitter.com/asfR7mcluU

— BitKE (@BitcoinKE) May 23, 2023

A separate survey by Visa shows digital remittances have surpassed non-digital remittances as the preferred method for transfers across the world’s regions, though African countries are not mentioned.

The survey indicates that between 60-70% of surveyed remittance users in North America, Saudi Arabia, and the United Arab Emirates have used app-based digital payments to send or receive money internationally.

Digital solutions remain the preferred choice for remittance transactions in the Asia Pacific region as well. The survey reveals that:

- A significant percentage of Filipino remittance receivers (57%) are inclined to use digital transfers for sending money in the future

- Additionally, 36% of Filipino respondents expressed their preference for receiving money internationally through digital channels

An analysis by IFAD (investing in rural people) highlights the significant growth of the remittances economy in Africa, which expanded from 44.3$ billion in 2007 to $60.5 billion in 2016. Eastern Africa experienced impressive growth, with total remittance value growing by 117% over that 10-year period.

A recent World Bank report said remittances to Sub-Saharan Africa, a region most highly exposed to the effects of global crisis, grew an estimated 5.2% to $53 billion in 2022, compared with 16.4% in 2021 (due mainly to strong flows to Nigeria and Kenya).

Remittances as a share of GDP are significant in:

- The Gambia (28%)

- Lesotho (21%)

- Comoros (20%)

Sending $200 to the region cost 7.8% on average in the second quarter of 2022, down from 8.7% a year ago.

Globally, the Visa survey reveals that 53% of consumers prefer to use digital methods for sending money internationally. The second-largest group of consumers, comprising 34% of respondents, still rely on physical banks or branches to send money overseas.

“Bank payments are subject to high international transfer fees, and also tend to offer less favourable exchange rates. It’s no wonder that more people are moving towards digital remittances, which are more competitive and offer much better value for money,” says Jonathan Merry, CEO of Money Transfers

Digital payments are also considered the most secure method by a strong proportion of remittance users across countries.

The availability of digital apps for remittances has led to an increase in both the frequency and the amount of money being sent overseas. The data suggests that in 2023, the total amount of worldwide remittances is projected to reach $750 billion, which represents a significant increase of $152 billion compared to the data from 2014 when tracking began.

Follow us on Twitter for the latest posts and updates

_______________________________________

_______________________________________

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK