Billionaire investor Charlie Munger says stock market ‘gambling’ is as addictive...

source link: https://finance.yahoo.com/news/billionaire-investor-charlie-munger-says-210112904.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

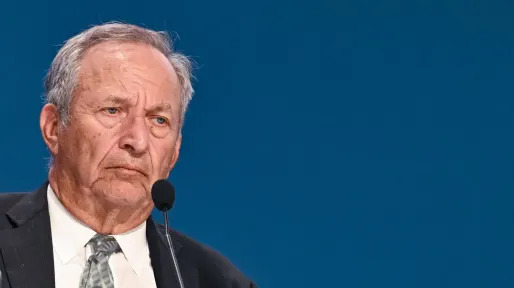

Billionaire investor Charlie Munger says stock market ‘gambling’ is as addictive as ‘heroin’—but he sees no way to fix it

Speculative trading boosted “meme stocks” and shares in many other risky companies during the COVID-19 lockdowns and helped retail investors profit tremendously before the market tanked.

Charlie Munger, Warren Buffett’s lieutenant at Berkshire Hathaway and a veteran long-term investor, thinks this kind of speculative trading is akin to an addiction—one that it should be done away with.

"They [people] love gambling, and the trouble is, it's like taking heroin,” Munger said in an interview with Berkshire Hathaway investment officer Todd Combs taped in April 2022 and published earlier this year. “A certain percentage of people when they start just overdo it. It's that addictive. It's absolutely crazy, it's gone berserk. Civilization would have been a lot better without it."

Munger said during the interview that the stock market attracts two types of traders: long-term investors and people wanting to “to do casino gambling.” The trouble comes when these two categories are allowed to trade together, according to the billionaire.

“Now, what earthly good is it for our country to make the casino part of capitalism more and more efficient, and more and more attractive, and more and more seductive? It's an insane public policy,” Munger said, adding that it causes harm to the country. “On the other hand, I think the chances of changing it are practically zero.”

Munger believes the effects of speculative trading caused the Great Depression, which started with the worst stock market crash in history in 1929. And while there are obvious perils of this form of “gambling,” he says nothing can be done about it.

At the time that Munger gave the interview, meme stocks like GameStop and AMC had surged almost 100-fold. Before the speculation-driven bump to its shares, AMC was at risk of bankruptcy, and GameStop’s was worth only a tiny fraction of what it had ballooned up to. And while market conditions have changed dramatically since then, meme stocks have seen good days even in 2023, especially when stocks seem to be climbing, adding to the frenzy.

Fortune

FortuneLarry Summers calls the fact that one in 25 dies before age 40 ‘the most disturbing set of data on America that I have encountered in a long time’

U.S. mortality data was "especially scary remembering that demographics were the best early warning on the collapse of the USSR,” Summers tweeted.

20h ago Fortune

FortuneGoogle has gone from offering perks like free massages to cutting back on staplers and office supplies as the company tightens its belt

Google is tapping its hybrid work structure to cut expenses on employee services as it gears up for a larger efficiency push.

6h ago Fortune

FortuneElon Musk’s swelling inventories of unsold Tesla cars have Wall Street worried

Even by Tesla’s own official count, the number of cars in stock is reaching levels not seen since the third quarter of 2020—despite the generous use of rebates to entice consumers.

13h ago Fortune

FortuneChatGPT will quickly handle at least half of the tasks of financial investment jobs, researchers predict

New research takes a look at how generative A.I. will impact the U.S. labor market.

16h ago Investopedia

InvestopediaUMass Economist: ‘There are Other Sectors We Don't Even Know About Waiting to Explode’

A bank collapse, civil disturbances, stagflation, and a commercial real estate implosion are all possible outcomes of the Federal Reserve’s campaign of anti-inflation rate hikes, one economics professor says.

6h ago Yahoo Finance

Yahoo FinanceWorkers must plan on Social Security shortfall when retirement planning, advisers say

Estimates last week showed Social Security's reserves are projected to run out in 2033.

7h ago Fortune

FortuneHow Summit Powder Mountain, a $40-million ski resort designed to be a utopia for the tech elite, skidded downhill

It was designed to be a haven for techies and billionaires. Instead, ten years on, it’s a “9,000-foot monument to the hubris of Silicon Valley’s big ideas.”

16h ago SmartAsset

SmartAssetHow Long Will $3 Million Last Me in Retirement?

How long $3 million will last in retirement depends on your spending habits and investment returns. While your spending habits are largely under your control, some costs such as healthcare expenses are not perfectly predictable. Likewise, while you can probably … Continue reading → The post How Long Will $3 Million Last in Retirement? appeared first on SmartAsset Blog.

14h ago Bloomberg

BloombergNorway’s Krone Leads Commodity FX Higher on OPEC+ Production Cut

(Bloomberg) -- The Norwegian krone led commodity currencies higher in early Monday trading in Asia after OPEC+ announced a shock oil-production cut, while the yen weakened on the prospect of higher crude prices.Most Read from BloombergOPEC+ Makes Shock Million-Barrel Cut in New Inflation RiskSwiss Prosecutors Probe Credit Suisse Deal, Job Cuts SeenRussia Blames Ukraine as Suspect Held in Pro-War Blogger’s DeathBillionaire Blocked From His New Palace Blasts ‘Socialist’ IndiaDubai’s Latest Boom Is

1d ago TipRanks

TipRanksBuy These Clean Energy Stocks, Morgan Stanley Says, Forecasting Over 100% Upside

Right now, we’re at the cusp of a world-changing shift in the green energy economy, as both social and political will have come together to promote a switch from traditional fossil fuels to sustainable and environmentally friendly energy sources. For investors, this shift can open up new vistas of opportunity. Morgan Stanley’s Andrew Percoco believes that the opportunity in clean energy is substantial. The analyst maintains a ‘constructive’ view of energy renewables, and picked out two stocks th

4h ago Zacks

ZacksPan American Silver (PAAS) Completes Yamana Gold Acquisition

Pan American Silver (PAAS) completes the much-awaited acquisition of Yamana Gold, which will boost its silver by 50%.

11h ago Barrons.com

Barrons.comApple Likely to Boost Its Dividend and Stock Buybacks Yet Again

The iPhone maker has been increasing its dividend for the last 10 years—and slashing share count for the last five. Expect both to continue when Apple reports March-quarter earnings.

10h ago Zacks

ZacksMedical Properties (MPW) to Dispose of Healthscope Portfolio

Medical Properties (MPW) enters an agreement with affiliates of HMC Capital to dispose of its Healthscope portfolio. The move is in line with its capital recycling strategy.

12h ago SmartAsset

SmartAssetWho Should Use Vanguard, Fidelity and Schwab?

SmartAsset compares three of the largest investment companies based on usability, trade experience, offerings and cost. Learn more here.

2d ago Investor's Business Daily

Investor's Business DailyDow Jones Futures: Tesla Dives Below Latest Buy Point On Deliveries Miss; What To Do Now

Dow Jones futures were lower late Monday. Tesla stock dived below its latest buy point after a Q1 deliveries miss; what to do now.

2h ago Barrons.com

Barrons.comTesla Set a Delivery Record. Why the Stock Is Dropping—and What Wall Street Thinks.

Tesla delivered 422,875 vehicles in the first quarter of 2023, up from 405,278 vehicles in the fourth quarter of 2022 and up from the 310,048 vehicles delivered in the year-ago period.

7h ago Zacks

ZacksThese 3 Top-Ranked Stocks Roared in Q1

Several stocks delivered outsized gains in Q1, with buyers stepping up consistently. Can they repeat the same performance in Q2?

8h ago Zacks

ZacksWall Street Analysts Think Enphase Energy (ENPH) Is a Good Investment: Is It?

According to the average brokerage recommendation (ABR), one should invest in Enphase Energy (ENPH). It is debatable whether this highly sought-after metric is effective because Wall Street analysts' recommendations tend to be overly optimistic. Would it be worth investing in the stock?

14h ago Benzinga

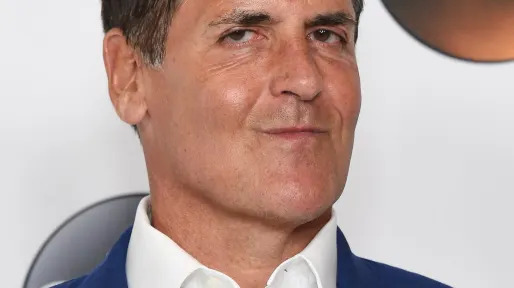

BenzingaMark Cuban Is Signing The Payroll Check For His Startup

The Silicon Valley Bank’s (SVB) unforeseen fallout has created ripple effects across the U.S. banking and startup sectors. This is because the SVB was one of the most coveted banks among startup companies and venture capitalists. What was the 16th-largest bank in the U.S. serviced approximately half of all U.S. venture capitalist-backed startups. Don’t Miss: Elon Musk & Sam Altman Say Scary Good AI Is On The Way – Here's How Retail Is Investing Millions Consequently, the banking mammoth’s sudden

9h ago Investor's Business Daily

Investor's Business DailyStocks To Buy And Watch: Dow Jones Leader Boeing, ServiceNow Eye New Buy Points

Dow Jones aerospace and defense giant Boeing is approaching a new buy point in today's stock market action. Shares rallied nearly 2%.

10h ago Barrons.com

Barrons.comApple Stock Nears a Record. iPhone Demand Could Help It Soar, Analyst Says.

Strong demand for the phones in Asia and improving revenue from services revenue bode well for the shares, analysts at Wedbush say.

14h ago Benzinga

BenzingaREITs Are Back In Favor With Analysts

Analysts’ estimates of real estate investment trusts (REITs) have been on a roller coaster ride in 2023. After beginning the New Year with a slew of upgrades on REITs that had been badly battered throughout 2022, the analyst community was extremely quiet in February. Although there were dozens of Maintain and Reiterate ratings, not one analyst upgraded a REIT in February, and there were nine REITs that received downgrades. But as March comes to an end, REITs seem to be back in favor with analyst

12h ago The Telegraph

The TelegraphPutin pushes Russian oil exports to record high

Vladimir Putin has pushed seaborne deliveries of Russian crude to record highs to fill Moscow's war chest, even as the Kremlin vowed to tighten oil supplies.

8h ago Zacks

ZacksAmazon (AMZN) Stock Sinks As Market Gains: What You Should Know

Amazon (AMZN) closed the most recent trading day at $102.41, moving -0.85% from the previous trading session.

6h ago Barrons.com

Barrons.comSmall-Cap Stocks Look Ready to Rally. Take a Look at These Two.

As of Friday's close, the Russell 2000 was at 44% of the S&P 500's level, a ratio seen in early 2020 when Covid-19's arrival left the economy in perilous waters.

9h ago Reuters

ReutersUS sales at top automakers rise on improving inventory, Toyota struggles

General Motors Co, which replaced Toyota as the top U.S. automaker in 2022, posted a 17.6% rise in first-quarter auto sales. "We gained significant market share in the first quarter, pricing was strong, inventories are in very good shape, and we sold more than 20,000 EVs (electric vehicles) in a quarter for the first time," GM Executive Vice President Steve Carlisle said in a statement.

17h ago CoinDesk

CoinDeskBitcoin Drops to $27.5K While Dogecoin Spikes After Twitter Logo Change

BTC needs a catalyst to break the $30,000 threshold. DOGE spikes after Twitter CEO Elon Musk changes the logo on the social media platform to the Dogecoin symbol from a blue bird.

6h ago Barrons.com

Barrons.comIntel Stock Scores an Upgrade. Fundamentals May Have Bottomed, Analyst Says.

The chip maker should be able to make its earnings estimates and may hit its chip pipeline schedule, writes Bernstein.

12h ago USA TODAY

USA TODAYTexas woman uses 'cash stuffing' and stimulus check to pay off nearly $80,000 in debt

Before she started cash stuffing, Jasmine Taylor said she was tired of being in financial distress. She turned that success into 'Baddies and Budgets'

2d ago Barrons.com

Barrons.com7 Dividend Stocks for Uncertain Economic Times

Treasuries aren't the only refuge in a slowdown. Dividend names also "can provide a margin of safety," says UBS.

13h ago Zacks

ZacksPetrobras (PBR) Faces Pressure to Reconsider Asset Sales

The government is pushing Petrobras (PBR) to reconsider its asset sales plan in order to maintain a balance between immediate financial needs and long-term strategic objectives.

16h ago Bloomberg

BloombergSentiment Toward Stocks Hasn’t Been This Bad in Years, Bank of America Says

(Bloomberg) -- Fears of an economic downturn evoked by bank collapses have turned Wall Street’s attitude toward stocks the most negative in several years, according to Bank of America.Most Read from BloombergWarner Bros. Nears Deal for Harry Potter Video SeriesOPEC+ Makes Shock Million-Barrel Cut in New Inflation RiskChina’s Yuan Replaces Dollar as Most Traded Currency in RussiaSwiss Prosecutors Probe Credit Suisse Deal, Job Cuts SeenBillionaire Blocked From His New Palace Blasts ‘Socialist’ Ind

7h ago Barrons.com

Barrons.comPlug Power Stock Falls as Morgan Stanley Cuts Price Target in Half

Analyst Andrew Percoco lowered his rating on the shares to the equivalent of Hold from Buy. HIs target for the price went to $15 a share from $35.

14h ago Zacks

ZacksApple (AAPL) Outpaces Stock Market Gains: What You Should Know

In the latest trading session, Apple (AAPL) closed at $166.10, marking a +0.72% move from the previous day.

6h ago Investor's Business Daily

Investor's Business DailyIs Verizon A Buy As Analysts Eye Consumer Unit Rebound?

VZ stock provides a dividend but a buyback has been shelved amid 5G wireless investments. When will revenue growth reaccelerate?

13h ago Investor's Business Daily

Investor's Business DailyIs Snowflake Stock A Buy Amid Amazon Pact, Buyback Program?

The valuation of Snowflake stock, the biggest software IPO ever, remains controversial. Here is what technical analysis says about buying SNOW stock.

13h ago Investor's Business Daily

Investor's Business DailyIs AMC Stock A Buy Or Sell Now? Here's What Fundamentals, Chart Action, Fund Ownership Metrics Say

In 2020, AMC lost $16.15 a share. Over the past five quarters, the company's sales have shrunk 22% to 99% vs. year-ago levels. Such results normally devastate most companies.

4h ago Reuters

ReutersBlackstone REIT limits investor redemptions again in March

NEW YORK (Reuters) -Blackstone Inc said on Monday it had again blocked withdrawals from its $70 billion real estate income trust in March as the private equity firm faced a flurry of redemption requests. Blackstone has been exercising its right to block investor withdrawals from BREIT since November after requests exceeded a preset 5% of the net asset value of the fund. BREIT fulfilled March withdrawal requests of $666 million, representing only 15% of the $4.5 billion in total redemption requests for the month, the firm said in a letter to investors.

12h ago Barrons.com

Barrons.comGM Sells More Than 20,000 Electric Vehicles for the First Time in a Quarter

GM delivers 20,670 electric vehicles in the first quarter, up from 16,266 delivered in the fourth quarter and up from the 457 delivered in the first quarter of 2022.

6h ago Fortune

FortuneMcDonald’s reportedly tells U.S. staff to work from home over the next 3 days so it can deliver layoff messages remotely

McDonald’s said it would deliver staffing notices virtually owing to the increased amount of personal travel for the week of April 3.

18h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK