Europe will pay the price for wiping out Credit Suisse bondholders as its ex-CEO...

source link: https://finance.yahoo.com/news/europe-pay-price-wiping-credit-132828213.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Europe will pay the price for wiping out Credit Suisse bondholders as its ex-CEO warns U.S. banks are ‘rubbing their hands’

The fateful decision by Swiss authorities to impose full losses on certain bondholders of failed lender Credit Suisse will make life more difficult for European banks going forward, warned the institute’s former CEO.

In a column published in the Financial Times on Thursday, Tidjane Thiam argued the distressed sale to cross-town rival UBS upended international finance's traditional hierarchy, in which stock owners such as the Saudi National Bank are always the first to lose their shirts when a company fails.

Instead the all-share deal forces investors that bought $17 billion in so-called Additional Tier 1 bonds to take a bath, argued the Ivorian, who served as CEO from 2015 until February 2020. This precedent could prove costly for lenders on the continent by further pushing up their funding costs.

“There is a basic principle that common equity takes the hit first,” he wrote, amid reports that affected bondholders are considering taking legal action.

“It seems that the treatment of AT1s, even if correct under the current Swiss rules, will raise the cost of capital for Swiss banks and European banks. This will have some of their U.S. peers rubbing their hands,” Thiam added.

The market is already pricing in higher capital costs for European banks

The deal values Credit Suisse’s equity at 3 billion Swiss francs ($3.3 billion). While the terms impose heavy losses on shareholders—with the battered stock losing a further two-thirds overnight— investors like the Saudi National Bank that pumped in 1.5 billion francs late last year did not lose everything.

By upending the traditional heirarchy of a bank resolution, bondholders will likely demand a higher return on their investment before subscribing to the next AT1 issue, according to Thiam.

“This new layer of uncertainty will have an adverse impact on the competitiveness of the European banking sector. Net net, U.S. and Asian rivals could come out of all this relatively stronger.

Fortune

FortuneCouple claims JPMorgan sold $10 million of their jewelry after drilling open a safety deposit box because they didn’t pay their rent

They allege they were not given notice before their personal belongings were auctioned off.

21h ago Fortune

FortuneU.S. Banks are sitting on $1.7 trillion in unrealized losses, research says. That’s not a problem—until it is

"As long as people aren't all coming in at the same time and demanding that their deposits back, you're okay, but that's exactly what's been happening," Prof. Stephan Weiler told Fortune. "So the chances of facing those unrealized losses are going up."

2d ago TipRanks

TipRanksSeeking at Least 7% Dividend Yield? Goldman Sachs Suggests 2 Dividend Stocks to Buy

Since the banking crisis began, investors have been looking toward the Federal Reserve. The central bank’s move on interest rates had been widely anticipated, and investors were eager for a sign to indicate whether the Fed saw inflation or a bank run crisis as the greater threat. With central bank’s announcement of a 25 basis point rate hike, or 0.25%, the impression is that the Fed has tried to take a middle path, and is slowing its interest rate policy to calm the banking sector while not aban

21h ago Fortune

Fortune‘Gerbil banking’ preceded the Great Depression. We’re seeing it again today

Big banks are attracting more deposits–and putting money back into failing banks. A similar system existed in the run-up to the Great Depression.

2d ago TheStreet.com

TheStreet.comFour Banks Collapsed. Worries About Two Others Persist. Will They Fall?

For the third consecutive week, the weekend promises to be decisive for the banking sector, as investors fear that Silicon Valley Bank's difficulties will spread. On March 10 regulators had to shut down the bank, resulting in the second-biggest bank failure in American history, after the collapse of Washington Mutual in the financial crisis of 2008. The crisis also reached Europe, pushing the Swiss government to force UBS to urgently buy its compatriot Credit Suisse for the modest sum of $3.24 billion.

15h ago Bloomberg

BloombergJack Dorsey’s Wealth Tumbles $526 Million After Hindenburg Short

(Bloomberg) -- Block Inc. co-founder Jack Dorsey’s net worth was hammered after Hindenburg Research’s latest report, which alleged the payments company ignored widespread fraud. Most Read from BloombergUBS Sends Khan to Stem Credit Suisse’s Private Banker ExitsJack Dorsey’s Block Vows to Fight Back After Hindenburg Says It’s Short the StockJack Dorsey’s Wealth Tumbles $526 Million After Hindenburg ShortCredit Suisse, UBS Among Banks in DOJ Russia-Sanctions ProbeDorsey’s fortune plunged by $526 m

1d ago Barrons.com

Barrons.comCharles Schwab Stock Got Hit in the Bank Mess. Be Careful.

The brokerage’s stock has plunged by more than a third this year as customers yank cash from low-yielding “sweep” accounts. What’s ahead.

13h ago The Telegraph

The TelegraphDeutsche Bank fears could become a self-fulfilling prophecy

The world remains on a knife-edge. After a period of relative calm following the bailout of Credit Suisse, the FTSE 100 has ended the week firmly in the red again amid another sharp sell-off in bank stocks.

4h ago Yahoo Finance

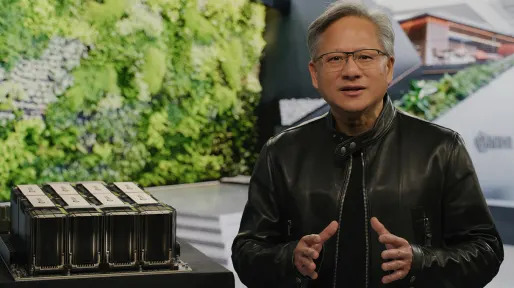

Yahoo FinanceNvidia CEO: 'We're seeing an acceleration in demand... because of generative AI'

Nvidia CEO Jensen Huang told Yahoo Finance that the company is seeing an increase in demand around generative AI.

19h ago TipRanks

TipRanksDown More Than 50%: 2 ‘Strong Buy’ Stocks That Are Too Cheap to Ignore

When stock prices fall, opportunities open up. That’s true whether we’re talking about a general market decline, or a slip in some individual stocks. However, it is crucial for investors to conduct due diligence and investigate the reasons behind the drop in price to ensure that they are making informed investment decisions. The key to success here is recognizing when a low-priced stock is fundamentally unsound or just facing tough trading conditions. Fortunately, Wall Street’s equity analysts a

2d ago Investor's Business Daily

Investor's Business DailyMarket Rally Still Hasn't Done This; Microsoft, Tesla Lead 6 Stocks Near Buy Points

The market rally attempt rose in a volatile week, but hasn't broken out or broken down. Here's what to do. Microsoft and Tesla are near buy points.

12h ago TipRanks

TipRanks‘Our Best Long-Term Picks’: Morgan Stanley Suggests 3 High-Quality Stocks to Buy Now

Stock experts often tout the merit of taking the long-term view rather than looking for short term gains. It’s a strategy that gets the thumbs up from Morgan Stanley’s US Equity Strategy team, led by Mike Wilson. Wilson has been one of the Street’s most vocal bears for a while, but while he does not see the bear market as over just yet, he forecasts a “stronger earnings picture” by next year. A friendlier monetary policy, high inflation receding, pent-up demand in investment/capex and in specifi

2d ago The Wall Street Journal

The Wall Street JournalHere’s What Retirement With Less Than $1 Million Looks Like in America

Total household balances in retirement accounts for those 55 to 64 years old are $413,814 on average, according to its estimates based on 2019 data, the most recent available. “For many, the expectation of retirement doesn’t match the facts of their everyday financial lives,” said Larry Raffone, chief executive of Edelman Financial Engines. Dana and Elsie Jones hoped to become snowbirds in retirement, living half the year in Florida.

17h ago Fortune

FortuneDeutsche Bank scare forces German chancellor to borrow line from Silicon Valley Bank CEO: ‘No cause for any kind of concern’

Deutsche shares fell as much as 15% in trading on Friday, prompting concerns it might be the next domino to fall after failed lender Credit Suisse.

15h ago Investor's Business Daily

Investor's Business DailyThe Cream Of The Crop: 5 Biotech Stocks That Outrank 91% Of All Stocks

The top five biotech stocks today have several commonalities: strong ratings. Some also show promising charts and are Tech Leaders.

17h ago Barrons.com

Barrons.comAltria Believes U.S. Revenue From Smoke-Free Products Could Double

The maker of Marlboro cigarettes hopes to increase U.S. sales volumes for smoke-free products by at least 35% by 2028.

18h ago Decrypt Media

Decrypt MediaCathie Wood Buys the Dip on Coinbase Stock Two Days After Dumping

ARK invest sold Coinbase shares on Tuesday, then bought an even larger haul on Thursday after word of the SEC's warning tanked the price.

11h ago TheStreet.com

TheStreet.comRealty Income Pays a 5.1% Dividend Yield; Here's When to Buy the Dip

Realty Income, stock symbol O, is one of the most consistent dividend payers in the markets. Here's when and where to buy the dip.

2d ago Fortune

FortuneThink Texas has a cheaper tax burden than California? Think again.

"When people are like, 'Oh California is so much more expensive than Texas,' that’s the top income tax rate."

2d ago MoneyWise

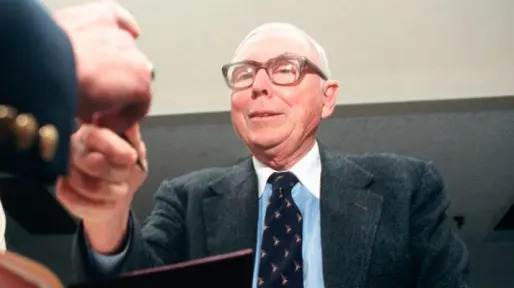

MoneyWise'It's a b----, but you gotta do it': Charlie Munger says that your first $100K is the toughest to earn — but most crucial for building wealth. Here's why it's such a magical milestone

Here's why 100K is a magic financial milestone.

2d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK