How Tribe Capital selected and ranked the 2023 Seed 100 and Seed 30 lists of the...

source link: https://finance.yahoo.com/news/tribe-capital-selected-ranked-2023-110000147.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

How Tribe Capital selected and ranked the 2023 Seed 100 and Seed 30 lists of the best early-stage venture capitalists

Insider's Seed 100 and Seed 30 lists are created based on data from Tribe Capital.

Tribe began with data on over 1,600 investors, analyzing 25 attributes of success, such as exits.

This analysis identifies skilled investors with a high likelihood of continued success.

The Seed 100 and Seed 30 lists of the best seed investors of 2023 are derived from a statistical analysis of investor track records. This analysis is adapted from the models Tribe Capital uses internally to identify the most promising seed investors for partnership.

The point is to identify investors with extraordinary skill and a high likelihood of continued success. To be named to the list, seed investors must:

Perform well with investments, including successful initial public offerings or acquisitions (exits meaningfully above "liquidation preference," aka ones that demonstrated increased company value, rather than simple capital raises).

Show intermediate signs of success, with seed investments that consistently receive material sums of follow-on investment.

Be active in the ecosystem, with moderate to high levels of seed-investing activity over the previous two years.

Our methodology starts with analyzing each investor's performance in 25 areas using Crunchbase and PitchBook data. Since our goal is to predict accomplishments, rather than to focus solely on achievements, we consider only active investors with a minimum of five investments between 2008 and 2023. Our list includes solo venture capitalists and angel investors worldwide, assessed based on their investments in US companies.

While each criterion carries equal weight, exits (IPOs or acquisitions) have the most influence in differentiating investors. Given that seed investments typically take seven to 10 years to exit, our analysis covers an extended time frame.

This year, we updated the model to better approximate the rate at which investments were exiting. We also reduced the penalty for lower investment counts — given the current, slower dealmaking environment compared with earlier years. This also allowed more emerging managers to enter the scope.

Bloomberg

BloombergBillionaire Drahi Tightens Grip on BT, Building Stake to 25%

(Bloomberg) -- Billionaire Patrick Drahi increased his stake in BT Group Plc to 24.5%, giving him double the holding of the next-biggest investor and increasing his control over the UK telecommunications giant.Most Read from BloombergCarl Icahn Is $15 Billion Poorer After Hunter Becomes the HuntedMcCarthy Says Debt Deal Remains Elusive as Negotiations ResumeChina’s $23 Trillion Local Debt Mess Is About to Get WorseRussia Pushes India for Help to Avert Global Financial IsolationSaudi Energy Minis

11h ago Bloomberg

BloombergHong Kong Lets Retail Investors Trade Crypto in New Rules

(Bloomberg) -- Hong Kong said retail investors can trade crypto under its new rulebook for the sector, stepping up a drive to develop a digital-asset hub even as the industry and regulators clash elsewhere in Asia.Most Read from BloombergCarl Icahn Is $15 Billion Poorer After Hunter Becomes the HuntedMcCarthy Says Debt Deal Remains Elusive as Negotiations ResumeChina’s $23 Trillion Local Debt Mess Is About to Get WorseRussia Pushes India for Help to Avert Global Financial IsolationSaudi Energy M

12h ago Bloomberg

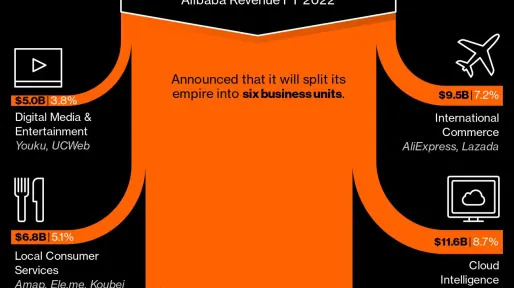

BloombergAlibaba’s Cloud Arm to Cut 7% of Staff in Overhaul, Sources Say

(Bloomberg) -- Alibaba Group Holding Ltd.’s cloud division has begun a round of job cuts that could reduce its staff by about 7%, part of an overhaul aimed at preparing the once fast-growing unit for a spinoff and eventual IPO.Most Read from BloombergCarl Icahn Is $15 Billion Poorer After Hunter Becomes the HuntedMcCarthy Says Debt Deal Remains Elusive as Negotiations ResumeChina’s $23 Trillion Local Debt Mess Is About to Get WorseRussia Pushes India for Help to Avert Global Financial IsolationS

10h ago TipRanks

TipRanks‘Too Cheap to Ignore’: Cathie Wood Snaps Up These 2 Stocks Under $10

Cathie Wood’s singular investing style has generated huge returns for investors of her ARK Invest ETFs during certain periods (such as during the pandemic). However, it’s a strategy that has also been responsible for racking up losses during other times, such as last year’s bear market. Wood’s preference has always been for disruptors – whether in tech, healthcare, or the auto industry – and even in difficult times, she has not deviated from that path. Whatever you make of her stock choices, Woo

7h ago Investor's Business Daily

Investor's Business DailyCybersecurity Firm Palo Alto Earnings Top Estimates On Cloud Growth

PANW stock rose as Palo Alto earnings for the April quarter topped Wall Street targets while revenue met views.

28m ago Business Insider

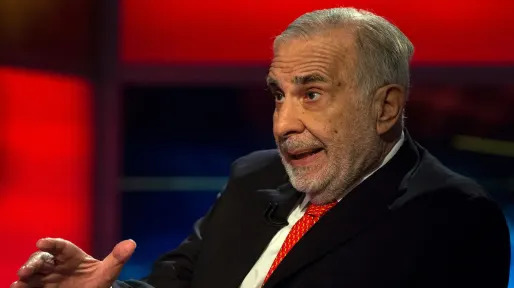

Business InsiderCarl Icahn's wealth has plunged by $15 billion since a short-seller targeted him – but the activist investor says he's ready to fight back

"If you're going to be bothered by this, you shouldn't be in this business," Icahn said in a recent interview after his fortune plummeted.

3h ago Investopedia

InvestopediaNvidia Q1 Earnings To Test Chipmaker's Lofty Valuations

Nvidia, the world's most valuable chipmaker, is expected to say revenue and net income shrank by as much as a fifth last quarter, putting its stock's 100% rally so far this year to the test.

7h ago TipRanks

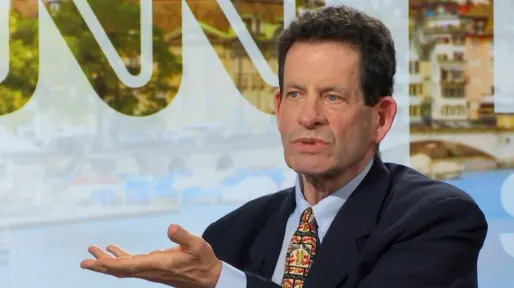

TipRanks‘Don’t Miss the Next Bull Market’: Billionaire Ken Fisher Stays Heavily Invested in These 2 ‘Strong Buy’ Stocks

After the bear market of 2022, the markets have made a recovery in 2023, with both the S&P 500 and, in particular, the NASDAQ showing healthy year-to-date gains. Therefore, it might be a natural instinct for investors who have nursed heavy losses to be eyeing the exit gate now that the market is rebalancing and the initial investment is back to breaking even. However, legendary investor Ken Fisher says that kind of thinking is a big mistake. “As initial bull market rallies build, investors — raw

1d ago Barrons.com

Barrons.comBud Light Sales Keep Cratering After Transgender Controversy. Price Wars May Be Next.

Bud Light sales were down 28.4% in the latest week, and parent Anheuser-Busch is now offering big rebates that could cut the cost of a case to under $5.

7h ago TipRanks

TipRanksGoldman Sachs Likes These 2 Stocks, Insiders Just Poured Millions Into Them — Here’s Why You Might Want to Ride Their Coattails

The well-worn adage ‘Keep it simple’ isn’t just a cliché; it holds true in many areas of life, including the stock market. It’s easy to get lost in the never-ending barrage of information and day-to-day drama on Wall Street, but a simple strategy will often point towards the best investment choices. One such strategy is to keep an eye on the insiders’ moves. These corporate officers are the ones who know best what is going on in the companies they oversee. When they are seen buying shares of the

21h ago Zacks

ZacksAT&T (T) Management Updates Shareholders on 2023 Targets

With a customer-centric business model, AT&T (T) is likely to benefit from the increased deployment of mid-band spectrum and greater fiber densification.

10h ago Barrons.com

Barrons.comAI Will Boost Microsoft and Google, Analysts Say. Worry About These Stocks Instead.

The splash made by ChatGPT this year “has opened people’s eyes” to the possibilities of artificial intelligence, analysts at Jefferies say—and has set the stage for winners and losers in the stock market. Among the winners are Microsoft —which backs OpenAI, the company behind ChatGPT—and Google parent Alphabet —which has developed its own AI chatbot called Bard—according to a team of Jefferies analysts led by Brent Thill. While ChatGPT represents a flashy new consumer-facing version of AI, enterprise adoption of the technology remains one of the biggest prizes.

6h ago Investor's Business Daily

Investor's Business DailyDow Jones Falls 150 Points After Biden-McCarthy Meeting; Lowe's Rallies On Earnings

The Dow Jones fell Tuesday after President Biden and House Speaker Kevin McCarthy failed to reach a deal at their debt ceiling meeting.

7h ago Investor's Business Daily

Investor's Business DailyWarren Buffett Stocks: Google Soars As LULU Stretches For Support

Google stock rejoins this screen of Warren Buffett stocks based on the investing strategy of Berkshire Hathaway's CEO.

1h ago Yahoo Finance

Yahoo FinanceBJ's earnings tell the whole story of the US economy right now

BJ's Wholesale Club reported results Tuesday morning that disappointed. But in those results were signs of inflation moderating while consumers grow more cautious, a microcosm of the US economy in one corporate release.

7h ago Zacks

Zacks3 Generic Drug Stocks to Watch Amid Macro Headwinds

The impact of macroeconomic headwinds on the Zacks Medical - Generic Drugs industry persists. New product launches provide some respite to AMPH, RDY and TEVA.

9h ago Investor's Business Daily

Investor's Business DailyThese 5 Growth Stocks Have Perfect 99 Ratings

A quick way to find the best growth stocks is to look for 99 MarketSmith ratings. InTest makes testing and technology products for the auto and EV, aerospace, industrial and semiconductor industries.

1d ago The Telegraph

The TelegraphKremlin gas profits plunge as tide turns in Putin’s energy war

Russian gas giant Gazprom’s net profit dropped over 40pc last year in another blow to Vladimir Putin's attempts to weaponise gas supplies.

2h ago Investor's Business Daily

Investor's Business DailyHow Much $10,000 Invested In Meta's IPO 11 Years Ago Is Worth Now

Sorry you didn't invest in Meta Platforms' initial public offering 11 years ago? Don't be. You probably did much better on other S&P 500 stocks.

1d ago Zacks

ZacksWall Street Analysts Look Bullish on Lithium Americas Corp. (LAC): Should You Buy?

Based on the average brokerage recommendation (ABR), Lithium Americas Corp. (LAC) should be added to one's portfolio. Wall Street analysts' overly optimistic recommendations cast doubt on the effectiveness of this highly sought-after metric. So, is the stock worth buying?

8h ago Zacks

ZacksHere's Why You Should Hold Lyft (LYFT) Stock in Your Portfolio

Solid driver supply and strong liquidity aid Lyft (LYFT). However, rising expenses are worrisome.

7h ago Business Insider

Business InsiderChina's economy has turned rotten and its reopening boom is a 'charade,' market expert says

"A growth model dependent on stimulus and debt was always going to be unsustainable, and now it has run out of steam."

22h ago Investor's Business Daily

Investor's Business DailyApple Inks Multibillion-Dollar Wireless-Chip Supply Deal With Broadcom

Apple announced a multiyear, multibillion-dollar agreement with Broadcom for the chipmaker to supply 5G wireless components.

45m ago SmartAsset

SmartAssetDoes Beneficiary Designation Overrule a Will?

Some financial products like life insurance or tax-advantaged retirement accounts require you to name one or more beneficiaries. However, that's not the case with many assets. For instance, you can buy a house or set up a savings account without … Continue reading → The post Differences of Beneficiary Designations vs. Wills appeared first on SmartAsset Blog.

1d ago Investor's Business Daily

Investor's Business DailyIs Palantir Stock A Buy On Its Artificial Intelligence Prospects In May 2023?

Will "generative" artificial intelligence boost Palantir stock in the commercial market amid slowing revenue growth for the company?

3h ago Investor's Business Daily

Investor's Business DailyBank Of America Upped Its Forecast For Stocks — Just Not The Ones You Think

Bank of America is getting more bullish on S&P 500 stocks. Just not the ones that have been driving the S&P 500 higher all year.

9h ago Bloomberg

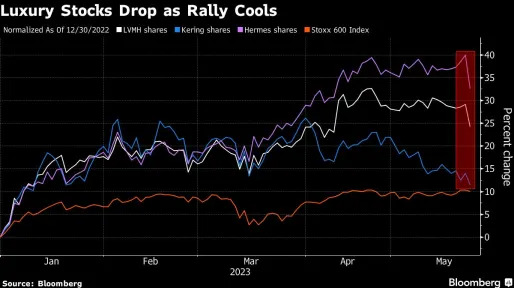

BloombergLuxury Stocks Lose $30 Billion in One Day on Demand Fears

(Bloomberg) -- A blistering rally in luxury goods stocks this year powered by international demand particularly from China has taken a hit, wiping out more than $30 billion from the sector on Tuesday.Most Read from BloombergCarl Icahn Is $15 Billion Poorer After Hunter Becomes the HuntedMcCarthy Says Debt Deal Remains Elusive as Negotiations ResumeChina’s $23 Trillion Local Debt Mess Is About to Get WorseRussia Pushes India for Help to Avert Global Financial IsolationSaudi Energy Minister Tells

8h ago The Wall Street Journal

The Wall Street JournalA Housing Bust Comes for Thousands of Small-Time Investors

They were offered the benefits of owning apartment-building rentals without any of the work, in real-estate investments that have already left some people empty-handed.

12h ago Bloomberg

BloombergBlackstone in Talks With Lenders on Maturing Chicago Office Loan

(Bloomberg) -- Blackstone Inc. is in discussions with lenders on a $310 million mortgage backed by a struggling Chicago office tower. Most Read from BloombergChina’s $23 Trillion Local Debt Mess Is About to Get WorseBiden-McCarthy Debt Talk Ends With Optimism, But Without a DealMexico Raises Alert Level on Volcano Rumbling Near CapitalParents Sue Elite Schools for ‘Indoctrinating’ Their Kids With Anti-Racist PoliciesChina’s New Covid Wave Set to See 65 Million Cases a WeekThe commercial mortgage

1d ago Quartz

QuartzThe US Treasury may have to break the law to keep the world’s richest nation from default

Congress is putting US Treasury Secretary Janet Yellen in a tough spot.

6h ago Investopedia

InvestopediaTop IBM Shareholders

The top IBM shareholders are James Whitehurst, Arvind Krishna, James Kavanaugh, Vanguard Group Inc., BlackRock Inc., and State Street Corp.

22h ago Barrons.com

Barrons.comLordstown Stock Dives After Reverse Split. The EV Start-Up Needs More Cash.

Shares of electric-vehicle start-up Lordstown Motors were plummeting in early trading after the company announced a 1-for-15 reverse stock split on Tuesday. Investors holding Lordstown stock (ticker: RIDE) should see fewer shares at a higher price in their brokerage accounts. Lordstown has about 243 million shares outstanding.

7h ago Zacks

ZacksHere's Why You Should Hold Onto Dow (DOW) Stock for Now

Dow (DOW) benefits from investment in high-return growth projects and cost-saving actions amid demand headwinds in Europe and Asia.

8h ago Yahoo Finance

Yahoo FinanceApple closes in on a $3 trillion stock market valuation

Apple's stock has been on autopilot this year.

9h ago Business Insider

Business InsiderThe White House has warned stocks will plunge 45% and a deep recession will strike in the 3rd quarter if the US defaults

About 8 million jobs could be lost if the US fails to raise its debt ceiling ahead of the upcoming deadline in early June, according to the analysis.

17h ago Zacks

ZacksBest Buy's (BBY) Q1 Earnings Coming Up: What's in the Cards?

Best Buy's (BBY) first-quarter fiscal 2024 results are likely to reflect a tough operating landscape, including inflation and a higher promotional backdrop.

1d ago The Wall Street Journal

The Wall Street JournalZoom Has Some Big Sales Calls to Make

The problem with Zoom Video Communications ’ latest results is that the wrong side of the business is doing better. Revenue of $1.1 billion exceeded Wall Street’s consensus estimate by 2%, and the company’s revenue projection for the second quarter also slightly exceeded analysts’ forecasts—the first time that has happened in three quarters, according to FactSet. Zoom shares jumped initially following the results Monday afternoon.

5h ago Zacks

ZacksAlbemarle Corporation (ALB) is Attracting Investor Attention: Here is What You Should Know

Albemarle (ALB) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

1d ago Zacks

ZacksHere is What to Know Beyond Why Deere & Company (DE) is a Trending Stock

Zacks.com users have recently been watching Deere (DE) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

8h ago Zacks

ZacksReasons to Add Puma (PBYI) Stock to Your Portfolio Right Now

Puma Biotechnology (PBYI), a top-ranked stock, has a promising development candidate, alisertib. Its only marketed product, Nerlynx (neratinib), is witnessing improving demand trends in the United States.

1d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK