'An Anvil, Not A Shoe': Elon Musk Warns Of A Crushing Blow To Commercial Real Es...

source link: https://finance.yahoo.com/news/anvil-not-shoe-elon-musk-193744844.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

'An Anvil, Not A Shoe': Elon Musk Warns Of A Crushing Blow To Commercial Real Estate — Here Are The Companies Set To Benefit From The Market Collapse

from home challenges,

From artificial intelligence to extraterrestrial life, Tesla Inc. CEO Elon Musk discussed a wide range of topics during his Fox News interview with Tucker Carlson. He also touched on commercial real estate — and the message is pretty dire.

“We really haven’t seen the commercial real estate shoe drop. That’s more like an anvil, not a shoe,” Musk said. “So the stuff we’ve seen thus far actually hasn’t even – it’s only slightly real estate portfolio degradation. But that will become a very serious thing later this year, in my view.”

He pointed out that the work-from-home trend has substantially reduced the use of office buildings around the world. And that does not bode well for commercial real estate.

“Almost all cities at this point have record vacancies of commercial real estate,” Musk explained.

These vacancies could have serious consequences — and even banks could be in trouble.

“Commercial real estate used to be something that was a Grade A asset, that if a bank had commercial real estate holdings those would be considered the highest security ... some of the safest assets you could have,” he said.

“Now, that is not the case anymore. One company after another is canceling their leases or not renewing their leases. Or, if they go bankrupt, there’s nothing for the bank who owns that real estate to go after, because they were a previously strong company now dead. What do you go after at that point?”

It’s a dire picture. Bank failures have already been in the headlines. Should they suffer further blows from the anticipated downfall of commercial real estate, the entire system could be at risk.

The Proverbial Ring Of Fire

Musk is not the only one who sees challenges for the segment on the horizon. Real estate industry veteran Benjamin Miller also predicts impending financial turbulence.

Miller is the co-founder and CEO of the real estate crowdfunding platform Fundrise. In the latest investor update, he wrote, “Before the next upswing begins, markets (along with all investors) must first pass through this final stage of financial turmoil, a crucible reforging of markets — akin to the proverbial ring of fire — where nerves will be tested and the ill-prepared left wanting.”

Engadget

EngadgetEx-Apple employee sentenced to three years in prison after $17 million fraud scheme

A judge ordered Dhirendra Prasad to pay Apple back in full and to give the IRS $1.9 million.

1d ago Barrons.com

Barrons.comWest Coast Ports Went from Congested Chaos to Alarming Quiet. It’s a National Problem.

The rapid decline of key West Coast ports should be worrying for anyone hoping for a robust economy, writes Christopher Tang.

12h ago South China Morning Post

South China Morning PostXi's phone call with Zelensky a diplomatic coup but China faces hurdles as peace broker, analysts say

Wednesday's phone call between Chinese President Xi Jinping and his Ukraine counterpart Volodymyr Zelensky was a diplomatic coup for Beijing but China still faces formidable challenges in mediating any peace between Ukraine and Russia, analysts said. The hour-long conversation, which was cautiously welcomed by the US and its European allies, signalled that China is willing to take a more active role as a peacemaker in regional conflicts, the analysts said. It also shows that Chinese leaders now

9h ago Fortune

FortuneBrittney Griner says she went to Russia to make $1 million a year—and spent 10 months in detention: ‘The whole reason a lot of us go over is the pay gap’

Brittney Griner made over $1 million per season while playing in Russia—more than quadruple her salary in the WNBA.

22h ago Barrons.com

Barrons.comWalmart’s Chicago Store Closures Weren’t a Fluke: Why Retailing in Cities Is So Hard

Big-box retailers spent the better part of the 2010s trying to enter urban markets. The economics can make it hard for them to stay there.

2d ago Fortune

FortuneCharlie Javice, who sold her startup Frank for $175 million and is accused of fraud, is running out of money

“Ms. Javice faces numerous impending deadlines for which she is incurring substantial expense,” said Michael Barlow, an attorney with law firm Abrams & Bayliss, in a recent letter to the judge.

2d ago Reuters

ReutersExxon, Chevron split over how to manage rising cash piles

The two largest U.S. oil companies - Exxon Mobil Corp and Chevron Corp - are minting cash from booming oil and gas operations, but are splitting over what to do next. Exxon's net hit $11.4 billion while Chevron earned $6.6 billion and with analysts expecting the strong results to continue this year. The result: huge cash reserves, far in excess of what they need for routine operations.

22h ago Fortune

FortuneJamie Dimon says he understands workers’ threats to not return to the office, but ‘they can not do it elsewhere’

The bank’s pro-office memo was instantly ripped apart by workers calling it “tone deaf” and “divisive.”

22h ago SmartAsset

SmartAssetInterest Rate for Series I Savings Bonds Falls to 4.3%: Here's What it Means

Gone are the days of series I savings bonds paying almost 7% in interest. The U.S. Treasury announced Friday that the inflation-protected bonds would start paying investors 4.3% on May 1, down from the 6.89% that they've paid out over … Continue reading → The post Interest Rate for Series I Savings Bonds Falls to 4.3%: Here's What it Means appeared first on SmartAsset Blog.

22h ago Fortune

FortuneOn Thursday, Lyft’s new CEO laid off over 1,000 employees. On Friday he ordered remaining ones back to the office

Lyft proudly announced just a year ago that employees could “work from the office, at home, or any combination of the two.”

22h ago SmartAsset

SmartAssetIn Case You Missed It: Your Required Minimum Distributions (RMDs) Are Officially Pushed Back

The SECURE 2.0 Act, signed by President Biden in December 2022, includes dozens of changes to provisions related to tax-advantaged retirement accounts. Among the most important changes is a provision, which took effect Jan. 1 of this year, that delays … Continue reading → The post Your Required Minimum Distributions (RMDs) Have Officially Been Pushed Back appeared first on SmartAsset Blog.

1d ago Investor's Business Daily

Investor's Business DailyCathie Wood Gets Crushed By An Investment That Costs 73% Less

Growth stocks in the S&P 500 are playing right into Cathie Wood's hands. But even the famed investor can't outperform a cheap index.

1d ago Barrons.com

Barrons.comIBM, Raytheon, and MetLife Boost Dividends

International Business Machines stock is in the red so far this year, but the company just marked 28 straight years of dividend increases.

11h ago Reuters

ReutersFDIC asks banks for final First Republic bids- media reports

The banking regulator reached out to banks late on Thursday seeking indications of interest, including a proposed price and estimated cost to the agency's deposit insurance fund, the report said. Bank of America is among several other institutions weighing a potential bid for First Republic, CNBC reported on Saturday, citing people with knowledge of the matter.

11h ago Business Insider

Business InsiderHere are the 4 issues that will determine the future of the global economy, according to Mohamed El-Erian

Markets have been on a rollercoaster ride and uncertainties around the global economy are mounting. Here's what El-Erian sees ahead.

16h ago TipRanks

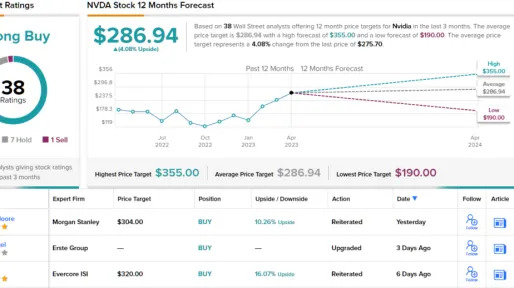

TipRanksKeep on Buying Nvidia Stock Ahead of Earnings, Says Morgan Stanley

Nvidia (NASDA:NVDA) has been on a remarkable run this year, with its shares surging by an impressive 89% year-to-date. The chip giant’s success can largely be attributed to this year’s hottest trend: Generative AI. The company is widely recognized as a leader in the field and seen as one set to benefit from increased adoption of the tech. In fact, with a view to next month’s F1Q earnings (May 24), Morgan Stanley analyst Joseph Moore thinks all the hoopla around AI should result in a strong repor

1d ago SmartAsset

SmartAssetIs It Better to Be Rich or Wealthy?

Being rich and being wealthy are often seen as being the same thing. After all, people who are rich or wealthy tend to have more assets and greater financial freedom than the typical person. In reality, there are some major … Continue reading → The post Key Differences Between Rich and Wealthy People appeared first on SmartAsset Blog.

1d ago Investopedia

InvestopediaTop CD Rates Today, April 28

See what today's top nationwide rate is for every CD term, and how it compares to the previous business day's top rate. We collect data from more than 200 financial institutions.

20h ago Investopedia

InvestopediaWhat a Fed Rate Hike Could Mean for Your Deposit Accounts

The Federal Reserve is poised to deliver what's expected to be another small rate increase Wednesday. Here's what that could mean for your savings and your debts.

1d ago Barrons.com

Barrons.comAmazon Earnings Are a Bad Omen for Big Tech Stocks. Here’s Why.

Eventually investors have to face reality: There are downsides to cutting costs and laying off staff.

20h ago

Recommend

-

9

9

SEO Competitor AnalysisYour Essential Guide to Crushing Competition[w/ Template]Written by Sam Underwood

-

4

4

95 million subscribers later, Disney's streaming division is crushing it Strong streaming performance helped Disney beat earnings estimates By...

-

4

4

Cash crunch risks crushing Dominic Cummings' hi-tech research brainchild Fears mount that the Advanced Research and Invention Agency lacks a unclear focus and will not have enough funding to deliver

-

9

9

Microsoft Cloud Show is sponsored by: Every business will eventually have to move to the cloud and adapt to it. That’s a fact.

-

8

8

Not mild — Omicron is not mild and is crushing health care systems worldwide, WHO warns "Just like previous variants, omicron is hospitalizing people, and it is killing people...

-

4

4

Elon Musk warns Twitter CEO over text message exposure

-

3

3

Twitter CEO Elon Musk warns company is at risk of bankruptcy...

-

2

2

Elon Musk Warns Against Margin Debt on Ris...

-

6

6

‘Out of control’ AI is a threat to civilisation, warns Elon Musk Tech figures urge companies to halt ‘dangerous race’ to u...

-

5

5

Home Elon Musk warns of dangers posed by AI

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK