Biden pressures US regulators to change bank rules

source link: https://finance.yahoo.com/biden-pressures-us-regulators-to-toughen-bank-rules-183301342.html?_tsrc=fin-notif

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Biden pressures US regulators to toughen bank rules

The White House is urging bank overseers to get stricter with regional lenders, outlining a series of steps it wants in the wake of the Silicon Valley Bank meltdown.

President Biden is asking federal banking regulators to tighten some of the rules loosened at the end of last decade for regional banks, forcing institutions the size of the failed Silicon Valley Bank to hold more liquid assets while undergoing more frequent stress tests.

The steps outlined by the White House Thursday don't require new legislation and can be imposed by regulators that currently oversee the nation’s banks, including the Federal Reserve. The Fed is currently reviewing what changes it can make on its own; its bank regulation chief, Michael Barr, told lawmakers Tuesday he does see a "need" for stronger liquidity and capital requirements.

One Republican lawmaker said the Fed already has the power to hold banks like Silicon Valley Bank accountable and it failed to do so. “Instead of giving more authority to regulators who were asleep at the wheel before these bank failures, we should hold them accountable for their inability to utilize their existing supervisory tools,” said Patrick McHenry, chair of the House Financial Services Committee.

The oversight of regional banks was first loosened in 2018 during the Trump administration with a bipartisan bill that re-defined which banks were deemed "systemically important" to those holding at least $250 billion in assets instead of $50 billion, undoing some of the strictest requirements imposed by Congress following the 2008 financial crisis.

That legislation also gave the Fed the power to tailor those rules, which it did along with other regulators in 2019. Current Fed Chair Jerome Powell was in charge of the Fed at the time. Some federal officials, including current Federal Deposit Insurance Corporation Chair Martin Gruenberg, objected to the revisions.

One key 2019 measure now receiving a lot of attention was the Fed’s decision to exempt banks with $100-$250 billion in assets from maintaining a standardized “liquidity coverage ratio.” The ratio is designed to show whether a lender has enough high-quality liquid assets to survive a crisis. A lack of liquidity turned out to be a major problem for Silicon Valley Bank as deposits left the bank and the value of its assets declined as interest rates rose. The $209 billion institution was seized by regulators on March 10.

Zacks

ZacksNIO, XPeng (XPEV), Li Auto (LI) Post March, Q1 Delivery Updates

NIO delivered 31,041 vehicles in first quarter of 2023, while XPeng and Li Auto delivered 18,230 and 52,584 vehicles respectively in the same period.

4h ago Zacks

ZacksFirst Republic Bank and JPMorgan are part of Zacks Earnings Preview

First Republic Bank and JPMorgan are part of Zacks Earnings Preview.

6h ago TipRanks

TipRanks‘Load Up,’ Says Raymond James About These 2 ‘Strong Buy’ Stocks

Everyone invests with the goal of generating big returns but it’s easy to get distracted by all the short-term noise generated on Wall Street. The key to investing success, according to Raymond James CIO Larry Adam, is to follow a few simple rules. One is to realize past performance does not necessarily guarantee future success. “History has shown that no single asset class has been a consistent winner year after year,” says Adam, “just as no single asset class remains at the bottom.” Secondly,

18h ago Zacks

ZacksHere is What to Know Beyond Why UnitedHealth Group Incorporated (UNH) is a Trending Stock

Zacks.com users have recently been watching UnitedHealth (UNH) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

3h ago Yahoo Finance

Yahoo FinanceRivian: Q1 deliveries top estimates, 'on track' to hit 2023 production forecast

EV-maker Rivian delivered some much needed positive news today to investors, announcing that Q1 deliveries that topped estimates for the quarter, and its production forecast is still on track.

1h ago Investor's Business Daily

Investor's Business DailyDow Jones Rallies 300 Points Amid Key Economic Data; Tesla Slides On Deliveries Miss

The Dow Jones rose 275 points Monday amid key economic data. Tesla stock dropped after the company's Q1 deliveries missed estimates.

1h ago Yahoo Finance

Yahoo FinanceHow Warren Buffett could steal the show in the second quarter: Morning Brief

Be ready to take notes from Warren Buffett. More on that, and what else to know in markets on Monday, April 3, 2023.

6h ago Zacks

ZacksEnphase Energy, Inc. (ENPH) is Attracting Investor Attention: Here is What You Should Know

Zacks.com users have recently been watching Enphase Energy (ENPH) quite a bit. Thus, it is worth knowing the facts that could determine the stock's prospects.

3h ago Zacks

ZacksPetrobras (PBR) Faces Pressure to Reconsider Asset Sales

The government is pushing Petrobras (PBR) to reconsider its asset sales plan in order to maintain a balance between immediate financial needs and long-term strategic objectives.

4h ago Barrons.com

Barrons.comApple Stock Nears a Record. iPhone Demand Could Help It Soar, Analyst Says.

Strong demand for the phones in Asia and improving revenue from services revenue bode well for the shares, analysts at Wedbush say.

2h ago Barrons.com

Barrons.comPlug Power Stock Falls as Morgan Stanley Cuts Price Target in Half

Analyst Andrew Percoco lowered his rating on the shares to the equivalent of Hold from Buy. HIs target for the price went to $15 a share from $35.

2h ago Barrons.com

Barrons.comExtra Space Agrees to Buy Life Storage. There’s a New Industry Leader.

The deal forms the largest storage-facility operator in the U.S, by number of locations, overtaking rival Public Storage.

2h ago The Wall Street Journal

The Wall Street JournalInvestors Are Too Spooked by Washington’s PBM Crackdown

Efforts to take on Cigna’s and CVS’s pharmacy benefit managers won’t hurt as much as Wall Street expects.

4h ago USA TODAY

USA TODAYTexas woman uses 'cash stuffing' and stimulus check to pay off nearly $80,000 in debt

Before she started cash stuffing, Jasmine Taylor said she was tired of being in financial distress. She turned that success into 'Baddies and Budgets'

1d ago Yahoo Finance

Yahoo FinanceWhat if the Fed hadn't made a 'mistake'? A hypothetical to consider.

Hypotheticals are hard, but what if we considered an alternative world where the Fed had done what critics say should've happened?

20h ago Bloomberg

BloombergBond Yields Drop, Stocks Waver After Big ISM Miss: Markets Wrap

(Bloomberg) -- Bond yields fell as a gauge of US factory activity contracted by more than expected, overshadowing inflation concerns fueled by OPEC+’s surprise plan to cut oil production.Most Read from BloombergOPEC+ Makes Shock Million-Barrel Cut in New Inflation RiskSwiss Prosecutors Probe Credit Suisse Deal, Job Cuts SeenRussia Blames Ukraine as Suspect Held in War Blogger’s DeathBillionaire Blocked From His New Palace Blasts ‘Socialist’ IndiaOil Surges 8% After OPEC+ Blindsides Market With P

43m ago Investor's Business Daily

Investor's Business DailyThese Are The 5 Best Stocks To Buy And Watch Now

Buying a stock is easy, but buying the right stock without a time-tested strategy is incredibly hard. So what are the best stocks to buy now or put on a watchlist?

14h ago Bloomberg

BloombergMorgan Stanley Strategist Says US Tech Stocks’ Rally Is Overdone

(Bloomberg) -- Morgan Stanley’s Michael Wilson — among the most prominent bearish voices on US equities — warns the rally in tech stocks that’s exceeded 20% isn’t sustainable and that the sector will return to new lows.Most Read from BloombergOPEC+ Makes Shock Million-Barrel Cut in New Inflation RiskSwiss Prosecutors Probe Credit Suisse Deal, Job Cuts SeenRussia Blames Ukraine as Suspect Held in War Blogger’s DeathBillionaire Blocked From His New Palace Blasts ‘Socialist’ IndiaOil Surges 8% Afte

5h ago SmartAsset

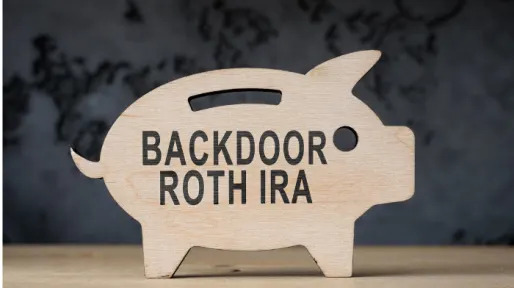

SmartAssetHow to Use Mega Backdoor Roths to Save on Taxes

A mega backdoor Roth is designed for 401(k) savers who want to enjoy Roth account tax benefits. Learn how a mega backdoor Roth rollover works.

1d ago Zacks

ZacksBest Income Stocks to Buy for April 3rd

IVR, GECC and ABR made it to the Zacks Rank #1 (Strong Buy) income stocks list on April 3, 2023.

3h ago

Recommend

-

5

5

Major regulators cooperating on AAM certification, integration rules

-

3

3

Gigi Sohn testimony — Biden FCC nominee slams critics, says ISPs shouldn’t get to choose regulators "It is critical for at least one member of the FCC to be a consumer advo...

-

5

5

This is officially bad — Silicon Valley Bank shut down by US banking regulators Tech-focused lender faced deposit outflows, failed late attempt to raise new capital....

-

4

4

Financial regulators close Silicon Valley Bank

-

5

5

MarketsSilicon Valley Bank is shut down by regulators in biggest bank failure since glo...

-

2

2

Home ...

-

3

3

Crypto...

-

3

3

TechWith ChatGPT hype swirling, UK government urges regulators to come up with rules...

-

5

5

US Regulators Are Investigating Adobe Canc...

-

1

1

Biden may cave to pressures from automakers and Trump on EV ambitions February 21, 2024

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK