Why insuring all bank deposits might make sense

source link: https://finance.yahoo.com/news/why-insuring-all-bank-deposits-might-make-sense-182443620.html

Go to the source link to view the article. You can view the picture content, updated content and better typesetting reading experience. If the link is broken, please click the button below to view the snapshot at that time.

Why insuring all bank deposits might make sense

FDIC's coverage

If you buy a home with a mortgage, you need insurance on the house. Not on part of the house, but on the whole thing.

Yet you can put money in a bank and only have insurance on some of it—and if you’re wealthy, only a tiny portion of it. The Federal Deposit Insurance Corp. (FDIC) insures deposits up to $250,000, through premiums banks pay for the coverage. For most ordinary people, that’s plenty of insurance, since the average bank balance is around $42,000. But when Silicon Valley Bank, or SVB, failed in early March, 94% of its deposits were above the insured amount, a glaring vulnerability that helped trigger a startling run on the bank and destabilized the regional banking sector.

Regulators and banking experts are now pondering whether it’s time to dramatically change the deposit-insurance system so that most or even all deposits in ordinary banks are covered by insurance. Federal regulators have already invoked emergency measures to cover all uninsured deposits at SVB and, implicitly, at any other bank that might fail. Some members of Congress are drafting legislation to formally change a deposit insurance system that still resembles the Depression-era stopgap that first went into effect in 1934.

“Coverage caps on federal deposit insurance have become not only anachronistic, but dangerous,” Robert Hockett of Cornell Law School writes in a new paper outlining how universal deposit insurance could work. “We have a much better solution in plain sight … remove all caps on federal deposit insurance, continue to risk-price its premia as required by law and afford FDIC the option of progressively pricing those premia as deposit amounts grow.”

Throughout the banking system, about 43% of all deposits are uninsured. If a bank fails, the government will cover 100% of deposits up to $250,000. In theory, deposits above that amount are supposed to be treated like assets managed in a takeover or liquidation, and sometimes redeemed at less than 100%. But that’s not what happened when SBV failed. The government covered all deposits, including the uninsured ones, because doing otherwise could have led to runs on uninsured deposits at hundreds of other banks and caused an immediate financial crisis.

Fox Business

Fox BusinessHow safe are credit unions amid bank turmoil?

A series of bank collapses in recent weeks has given some depositors the jitters, with many moving their funds to larger institutions for safety. So how are credit unions faring?

2d ago Yahoo Finance

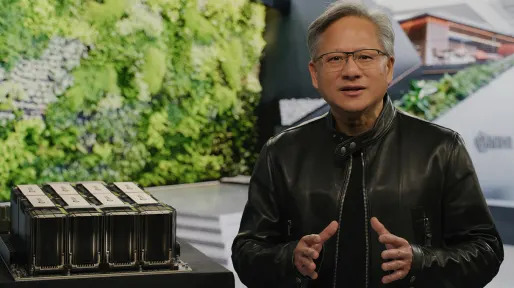

Yahoo FinanceNvidia CEO: 'We're seeing an acceleration in demand... because of generative AI'

Nvidia CEO Jensen Huang told Yahoo Finance that the company is seeing an increase in demand around generative AI.

19h ago Yahoo Finance

Yahoo FinanceSmall banks lost $120 billion in deposits during SVB tumult

Customers withdrew $120 billion from regional banks in one week, while giving $67 billion to industry giants

13h ago Yahoo Finance

Yahoo FinanceFintechs capitalize on concerns over FDIC's limited insurance for deposits

SoFi Bank, Mercury, and Crescent launched deposit products that cover more than the standard FDIC $250,000 insurance.

13h ago Reuters

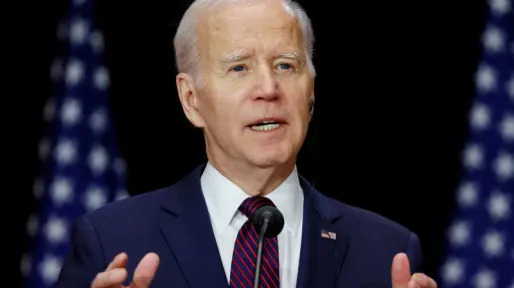

ReutersBiden said federal deposit insurance could be tapped further if banks fail

OTTAWA (Reuters) -President Joe Biden said on Friday that federal deposit insurance could be tapped for deposits above $250,000 if other U.S. banks fail, expressing confidence that mid-sized U.S. banks would survive strains in the sector. Biden said U.S. banks are in "pretty" good shape, people's savings were secure and he did not see an industry ready to explode. "If we find that there's more instability than appears, we'd be in a position to have the FDIC use the power it has to guarantee those (deposits) above $250,000 like they did already," he told reporters at a news conference in the Canadian capital of Ottawa.

12h ago Fox Business

Fox BusinessDeutsche Bank shares sink: What to know

Shares for Deutsche Bank are down Friday amid concerns the German bank will pay higher costs for financial derivatives, called credit default swaps that insure bondholders against banks defaulting on debt.

18h ago Reuters

ReutersSmall U.S. banks see record drop in deposits after SVB collapse

Borrowings at small banks, defined as all but the biggest 25 commercial U.S. banks, increased by $253 billion to a record $669.6 billion, the Fed's weekly data showed. "As a result, small banks had $97 billion more in cash on hand at the end of the week, suggesting that some of the borrowing was to build war chests as a precautionary measure in case depositors asked to redeem their money," Capital Economics' analyst Paul Ashworth wrote. SVB collapsed after it was unable to meet a swift and massive run by depositors who took out tens of billions of dollars in a matter of hours.

13h ago Fortune

FortuneDeutsche Bank scare forces German chancellor to borrow line from Silicon Valley Bank CEO: ‘No cause for any kind of concern’

Deutsche shares fell as much as 15% in trading on Friday, prompting concerns it might be the next domino to fall after failed lender Credit Suisse.

15h ago Barrons.com

Barrons.comFord’s Next Electric Truck Is Coming. Think ‘Millennium Falcon With a Back Porch.’

Ford Motor has a new electric truck on the drawing board. Ford CEO Jim Farley says it will be like the “Millennium Falcon with a back porch attached.” Friday, Ford said its Blue Oval City “mega-campus” in West Tennessee is on track to begin producing vehicles in 2025.

22h ago Yahoo Finance

Yahoo FinanceFed's Bullard sees more rate hikes as bank stress abates

St. Louis Fed President James Bullard is optimistic stresses in the the banking system will abate in the weeks and months ahead.

16h ago AP Finance

AP FinanceBank failures and rescue test Yellen's decades of experience

Working against the clock to stop a developing banking crisis, Treasury Secretary Janet Yellen had until sunset on Sunday, March 12, to come up with a plan to calm the U.S. economy. Paulson, who ran the Treasury Department during the financial crisis in 2008, counseled immediate government action. A bank run on Silicon Valley Bank had begun earlier in the week.

5h ago The Wall Street Journal

The Wall Street JournalWhere to Put Your Money During a Banking Crisis

Market turmoil is sending nervous investors into cash, but there are several options better than parking it in a mattress.

13h ago TheStreet.com

TheStreet.comFour Banks Collapsed. Worries About Two Others Persist. Will They Fall?

For the third consecutive week, the weekend promises to be decisive for the banking sector, as investors fear that Silicon Valley Bank's difficulties will spread. On March 10 regulators had to shut down the bank, resulting in the second-biggest bank failure in American history, after the collapse of Washington Mutual in the financial crisis of 2008. The crisis also reached Europe, pushing the Swiss government to force UBS to urgently buy its compatriot Credit Suisse for the modest sum of $3.24 billion.

15h ago SmartAsset

SmartAssetIs $3 Million Enough to Retire at 65?

To some people, $3 million will sound like a lot. You probably think $3 million is enough to retire if you're among that crowd. But retiring with $3 million at 65 can last depending on your longevity, lifestyle and other … Continue reading → The post Is $3 Million Enough to Retire at 65? appeared first on SmartAsset Blog.

21h ago Bloomberg

BloombergFirst Republic Whiplashes Investors as Bank Concerns Linger

(Bloomberg) -- First Republic Bank shares ended lower Friday on the heels of another downgrade and as financial turmoil spread to a European lender, deepening concern about the banking sector. Most Read from BloombergDeutsche Bank Drops in Selloff Citi Describes as IrrationalRussia Seeks 400,000 More Recruits as Latest Ukraine Push Stalls‘Zoom Towns’ Exploded in the Work-From-Home Era. Now New Residents Are Facing LayoffsBuy-or-Rent Premium Is Highest Since 2006 Housing BubbleThe shares whipsawe

13h ago Reuters

ReutersDeutsche Bank shares plunge, default insurance at highest since 2018

LONDON (Reuters) -Deutsche Bank shares tumbled on Friday after the cost of insuring the bank's debt against the risk of default shot to more than four-year highs, highlighting concerns among investors about the stability of Europe's banks. The region's banking sector has had a rough ride in the last week, with a state-backed rescue of Credit Suisse and turmoil among regional U.S. banks fuelling concerns about the health of the global banking sector. Deutsche shares, which have lost more than a fifth of their value so far this month, fell by as much as 14.9% on Friday to their lowest in five months.

1d ago Barrons.com

Barrons.comCharles Schwab Stock Got Hit in the Bank Mess. Be Careful.

The brokerage’s stock has plunged by more than a third this year as customers yank cash from low-yielding “sweep” accounts. What’s ahead.

13h ago Fortune

Fortune‘We view this as an irrational market,’ Citigroup analysts worry that major bank stocks like Deutsche Bank are cratering for psychological reasons

Citi really fears the "knock-on impact from various media headlines on depositors psychologically," regardless of whether the initial reasoning was correct.

15h ago MoneyWise

MoneyWiseThe age of 62 remains the most popular time to claim Social Security benefits — but are most people correct? Here are the pros and cons of cashing in early

Here are the pros and cons of cashing in early — yes, early — once you hit that charmed age.

21h ago Fortune

FortuneThink Texas has a cheaper tax burden than California? Think again.

"When people are like, 'Oh California is so much more expensive than Texas,' that’s the top income tax rate."

2d ago

Recommend

About Joyk

Aggregate valuable and interesting links.

Joyk means Joy of geeK