This banking crisis isn’t 2008. That doesn’t make it a good thing

source link: https://finance.yahoo.com/news/this-banking-crisis-isnt-2008-that-doesnt-make-it-a-good-thing-morning-brief-093058615.html?_tsrc=fin-notif

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

This banking crisis isn’t 2008. That doesn’t make it a good thing: Morning Brief

This article first appeared in the Morning Brief. Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET. Subscribe

Wednesday, March 29, 2023

Today's newsletter is by Myles Udland, Head of News at Yahoo Finance. Follow him on Twitter @MylesUdland and on LinkedIn. Read this and more market news on the go with the .

A daily refrain from investors and financial commentators has been to remind viewers, listeners, readers, and anyone else within earshot that this banking crisis is not 2008.

"Similarities with the lead-up to the global financial crisis are becoming more apparent each week, but we believe key differences make a reprise unlikely," wrote Tamara Basic Vasiljev, senior economist at Oxford Economics, in a note to clients on Tuesday.

"More banking sector upheaval and consolidation is possible, but we think broader economic damage is likely to be contained," Vasiljev added.

And indeed, current angst over FDIC insurance limits, business model risks among regional banks, and another iteration of fears about the commercial real estate market all remain a safe distance from the existential questions the 2008 crisis surfaced at its nadir.

As my former editor Sam Ro used to say, the 2008 crisis didn't peak until people were openly doubting the foundations of capitalism.

But the current bank crisis is no joke, either.

Three U.S. banks have failed this month. Over $100 billion in deposits have flowed out of small banks.

By assets, this year's failures are exceeded only by those seen in 2008, when 25 banks holding north of $370 billion in assets went under. The scale of this crisis' failures ought not to be dismissed.

Moreover, the policy outlook remains fractured.

The Federal Reserve raised rates again last week, bringing rates to their highest levels since October 2007.

And while the central bank notably pared back its expectations for more rate hikes this year, Fed officials expect another 0.25% rate hike will be needed to slow inflation.

Zacks

ZacksFirst Republic Bank and JPMorgan are part of Zacks Earnings Preview

First Republic Bank and JPMorgan are part of Zacks Earnings Preview.

6h ago TipRanks

TipRanksJ.P. Morgan Says Buy These 2 High-Yield Dividend Stocks — Including One With 9% Yield

After a rough month from mid-February to mid-March, investors have reason for some positive sentiment in what’s been a highly volatile environment. Since hitting bottom on March 13, the S&P 500 has gained back 6.5%, and is back up to a 7.5% year-to-date gain. Increases have been even more impressive for the NASDAQ index, which rose 17% in Q1 – for its best quarterly performance since 2020. But not so fast, says JPMorgan asset management CIO Bob Michele, who takes a cautious view of the long-term

1h ago TipRanks

TipRanks‘Load Up,’ Says Raymond James About These 2 ‘Strong Buy’ Stocks

Everyone invests with the goal of generating big returns but it’s easy to get distracted by all the short-term noise generated on Wall Street. The key to investing success, according to Raymond James CIO Larry Adam, is to follow a few simple rules. One is to realize past performance does not necessarily guarantee future success. “History has shown that no single asset class has been a consistent winner year after year,” says Adam, “just as no single asset class remains at the bottom.” Secondly,

18h ago Zacks

ZacksHere is What to Know Beyond Why UnitedHealth Group Incorporated (UNH) is a Trending Stock

Zacks.com users have recently been watching UnitedHealth (UNH) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

3h ago Yahoo Finance

Yahoo FinanceRivian: Q1 deliveries top estimates, 'on track' to hit 2023 production forecast

EV-maker Rivian delivered some much needed positive news today to investors, announcing that Q1 deliveries that topped estimates for the quarter, and its production forecast is still on track.

1h ago Yahoo Finance

Yahoo FinanceHow Warren Buffett could steal the show in the second quarter: Morning Brief

Be ready to take notes from Warren Buffett. More on that, and what else to know in markets on Monday, April 3, 2023.

6h ago Zacks

ZacksEnphase Energy, Inc. (ENPH) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Enphase Energy (ENPH) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

3h ago Yahoo Finance

Yahoo FinanceWhat if the Fed hadn't made a 'mistake'? A hypothetical to consider.

Hypotheticals are hard, but what if we considered an alternative world where the Fed had done what critics say should've happened?

20h ago Zacks

ZacksPetrobras (PBR) Faces Pressure to Reconsider Asset Sales

The government is pushing Petrobras (PBR) to reconsider its asset sales plan in order to maintain a balance between immediate financial needs and long-term strategic objectives.

4h ago Reuters

ReutersBlackstone REIT limits investor redemptions again in March

Blackstone Inc said on Monday that it had again blocked withdrawals from its $70 billion real estate income trust in March as the private equity firm faced a flurry of redemption requests. Blackstone has been exercising its right to block investor withdrawals from BREIT since November last year after requests exceeded a preset 5% of the net asset value of the fund. BREIT fulfilled withdrawal requests of $666 million in March, representing only 15% of the $4.5 billion in total redemption requests for the month, the firm said in a letter to investors.

20m ago Barrons.com

Barrons.comApple Stock Nears a Record. iPhone Demand Could Help It Soar, Analyst Says.

Strong demand for the phones in Asia and improving revenue from services revenue bode well for the shares, analysts at Wedbush say.

2h ago The Wall Street Journal

The Wall Street JournalHow Nikki Haley Went From Friend to Foe of Government Aid for Boeing

The Republican 2024 presidential hopeful is drawing flak over the aerospace company’s role in her political career.

6h ago Yahoo Finance

Yahoo FinanceOil pops, Dow rallies as second quarter gets underway: Stock market news today

A move higher in oil prices, a mega merger in the media space, and more bad news from the U.S. manufacturing sector offered investors a mixed picture early Monday to start the second quarter of the year.

2h ago Investor's Business Daily

Investor's Business DailyThese Are The 5 Best Stocks To Buy And Watch Now

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist?

15h ago USA TODAY

USA TODAYTexas woman uses 'cash stuffing' and stimulus check to pay off nearly $80,000 in debt

Before she started cash stuffing, Jasmine Taylor said she was tired of being in financial distress. She turned that success into 'Baddies and Budgets'

1d ago Zacks

ZacksBest Income Stocks to Buy for April 3rd

IVR, GECC and ABR made it to the Zacks Rank #1 (Strong Buy) income stocks list on April 3, 2023.

3h ago Bloomberg

BloombergBitcoin Liquidity Is Drying Up as Crypto ‘Tourists’ Recoil From Industry Disorder

(Bloomberg) -- By just about any measure, Bitcoin liquidity remains low, despite the cryptocurrency’s eye-catching upsurge this year. Most Read from BloombergOPEC+ Makes Shock Million-Barrel Cut in New Inflation RiskSwiss Prosecutors Probe Credit Suisse Deal, Job Cuts SeenRussia Blames Ukraine as Suspect Held in War Blogger’s DeathBillionaire Blocked From His New Palace Blasts ‘Socialist’ IndiaOil Surges Most in a Year After OPEC+’s Shocking Production CutInvestors have been paying more on trade

4h ago Zacks

ZacksApellis (APLS) Kindles Acquisition Interest Per Bloomberg

Per a Bloomberg article, Apellis Pharmaceuticals (APLS) is considering a possible buyout by larger pharma companies.

4h ago Investor's Business Daily

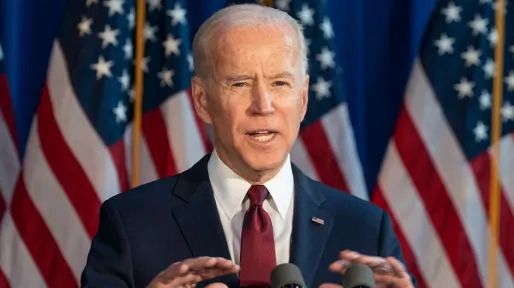

Investor's Business DailyBiden Approval Rating Shows Resilience As Financial Stress Rises

President Biden's approval rating is holding near its best level in more than a year, though cracks in the economic outlook are emerging, the IBD/TIPP Poll finds.

2h ago Barrons.com

Barrons.com7 Dividend Stocks for Uncertain Economic Times

Treasuries aren't the only refuge in a slowdown. Dividend names also "can provide a margin of safety," says UBS.

1h ago

Recommend

-

16

16

Reading Time: 4 minutesHave you ever imagined a world without Banks? Just try it, and you will find it very difficult to live in a world without banks. Banks are one of the most important parts of the financial economy of any country. On the...

-

9

9

NBW Pluggdin CFTC Commissioner Views Crypto Crash As Similar to the 2008 Banking Crisis

-

5

5

Terra, Celsius, and lessons from the 2008 fina...

-

5

5

March 14, 2023 ...

-

4

4

Peter Schiff Blames Regulation For Banking Crisis March 19, 2023

-

1

1

Home ...

-

4

4

Ethereum Surges While Bitcoin Holds Steady: Is the Banking Crisis Over?

-

4

4

Home ...

-

4

4

What Does the Banking Crisis Mean for Startups and Small Business Owners? Author, CPA and business owner Gene Marks break down everything entre...

-

5

5

3 Reasons The Banking Crisis Isn’t a Repeat of 2008 Skip to main conten...

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK