Tax policy and enforcement aren't race-neutral, two studies find

source link: https://finance.yahoo.com/news/tax-policy-and-enforcement-arent-race-neutral-two-studies-find-181648332.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Tax policy and enforcement aren't race-neutral, two studies find

Tax breaks and tax enforcement are not agnostic when it comes to race, according to a pair of recent studies.

White taxpayers disproportionately benefit from five studied tax breaks versus Black Americans, in many cases when adjusting for income, according to a Treasury study from the Office of Tax Analysis. And even when Black taxpayers benefit more than their white counterparts from one credit, they are then subject to more audits because of it, a second study from Stanford University found.

The findings, which confirm previous research on tax disparities, underscore how supposedly race-neutral tax systems and policies can actually magnify racial disadvantages and perpetuate bias.

“The recently released working paper from the Treasury Department and other research articles are consistent with previous research conducted by CFP Board and others,” Kevin R. Keller, CEO of the Certified Financial Planner Board of Standards (CFP Board), told Yahoo Finance. “While the findings are disappointing, they are not surprising.”

Where white taxpayers benefit more

The Treasury report examined eight tax expenditures: capital gains and dividends, charitable contribution deduction, pass-through income deduction, home mortgage interest deduction (HMID), exclusion for employer contributions to medical insurance, the child tax credit (CTC), premium tax credit (PTC), and earned income tax credit (EITC).

According to the study, 92% of the tax benefits from the capital gains preferential rate went to white taxpayers. Additionally, that percentage was 91% for the charitable donations deduction, 90% for pass-through income deduction, 84% for the mortgage interest deduction, and 82% for the employer medical exclusion.

The disproportionate tax benefit for whites narrowed some when it came to the child tax credit (CTC) and premium tax credit (PTC).

Capital gains

Many taxpayers' income is based on salary or hourly wages and is taxed around 37% or less, depending on income. However, capital gains income and dividends are taxed at a preferential rate of no more than 20%.

AP Finance

AP FinanceIntel co-founder, philanthropist Gordon Moore dies at 94

Gordon Moore, the Intel Corp. co-founder who set the breakneck pace of progress in the digital age with a simple 1965 prediction of how quickly engineers would boost the capacity of computer chips, has died. Moore died Friday at his home in Hawaii, according to Intel and the Gordon and Betty Moore Foundation. Moore, who held a Ph.D. in chemistry and physics, made his famous observation — now known as “Moore's Law” — three years before he helped start Intel in 1968.

15h ago Reuters

ReutersFactbox: The biggest financial crises of the last four decades

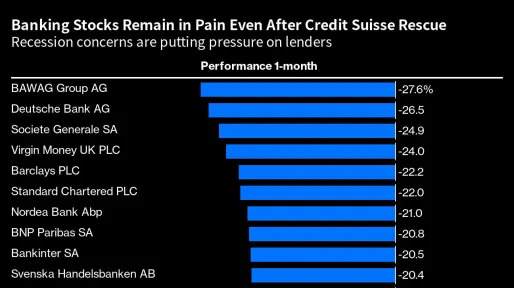

Fears of banking contagion remain, and investors are worried that global economies will suffer if the effects of higher interest rates torpedo more lenders.

10h ago Bloomberg

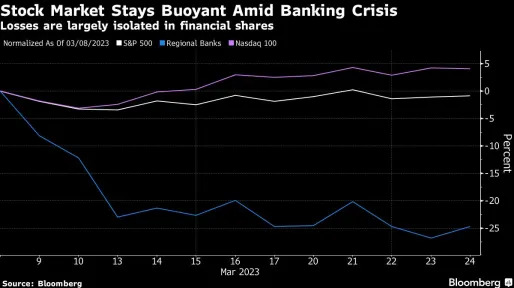

BloombergBank Chaos Tests Traders’ Nerves and Rewards Those Doing Nothing

(Bloomberg) -- The plot twists in markets have lately been riveting. The urge to react has been intense. Doing so has mostly been a mistake.Most Read from BloombergGreenland Solves the Daylight Saving Time DebateCredit Suisse Wouldn’t Have Lasted Another Day, Minister SaysUS Mulls More Support for Banks While Giving First Republic TimeRussia Seeks 400,000 More Recruits as Latest Ukraine Push Stalls‘Zoom Towns’ Exploded in the Work-From-Home Era. Now New Residents Are Facing LayoffsIt’s still ear

11h ago Yahoo Finance

Yahoo FinancePanera Bread palm scanners ‘provide another level of convenience, personalized service’: CEO

Forget your credit card on your next Panera Bread run? No worries, you'll soon be able to pay with the palm of your hand.

6h ago Yahoo Finance

Yahoo FinanceWhat young TikTok creators think about a possible ban: 'People will freak out'

It’s not just TikTok as a company that has a lot at stake right now. The people who are on TikTok the most, the influencers — also called creators — are also in the crosshairs.

1d ago TheStreet.com

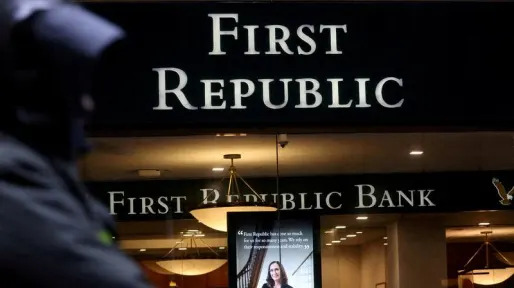

TheStreet.comFour Banks Collapsed. Worries About Two Others Persist. Will They Fall?

For the third consecutive week, the weekend promises to be decisive for the banking sector, as investors fear that Silicon Valley Bank's difficulties will spread. On March 10 regulators had to shut down the bank, resulting in the second-biggest bank failure in American history, after the collapse of Washington Mutual in the financial crisis of 2008. The crisis also reached Europe, pushing the Swiss government to force UBS to urgently buy its compatriot Credit Suisse for the modest sum of $3.24 billion.

1d ago MoneyWise

MoneyWiseJeremy Siegel says there's a silver lining to the current bank crisis — making him more optimistic about 2024. Is the famed economist onto something?

Recent turmoil = a more bullish outlook? Here's how

11h ago TipRanks

TipRanksSeeking at Least 7% Dividend Yield? Goldman Sachs Suggests 2 Dividend Stocks to Buy

Since the banking crisis began, investors have been looking toward the Federal Reserve. The central bank’s move on interest rates had been widely anticipated, and investors were eager for a sign to indicate whether the Fed saw inflation or a bank run crisis as the greater threat. With central bank’s announcement of a 25 basis point rate hike, or 0.25%, the impression is that the Fed has tried to take a middle path, and is slowing its interest rate policy to calm the banking sector while not aban

1d ago Reuters

ReutersUS mulls more support for banks while giving First Republic time - Bloomberg News

All deliberations are at an early stage and an expansion of the Federal Reserve's emergency lending program is one of the many considerations by officials to support the failing lender, the report said, citing people with knowledge of the situation. While any changes to the Fed's liquidity offerings would apply to all eligible users, the adjustments could be designed to ensure that First Republic benefits from the changes, Bloomberg said. Representatives for the U.S. Treasury and the Federal Reserve did not immediately respond to Reuters' request for a comment.

3h ago SmartAsset

SmartAssetAre You Rich? Biden Might Double Your Capital Gains Taxes

While social issues have dominated news coverage recently, one of the most contentious and important issues in Washington never changes - tax policy. One of former President Donald Trump's biggest victories was his 2017 tax plan that drastically reduced taxes … Continue reading → The post Are You Rich? Biden Wants to Double Your Capital Gains Taxes and Implement a Wealth Tax appeared first on SmartAsset Blog.

1d ago The Wall Street Journal

The Wall Street JournalHere’s What Retirement With Less Than $1 Million Looks Like in America

Total household balances in retirement accounts for those 55 to 64 years old are $413,814 on average, according to its estimates based on 2019 data, the most recent available. “For many, the expectation of retirement doesn’t match the facts of their everyday financial lives,” said Larry Raffone, chief executive of Edelman Financial Engines. Dana and Elsie Jones hoped to become snowbirds in retirement, living half the year in Florida.

1d ago Fortune

FortuneEurope will pay the price for wiping out Credit Suisse bondholders as its ex-CEO warns U.S. banks are ‘rubbing their hands’

Tidjane Thiam says the controversial decision by Swiss authorities will mean U.S. and Asian lenders could come out of banking crisis stronger.

1d ago South China Morning Post

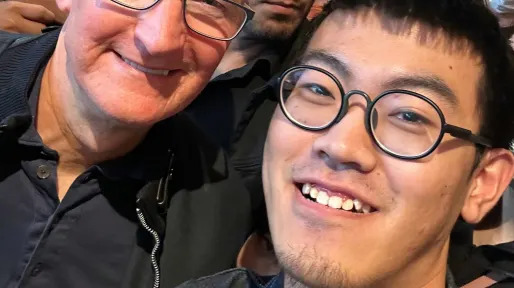

South China Morning PostApple CEO Tim Cook to meet top China officials amid growing risks of supply chain decoupling with the US

Apple CEO Tim Cook will be among a small group of top US executives attending a high-profile summit hosted by the Chinese government this weekend, in a show of commitment to the market amid decoupling risks and supply chain adjustments. The head of the world's most valuable company will join Jon Moeller, CEO of consumer goods giant Procter & Gamble; Stephen Schwarzman, CEO of investment firm Blackstone; and Ray Dalio, founder of the world's largest hedge fund Bridgewater Associates, at the China

2d ago The Wall Street Journal

The Wall Street JournalWhere to Put Your Money During a Banking Crisis

Market turmoil is sending nervous investors into cash, but there are several options better than parking it in a mattress.

1d ago SmartAsset

SmartAssetIs There Actually an RMD Cut-Off Age?

Required minimum distributions (RMDs) are the minimum amount that you must withdraw from certain tax-advantaged retirement accounts. They begin at age 72 or 73, depending on your circumstances and continue indefinitely. There is, unfortunately, no age when RMDs stop. You … Continue reading → The post At What Age Do RMDs Stop? appeared first on SmartAsset Blog.

12h ago Bloomberg

BloombergThe Flight to Safety Is About the Next Recession, Not Banks

(Bloomberg) -- Fears of tightening financial conditions leading to a recession are driving traders to rethink their risk exposure and seek out safety in the stock market. Most Read from BloombergGreenland Solves the Daylight Saving Time DebateCredit Suisse Wouldn’t Have Lasted Another Day, Minister SaysUS Mulls More Support for Banks While Giving First Republic TimeRussia Seeks 400,000 More Recruits as Latest Ukraine Push Stalls‘Zoom Towns’ Exploded in the Work-From-Home Era. Now New Residents A

12h ago Bloomberg

BloombergValley National, First Citizens Said to Bid on Silicon Valley

(Bloomberg) -- Valley National Bancorp and First Citizens BancShares Inc. are both vying for Silicon Valley Bank after its collapse earlier this month, according to people familiar with the matter. Most Read from BloombergGreenland Solves the Daylight Saving Time DebateCredit Suisse Wouldn’t Have Lasted Another Day, Minister SaysUS Mulls More Support for Banks While Giving First Republic TimeRussia Seeks 400,000 More Recruits as Latest Ukraine Push Stalls‘Zoom Towns’ Exploded in the Work-From-Ho

1h ago Investor's Business Daily

Investor's Business DailyCheap Stocks To Buy: Should You Watch These 5 Growth Stocks?

Regardless of what stage of the market cycle we're in, some folks never tire of searching for cheap stocks to buy. If it has thin trading volume, the fund manager will have an awfully tough time accumulating shares — without making a big impact on the stock price. IBD research also finds that dozens, if not hundreds, of great stocks each year do not start out as penny shares.

1d ago Bloomberg

BloombergSan Francisco Fed’s Mary Daly Skips Conference Remarks After SVB Collapse

(Bloomberg) -- Federal Reserve Bank of San Francisco President Mary Daly, who is among senior central bankers whose role in the collapse of Silicon Valley Bank is under scrutiny, has pulled out of an appearance at a conference hosted by her bank.Most Read from BloombergGreenland Solves the Daylight Saving Time DebateCredit Suisse Wouldn’t Have Lasted Another Day, Minister SaysUS Mulls More Support for Banks While Giving First Republic TimeRussia Seeks 400,000 More Recruits as Latest Ukraine Push

1d ago Investor's Business Daily

Investor's Business DailyMarket Rally Attempt Still Needs To Do This; Microsoft Leads 6 Stocks Near Buy Points

The market rally attempt rose in a volatile week, but hasn't broken out or broken down. Here's what to do. Microsoft and Tesla are near buy points.

8h ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK