US Gets New Levers From Japan to Curb China’s Chip Ambitions

source link: https://finance.yahoo.com/news/us-gets-levers-japan-curb-230000085.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

US Gets New Levers From Japan to Curb China’s Chip Ambitions

US Gets New Levers From Japan to Curb China’s Chip Ambitions

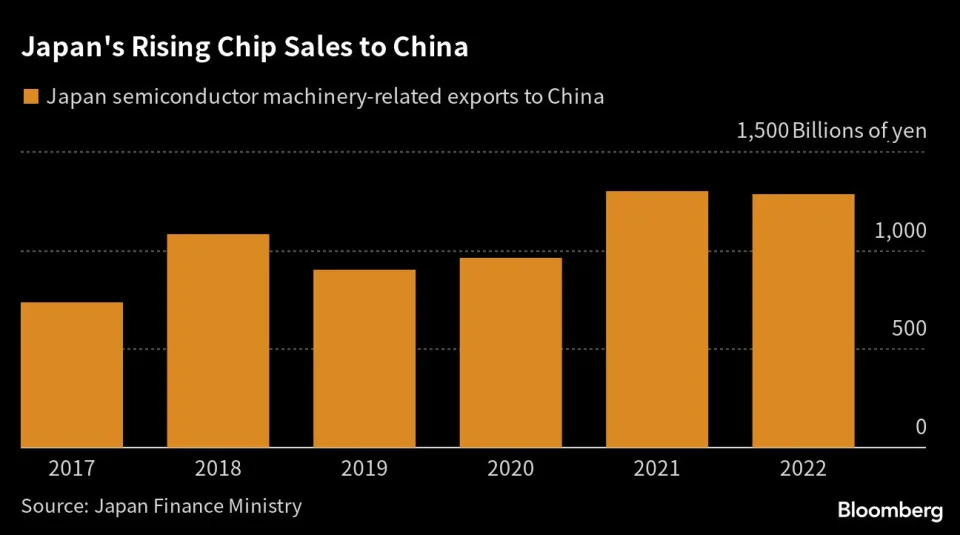

(Bloomberg) -- Japan’s decision to join the US and Netherlands in restricting exports of chipmaking gear to China is giving the allies powerful new weapons to deploy in the escalating technology war.

Most Read from Bloomberg

Japan’s trade ministry said last week that suppliers of 23 types of chip technology will need government approval to export to countries including China as early as July. That affects a broad range of companies that have been central to China’s efforts to build a domestic chip industry, including Tokyo Electron Ltd., Nikon Corp. and Screen Holdings Co.

While not as high-profile as their counterparts in the US or Netherlands, Japanese companies control key steps in the semiconductor supply chain, which could be used as potential chokepoints against China. Screen, for instance, is the leading producer of wafer cleaning equipment. Lasertec Corp. is the sole supplier of machines needed to inspect designs for the world’s most advanced chips, using extreme ultraviolet lithography chipmaking.

“The goal of these new controls is to cut off Chinese firms from a broad array of advanced chipmaking tools with the aim of making it more difficult for Chinese firms to manufacture advanced chips for artificial-intelligence purposes,” said Chris Miller, an economic historian and author of Chip War: the Fight for the World’s Most Critical Technology. The idea is to slow down China’s tech development to help widen the gap between China’s military capabilities and that of the US and its allies, he said.

When the Biden administration unveiled its sweeping restrictions on chip-related exports to China in October, American companies such as Applied Materials Inc. were directly affected by the rules. With the addition of the Netherlands and now Japan, all the major countries that produce chipmaking equipment are participating in the China blockade. The restrictions cover the most advanced machines, including those that make logic chips at 16 nanometers or more advanced geometries.

Bloomberg

BloombergBrazil’s Finance Chief Weighs Steps to Ease Credit as Markets Reel

(Bloomberg) -- Brazil’s finance chief is considering a series of measures to boost credit in Latin America’s largest economy, saying capital markets have “stalled” under the weight of high interest rates.Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Online TV SeriesToronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the LineChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaJamie Dimon Warns US Banking Crisis Will Be Felt for YearsRead the New York Felo

7h ago Reuters

ReutersExclusive-Bank of England approves UBS's Credit Suisse takeover in UK -sources

The Bank of England has approved UBS Group AG's takeover of Credit Suisse Group AG in the United Kingdom, people familiar with the process told Reuters, a key market for the Swiss lenders racing to close the rescue deal. Representatives for UBS and Credit Suisse declined to comment. On March 19, just after the deal was announced, the Bank of England said it welcomed "the comprehensive set of actions set out by the Swiss authorities today in order to support financial stability," without elaborating.

8h ago Bloomberg

BloombergCIBC CEO Says Mortgage Aid Sustainable for ‘Foreseeable Future’

(Bloomberg) -- Canadian Imperial Bank of Commerce Chief Executive Officer Victor Dodig said the accommodations his bank is making for variable-rate mortgage holders who’ve seen their borrowing costs spike are “sustainable for the foreseeable future.”Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Online TV SeriesToronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the LineChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaJamie Dimon Warns US Banking Crisi

10h ago The Telegraph

The Telegraph‘I didn’t bring my gun today’: Credit Suisse executives face shareholder anger at chaotic investor meeting

Credit Suisse executives were told they would have been crucified in mediaeval times for overseeing the bank’s ignominious rescue deal during a chaotic final shareholder meeting on Tuesday.

8h ago Fortune

Fortune‘I am truly sorry’: Credit Suisse chairman grovels with police security at his side as he apologizes for wiping out billions in shareholder value

“I apologize that we were no longer able to stem the loss of trust that had accumulated over the years, and for disappointing you,” Axel Lehmann said at the bank’s final shareholder meeting.

6h ago Bloomberg

BloombergFed’s Mester Says Rates Should Rise Above 5%, Stay for Some Time

(Bloomberg) -- Federal Reserve Bank of Cleveland President Loretta Mester said policymakers should move their benchmark rate above 5% this year and hold it at restrictive levels for some time to quell inflation, with the exact level depending on how quickly price pressures ease.Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Online TV SeriesToronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the LineChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaJamie

3h ago Bloomberg

BloombergInvestors Unloaded Saudi Arabian Bonds After Surprise OPEC+ Move

(Bloomberg) -- Investors have been unloading bonds from Saudi Arabia and other Gulf states since a surprise OPEC+ production cut on the weekend sent the price of oil surging, an unusual move that traders say reflects how expensive the region’s debt has become.Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Online TV SeriesChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaJamie Dimon Warns US Banking Crisis Will Be Felt for YearsStocks Halt Winning Streak as Bonds Cli

16h ago Reuters

ReutersJapan's March service-sector grows at fastest rate in over nine years - PMI

The final au Jibun Bank Japan Services purchasing managers' index (PMI) rose to a seasonally adjusted 55.0 last month, from February's 54.0, marking the quickest rate of expansion since October 2013. "The Japanese services economy signalled a sharp improvement in demand conditions at the end of the first quarter of 2023 as the dissipating impact of the COVID-19 pandemic and stronger customer confidence combined to boost output and orders," said Usamah Bhatti, economist at S&P Global Market Intelligence. The subindexes of new orders and overseas demand grew for a seventh month, rising at the fastest pace since February 2019 and December 2022, respectively.

2h ago Reuters

ReutersDollar's crown to slip as peers catch up in rates race: Reuters poll

The U.S. dollar will weaken against most major currencies this year as the interest rate gap with its peers stops widening, putting the currency on the defensive after a multi-year run, according to a Reuters poll of foreign exchange strategists. Despite starting the year on a weak footing, the dollar bounced back sharply in February, gaining nearly 3% for the month, on expectations the U.S. Federal Reserve would take interest rates higher than previously thought. However, the failure of two regional U.S. banks in March forced the Fed to temper those expectations, pushing the greenback to retreat and give back nearly all of its previous month's gains, a trend likely to persist in the near-to-medium term.

3h ago The Wall Street Journal

The Wall Street JournalMicron Gets Caught in U.S.-China Crossfire

China’s investigation into the computer-memory maker has sparked fears that Beijing is finally striking back at U.S. chip companies.

2d ago Bloomberg

BloombergOne Shale Executive Correctly Called OPEC+’s Surprise Output Cut

(Bloomberg) -- OPEC+’s decision to cut production this past Sunday shocked traders around the world and heightened worries of a rebound in inflation, but one Texas shale executive forecast the move — almost exactly — back in January. Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Online TV SeriesToronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the LineChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaJamie Dimon Warns US Banking Crisis Will Be Felt f

7h ago Bloomberg

BloombergBillionaire Richard Branson’s Space Empire Teeters as Virgin Orbit Flops

(Bloomberg) -- Billionaire Richard Branson’s space empire is getting a bruising reality check.Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Online TV SeriesToronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the LineChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaJamie Dimon Warns US Banking Crisis Will Be Felt for YearsRead the New York Felony Indictment Against TrumpVirgin Orbit Holdings Inc., the satellite-launch firm that only a few months ago wa

4h ago Fortune

FortuneWhat is a CD ladder? Here is how this savings strategy works

Utilize CD ladders for low-risk, regular returns over time.

10h ago Reuters

ReutersSK Hynix raises $1.7bln in convertible bond as chip slump deepens

South Korea's SK Hynix has raised $1.7 billion in its first convertible bond sale in a decade, as the world's second-largest memory chipmaker braces for deepening quarterly losses, hit by a sharp downturn in global semiconductor demand. The financing, the first such deal by the firm since it was acquired by energy to telecoms conglomerate SK Group in 2012, follows a rare $15.2 billion financing deal by cash-rich Samsung Electronics in February. SK Hynix said in a regulatory filing on Tuesday that the proceeds of the bond sale would be used to fund operations such as buying chip production materials.

1d ago Reuters

ReutersSamsung quarterly profit set to hit 14-year low amid chip glut

Samsung Electronics Co Ltd's first-quarter profit is expected to plunge 92% to the lowest for any quarter in 14 years, as a chip glut worsens and buyers like data centres and computer makers slow purchases amid a global economic slowdown. The launch of a new flagship smartphone is expected to have supported mobile profits, but its chip division likely reported quarterly losses of more than 3 trillion won ($2.3 billion) as memory chip prices fell and its inventory values were slashed, analysts said. Samsung, the world's biggest maker of memory chips, TVs and smartphones as of 2022, is a bellwether for global consumption trends.

5h ago The Telegraph

The TelegraphSaudi crown prince hands Putin his biggest weapon in the energy war

During his presidential campaign Joe Biden pledged to make Saudi Arabia an international pariah. Then came sky high inflation and a war. In July, Biden swallowed his words and travelled to Jeddah to meet the Crown Prince Mohammad Bin Salman.

22h ago TipRanks

TipRanksJ.P. Morgan Says Buy These 2 High-Yield Dividend Stocks — Including One With 9% Yield

After a rough month from mid-February to mid-March, investors have reason for some positive sentiment in what’s been a highly volatile environment. Since hitting bottom on March 13, the S&P 500 has gained back 6.5%, and is back up to a 7.5% year-to-date gain. Increases have been even more impressive for the NASDAQ index, which rose 17% in Q1 – for its best quarterly performance since 2020. But not so fast, says JPMorgan asset management CIO Bob Michele, who takes a cautious view of the long-term

2d ago Bloomberg

BloombergSuncor Unit Charged in Oil-Worker Death Amid Activist Scrutiny

(Bloomberg) -- Suncor Energy Inc.’s majority-owned unit Syncrude Canada Ltd. was charged with safety violations in the death of an oil sands worker, the latest setback for a company under investor pressure to improve its safety record.Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Online TV SeriesToronto-Dominion Becomes Biggest Bank Short With $3.7 Billion on the LineChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaJamie Dimon Warns US Banking Crisis Will Be Felt

11h ago Zacks

ZacksRising Oil Prices? 3 Stocks Worth Considering

Energy stocks are seeing increased attention from investors following a surprise production cut from OPEC on Sunday. After retreating in 2023 and particularly so throughout March, oil prices surged on the news. Where do energy stocks go from here?

8h ago Investor's Business Daily

Investor's Business DailyAnalysts Predict A Blowout First-Quarter Profit From 11 Stocks

Brace yourself for lots of highs and lows when it comes to first-quarter S&P 500 earnings results. The spread will be large.

16h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK