'It's As If The Whole Country Takes A Pay Cut:' Top Economist Warns Of A Recessi...

source link: https://finance.yahoo.com/news/whole-country-takes-pay-cut-173925398.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

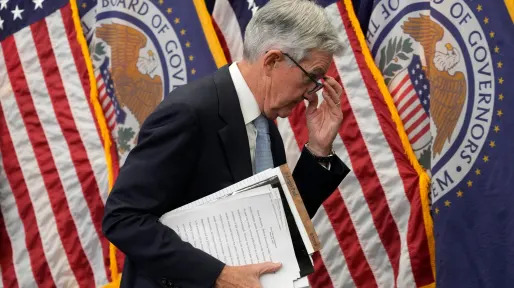

Fears of a recession have mounted since the U.S. Federal Reserve began hiking interest rates in early 2022.

Although the latest gross domestic product (GDP) figures indicated growth, a recession could be imminent according to David Rosenberg, president of Rosenberg Research and former chief North American economist at Merrill Lynch.

“The leading indicators are telling me that the recession is actually starting this quarter,” he said in a recent YouTube interview with Blockworks Macro. “If it’s not this quarter I think it’s next quarter. It’s certainly not a 2024 story.”

With rampant inflation, many Americans are grappling with wages that struggle to keep up with the rising cost of living. Should a recession materialize, it could result in greater financial hardships.

“A recession is a very big call because it is actually a haircut to national income. It's as if the whole country takes a pay cut,” Rosenberg explains. “It's not that we take the Lamborghini from 80 down to 20. It's that we go in reverse.”

Meanwhile, a recession could also spell trouble for the stock market.

Expecting a recession in 2023? Don't miss these stories from Benzinga:

Downside Ahead

Stocks had a terrible run in 2022, with the S&P 500 plunging 19.4%. While they’ve bounced back a bit in 2023 — the benchmark index is up 9% year to date — Rosenberg doesn’t believe the turmoil is over.

“I am bearish on equities as an asset class,” Rosenberg said, adding that he doesn’t believe “a recession is fully priced in.”

The reason behind his negative outlook on equities has to do with valuation.

“I don’t like the valuations. I mean, we’re pressing against a 19 forward multiple,” he said, referring to the forward price-to-earnings ratio. “So what does that get you? Like 5.3% as an earnings yield. I can pick up 5.4[%] in single-A triple-B corporate credit ... wind up in a better part of the capital structure.”

Benzinga

BenzingaWarren Buffett Spends $3.17 Per Day On This Breakfast Fit For a Billionaire

Billionaire investing guru Warren Buffett knows that sometimes the simplest things in life can bring the most joy, including breakfast. Don’t Miss: Thanks to changes in federal law, anyone can become a venture capitalist and invest in startups for as little as $100. Learn How Anyone Can Invest in Top AI Startups Instead of splurging on haute cuisine, Buffett sticks to his humble McDonald's order, proving that just because he's a billionaire doesn't mean he needs to trade in his sausage and egg b

5h ago SmartAsset

SmartAssetBad News: The Next Social Security Cost-of-Living Adjustment Could Be Disappointingly Low

As inflation has reached highs over the past year, retirees are spending more. And as a result, their Social Security benefits are increasing. The cost of living adjustment (COLA) is 8.7% in 2023, according to the Social Security Administration. And as … Continue reading → The post Bad News: The Next Social Security Cost-of-Living Adjustment Could Be Just 3% appeared first on SmartAsset Blog.

14h ago Investopedia

InvestopediaHere’s Where Prices For ‘Overvalued’ Homes Are Falling The Most

High-priced West Coast markets have taken the biggest beating in a housing market suffering an affordability shock.

9h ago Barrons.com

Barrons.comBitcoin Is Falling. The Fed Decision Could Mean ‘All Bets Are Off’ for Cryptos.

Bitcoin has torn higher this year amid expectations of easier monetary policy from the Federal Reserve. That narrative will be put to the test Wednesday.

15h ago Business Insider

Business InsiderElon Musk says the pile of dead banks proves more rate hikes will cause a severe recession: 'I may have more real-time global economic data in one head than anyone ever'

"Further rate hikes will trigger severe recession. Mark my words," Elon Musk said in a tweet on Sunday.

1d ago Business Insider

Business InsiderApple reportedly attracted $1 billion in deposits into its new high-yield savings account in just 4 days

More than 240,000 savings accounts were opened in the first four days of launch, which represents just 0.002% of Apple's US iPhone user base.

2h ago The Telegraph

The TelegraphHalf of America’s banks are potentially insolvent – this is how a credit crunch begins

The twin crashes in US commercial real estate and the US bond market have collided with $9 trillion uninsured deposits in the American banking system. Such deposits can vanish in an afternoon in the cyber age.

14h ago Business Insider

Business InsiderStocks could soon retest all-time highs as markets react to possible 'thesis-changing' final rate hike from the Fed, Fundstrat says

"This will likely be the last hike of the cycle. This is thesis changing," Fundstrat said, predicting the S&P 500 could notch 4,750 by year-end.

22h ago Fortune

FortuneThe skills gap is so big that nearly half of workers will need to retrain this decade. These 10 skills are most in demand

Hint: They’re mostly soft skills.

1d ago Yahoo Finance

Yahoo FinanceStocks sink as bank shares plunge, Fed meeting gets underway: Stock market news today

Investors are worried there's more turmoil to come for regional banks. They're also looking ahead to Fed decision day Wednesday.

7h ago TipRanks

TipRanksWells Fargo Says Buy These 2 High-Yield Dividend Stocks — Including One With 10% Yield

The latest economic data presents a mixed picture for the US economy. The growth data for the first quarter has been released, indicating that the GDP increased by only 1.1%, which is a sharp slowdown from 2H22, and feeding fears of a recession later this year. On the inflation front, the steady rise in prices has been easing back, and the March year-over-year number was just 5%, below the forecast and the lowest in nearly 2 years. The moderating inflation rate is an indicator that the Fed’s pol

3h ago Yahoo Finance

Yahoo FinanceStocks moving in after-hours: Ford, Starbucks, AMD

These are the stocks moving in after-hours on Tuesday, May 2, 2023.

6h ago Barrons.com

Barrons.comPfizer Will Shift Focus to Dividends and Share Buybacks, Execs Say

The big pharma company Pfizer has been on an M&A hot streak over the past couple of years, digging into its Covid-19 vaccine and therapeutic windfalls to go on a big-ticket buying spree. “What we believe is going to happen now that we start to harvest the investments that we made in business development transactions,” Pfizer Chief Financial Officer David Denton told Barron’s, speaking shortly after the company reported first-quarter results that beat Wall Street expectations. “Shareholders prefer some level of share repurchase, and we’ll be able to do that as well.”

7h ago Yahoo Finance

Yahoo FinancePacWest, Western Alliance crash as regional bank fears continue to shake markets

Their drops come one day after JPMorgan Chase purchased the bulk of First Republic, in a deal that was designed to restore stability to the banking system after two months of turmoil.

7h ago TipRanks

TipRanks‘Investment opportunity of a lifetime’: Cathie Wood says the robotaxi market could be worth trillions — here are 3 stocks to invest in it (besides Tesla)

Advances in technology often come loaded with financial opportunities and scanning the one presented by the nascent autonomous driving sector, Cathie Wood thinks there is a huge one at play. The Ark Invest CEO has not been shy about making some bold predictions in the past and thinks investors should not underestimate what’s in store for this up-and-coming industry. “We think that the robotaxi opportunity globally will deliver $8 to $10 trillion in revenue by 2030 and is one of the most importan

2d ago Bloomberg

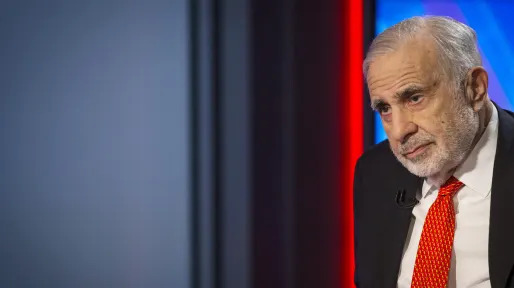

BloombergIcahn Hit by Hindenburg Short as Activist Becomes Target

(Bloomberg) -- Carl Icahn, the famed activist investor who’s made a career out of starting corporate brawls, found himself on the receiving end of criticism Tuesday after Hindenburg Research disclosed a short call against his investment firm.Most Read from BloombergNigeria Targeted a UK Mansion; Its Next Leader’s Son Now Owns ItWall Street Rattled by 15% Tumble in Pair of Banks: Markets WrapIBM to Pause Hiring for Jobs That AI Could DoCarl Icahn’s Wealth Plunges $10 Billion on Hindenburg Short-S

7h ago Reuters

ReutersExplainer: How the Fed might act in a US default

The risk of default looms ever larger after Treasury Secretary Janet Yellen on Monday said the date the government may run short of funds to pay its bills under the current $31.4 trillion debt limit may be as early as June 1. Time is running short and President Joe Biden and congressional Republicans are unlikely even to meet for the first time for another week. Despite Powell's protestations, the Fed would have a role in trying to limit the harm to financial stability.

6h ago Yahoo Finance

Yahoo FinanceCarl Icahn targeted by short seller Hindenburg for 'Ponzi-like' structure

A well-known short seller is taking on a famed activist.

8h ago Investor's Business Daily

Investor's Business DailyArista Networks Plunges On 'Conservative' 2023 Outlook Amid AI Buzz

Arista Networks reported first-quarter results that topped analyst views amid high expectations for the company's shares. But Arista stock fell.

6h ago Barrons.com

Barrons.comRegional Bank Stocks Fall Hard. Why Now Is a Mystery.

PacWest Bancorp slid 28% and Western Alliance Bancorporation dropped by 15% following the sale of First Republic Bank to JPMorgan Chase on Monday.

7h ago Bloomberg

BloombergLordstown Motors Warns of Bankruptcy as Foxconn Deal Unravels

(Bloomberg) -- Lordstown Motors Corp. may be forced to cease operations and file for bankruptcy after manufacturing giant Foxconn told the electric-vehicle company that it’s prepared to pull out of a production partnership.Most Read from BloombergJPMorgan Ends First Republic’s Turmoil After FDIC SeizureFirst Republic’s Jumbo Mortgages Brought On Bank’s FailureBuffett Will Beat the Market as Recession Looms, Investors SayPeak Oil Spells Trouble for ConsumersIBM to Pause Hiring for Jobs That AI Co

1d ago Reuters

ReutersPNC promises up to $15 billion in short-term debt to provide additional liquidity

The regional bank, which has so far been insulated from deposit flight, said in a filing the holding company can offer up to $5 billion and the banking unit $10 billion. No commercial paper has been issued as of March 31, the filing said. Commercial paper is an unsecured debt instrument issued by companies to finance short-term needs such as inventories and payroll.

7h ago Investor's Business Daily

Investor's Business DailyFour Stocks Turn $10,000 Into $50,000 In Four Months

April turned out to be great month for most S&P 500 investors. But it was stupendous for those who picked the best stocks.

2d ago Benzinga

BenzingaWhat's Going On With Mastercard And Visa Shares Today

Mastercard Inc (NYSE: MA) and Visa Inc (NYSE: V) shares are trading lower on Tuesday as Mizuho flagged their declining U.S. personal consumption expenditure share. Mizuho analyst Dan Dolev maintains Mastercard with a Buy, lowering the price target from $405 to $400. Dolev's analysis suggests that Visa and MA's share of incremental U.S. personal consumption expenditures (PCE) continued to decline in 1Q 2023. Visa's share is now trending below its long-term averages, while MA is trending roughly i

6h ago TipRanks

TipRanksShould You Buy This ETF for Its 12.3% Dividend Yield? Here’s What You Need to Know

Investors are often intrigued by ETFs that feature sky-high dividend yields, such as the Amplify High Income ETF (NYSEARCA:YYY), which currently yields 12.3%. While the thought of receiving passive income with this type of yield is indeed enticing, and YYY has some good things going for it, investors also need to look under the hood before committing to these types of ETFs. Here’s more on YYY and why most investors should likely proceed with caution. What is YYY ETF? Operated by Amplify ETFs, YY

1d ago Yahoo Finance

Yahoo FinanceNew lower I bond rate comes with 'a pleasant surprise'

The annualized yield for the Treasury Department’s inflation-protected assets is 4.3% for new purchases made until October 31.

1d ago Yahoo Finance

Yahoo FinanceFirst Republic stock investors face 'wipe-out,' analyst says

JPMorgan did not assume First Republic’s corporate debt or preferred stock, meaning institutional investors will not be a made whole. One analyst expects common shareholders to get wiped out, too.

1d ago Reuters

ReutersPrudential Financial profit misses on lower assets under management

As a result, assets under management declined 12.5% to $1.42 trillion in the quarter as investors yanked capital from speculative assets and instead sought refuge in safer bets. Prudential had last year said it was making progress in moving its business focus from market-sensitive revenue segments to more stable and recurring sources of income.

6h ago Zacks

ZacksOneok Inc. (OKE) Surpasses Q1 Earnings Estimates

Oneok (OKE) delivered earnings and revenue surprises of 13.04% and 11.81%, respectively, for the quarter ended March 2023. Do the numbers hold clues to what lies ahead for the stock?

5h ago Zacks

ZacksInvestors Heavily Search Pioneer Natural Resources Company (PXD): Here is What You Need to Know

Zacks.com users have recently been watching Pioneer Natural Resources (PXD) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

14h ago Reuters

ReutersAMD shares sink on forecast miss as PC market remains weak

(Reuters) -Advanced Micro Devices shares slumped on Tuesday after the chipmaker forecast quarterly sales below estimates due to a weak PC market, overshadowing the company's optimism that the chip market would start to recover in the second half of 2023. The company also missed analyst estimates for PC and data center chips sales for the first quarter, and its shares fell over 6% in extended trading. That stood in contrast to rival Intel Corp, whose shares rose nearly 3% in extended trading.

7h ago Investopedia

InvestopediaWhere Are CD Rates Headed This Year?

CD rates are already at record highs, with many options to earn more than 5% on a variety of terms. But will Fed moves drive them even higher, or is the peak behind us?

1d ago Bloomberg

BloombergIcahn Enterprises’ Plunge Just One of Short-Seller Hindenburg’s Many Big Hits

(Bloomberg) -- Icahn Enterprises LP’s steepest one-day plunge on record after Hindenburg Research disclosed a short call against the investment firm added to the list of big hits dealt by the short-seller that’s become a household name on Wall Street. Most Read from BloombergNigeria Targeted a UK Mansion; Its Next Leader’s Son Now Owns ItWall Street Rattled by 15% Tumble in Pair of Banks: Markets WrapIBM to Pause Hiring for Jobs That AI Could DoCarl Icahn’s Wealth Plunges $10 Billion on Hindenbu

6h ago Bloomberg

BloombergFormer Coinbase Official Balaji Srinivasan Closes Out $1 Million Bitcoin Bet Early

(Bloomberg) -- Balaji Srinivasan, the former chief technology officer of Coinbase Global Inc., said he closed out what appeared to be a losing bet that Bitcoin would rise to $1 million within 90 days. Most Read from BloombergNigeria Targeted a UK Mansion; Its Next Leader’s Son Now Owns ItWall Street Rattled by 15% Tumble in Pair of Banks: Markets WrapIBM to Pause Hiring for Jobs That AI Could DoCarl Icahn’s Wealth Plunges $10 Billion on Hindenburg Short-Seller ReportRegional Bank Shares Plunge o

6h ago Investopedia

InvestopediaWho’s Paying for All These Bank Failures?

With the collapse of First Republic Bank, now the third high-profile bank failure in the U.S. this year, you may be wondering who is on the hook for the government bailouts.

1d ago Investopedia

InvestopediaJPMorgan To Pay FDIC $10.6 Billion For First Republic, This is What It Gets

JPMorgan Chase & Co. may be getting a quite a bit more than its money's worth as the deal to buy First Republic comes with assets and big guarantees from FDIC.

1d ago The Wall Street Journal

The Wall Street JournalUnity Conducts Its Third and Largest Round of Layoffs in a Year

The software company’s move to let go about 600 employees follows a recent string of job cuts in the tech industry and beyond.

3h ago Zacks

ZacksSuper Micro Computer (SMCI) Misses Q3 Earnings and Revenue Estimates

Super Micro (SMCI) delivered earnings and revenue surprises of -2.98% and 6.67%, respectively, for the quarter ended March 2023. Do the numbers hold clues to what lies ahead for the stock?

5h ago Barrons.com

Barrons.comStarbucks Beats Earnings and Sales. Why the Stock Is Down.

Expectations were high heading into the coffee retailer's second-quarter earnings. Guidance may have fallen short.

5h ago Zacks

ZacksAB InBev (BUD) to Report Q1 Earnings: What's on the Cards?

AB InBev's (BUD) Q1 results are expected to reflect gains from premiumization efforts, expansion of the beyond beer portfolio and digital initiatives, offset by elevated costs and currency headwinds.

12h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK