Navigating Today's Commercial Real Estate Market – CryptoMode

source link: https://cryptomode.com/navigating-todays-commercial-real-estate-market/

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Navigating Today’s Commercial Real Estate Market

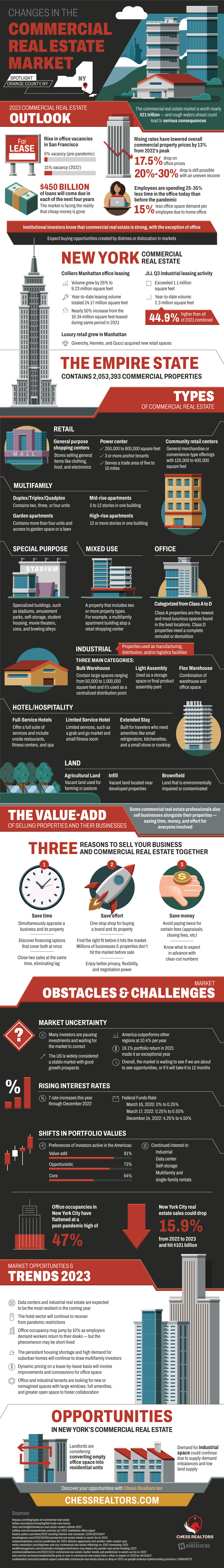

As the world continues to navigate the ongoing COVID-19 pandemic, commercial real estate markets in the United States are facing a number of challenges and opportunities in 2023. According to recent reports, the rise in office vacancies has had a significant impact on commercial real estate in San Francisco. In the pre-pandemic period, the vacancy rate was 6%, but in 2022, the rate increased to 15%. The rising rates have lowered property prices by 13% from 2022’s peak, while office prices have dropped 17.5%. It is expected that prices could still drop 20-30%, which is bad news for investors.

One of the factors contributing to the decline in office occupancy is that employees are spending 25-35% less time in the office today than before the pandemic. This translates to 15% less office space demand per employee. Additionally, an estimated $450 billion of loans will come due in each of the next four years- cheap money is gone. The market is facing market uncertainty, rising interest rates, and shifts in portfolio values. However, the US is widely considered a stable market with good growth prospects, and the optimists are seeing if opportunities will arise immediately or within 6 to 12 months. There are buying opportunities created by distress or dislocation in markets.

There are a variety of property types, including retail, multifamily, office, industrial, hotels/hospitality, land, mixed-use, and special purpose properties. Industrial real estate is expected to be the most resilient in the coming year, and the hotel sector will continue to recover from pandemic restrictions. The persistent housing shortage and high demand for suburban homes will continue to draw investors to multifamily and single-family rentals, self-storage, and data centers. While there are challenges ahead, commercial real estate investors who remain vigilant and adaptable will continue to find success in the market.

Source: ChessRealtors.com

None of the information on this website is investment or financial advice and does not necessarily reflect the views of CryptoMode or the author. CryptoMode is not responsible for any financial losses sustained by acting on information provided on this website by its authors or clients. Always conduct your research before making financial commitments, especially with third-party reviews, presales, and other opportunities.

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK