ChatGPT asked the founder of the world’s largest hedge fund for his best investi...

source link: https://finance.yahoo.com/news/chatgpt-asked-founder-world-largest-203548114.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

ChatGPT asked the founder of the world’s largest hedge fund for his best investing tip. This was his response

a look at generative AI models.

When you’re Ray Dalio, you don’t ask ChatGPT questions—ChatGPT asks you questions. Well, kind of. The billionaire founder of the world’s largest hedge fund, Bridgewater Associates, fielded a question from OpenAI’s chatbot on his YouTube channel over the weekend—and it was a good one, if a little simplistic.

More from Fortune: 5 side hustles where you may earn over $20,000 per year—all while working from home Looking to make extra cash? This CD has a 5.15% APY right now Buying a house? Here's how much to save This is how much money you need to earn annually to comfortably buy a $600,000 home

“What’s the most important lesson you’ve learned about investing throughout your career?” ChatGPT wrote, when prompted by a human to ask the famous investor a question.

Dalio’s response was also rather simplistic—diversification. The billionaire called the strategy that seeks to reduce portfolio risk by investing in a wide range of unrelated assets the “holy grail” for investors.

“A lot of people think that the way you make a lot of money is to come up with the best single, or few, bets. That’s wrong. That approach to the game will knock you out,” he said. “How do you diversify well to have a good return relative to your risk? That’s the most important principle.”

Dalio, who founded Bridgewater Associates in 1975, repeated one of his favorite lines in the video, arguing that investors should always remain humble and remember that “what you don’t know is greater than what you do know.”

This lack of certainty means it only makes sense to diversify into different asset classes like real estate, commodities, equities, and bonds. By diversifying into “10 or 15 good, uncorrelated investments,” investors can reduce their risk by as much as 80% without sacrificing returns, according to Dalio, who noted that “risk reduction is really key” to building wealth.

While it’s rare for a billionaire investor to dish out this kind of basic advice, passing on life lessons is nothing new for Dalio. His books—including Principles: Life and Work; Principles for Dealing With the Changing World Order; and Principles: Your Guided Journal—are filled with tips on how to navigate the complexities of life and investing. And Dalio has leaned into his role as an educator after transitioning control of Bridgewater Associates to the fund’s co-CEOs, Nir Bar Dea and Mark Bertolini, last year, amassing nearly 2.2 million followers on his YouTube channel.

Benzinga

BenzingaBillionaire Charlie Munger's Investment Advice Could Make Gen Z Rich — With A Little Patience

Charlie Munger is the billionaire extraordinaire who wears many hats, including being the director of Daily Journal Corp. and the longtime vice chairman of the legendary Warren Buffett's holding firm Berkshire Hathaway Inc. His decades-long experience in investing and finance makes him a force to be reckoned with. Don’t Miss: Qnetic Unveils Revolutionary Flywheel Energy Storage System to Accelerate Renewable Energy Adoption Munger has some advice for young investors who are looking to make their

19h ago TipRanks

TipRanksDown More Than 50%: Analysts Say Buy These 3 Beaten-Down Stocks Before They Bounce Back

Investing is often a game in reverse psychology. There’s a natural tendency to chase stocks that are outperforming the market, but the savvy investor will know that finding the ones languishing in the doldrums could potentially generate the best returns. The key of course is to sort the wheat from the chaff and find the beaten-down names that for one reason or another are severely undervalued. This is where Wall Street’s stock pros come in handy. They can point investors toward such temporarily

1d ago Bloomberg

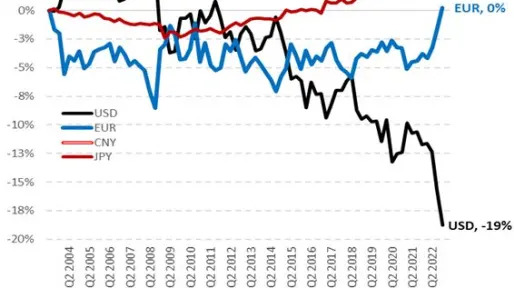

BloombergDe-Dollarization Is Happening at a ‘Stunning’ Pace, Jen Says

(Bloomberg) -- The dollar is losing its reserve status at a faster pace than generally accepted as many analysts have failed to account for last year’s wild exchange rate moves, according to Stephen Jen. Most Read from BloombergWorthless Degrees Are Creating an Unemployable Generation in IndiaOne Tesla Deal Propels Little-Known Family to $800 Million FortuneApple, Goldman Sachs Debut Savings Account With 4.15% Annual YieldFirst Republic Worked Hard to Woo Rich Clients. It Was the Bank’s UndoingC

1d ago TipRanks

TipRanksThese 2 ‘Strong Buy’ Penny Stocks Could Rally to $40 (or More), Says Piper Sandler

Bull or bear market, no investment is a sure thing. Especially in the current financial environment, which remains riddled with uncertainty, finding compelling plays can be challenging for even the most seasoned market watchers. However, this is not to say that investment opportunities with stand-out growth prospects can’t be found. For the more risk-tolerant investor, penny stocks, or tickers trading for less than $5 per share, can be an enticing option. The appeal is clear; the bargain price t

2h ago SmartAsset

SmartAssetAsk an Advisor: I Am 60 Years Old, Have $1.1M Cash, $880K in a 401(k), Several Pensions and Social Security. Should I Retire Now?

I am 60 years old, married, with no mortgage. We also have $1.1 million in liquid cash and $880,000 in a 401(k). I will have two pensions, which have not started yet, and my wife will have one pension, all … Continue reading → The post Ask an Advisor: I Am 60 Years Old, Have $1.1M Cash, $880K in a 401(k), Several Pensions and Social Security. Should I Retire Now? appeared first on SmartAsset Blog.

1d ago Reuters

ReutersFox resolves Dominion case, but $2.7 billion Smartmatic lawsuit looms

Fox News on Tuesday disposed of one legal threat with its $787.5 million defamation settlement with Dominion Voting Systems, but the network still faces a $2.7 billion lawsuit from another voting technology company, Smartmatic USA, over its coverage of debunked election-rigging claims. Dominion accused Fox and its parent company Fox Corp of ruining its business by airing claims that its machines were used to rig the 2020 U.S. presidential election in favor of Democrat Joe Biden and against then-president Donald Trump, a Republican. Fox and its parent company Fox Corp averted a six-week trial in Delaware Superior Court with the deal, which is half of the $1.6 billion Dominion sought but still by far the largest ever defamation settlement publicly announced by an American media company, according to legal experts.

8h ago Yahoo Finance

Yahoo FinanceHere’s how much President Biden paid in taxes in 2022

President Joe Biden and Vice President Kamala Harris released their complete 2022 tax returns as tax day wound down.

17h ago Bloomberg

BloombergBrookfield Defaults on $161 Million Office-Property Debt

(Bloomberg) -- Brookfield Corp. funds have defaulted on a $161.4 million mortgage for a dozen office buildings, mostly around Washington, DC, as rising vacancies hit property values.Most Read from BloombergWorthless Degrees Are Creating an Unemployable Generation in IndiaOne Tesla Deal Propels Little-Known Family to $800 Million FortuneApple, Goldman Sachs Debut Savings Account With 4.15% Annual YieldFox to Pay $787 Million to Settle Election Suit, Dominion SaysChatGPT Can Decode Fed Speak, Pred

1d ago Yahoo Finance

Yahoo FinanceTesla cuts prices again ahead of Q1 earnings report

Tesla slashed the prices of its Model 3 and Model Y EVs again as Wall Street readies for earnings.

5h ago Bloomberg

BloombergTesla Slashes Prices of Key Models Again Ahead of Earnings

(Bloomberg) -- Tesla Inc. is cutting prices in the US for the second time this month and just ahead of its latest earnings report, further demonstrating Elon Musk’s willingness to sacrifice profitability for demand.Most Read from BloombergAirline Blunder Sells $10,000 Asia-US Business Class Tickets for $300Tesla Slashes Prices of Key Models Again Ahead of EarningsWorthless Degrees Are Creating an Unemployable Generation in IndiaIndia Passes China as World’s Most Populous Nation, UN SaysDisney Is

4h ago Business Insider

Business InsiderAlphabet loses $55 billion in market value after Samsung reportedly considers replacing Google with Bing in its phones

Alphabet employees were shocked when they learned in March that Samsung was considering replacing Google search with Bing, according to the NYT.

2d ago SmartAsset

SmartAsset$400k Will Last You This Long in Retirement

Data from the Federal Reserve shows that the average savings in the United States at retirement age is just $255,200. So if you find yourself with $400,000 in assets at retirement age, congratulations! You're doing much better than average. But how … Continue reading → The post How Long Will $400k Last in Retirement? appeared first on SmartAsset Blog.

1d ago Business Insider

Business InsiderA single order from Elon Musk's Tesla has boosted a family's fortune to over $800 million

Shares in L&F, a battery-materials company, soared after it won a $2.9 billion order from Tesla. That boosted the wealth of a family who owns stock in the firm.

1d ago Fortune

FortuneThings are getting really weird in the housing market

The 2023 housing market doesn't look like a national housing crash. It also doesn't look normal.

1d ago The Wall Street Journal

The Wall Street JournalFidelity and State Street Push to Make 401(k)s More Like Pensions

More retirement plans will offer annuity options, though so far companies have been slow to sign up.

8h ago Zacks

ZacksFirst Republic Bank (FRC) is Attracting Investor Attention: Here is What You Should Know

First Republic Bank (FRC) has received quite a bit of attention from Zacks.com users lately. Therefore, it is wise to be aware of the facts that can impact the stock's prospects.

1d ago Zacks

ZacksPetrobras (PBR) Sells Entire Stake in Norte Capixaba Cluster

Petrobras (PBR) receives $426.65 million from Seacrest Petroleo SPE Norte Capixaba Ltda on concluding the sale of four onshore production fields in the State of Espirito Santo.

6h ago Zacks

ZacksIs Most-Watched Stock Medical Properties Trust, Inc. (MPW) Worth Betting on Now?

Zacks.com users have recently been watching Medical Properties (MPW) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

5h ago Yahoo Finance

Yahoo FinanceDeposits dropped at regional banks USB and CFG during 1Q tumult

Some of the nation's largest regional banks offer new signs of how they fared during a tumultuous period for the industry

6h ago Investor's Business Daily

Investor's Business DailyAbbott Labs Hits Two-Month High With The Help Of One First-Quarter Rock Star

Abbott Laboratories reported better-than-expected first-quarter sales despite a slowdown from its Covid test segment. ABT stock jumped.

2h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK