Family office 'overwhelmingly overweight' in developed markets investments: Gold...

source link: https://finance.yahoo.com/video/family-office-overwhelmingly-overweight-developed-002739935.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Family office 'overwhelmingly overweight' in developed markets investments: Goldman Sachs partner

Family office 'overwhelmingly overweight' in developed markets investments: Goldman Sachs partner

Sara Naison-Tarajano, Goldman Sachs Global Head of Private Wealth Management Capital Markets, joins Yahoo Finance Live to discuss where Goldman Sachs family offices are investing according to a survey, cryptocurrency investments, and the company's outlook based on investment trends.

-

Family office 'overwhelmingly overweight' in developed markets investments: Goldman Sachs partner

-

Berkshire Hathaway portfolio, Beam Global, Tesla: Stocks moving in after hours

-

Consumer debt, Microsoft-Activision deal, SVB testimony: What to watch this week

-

C3.ai stock surges following Q4 earnings update

-

Debt ceiling talks, NRG, Crocs: Stocks trending after the closing bell

-

OpenAI CEO Sam Altman set to testify to lawmakers on Tuesday over AI oversights

-

Retail sales expected to 'rebound from March' amid economic, inflation pressures: Analyst11:37

Retail sales expected to 'rebound from March' amid economic, inflation pressures: Analyst11:37 -

SoFi stock drops following analyst downgrade

-

Americans should be finding 'better ways to control' their spending habits: Financial expert

-

IRS looks into setting up a government-run tax filing system

-

Stock markets close higher on Monday

-

Inflation: Companies are 'sneaking in margin expansions' amid economic pressures, economist says

-

Average age of cars on the road reach record high at 12.5 years

Sara Naison-Tarajano, Goldman Sachs Global Head of Private Wealth Management Capital Markets, joins Yahoo Finance Live to discuss where Goldman Sachs family offices are investing according to a survey, cryptocurrency investments, and the company's outlook based on investment trends.

Video Transcript

- Goldman Sachs getting the pulse of where the ultra wealthy are looking to invest this year. Joining us now is Sarah Naison-Tarajano, Goldman Sachs Global Head of Private Wealth Management Capital Markets. Sara, it's great to see you here. So you're out with the new report. You spoke to a number of family offices. One of my big takeaways from this report was this risk on attitude, the sentiment that you guys found speaking with all these family offices. What do you think is driving that?

SARA NAISON-TARAJANO: Yeah, and I would say, look, the reason that we've talked about this risk on sentiment is that we see a number of families talking about looking to invest in equities in the future even more. So 48% say they're prepared to invest in equities in the future in the next 12 months and over 40% in alts. I think that really comes down to family offices being a very nimble investor based who can act when others are running away from the market.

You have to remember, they aren't answering to a set of outside investors. They don't have to worry about redemptions the way other investors do, so they can be in a position to act. And I think they are prepared to do so upon dislocations.

- So Sara, I wanted to ask you. Was there anything that surprised you in terms of this data? Because, for instance, my perspective, when I was looking at the geographic allocation going forward and I saw that only 26% of respondents plan to increase their allocation to US markets, talk to us about the breakdown of where they're looking to put their money, and was there anything that surprised you?

SARA NAISON-TARAJANO: Yeah, I would say, overall, in terms of the results of the survey, one thing I'll just start with is, actually, the allocations have stayed quite similar from our last paper published in 2021. And I think this is really a testament to family offices being patient capital, and also, the lack of leverage in the system. So there hasn't been a need to really shift significantly the asset allocations. When we surveyed this group in 2021, they had 45% in alternatives. Today, they have 44%.

Investor's Business Daily

Investor's Business DailyDow Jones Futures: McCarthy Says Sides Are 'Far Apart' On Debt Ceiling; AI Stock C3.ai Rockets 23%

Dow Jones futures: House Speaker Kevin McCarthy said the sides are "far apart" on debt ceiling talks. AI stock C3.ai rocketed 23%.

5h ago Business Insider

Business InsiderInvestor sentiment is so bearish that it's pointing to a potentially huge rally in the stock market as inflation keeps falling, Fundstrat says

Investor positioning in the stock market is "lopsided," and any positive updates could spark a rally, according to Fundstrat's Tom Lee.

5h ago Investopedia

InvestopediaDow Jones Today: Index Inches Up Before Debt Ceiling Talks

The Dow Jones Industrial Average finished higher by 0.14%, or 48 points, after see-sawing between gains and losses throughout the trading session. It’s the first time in six sessions that the Dow has finished in the green. President Biden is scheduled to meet with members of Congress Tuesday to negotiate raising the debt ceiling.

5h ago Fox Business

Fox BusinessAmazon planning conversational AI chatbot for website search

Amazon is looking to overhaul its search functionality to incorporate a conversational chatbot driven by artificial intelligence according to job postings on its website.

3h ago Zacks

ZacksV.F. (VFC) Outpaces Stock Market Gains: What You Should Know

In the latest trading session, V.F. (VFC) closed at $21.66, marking a +1.74% move from the previous day.

4h ago Bloomberg

BloombergAlibaba Vows ‘Historic’ Investment in Taobao and Content

(Bloomberg) -- Alibaba Group Holding Ltd.’s e-commerce division will make “huge” investments in its Taobao shopping app, as the newly created arm seeks to ward off competition from social media platforms.Most Read from BloombergTurkey Latest: Erdogan Says Unclear If Vote Will Go to RunoffTurkey Set for Runoff as Erdogan Falls Just Short of VictoryS&P ETF Barely Budges on Yellen’s Late-Day Notice: Markets WrapChicago’s Empty Office Towers Threaten Its Future as a Major Financial HubMicrosoft’s $6

1h ago Yahoo Finance

Yahoo FinanceFanatics' $150 million deal for PointsBet reflects industry 'growing up'

The deal shows how the sports betting industry — which some believe could more than double to be worth $167 billion by the end of decade —has been a tough one for smaller players to survive in. It's either find more capital to keep up with the Joneses, or leave the neighborhood.

7h ago Investor's Business Daily

Investor's Business DailyBest Dow Jones Stocks To Buy And Watch In May 2023: Apple, Microsoft Fall

The best Dow Jones stocks to buy and watch in May 2023 include Apple stock, Boeing and Microsoft in today's stock market.

8h ago Reuters

ReutersGoldman fined $7 million by ECB over credit risk reporting

FRANKFURT (Reuters) -The European Central Bank said on Monday it had fined Goldman Sachs' European unit 6.63 million euros ($7.3 million) for underreporting the risk associated with some corporate credit, thereby flattering its balance sheet. Goldman Sachs said in a statement it had "closely cooperated with the ECB" and "taken all necessary steps" to resolve the issue. The ECB, the euro zone's top banking supervisor, said Goldman Sachs Bank Europe misclassified some corporate exposures for eight straight quarters in 2019-21, assigning a lower risk to them than the rules prescribe.

9h ago Reuters

ReutersUS consumers keep vehicles for a record 12.5 years on average -S&P

The average age of U.S. cars and light trucks this year climbed to a record 12.5 years, reflecting the impact of supply constraints on dealer inventories of new vehicles in 2022, as well as reduced consumer demand from higher inflation and interest rates, according to the study by S&P Global Mobility. Electric vehicles are bucking the aging trend, according to S&P. The average age of battery electric vehicles (BEV) in the U.S. actually fell to 3.6 years, down slightly from 3.7 years in 2022.

15h ago Reuters

ReutersNelson Peltz adds to Disney stake following share sale in Q1 - Bloomberg News

Trian has purchased roughly 500,000 more shares since the end of March, giving it a total of 6.4 million, the report said, citing a person familiar with Peltz's holdings. The fund started the year with 9.4 million Disney shares, before cutting its stake by 34% by the end of March, according to the report. Billionaire Peltz ended his quest for a board seat at Walt Disney after Chief Executive Bob Iger laid out plans for cutting 7,000 jobs as part of an effort to save $5.5 billion in costs and make the company's streaming business profitable.

2h ago Business Insider

Business InsiderTaylor Swift showed her financial savvy when she avoided a FTX deal. She puts her money in a niche type of fund, an elite investor says.

Taylor Swift's father told Boaz Weinstein the singer invests in a particular type of mutual fund, the hedge fund manager tweeted after a concert.

8h ago Yahoo Finance

Yahoo FinanceStocks moving in after-hours: Berkshire Hathaway, Capital One, Beam, Tesla

Stocks moving in after-hours: Berkshire Hathaway, Capital One, Beam, Tesla

5h ago Zacks

ZacksTop Analyst Reports for Visa, Pfizer & SAP

Today's Research Daily features new research reports on 16 major stocks, including Visa Inc. (V), Pfizer Inc. (PFE) and SAP SE (SAP).

6h ago TipRanks

TipRanksSeeking at Least 11% Dividend Yield? Here Are 2 Top ETFs to Consider

You’ve probably heard the old market adage to “Sell in May and go away.” Instead, how about using this time to start considering dividend-paying ETFs? There’s no time like the present to start building a dividend portfolio that can set you up with years of passive income. Here are two big dividend ETFs that both yield over 11% that you can consider using to jumpstart your dividend portfolio. Even better, while some high-yield ETFs lure investors in with eye-popping yields but then end up providi

7h ago TipRanks

TipRanksCathie Wood Sees the Value of These 2 Stocks Differently Than Goldman Sachs

Cathie Wood has built a reputation as one willing to bet on disruptive tech and potential game-changing stocks. It’s a strategy the ARK Invest CEO has stuck to whether her choices have easily outperformed the market – as was the case during the pandemic – or badly trailed it – as happened last year. So far, this year, Wood’s flagship fund, the ARK Innovation ETF, has done rather well, showing year-to-date gains of a market-beating 24% although the ETF still remains some distance off the highs no

13h ago TipRanks

TipRanksThese 2 EV Stocks Under $10 Have Over 70% Upside Potential, Says Cantor

Electric vehicles (EVs) have been dominating headlines due to the convergence of social, cultural, and political forces driving a shift from conventional combustion-powered cars to zero-emission vehicles. This shift has sparked a surge in government programs and spending designed to quickly expand the infrastructure needed to support a growing fleet of EVs. In return, we are also seeing enormous growth in EV manufacturers. The infrastructure support is substantial. Cantor senior analyst Andres S

4h ago Bloomberg

BloombergStan Druckenmiller, David Tepper Lead Family Offices Betting on AI

(Bloomberg) -- Billionaire investing titans Stanley Druckenmiller and David Tepper loaded up on stocks benefiting from the artificial intelligence boom during the first quarter. Most Read from BloombergTurkey Latest: Erdogan Says Unclear If Vote Will Go to RunoffTurkey Set for Runoff as Erdogan Falls Just Short of VictoryS&P ETF Barely Budges on Yellen’s Late-Day Notice: Markets WrapChicago’s Empty Office Towers Threaten Its Future as a Major Financial HubMicrosoft’s $69 Billion Activision Deal

4h ago Reuters

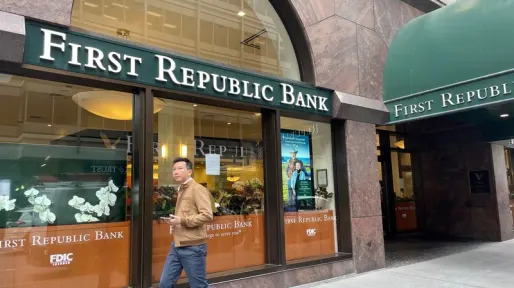

Reuters'Big Short' investor Burry bet on regional banks in first quarter

Hedge fund manager Michael Burry, who rose to fame with his bets against the U.S. housing market before the 2008 financial crisis, added new positions in several regional banks during a tumultuous first quarter for the sector, according to securities filings released on Monday. Burry's Scion Asset Management’s positions included 150,000 shares in First Republic Bank, 250,000 shares in PacWest Bancorp, 850,000 shares in New York Community Bancorp, and 125,000 shares of Western Alliance Bancorp , filings showed. First Republic collapsed May 1, making it the largest bank failure since the 2008 financial crisis.

8h ago Benzinga

Benzinga'We Don't Want To Compete With Elon': Warren Buffett Praises Tesla CEO, But These EV Companies — Including One In His Portfolio — Are Still In The Game

Elon Musk and Warren Buffett are talented in their own right. One is a serial entrepreneur who co-founded Tesla Inc., revolutionized the electric car industry and is sending rockets into space. The other is an investing legend who has helped Berkshire Hathaway Inc. shareholders generate extraordinary returns for decades. At Berkshire’s latest annual shareholders meeting, Buffett spoke highly of the Tesla CEO. “Elon is a brilliant, brilliant guy,” Buffett said. “He dreams about things, and his dr

10h ago Barrons.com

Barrons.comMagellan Midstream Holders Face Big Tax Hit From Oneok Deal

People with units of the pipeline operator will be fully taxed on the entire cash-and-stock deal, so much of their gains will go to Uncle Sam.

6h ago Investor's Business Daily

Investor's Business DailyONON Stock Is On Fire This Year. Why Analysts See More Upside For On Holding.

On Holding earnings are due early Tuesday, with analysts betting on huge gains for the Swiss maker of On brand shoes. ONON stock has soared in 2023.

6h ago Investopedia

InvestopediaONEOK Buys Magellan for $18.8 Billion to Add Oil, Refined Products

Natural gas pipeline operator ONEOK agreed to buy Magellan Midstream Partners, L.P. for $18.8 billion.

6h ago Barrons.com

Barrons.comSoFi CEO Anthony Noto Discloses Stock Purchases by Wife Dating Back to 2021

The chief executive disclosed on Tuesday about $220,000 of SoFi stock purchases made by his wife Kristin Noto from August 2021 through this May.

8h ago Barrons.com

Barrons.comC3.ai Stock Rises on Earnings Update. Demand Is ‘Just Exploding’ for Enterprise AI, CEO Says

The artificial-intelligence software provider forecast higher revenue and a lower operating loss in its fourth quarter than it had told investors to expect.

9h ago The Wall Street Journal

The Wall Street JournalBerkshire Hathaway Opens New Position in Capital One, Exits Taiwan Semiconductor, BNY Mellon

Berkshire Hathaway's 13F is out. + Warren Buffett's company trimmed its stakes in Chevron, McKesson, Activision Blizzard, General Motors, AON, Ally Financial, Amazon.com and Celanese in the first quarter, the filing showed.

6h ago Investor's Business Daily

Investor's Business DailyAI Stock Surges On Upbeat Sales Views; Is AI Stock A Buy Now?

Artificial intelligence is transforming industries, from defense and utilities to health care and retail. Will C3.ai lead the multibillion-dollar change?

5h ago USA TODAY

USA TODAYAn elderly man was scammed out of millions. Could the bank have done more to prevent fraud?

Larry Cook, 76, wired $ 3.6 million to possible scammers abroad. The bank reported him to adult protective services, but continued wiring his money.

2d ago Barrons.com

Barrons.comApple iPhone Sales May Disappoint. Buy the Stock Anyway.

KeyBanc Capital Markets said recent credit card data showed spending for Apple products was down 18% month-over-month in April.

9h ago Investor's Business Daily

Investor's Business Daily8 Stocks' Monster Profit Growth Can't Be Contained

Profits are down at S&P 500 companies at large. But a few are putting up monster profit gains that seem to have no bounds.

14h ago Barrons.com

Barrons.comThese Stocks Are Moving the Most Today: Oneok, Magellan Midstream, Sarepta, Western Digital, SoFi, and More

Oneok will be buying Magellan Midstream Partners in a cash-and-stock deal with a value of about $18.8 billion including debt, Sarepta stock surged after a FDA panel recommended approval of a gene therapy for muscular dystrophy, and SoFi stock was downgraded.

6h ago Zacks

ZacksAll You Need to Know About Inovio (INO) Rating Upgrade to Buy

Inovio (INO) has been upgraded to a Zacks Rank #2 (Buy), reflecting growing optimism about the company's earnings prospects. This might drive the stock higher in the near term.

10h ago SmartAsset

SmartAssetI'm High-Net Worth. Why Do I Keep Getting Denied a Loan?

If you're going to the bank for a loan, you might think it would be easier as a millionaire. However, when it comes to high-net-worth lending, more money can mean more problems if the individual doesn't have conventional income or … Continue reading → The post How Does High-Net-Worth Lending Work? appeared first on SmartAsset Blog.

13h ago Bloomberg

BloombergJPMorgan’s Kolanovic Sees Stock Selloff as US Debt Talks Drag On

(Bloomberg) -- JPMorgan Chase & Co.’s Marko Kolanovic joined a chorus of Wall Street strategists Monday in warning that the US debt-ceiling impasse is yet another headwind threatening the outlook for equity markets.Most Read from BloombergTurkey Latest: Erdogan Says Unclear If Vote Will Go to RunoffTurkey Set for Runoff as Erdogan Falls Just Short of VictoryS&P ETF Barely Budges on Yellen’s Late-Day Notice: Markets WrapChicago’s Empty Office Towers Threaten Its Future as a Major Financial HubMic

6h ago Zacks

ZacksSchwab (SCHW) Records a Fall in April Core Net New Assets

Schwab (SCHW) reports a decrease in core net new assets for April.

10h ago Zacks

ZacksZacks Industry Outlook Highlights Marathon Petroleum, Valero Energy, Murphy USA and PBF Energy

Marathon Petroleum, Valero Energy, Murphy USA and PBF Energy are part of the Zacks Industry Outlook article.

13h ago Zacks

ZacksSell These 4 Toxic Stocks to Prevent Portfolio Losses

The basic understanding of toxic stocks can help investors avoid huge losses and derive maximum benefit from their portfolios. Some toxic stocks that investors may consider dumping are BROS, CHGG, PI and ANGO.

13h ago Zacks

ZacksWhat You Need to Know Ahead of Alibaba's (BABA) Q4 Earnings?

Alibaba's (BABA) fourth-quarter fiscal 2023 results are expected to reflect strength in the e-commerce and cloud businesses despite macroeconomic concerns.

10h ago Investor's Business Daily

Investor's Business DailyHome Depot Earnings Expected To Fall For The First Time In Three Years

Home Depot earnings are due Tuesday with analysts predicting the first decline in three years. The Dow Jones stock is struggling.

6h ago The Wall Street Journal

The Wall Street JournalMega Midstream Merger Has Investors Shrugging

Analysts expected energy company Oneok to make a big deal. The company on Sunday [announced](https://www.wsj.com/articles/14-billion-deal-to-create-mega-pipeline-company-42d279d6?mod=markets_featst_pos1) that it agreed to merge with Magellan Midstream Partners in a deal that would create the second biggest midstream operator in the U.S. with a market value of $40 billion. Investors aren’t sold on the deal; Oneok's stock was down as much as 9.9% late Monday morning.

9h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK